- Opinion: These unsung investing heroes say 10 overlooked stocks are poised to outperform in 2021 (MarketWatch)

- Jerry Seinfeld: Transcendental Meditation and weight training will ‘solve just about anyone’s life’ (CNBC)

- The Benefits of Sticking to New Year’s Resolution to Work Out More (Wall Street Journal)

- The U.K. Has Finally Cut Ties With the EU. Here’s What Has Changed. (Wall Street Journal)

- Tech That Will Change Your Life in 2021 (Wall Street Journal)

- OPEC+ Emerges From Chaos of 2020 to Face Delicate Balancing Act (Bloomberg)

- More Than 10.8 Million Shots Given: Covid-19 Vaccine Tracker (Bloomberg)

- The Waldorf-Astoria’s Iconic Clock Is Ready To Run Again (Bloomberg)

- How to Invest Like Warren Buffett (Morningstar)

- Charlie Munger on disruption and technology (Morningstar)

- Why the Future Now Looks Brighter for Value Investing (Nasdaq)

- January Almanac: Still a Solid Month in Post-Election Years (Almanac Trader)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The 25 Greatest Supercars of the Last 100 Years (and Beyond) (Robb Report)

- Everything Coming to Netflix, Hulu, Amazon Prime and HBO Max In January (Maxim)

Tag: StockMarket

Be in the know. 15 key reads for New Year’s Day!

- 2021’s Dogs of the Dow (24/7 Wall Street)

- There’s a Science to Keeping New Year’s Resolutions (Bloomberg)

- Barron’s Best Income Investments for 2021 (Barron’s)

- These 7 Value Stocks Deserve a Fresh Look in 2021 (Barron’s)

- We Found a Bubble–but It May Not Be What You Think It Is (Barron’s)

- It’s Another Double-Digit Gain for the S&P 500. Here’s What Could Come Next. (Barron’s)

- Walmart Was a Pandemic Winner. How It Can Keep the Momentum Going in 2021. (Barron’s)

- Honeywell Had Quite a 2020. This Year Could Be Better. (Barron’s)

- Merck Is One of Barron’s Top Stock Picks for the New Year. Here’s Why. (Barron’s)

- How Barron’s Has Helped Investors Understand a World Marked by Upheaval for 100 Years (Barron’s)

- Nordstrom Might Have Had a Merry Holiday, Analyst Says (Barron’s)

- Casino Stocks Could Make a Comeback (Barron’s)

- Surprise Ending for Publishers: In 2020, Business Was Good (New York Times)

- The Oxford-AstraZeneca Vaccine Could be a Game-Changer for Inequality (Barron’s)

- NYSE to Delist China’s Major Telecommunications Operators (Wall Street Journal)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 63

Article referenced in VideoCast above:

The Kenny Chesney “Happy Does” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 53

Article referenced in podcast above:

