- Johnson & Johnson Expects Vaccine Trial Results in January (Barron’s)

- Looking For Light. The Energy Report 12/09/2020 (Phil Flynn)

- The Latest Lap in Bluebird’s and Crispr’s Race to Cure Sickle Cell (Barron’s)

- “No End In Sight”: Watch Gundlach’s DoubleLine Webcast (ZeroHedge)

- ECB Preview: Here Comes Another €500 Billion In QE (ZeroHedge)

- The Consumer Could Explode in 2021. Here Are the Stocks to Buy. (Barron’s)

- White House Proposes $916 Billion Stimulus Package With Direct Payments to Americans (Barron’s)

- Wall Street Is Still Cautious on Wells Fargo Stock. Analysts have increasingly warmed to the bank in recent months, believing that it has more upside than peers as it navigates through regulatory issues. (Barron’s)

- A Life-Changing Ferrari 458 Spider (WSJ)

- Boeing Makes First 737 MAX Delivery Since Lifting of FAA Ban (Wall Street Journal)

- Louis Pasteur Had Good Advice About Luck and Life (Wall Street Journal)

- Stock Buybacks Have Fallen Off a Cliff. Why They’re Set to Make a Comeback. (Barron’s)

- The market may be about to pause, this strategist says — but he’s still optimistic about stocks next year (MarketWatch)

- Ray Dalio Sees ‘Flood of Money’ With Soaring Asset Prices (Bloomberg)

- How To Invest Like Nelson Peltz (Benzinga)

- Wall Street forecasts just keep going up: Morning Brief (Yahoo! Finance)

- A Short Seller Claims a ‘Fictional Character’ Wrote This Company’s Medical Research (Institutional Investor)

- Jamie Dimon signals strong end to year on Wall Street (Financial Times)

Tag: StockMarket

Unusual Options Activity – Teva Pharmaceutical Industries Limited (TEVA)

Data Source: barchart

Today some institution/fund purchased 4,897 contracts of March $8 strike calls (or the right to buy 489,700 shares of Teva Pharmaceutical Industries Limited (TEVA) at $8). The open interest was just 729 prior to this purchase. Continue reading “Unusual Options Activity – Teva Pharmaceutical Industries Limited (TEVA)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Tuesday…

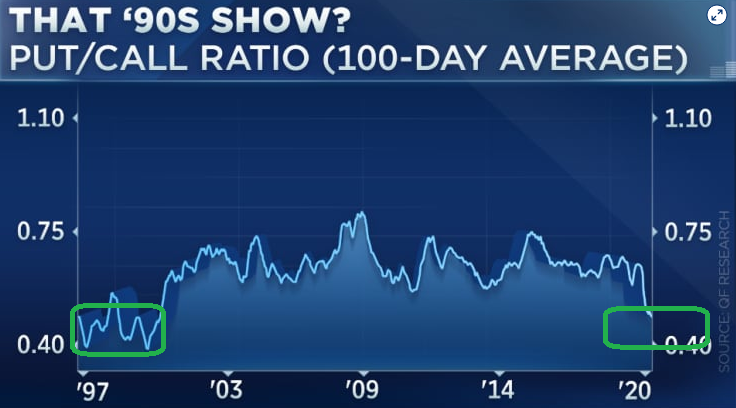

- These 4 technical indicators are pointing to a roaring stock market in the 1st half of 2021, according to BofA (Business Insider)

- The Case For Value And What It Means For Europe (ZeroHedge)

- Raytheon’s board OKs $5 billion share buyback (MarketWatch)

- Watch this signal to see if the rally can continue, strategist says (MarketWatch)

- ‘Smart money’ index hits one-year low, as stock market trades near records (MarketWatch)

- Chamath Palihapitiya – The Social Capital Flywheel (EP.167) (capitalallocatorspodcast)

- Bill Gates Says 6 COVID-19 Vaccines Likely To Get Regulatory Approval By Q1 (Benzinga)

- Boeing 737 MAX Passenger Flights To Start With Brazil’s Gol (Benzinga)

- Restaurant owner: Coronavirus lockdowns in California will bring death, poverty (Fox Business)

- Does Dan Loeb Secretly Love Short Selling? (institutionalinvestor)

- UBS Upgrades Boeing (BA) to Buy; Out-Year FCF Estimates Move Materially Higher (Street Insider)

- GE’s stock gains after $4 billion in actions to strengthen balance sheet (MarketWatch)

- Pfizer Shot Effective, Safe, FDA Staff Says Before Meeting (Bloomberg)

- U.K. Begins Western World’s First Covid Shots (Bloomberg)

- Why the market’s lowest-quality stocks are embarking upon a rally that should extend for months, according to one Wall Street strategist (Business Insider)

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Monday…

- Goldman Sees Higher Oil Prices in 2021 After OPEC+ Agreement (Street Insider)

