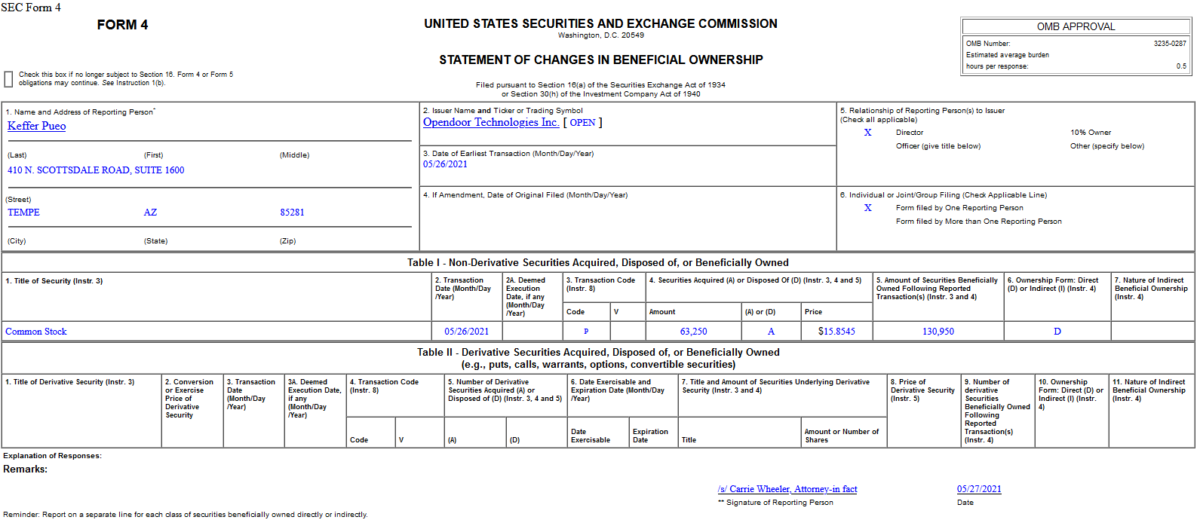

On May 26, 2021, Pueo Keffer – Director of Opendoor Technologies Inc. (OPEN) – purchased 63,250 shares of OPEN at $15.85. His out of pocket cost was $1,002,797.

Tag: StockMarket

Tom Hayes – Quoted in Reuters article – 5/27/2021

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Thursday…

- Airbus Increases A320 Jet Production as Aerospace Giant Signals Recovery (Barron’s)

- Meme Stocks Are Rallying. Analysts Aren’t Focusing on Potential Short Squeezes. (Barron’s)

- Food Network’s Guy Fieri snags $80M deal that renews his 2 shows (Fox Business)

- Glaxo, Once a Covid Also-Ran, Gets Go-Ahead for Antibody (Barron’s)

- Facebook Set for Antitrust Probe Over Online Marketplace, According to Report (Barron’s)

- Toll Brothers Earnings Show Luxury Homes Are Still Booming (Barron’s)

- EU Eyes Formal Antitrust Investigation Into Facebook (Wall Street Journal)

- US workers file 406,000 new jobless claims as economy heats up (New York Post)

- Influencers Say They Were Urged to Criticize Pfizer Vaccine (New York Times)

- See if your favorite beach is among the top 10 beaches in America for 2021 (USA Today)

- 1970s Inflation Is So 50 Years Ago (Bloomberg)

- The Fed keeps expanding its powers, and that’s making some people nervous (CNBC)

- Activist Fund Elliott Management Could Give GSK Some Space: Report (MarketWatch)

- U.S. GDP expanded at unrevised 6.4% rate in first quarter (MarketWatch)

- U.S. durable-goods orders decline 1.3% in April; core data show orders up 1% (MarketWatch)

- Biden’s proposed budget to push spending to highest sustained levels since World War II: report (MarketWatch)

- Royal Caribbean Group (RCL) sets June return for sailing from the US (Street Insider)

