- As Summer Driving Season Starts, Gas Prices Surge (Barron’s)

- 5 Biopharma Stocks That Are Cheap and Growing (Barron’s)

- Nasdaq Shrugs Off ‘Tapering Talk’ (Barron’s)

- Tencent Earnings Power Through Tech Crackdown (Wall Street Journal)

- Salesforce Stock Gets a Boost as Morgan Stanley Turns Bullish After Sharp Drop (Barron’s)

- Netflix Stock Has Been Stuck in a Rut. Why One Analyst Offers Rave Reviews. (Barron’s)

- Tesla To Deliver Model S Plaid On June 3; Musk Calls It ‘Fastest Production Car Ever’ (Benzinga)

- Amid a Bear Market in SPACs, Hedge Funds Stuck With Them (Institutional Investor)

- Fed Officials Hinted They Might Soon Talk About Slowing Bond-Buying (New York Times)

- Unemployment claims continue to fall as states slash extra benefits (New York Post)

- Hedge Fund Picks at Sohn 2020 Show Perils of Covid Investing (Bloomberg)

- Step Inside the ‘Little Island,’ Barry Diller’s $260 Million Public Park (Bloomberg)

- BofA Securities Channel Checks Suggest Upside for salesforce.com (CRM) (StreetInsider)

- Philly Fed factory activity grows at slower pace in May (Reuters)

- Forget the crypto chaos. Look at this underappreciated sector for stock-market gains, says strategist. (MarketWatch)

Tag: StockMarket

The Weeknd’s “Save Your Tears” Stock Market (and Sentiment Results)…

At the beginning of the year, we laid out the case for a 2013/2017 type market that would have a handful of small pullbacks (3-5%) on the S&P 500 – and likely finish out the year with a mid-teens gain. So far that has held true, and the short term panic may very well prove to be unnecessary. Continue reading “The Weeknd’s “Save Your Tears” Stock Market (and Sentiment Results)…”

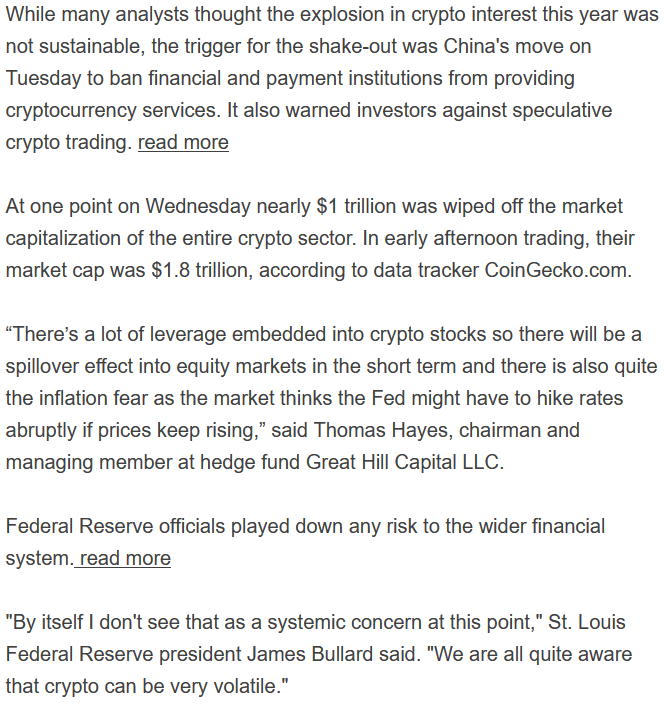

Tom Hayes – Quoted in Reuters article – 5/19/2021

Thanks to Gertrude Chavez-dreyfuss, Sujata Rao and Tommy Wilkes for including me in their article on Reuters today. You can find it here:

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- 3 Things to Watch for in the Fed Minutes Today (Barron’s)

- Could UWM Be The Next Target For Reddit Traders? (Benzinga)

- U.S. postpones ban on trading Chinese stocks with alleged military ties (CNBC)

- Retail Earnings Show There’s No Stopping the U.S. Consumer (Barron’s)

- Bitcoin Tumbles Below $40,000 After China Issues Crypto Warning (Barron’s)

- The Chip Shortage Could Be on Its Way Out (Barron’s)

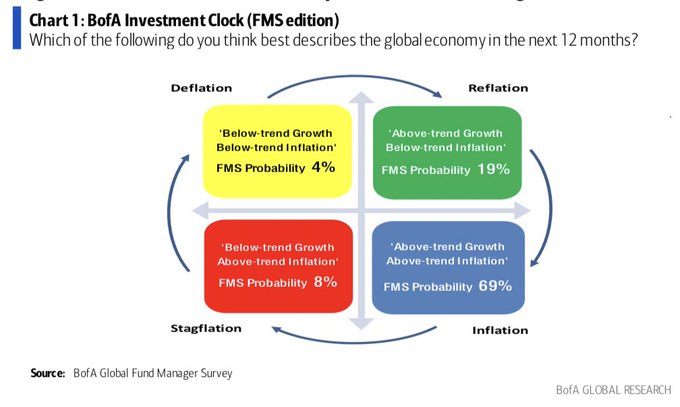

- Fund managers making late cyclical push with tech demand at three-year lows, Bank of America survey finds (MarketWatch)

- U.S. Bank Stocks Shine as Investors Bet on an Economic Recovery (Wall Street Journal)

- Hertz, the Original Meme Stock, Rewards Its True Believers (Wall Street Journal)

- Daniel Boulud Launches New York City Restaurant Amid Covid-19 Recovery (Wall Street Journal)

- Ducatis Run in the Family (Wall Street Journal)

- Europe to welcome fully vaccinated travelers – it’s just not clear when (USA Today)

- Target sales jump 23% as exclusive brands, curbside pickup draw in shoppers (CNBC)

- Melvin Capital Closed Out All of Its Public Short Positions in the First Quarter (Institutional Investor)

- US telecoms decide focusing on pipes isn’t so dumb after all (Financial Times)

- Nvidia tries to stop its chips being used for crypto mining (Financial Times)

- Investors support Shell’s strategy for net-zero emissions despite backlash (Financial Times)

- Netflix (NFLX) Coverage Assumed at Jefferies at ‘Buy’, Seen as the ‘Premier, Must-Have OTT Service’ (Street Insider)

- JD.com (JD) Tops Q1 EPS by 3c, Revenue Beats (Street Insider)

- Baidu (BIDU) Tops Q1 EPS by 23c, Revenues Beat; Offers 2Q Revenues Outlook (Street Insider)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 5/18/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – May 18, 2021

Tom Hayes – CNN Appearance – 5/18/2021

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Tuesday…

- Amazon in talks to buy MGM for $9bn (Financial Times)

- Burry of ‘The Big Short’ has bet against Tesla: report (Fox Business)

- Investors bet on commercial real estate, undeterred by empty offices and hotel rooms (Fox Business)

- Brent crude hits $70 as traders bet on sustained revival in oil demand (Financial Times)

- Rolls-Royce courts investors for mini nuclear plants (Financial Times)

- Earnings up, multiples down: Morning Brief (Yahoo! Finance)

- Frank Sinatra’s historic homes: From NYC to Palm Desert (New York Post)

- ‘Succession’ Meets ‘90 Day Fiancé’ in WarnerMedia-Discovery Deal (New York Times)

- Foreign investors tiptoe into frontier markets in search of returns (Financial Times)

- Service sector activity surged at record pace in May, NY Fed survey finds (Reuters)

- U.S. housing starts drop sharply; building permits rise modestly (Reuters)

- Biggest Shorting Of Tech Stocks By Hedge Funds In 5 Years: Goldman Prime (ZeroHedge)

- Baidu (BIDU) Tops Q1 EPS by 23c, Revenues Beat; Offers 2Q Revenues Outlook (Street Insider)

- Fisker (FSR) Won’t Accept or Invest in Bitcoin (BTC) as It Is ‘Not Environmental-Friendly’ (Street Insider)

- Elliott Wants Duke Energy (DUK) to Split Into Three Regionally-Focused Utilities (StreetInsider)

- Walmart Raises Full-Year Guidance as Earnings Beat Expectations (Barron’s)

- SolarEdge Stock Is Beaten Down. Why It’s Not Out. (Barron’s)

- Home Depot’s Earnings Smash Forecasts (Barron’s)

- Glaxo Has Good News on Another Vaccine. It’s a Tougher Market Now. (Barron’s)

- Fund managers position for ‘boom expectations’ with tech demand at three-year lows, Bank of America survey finds (MarketWatch)

- Clarida says economy hasn’t made the progress needed for Fed to scale back asset purchases (MarketWatch)

- Fund Managers Say ‘Long Bitcoin’ Is the Most Crowded Trade in the World (Bloomberg)

- The Businessweek How-To Issue: 50+ Lessons From Really Smart People (Bloomberg)

- EU Suspends Plans to Raise Tariffs on U.S. Whiskey, Other Goods (Wall Street Journal)

- Energy and Materials Shares Lead the Way in a Turbulent Stretch for Stocks (Wall Street Journal)

May Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “May Bank of America Global Fund Manager Survey Results (Summary)”