BBC World News – Thomas Hayes – Chairman of Great Hill Capital – January 13, 2021

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Wednesday…

- Exxon Mobil stock rises again after J.P. Morgan analyst turns bullish for the first time in 7 years (MarketWatch)

- Oil Rally Will Continue as Producers Curb Supplies (Barron’s)

- 5 Stocks to Play the Next Surge in Natural Gas (Barron’s)

- GM Teased Flying Cars at CES. Its Ambitions Are Even Bigger. (Barron’s)

- LNG Cargo Prices Rising Faster Than Bitcoin (Yahoo! Finance)

- Regeneron Inks Deal to Sell Covid-19 Treatment to U.S., Even as Usage Lags (Barron’s)

- Barron’s Daily: The Apple Car Chatter Is Back—and It’s Helping Everyone Except Apple (Barron’s)

- Bristol Myers Looks to Drug Pipeline to Turbocharge Growth (Barron’s)

- Bank of America Stock Could Pop on Earnings. How to Play the Results. (Barron’s)

- What Eli Lilly’s Good News About Its Alzheimer’s Drug Means for Biogen (Barron’s)

- GM unveils self-driving Cadillac that can fly (New York Post)

- Atop the Powerful Budget Committee at Last, Bernie Sanders Wants to Go Big (New York Times)

- Bitcoin Will Break Wall Street’s Heart (Wall Street Journal)

- Walgreens to launch credit cards with Synchrony Financial and Mastercard (MarketWatch)

- Lagarde Blasts Bitcoin’s Role in Facilitating Money Laundering (Bloomberg)

- Occidental to Strip Carbon From the Air and Use It to Pump Crude (Bloomberg)

- 6 Energy Stocks Trading Well Below 52-Week Highs (247wallst)

- Schumer pledges quick delivery of $2,000 stimulus checks: ‘We will get that done’ (Fox Business)

- Mortgage refinancing jumps 20% to begin the year (Fox Business)

- Billionaire investor Howard Marks discussed Tesla’s valuation, growth vs value investing, and the Fed juicing markets in a recent interview. Here are the 8 best quotes. (Business Insider)

- Oil prices rise to near 1-year highs as vaccines, stimulus and Saudi Arabian production cuts lift the energy outlook (Business Insider)

- The bull market will continue in 2021 with stock holdings still well below dangerous Global Financial Crisis levels, JPMorgan says (Business Insider)

- Covid-19 Rapid-Test Sites Planned for New York Office Buildings (Wall Street Journal)

- New GM Electric-Truck Business Targets Delivery Market (Wall Street Journal)

- Big Real-Estate Firms Turn Buyers of Their Own Shares (Wall Street Journal)

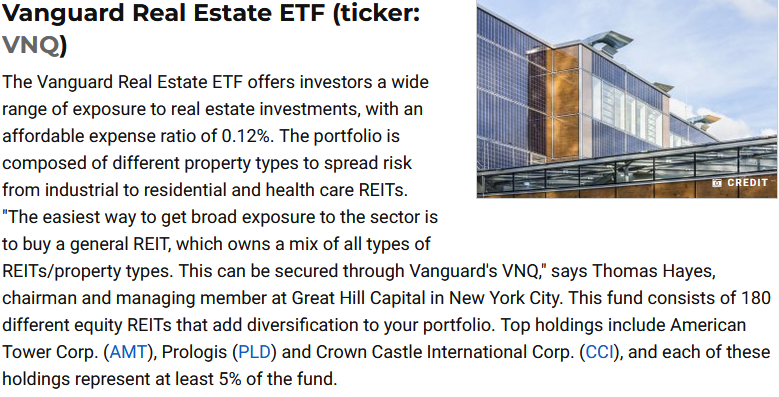

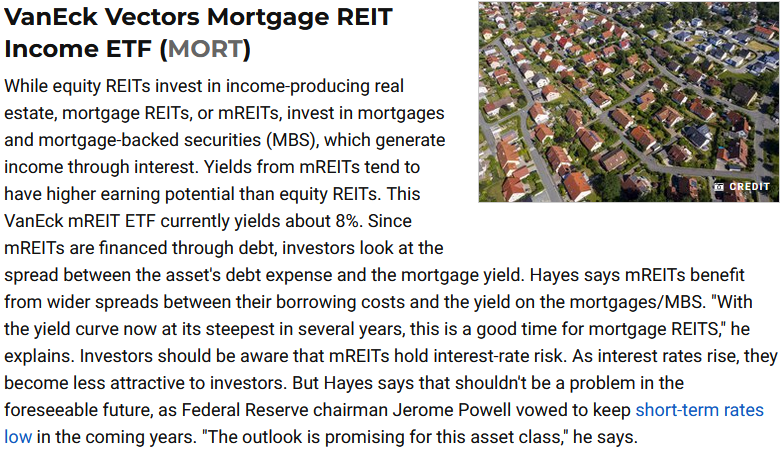

Tom Hayes – Quoted in U.S. News & World Report article – 1/12/2021

Thanks to Paulina Likos for including me in her article in U.S. News & World Report today. You can find it here:

Click Here to View The Full Article at U.S. News & World Report

Tom Hayes – CGTN America Appearance – 1/12/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – January 12, 2021

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/12/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 12, 2021

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Tuesday…

- Wells Fargo’s stock surges toward 10-month high after UBS analyst upgrades to ‘top pick’ (MarketWatch)

- Underinvestment Risk Rising. The Energy Report 01/12/2021 (Phil Flynn)

- Bank of America Stock Could Pop on Earnings. How to Play the Results. (Barron’s)

- What to Expect From Banks’ Earnings (Barron’s)

- Why Bill Miller Likes Teva, Gannett, and Bitcoin (Barron’s)

- Elon Musk’s Internet Venture Gets the Green Light in Another Major Market (Barron’s)

- Intel Unveils New Chips. What Investors Need to Know. (Barron’s)

- U.S. Daily Covid Vaccinations Rise by Record 1.25 Million (Bloomberg)

- ‘You’re A Fool’ Who Will ‘Lose Everything’ If You Take On Debt To Invest In Crypto, Mark Cuban Says (Benzinga)

- Cramer: With Trump Out Of Picture, Twitter Could Struggle To Draw New Users (Benzinga)

- Gilead CEO: We Expect Remdesivir To Work On New COVID-19 Strains (Benzinga)

- Howard Marks’s Latest Warning (Institutional Investor)

- Jabs equal jobs? Fed sees possible economic boom if vaccine gets on track (Reuters)

- Playing chicken: Iran sets up challenge for Biden with nuclear ramp-up (CNBC)

- How this 34-year-old chess champion became India’s youngest new billionaire (CNBC)

- First, the Good News on Biden’s Stimulus (Wall Street Journal)

- Buying airline stocks now takes ‘leap of faith,’ analyst says (MarketWatch)

- Banks are back — almost half of 15 large U.S. banks are expected to increase quarterly profit (MarketWatch)

- Bank of America stock rallies after analyst says it’s time to buy (MarketWatch)

- 2-year/10-year Treasury yield curve steepest since mid-2017 (MarketWatch)

Tom Hayes – Quoted in Reuters article – 1/11/2021 (evening)

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here:

Where is money flowing today?

Data Source: Finviz