- Goldman Sachs Upgrades Occidental Petroleum (OXY) to Buy (Street Insider)

- 5 High-Yielding Dividend Aristocrats May Be the Best Stocks to Own Now (24/7 Wall Street)

- White House sticks by Biden’s $4T spending plans despite Dimon warning (Fox Business)

The “Astronaut in the Ocean” Stock Market (and Sentiment Results)…

For anyone who has watched the Nasdaq and Chinese Stocks since the beginning of the year, the lyrics (in Masked Wolf’s “Astronaut in the Ocean”) that best describe their movement (floating action/little progress) are as follows: Continue reading “The “Astronaut in the Ocean” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- 4 Red-Hot IT Giants May Have Huge Upside Potential (24/7 Wall Street)

- Icahn on Inflation, Investing, and What He Misses About NYC: Q&A (Bloomberg)

- In Apple Antitrust Trial, Judge Signals Interest in Railroad, Credit-Card Monopoly Cases (Wall Street Journal)

- Covid Shot Makers to Share in Up to $190 Billion Sales Bonanza (Bloomberg)

- Elon Musk’s Mars Ambition Could Be the Riskiest Human Quest Ever (Bloomberg)

- Brussels to open formal antitrust probe into Facebook (Financial Times)

- Tesla has over 1 million Cybertruck reservations, unofficial tally says (FoxBusiness)

- Investors Should Catch Vimeo on Replay (Wall Street Journal)

- In Praise of the Dow on Its Birthday (Wall Street Journal)

- Disney’s Parks Getting Back on the Rails (Wall Street Journal)

- DC attorney general sues Amazon on antitrust grounds, alleges it illegally raises prices (CNBC)

- Why Big Tech Stocks Look Promising Now (Barron’s)

- 12 European Stocks That Analysts Love and Investors Are Ignoring (Barron’s)

- It’s Time to Stop Paying Americans to Stay Home (Barron’s)

- The Anatomy of Inflation Scenarios for the U.S. Economy (Barron’s)

Tom Hayes – CGTN America Appearance – 5/25/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – May 25, 2021

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Tuesday…

- Germany’s Cartel Office Starts Probe of Google (Barron’s)

- Stocks to Open Higher as Inflation Concerns Subside (Barron’s)

- Oil fades as traders eye Iran nuclear talks (MarketWatch)

- AutoZone Earnings Show That Everyone Is Still Fixing Their Cars (Barron’s)

- The Great American Cleanup: Deodorant, Teeth Whitener Fly Off the Shelves (Wall Street Journal)

- Federal Reserve’s Balance Sheet Could Hit $9 Trillion, Report Says (Wall Street Journal)

- Fracking Companies Continue Consolidation as Cabot, Cimarex Form $14 Billion Firm (Wall Street Journal)

- Inflation Starts to Hit Auto and Home Insurers (Wall Street Journal)

- U.S. Home Prices Surge Most Since 2005, Fueled by Low Rates (Bloomberg)

- Fed Officials Play Down Risk That Higher Inflation Will Persist (Bloomberg)

- Iran Has Huge Hoard of Floating Oil to Clear When Sanctions Lift (Bloomberg)

- Distressed Commercial Real Estate Is Still Sitting in Purgatory (Bloomberg)

- Fed’s Evans says easy monetary policy has his ‘full’ support (Reuters)

- Bullard: Fed ‘not quite there yet’ to start taper talk (Yahoo! Finance)

- Opinion: Dow 37,000? It’s possible if U.S. stocks stage an ‘average’ summer rally (MarketWatch)

- Consumer confidence slips in May for first time in six months on worries about jobs and inflation (MarketWatch)

- Fed’s Bullard says most cryptocurrencies ‘are worthless’ (MarketWatch)

- Boeing (BA) 737 Tracker Shows Substantial Increase in Domestic Flights in April – Morgan Stanley (Street Insider)

- Selling by Retail Largest Since Early March 2020 – BofA (Street Insider)

- This Is the Best James Bond Movie (24/7 Wall Street)