The Kenny Chesney “Happy Does” Stock Market (and Sentiment Results)…

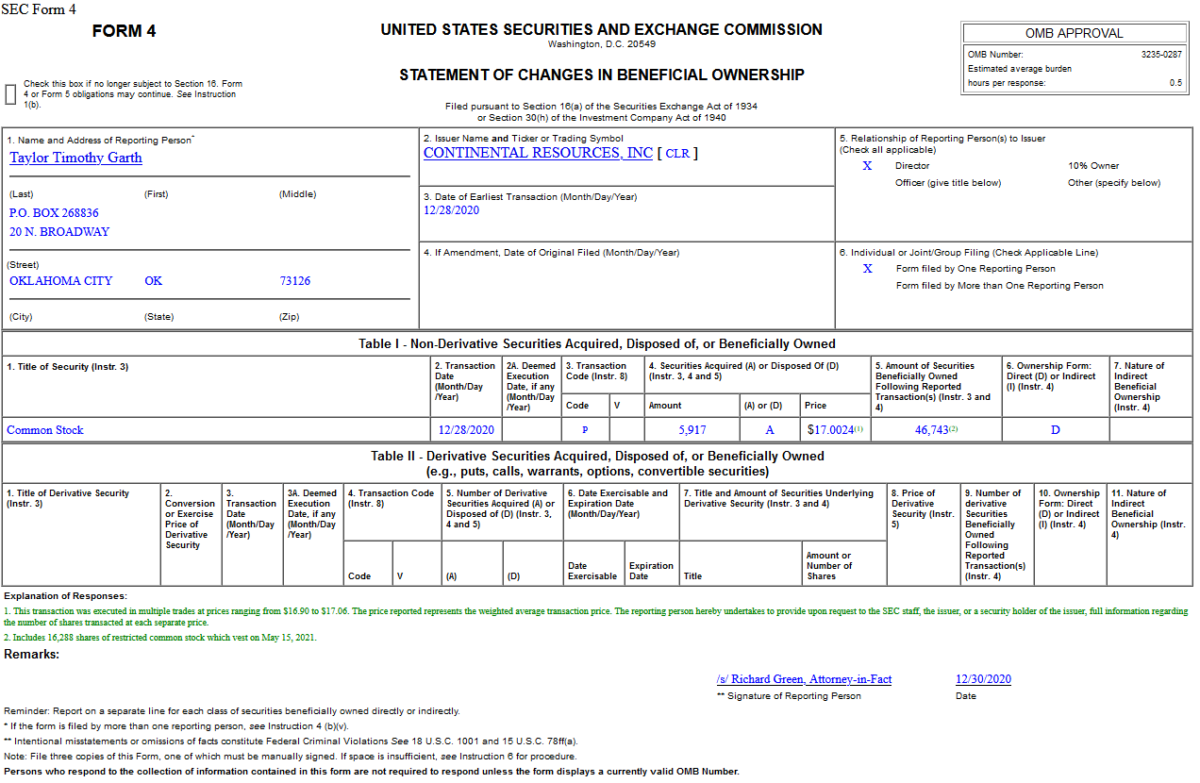

Insider Buying in Continental Resources, Inc. (CLR)

On Dec 28, 2020, Garth Taylor – Director of Continental Resources, Inc. (CLR) – purchased 5,917 shares of CLR at $17.00. His out of pocket cost was $100,603.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for New Year’s Eve…

- Chinese Tech Stocks Are in Hot Water. It May Not Last. (Barron’s)

- Why Nordstrom Looks Like a Department Store Survivor (Barron’s)

- Casino Stocks Just Might Make a Comeback (Barron’s)

- JPMorgan Chase Stock Is a Beaten-Down Bet on Better Times (Barron’s)

- Record IPO Surge Set to Roll On in 2021 (Wall Street Journal)

- Post-Vaccine Vacation Dreamers Plot to ‘Get the Hell Out of Their House’ (Wall Street Journal)

- Amazon Buys Wondery as Podcasting Race Continues (New York Times)

- U.S. weekly jobless claims fall for second straight week (Reuters)

- 5 Very Contrarian Stocks to Buy Now for 2021 That All Pay Big Dividends (24/7 Wall Street)

- Tesla Short Sellers Lost $38 Billion in 2020 as Stock Surged (Bloomberg)

- Trading legend Art Cashin shares his poem to say goodbye to 2020 and welcome the New Year (CNBC)

- Why Jeff Bezos always thinks three years out and only makes a few decisions a day (CNBC)

- Bryn Mawr’s Jeff Mills believes the small-caps boom is only just beginning and 2021 will deliver even bigger gains (Business Insider)

- Google’s founders visited Warren Buffett more than a decade ago – and were so inspired they modeled Alphabet on Berkshire Hathaway (Business Insider)

- How One Rolex Became The NBA’s De Facto Starter Watch (Bloomberg)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- These Stocks Have Been Left Behind in the Rally. They May Be Ripe for Picking. (Barron’s)

- Here’s What Happens Now That Oxford-AstraZeneca Vaccine Won U.K. Clearance (Bloomberg)

- Biotech Stocks Ready for More Covid-19 Results in First Quarter (Bloomberg)

- A Stretch of Pristine Land in Florida Is Finally Booming During Covid (Bloomberg)

- Warren Buffett paid out $60 million after the Red Sox won the World Series in 2007 (Business Insider)

- Here’s the difference between the dot-com bubble and today’s soaring stock market, according to DataTrek (Business Insider)

- The Vaccine Dominated 2020 for J&J. Next Year Should Be More Normal. (Barron’s)

- Bitcoins Dirty Little Secret. The Energy Report 12/30/2020 (Phil Flynn)

- Regeneron COVID-19 Antibody Cocktail Shows Positive Response In Hospitalized Patients (Benzinga)

- Third Point Urges Intel To Explore Strategic Alternatives: Report (Benzinga)

- These are the 20 worst-performing S&P 500 stocks of 2020 — analysts see double-digit rebounds for 6 of them in 2021 (MarketWatch)

- Fed, Treasury Provide One-Week Reprieve for ‘Main Street’ Program After Demand Surges (Wall Street Journal)

- Lamborghini, Maserati, Mini, T-Bucket: Our Favorite My Ride Cars of 2020 (Wall Street Journal)

- Inside the Google-Facebook Ad Deal at the Heart of a Price-Fixing Lawsuit (Wall Street Journal)

- Covid-19 Vaccine Outlook Prompts Businesses to Dust Off Return-to-Office Plans (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz