Data Source: Finviz

Tag: StockMarket

Be in the know. 20 key reads for Thursday…

- Fed Stays the Course (Barron’s)

- What’s Inside the $908 Billion Stimulus Bill (Barron’s)

- Lennar Says This Was Its Best Year Ever. What It Expects in 2021. (Barron’s)

- Oil trades at more-than-9-month highs (MarketWatch)

- Wall Street Is Warming Up to Exxon Mobil Stock (Barron’s)

- Latest Google antitrust lawsuit accuses it of ‘unlawful’ union with Facebook (New York Post)

- 10 States Accuse Google of Abusing Monopoly in Online Ads (New York Times)

- U.S. Housing Starts Rose For a Third-Straight Month in November (Bloomberg)

- Powell Sees Light at End of Tunnel and Policy Staying Very Easy (Bloomberg)

- 5 things to know before FDA panel votes on Moderna’s Covid vaccine Thursday (CNBC)

- Weekly jobless claims unexpectedly rise, hit highest level since early September (CNBC)

- Antibody drugs could cut Covid-19 hospitalizations by half, but they’re not getting to Americans (CNBC)

- Facebook declares war on Apple (MarketWatch)

- DoorDash, Grubhub, Others Could Face Pared-Down Menu (Wall Street Journal)

- Fed sees US GDP fully rebounding by end 2021. (Business Insider)

- Goldman Sachs Has 4 Sizzling Energy Stocks to Buy That All Pay 5% or More Dividends (24/7 Wall Street)

- EU sounds optimistic note as hopes for Brexit trade deal mount (Financial Times)

- Pfizer COVID-19 Vaccine US Supply Could Rise 40% As FDA Clears Use Of Extra Doses In Vials (Benzinga)

- These Are the U.S. Antitrust Cases Facing Google, Facebook and Others (Wall Street Journal)

- Texas’ Tax Advantage Is All About Individuals, Not Business Taxes (Wall Street Journal)

The Luke Combs, “Lovin’ On You” Stock Market (and Sentiment Results)…

The song we chose to capture this week’s market sentiment is Luke Combs’ “Lovin’ on You.” These lyrics accurately describe managers’ (and retail investors’) feelings for the market as of late: Continue reading “The Luke Combs, “Lovin’ On You” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 16,372 contracts of Feb $55 strike calls (or the right to buy 1,637,200 shares of Exxon Mobil Corporation (XOM) at $55). The open interest was just 3,968 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”

Be in the know. 30 key reads for Wednesday…

- 16 Bank Stocks That Could Outpace the Sector in 2021 (Barron’s)

- Speakeasy of secrets: Forgotten tales of debauchery from NYC’s ‘21’ Club (New York Post)

- Banks’ Billions in Payouts Hinge on Fed’s View of the Pandemic (Bloomberg)

- What Spending Slowdown: BofA Credit, Debt Cards Show Soaring Retail Sales (ZeroHedge)

- December Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- Goldman Sachs Upgrades ExxonMobil (XOM) to Buy; Challenges Reflected in Valuation with Upside Potential (Street Insider)

- 10 Ways to Play a 2021 Energy-Stock Rebound (Barron’s)

- The 2021 Dogs of The Dow (Barron’s)

- The Fed’s Monetary Stimulus Has Boosted Household Wealth (Barron’s)

- The Fed Is Walking a Tightrope With Its Policy Messaging (Barron’s)

- It Has Definitely Been a Big Year for IPOs. It Just Might Be Tech Bubble 2.0. (Barron’s)

- Tech Giants Face New Rules in Europe, Backed by Huge Fines (Wall Street Journal)

- FDA Finds Moderna Covid-19 Vaccine Highly Effective (Wall Street Journal)

- Congressional Leaders Say They Are Closer to Deal on Covid-19, Year-End Spending Bill (Wall Street Journal)

- Real Estate’s Biggest Losers Enjoy a One-Month Stock Bounce (Wall Street Journal)

- Moderna Vaccine Is Highly Protective Against Covid-19, the F.D.A. Finds (New York Times)

- Critical to Vaccines, Cold Storage Is Wall Street’s Shiny New Thing (New York Times)

- Leaders Close In on Aid Deal Below $900 Billion (Bloomberg)

- Lyft Wants People to Be Hailing Fully Driverless Cars on Its App by 2023 (Bloomberg)

- Fed Mulls Shift in Bond Buying Program: FOMC Decision-Day Guide (Bloomberg)

- The FTC’s Antitrust Case Against Facebook Stakes Out New Ground (Bloomberg)

- Rich States Uncover Tax Windfall, Undercutting Push for More Aid (Bloomberg)

- Refinance demand jumps 105% annually, as mortgage rates set another record low (CNBC)

- U.S. retail sales decrease more than expected in November (Reuters)

- Fed faces tricky act balancing impact of vaccines against economic pain (Reuters)

- Former poker champion says this common mistake is a ‘huge problem’ in business (Yahoo! Finance)

- Southwest to take delivery of 35 737 MAX jets through end-2021 (Yahoo! Finance)

- ‘It’s Going to Rain Dividends and Buybacks Next Year.’ What to Expect for Markets and Consumer Stocks in 2021. (Yahoo! Finance)

