Data Source: Finviz

Tag: StockMarket

Be in the know. 15 key reads for Wednesday…

- Crude Oil Prices Soar As Saudi Arabia Gives The Industry A ‘Great New Year Present’ (Investor’s Business Daily)

- U.S. bankruptcy filings hit 35-year low thanks to government pandemic aid (Reuters)

- Tesla Is ‘Definitely Overvalued,’ Says Bill Gross. What He’s Buying Instead. (Barron’s)

- Merck Stock Is Deeply Undervalued, Says Citi. It Could Surge in 2021. (Barron’s)

- Pfizer Drops the Big Blue Pill to Highlight Shift in Strategy (Barron’s)

- World’s Super-Rich Families Want More Hedge Funds, Survey Finds (Bloomberg)

- These 6 Dividend Payers Look Primed for Growth in Earnings—and Payouts (Barron’s)

- U.K. Stocks Are at 20-Year Lows. Why It’s Time to Buy Post-Brexit. (Barron’s)

- Saudi Arabia to Cut Oil Production Sharply in Bid to Lift Prices (Wall Street Journal)

- 2020 SPAC Boom Lifted Wall Street’s Biggest Banks (Wall Street Journal)

- Wyndham Destinations Buys Travel + Leisure From Meredith for $100 Million (Wall Street Journal)

- Oil Market’s Surprise Gift Has a Dark Side (Wall Street Journal)

- Jim Cramer picks his 9 dividend stocks for income-driven investors (CNBC)

- 2 Top Homebuilder Stocks For 2021, According To BofA (Benzinga)

- BofA Securities Out With Top 10 Stock Ideas for Q1 2021 (24/7 Wall Street)

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Tuesday…

- 2 Lenders That Will Gain if Things Go Right for Banks This Year (Barron’s)

- How does the stock market perform after a 1% drop — or worse — to start a year? (MarketWatch)

- The One-of-a-Kind Lamborghini SC20 Is Both Road Registered and Race Ready (Barron’s)

- Haven, the Amazon-Berkshire-JPMorgan venture to disrupt health care, is disbanding after 3 years (CNBC)

- After the pandemic hit, he decided to knock on random mansion doors and ask, ‘What do you for a living?’ Now, his TikTok account’s blowing up. (MarketWatch)

- Byron Wien Says S&P 500 Will Tumble Before Rallying to 4,500 (Bloomberg)

- Wharton’s Jeremy Siegel: ‘Dow could easily tack on another 10% to 15%,’ but warns of a near-term setback (CNBC)

- Get Ready for Health-Care Stocks to Go Wild. How to Play Them. (Barron’s)

- NYSE Scraps Plan To Delist China Telecom Firms (Barron’s)

- Oil prices rise on Iran worries as OPEC+ talks continue (MarketWatch)

- Markets Expect GOP to Hold Senate in Georgia Runoff. Here’s What Happens if They Don’t. (Barron’s)

- 7 Value Stocks That Could Outperform in 2021 (Barron’s)

- The Stock Market Got Hit Hard by Covid Fears. Why the Concerns May Be Overblown. (Barron’s)

- What Should You Do With Boeing Stock? Don’t Ask Wall Street. (Barron’s)

- European Airlines Face an Uneven Recovery. 3 Stocks to Buy—and 3 to Avoid—for 2021. (Barron’s)

- Why Section 230 could get repealed in 2021 (USA Today)

- U.K. Bets 2 Million Vaccine Shots a Week Will End Lockdown (Bloomberg)

- Herbalife stock soars as Carl Icahn sells, says ‘role as activist not needed’ (New York Post)

- The U.S. real estate markets that are poised for a post-pandemic boom in 2021 (MarketWatch)

- New York Moves to Accelerate Covid-19 Vaccinations (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/4/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 4, 2021

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Quoted in Reuters article – 1/4/2021

Thanks to Medha Singh and Shivani Kumaresan for including me in their article on Reuters today. You can find it here:

Be in the know. 10 key reads for Monday…

- Investors handicapping the new market year see similarities to 2010′s recovery and 1999′s risk binge (CNBC)

- The fate of value stocks rests on the Georgia Senate races, J.P. Morgan strategists say (MarketWatch)

- Costco, Walgreens Boots Alliance, Constellation Brands, and Other Stocks to Watch This Week (Barron’s)

- For 2021, It Will All Come Down to iPhones for Apple. (Barron’s)

- S&P 500, Dow aim record open as economic rebound hopes fuel rally (Reuters)

- Fed has been successful at convincing markets it will be more dovish down the road, Bernanke says (MarketWatch)

- Israel Vaccinates More Than 10% of Its Population in Two Weeks (Wall Street Journal)

- Spinoffs to success: These multibillion dollar US companies didn’t exist a decade ago (USA Today)

- Google Workers Unionize, Escalating Tension With Management (Bloomberg)

- Fauci Says U.S. Covid Vaccine Pace Rising After Slow Start (Bloomberg)

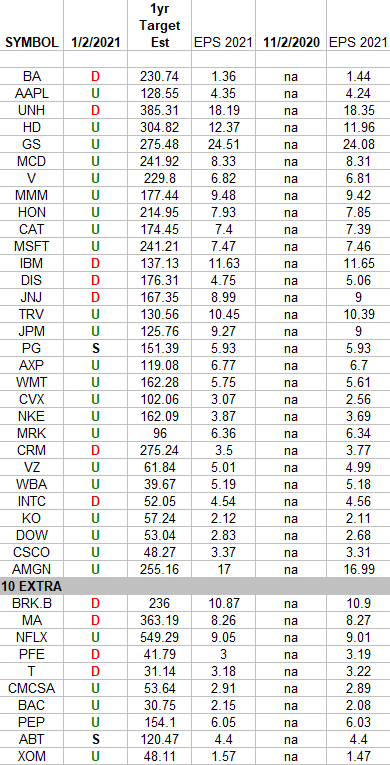

DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 10 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions”

Be in the know. 15 key reads for Sunday…

- Wall Street Eyes Billions in the Colorado’s Water (New York Times)

- How the American Mortgage Machine Works (Wall Street Journal)

- Why BlackRock Stock Will Continue to Rock (Barron’s)

- From Stocks to Bitcoin, Investors Bet the ‘Everything Rally’ Will Continue (Wall Street Journal)

- Barron’s First Picks And Pans Of 2021: Disney, Home Depot, Intel, Nike, Nordstrom And More (Benzinga)

- Barstool Fund Raises Nearly $17 Million For Small Businesses Affected By COVID-19 (Benzinga)

- Wall Street readies for more stock froth amid economic pain in 2021 (New York Post)

- ‘The Comedy Store’: TV Review (Hollywood Reporter)

- James Bond movies: Ranking 007’s best, worst and everything in between (CNET)

- California Businesses Leave The State By The Thousands (Hoover)

- Economists Expect Tough Winter, Then a Rebound (Wall Street Journal)

- Goldman’s Jan Hatzius on the Lessons Learned in 2020 (Podcast) (Bloomberg)

- Who Was the Real Holly Golightly? (Town & Country)

- The McLaren F1 Is Still the Definition of the Perfect Supercar (roadandtrack)

- Big Pharma Heads Toward a Deals Spree (Wall Street Journal)