- 2 Reasons This Will Be Gilead’s Year, Says Morgan Stanley (Barron’s)

- Hershey, Allstate and 8 Other Beaten-Down Stocks With Rising Earnings Prospects (Barron’s)

- Shipping Rates Are Soaring. What That Says About the Economy — and Inflation. (Barron’s)

- Netflix Is Soaring Because Subscriber Growth Topped Estimates and It May Even Buy Back Stock (Barron’s)

- ‘Act big’ now to save economy, worry about debt later, Yellen says in Treasury testimony (Reuters)

- US finance chiefs weigh how to spend vast corporate cash piles (Financial Times)

- Morgan Stanley Reports Blowout Quarter Cementing The Bank’s Best Year In History (ZeroHedge)

- Over $5B in US small business relief loans approved in first week –SBA (FoxBusiness)

- Banks Need a Pickup in Loans to Prosper (Wall Street Journal)

- Emerging Markets Have Less Reason to Fear the Fed (Wall Street Journal)

- Herd Immunity Could Be Closer Than We Think (CNBC)

- Janet Yellen suggests ‘curtailing’ cryptocurrencies such as Bitcoin, saying they are mainly used for illegal financing (Business Insider)

- Biden’s rescue plan could boost 2021 GDP growth to 11.4%, JPMorgan’s global chief strategist says (Business Insider)

- AMC soars 37% after issuing $100 million in debt to stave off bankruptcy (Business Insider)

- Sen. Joe Manchin calls for up to $4 trillion in infrastructure spending as Democrats are poised to control Congress (Business Insider)

- Emerging Markets Have Less Reason to Fear the Fed (Wall Street Journal)

- This Should Be a Big Year for Industrial Stocks. These Are Wall Street’s Favorites. (Barron’s)

- China’s Consumers Fall Behind Even as Its Economy Marches Forward (Wall Street Journal)

- Biden to kick off presidency by signing 17 executive actions (New York Post)

- New Opportunities and Risks Arise for Investors as Democrats Take Power (Barron’s)

Tag: StockMarket

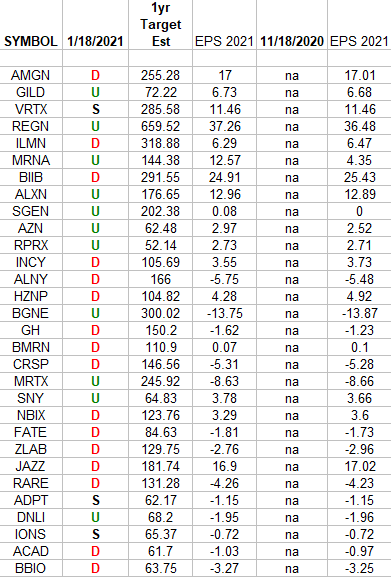

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

Tom Hayes – Quoted in Reuters article – 1/19/2021

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Tuesday…

- Yellen Readies Big Changes for Treasury (New York Times)

- Bank of America profits jump as it releases over $800m of loan loss reserves (Financial Times)

- Dollar Shorts Mount Before Yellen Outlines Market-Based Policy (Bloomberg)

- BofA Clients With $561 Billion Say Bitcoin Is Most Crowded Trade (Bloomberg)

- Goldman Sachs Says Buy Stocks on Any Market Weakness (Bloomberg)

- Goldman Sachs crushes analysts’ estimates on stronger-than-expected stock trading, banking (CNBC)

- Bank of America posts profit that exceeds analysts’ expectations (CNBC)

- China’s shift from coal helped push natural gas prices to a peak: Eurasia Group (CNBC)

- Oil demand will pick up in 2021, but it will take until the second half of the year for that to filter through. The IEA is forecasting a rise of 5.5 million barrels per day in demand. (Business Insider)

- Investor bets against the dollar are at their biggest in almost 10 years, but rising Treasury yields are a red flag for bears, analysts say (Business Insider)

- How Walgreens, CVS, Kroger, and other retailers plan to leverage tech, convenience, and public trust to get the chaotic mass vaccine rollout back on track (Business Insider)

- Emerging Markets Have Less Reason to Fear the Fed (Wall Street Journal)

- Tomorrow Q4 Earnings Begin In Earnest: Here’s What To Expect… And Why They Don’t Matter (ZeroHedge)

- The Dogs of the Dow and Other High Yielders Keep Roaring Into 2021 (Barron’s)

- The Stock Market Can’t Get Much Better From Here. Why a Correction Could Be Coming. (Barron’s)

- FT Alphaville presents: the EV bubble in real time (Financial Times)

- Occidental claims green push ‘does more than Tesla’ (Financial Times)

- Coronavirus latest: Halliburton signals oil industry poised to climb back after 2020 crash (Financial Times)

- Boeing 737 Max recertified to fly in Europe from next week (Financial Times)

- Investors think there’s more chance Tesla and bitcoin will halve than double, warns Deutsche Bank (MarketWatch)

- Blackstone’s Schwarzman: New U.S. admin going to take a ‘softer tone’ towards China (Reuters)

- The Geezer, Still a Goat: Ageless Tom Brady’s at It Again (Wall Street Journal)

- Keystone XL Oil Project Pledges Zero Carbon Emissions (Wall Street Journal)

- After Stock Surge, Investors Ask Companies What’s Ahead (Wall Street Journal)

- Social-Media Algorithms Rule How We See the World. Good Luck Trying to Stop Them. (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/18/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 18, 2021

Be in the know. 12 key reads for #MLKDay2021

- 5 Food Stocks to Buy in 2021 (Barron’s)

- Why Clover Health Chose a SPAC to Go Public (Barron’s)

- Squeeze play? How the ‘most shorted’ stocks are crushing the market in the new year (MarketWatch)

- Behind a Secret Deal Between Google and Facebook (New York Times)

- Opinion: Here are the biggest stock market winners and losers in Biden’s massive stimulus plan (MarketWatch)

- China Is Only Major Economy to Report 2020 Growth (Wall Street Journal)

- Dollar Shorts Mount Before Yellen Outlines Market-Based Policy (Bloomberg)

- Barron’s Picks And Pans: Exxon Mobil, GameStop, Intel, 3M, Toll Brothers And More (Yahoo! Finance)

- Here’s How Americans Are Spending Their Stimulus Payments (Benzinga)

- How to bring Brooks Brothers back from the brink (Financial Times)

- Bill Gates is now the largest farmland owner in America (MarketWatch)

- US small-cap stocks have raced ahead of their bigger peers in 2021. Experts say a number of factors could send them higher. (Business Insider)

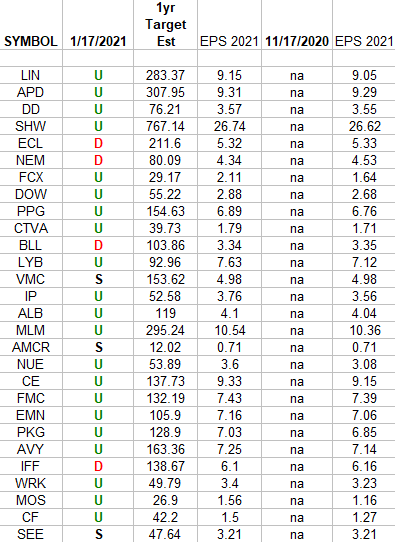

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2021 estimates were: 11/17/2020 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Be in the know. 17 key reads for Sunday…

- What 1919 Teaches Us About Pent-Up Demand (NPR Planet Money)

- Seasonal Soft Patch Ahead Starting Next Week (Almanac Trader)

- Airline Investors Look for Bluer Skies Later This Year (Barron’s)

- A new activist takes on Exxon to reverse the oil giant’s underperformance (CNBC)

- Tanger Factory Outlet Centers Brings Back Its Dividend (Barron’s)

- Concierge Medicine Has Boomed During Covid. Here’s How to Tell if It’s Right for You. (Barron’s)

- Parler’s de-platforming shows extreme power of cloud providers like Amazon (CNBC)

- Carnival’s Wave Season Should Lift Its Shares (Wall Street Journal)

- Behind the Wheel of the 2021 Mustang Mach-E— Ford’s First Fully-Electric Mustang (Maxim)

- After Rocky Start, Opportunity Zones Could Boom In 2021 (Forbes)

- A THREE-MONTH LOOK AT SECTOR LEADERSHIP SHOWS MORE OPTIMISM — RISING COMMODITY PRICES AND RISING BOND YIELDS HAVE ALSO PLAYED A ROLE (stockcharts)

- ECRI Weekly Leading Index Update (advisorperspectives)

- After Stock Surge, Investors Ask Companies What’s Ahead (Wall Street Journal)

- CRISPR and the Splice to Survive (New Yorker)

- Biden Names Top Geneticist Eric Lander as Science Adviser (scientificamerican)

- Cowen’s Co-President on Why SPACs Are Having a Moment (Podcast) (Bloomberg)

- Lotus and Renault Are Teaming Up to Build an All-Electric Alpine Sports Car (roadandtrack)