- Spectre of higher inflation threatens historic bond rally (Financial Times)

- There is no stock market bubble (Financial Times

Tom Hayes – CGTN Global Business Appearance – 12/15/2020

CGTN Global Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 15, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Tuesday…

- Wells Fargo upgraded to Outperform from Market Perform at Keefe Bruyette (TheFly)

- This Is How Vaccines Are Distributed and Which Stocks Benefit (Barron’s)

- ‘It’s an economic war’— Warren Buffett urges Congress to extend relief for small businesses (CNBC)

- Lockheed Martin awarded $900M F-16 service contract (Fox Business)

- Why These Tech Stocks Face a Regulatory Reckoning in Europe On Tuesday (Barron’s)

- Why Consumer Stocks Will Remain in Focus in 2021 (Barron’s)

- This is not just a value recovery – it could be the biggest market opportunity of our lifetimes (fnLondon)

- China’s economic recovery picked up in November (MarketWatch)

- Here’s what the stock market predicts for 2021 (USA Today)

- Demand for 2021 Ford F-150 pickups exceeds supply (USA Today)

- The ‘Savings Glut’ Is Really a Dearth of Investment (Bloomberg)

- FDA staff endorses emergency use of Moderna’s Covid vaccine in a critical step toward approval (CNBC)

- Goldman Sachs CEO said that 90% of small businesses have exhausted PPP funds (CNBC)

- Casinos should have a huge year in 2021, Jim Cramer says (CNBC)

- The S&P 500 could soar 18% in 2021 as social and economic disruptions from the pandemic reverse, says a Wall Street chief strategist (Business Insider)

- Goldman Sachs CEO expresses concern about market euphoria driven by small investors buying IPOs (CNBC)

- Warren Buffett’s right-hand man discussed the ‘frenzy’ in stocks, technological shifts, and what makes a great investor in a recent interview. Here are Charlie Munger’s 22 best quotes. (Business Insider)

- GE’s stock bounces toward snapping 3-day losing streak after Deutsche Bank boosts price target (MarketWatch)

- These 3 regions hold the best bets for 2021, say top fund managers (MarketWatch)

- Ameriprise, CI Eyeing Wells Fargo Asset Management Arm (Yahoo! Finance)

- Fleeing New Yorkers resulted in an estimated $34 billion in lost income –study (Reuters)

- EU warns that it may break up Big Tech companies (Financial Times)

- FTC Demands Social-Media, Operations Data From Big Tech Companies (Wall Street Journal)

- ‘The Best Year Ever’: 2020 Was Surprisingly Good to Small Banks (Wall Street Journal)

- Steel Orders Jump After Covid-19 Slowdown (Wall Street Journal)

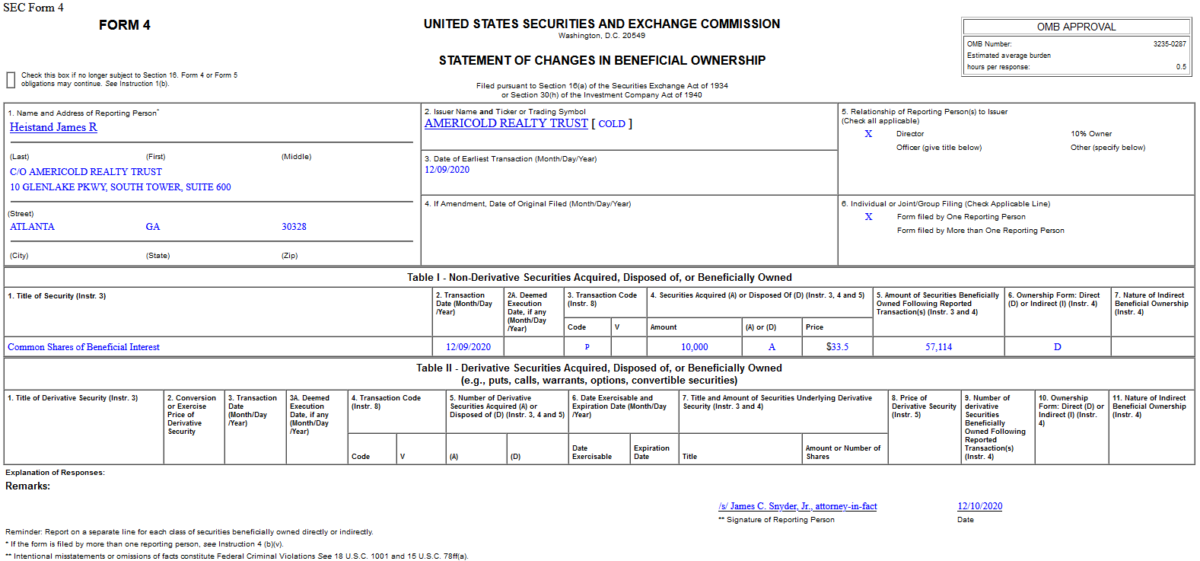

Insider Buying in Americold Realty Trust (COLD)

On December 19, 2020, James Heistand – Director of Americold Realty Trust (COLD) – purchased 10,000 shares of COLD at $33.50. His out of pocket cost was $335,000.

Where is money flowing today?

Data Source: Finviz