- The stock market is undergoing a ‘rare reversal’ that’s historically signaled double-digit returns to come, says one Wall Street chief strategist (Business Insider)

- Walgreens (WBA) Options Activity Resuscitates LBO Talk – Deutsche Bank (Street Insider)

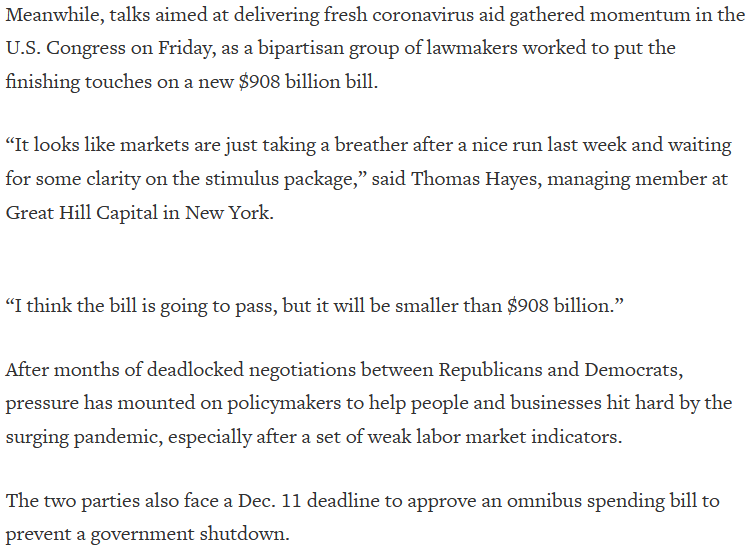

- Wall Street headed lower on Sino-U.S. tensions; stimulus deal awaited (Reuters)

- Wayne Gretzky’s rookie card could be the first in hockey to break the $1-million milestone (The Star)

- ‘We are only in the middle of the bull market’ and a buying opportunity could come soon, JPMorgan says (MarketWatch)

- Relationship between a rising stock market and weak dollar strongest since the wake of the financial crisis — will it continue? (MarketWatch)

- The Boeing MAX 737 Jet Is Carrying Passengers Again. What It Means for the Stock. (Barron’s)

- 7 Stocks That Could Soar on Higher Oil Prices (Barron’s)

- JPMorgan Warns of Crowded Trades Amid Markets’ ‘Clear Consensus’ (Bloomberg)

- Barron’s Latest Picks And Pans: Airbnb, Bank Stocks, Dividend Aristocrats And More (Benzinga)

- Pound falls over deadlock in EU-UK trade talks (Financial Times)

- UBS Upgrades Spirit AeroSystems (SPR) to Buy; 737 Accounted for ~90% of Earnings in 2018 (Street Insider)

- A Covid Vaccine Has Arrived. Get Ready for the Rollout (Bloomberg)

- Details of $908 Billion U.S. Pandemic Relief Plan Set for Release (Bloomberg)

- Airbnb, DoorDash Boost Price Ranges Ahead of Mega Week for IPOs (Bloomberg)

- These 10 vehicles are the hottest 2021 classic cars, according to collector car insurer Hagerty (USA Today)

- Nearly $4.4 trillion of home mortgages are set to be originated this year (Bloomberg)

- JPMorgan sends policy recommendations to Biden team on ways to prevent more Covid-related misery (CNBC)

- Gene Editing Shows Promise in Sickle-Cell Disease (Wall Street Journal)

Tom Hayes – Quoted in Reuters article – 12/7/2020

Thanks to Shriya Ramakrishnan and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Be in the know. 16 key reads for Sunday…

- Stock market 2021: Stocks expected to keep climbing as strategists look to a brighter 2021 (Yahoo! Finance)

- U.S. Vaccines May Start Friday Amid Covid’s Worst: Virus Update (Bloomberg)

- Why a vaccine won’t be yet another ‘false dawn’ for value stocks: ‘This one does feel different’ (fnLondon)

- 7 Bank Stocks That Could Thrive in the Biden Era (Barron’s)

- Saudis Raise Crude Pricing to Asia as Vaccines Buoy Oil Market (Bloomberg)

- A Monetary Mind at the Treasury (project-syndicate)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- TEN-YEAR TREASURY YIELD NEAR 1% MARK… STOCK INDEXES ARE HITTING NEW RECORDS — FINANCIAL SPDR HITS NEW RECOVERY HIGH (John Murphy)

- Top economists say this is what’s on their stimulus wishlist—and the bipartisan bill looks pretty close (Fortune)

- Wolfgang Puck Is Now Shipping His Famed Smoked Salmon Pizza Nationwide (Robb Report)

- Bryan Cranston Breaks Bad Again. And It’s a Thrill to Watch. (Daily Beast)

- How Moderna’s Vaccine Works (New York Times)

- Sean Connery’s 007 pistol from ‘Dr.No’ sells for $256,000 (OANN)

- 2021 Dodge Durango SRT Hellcat Quick Review: C’mon and Bring the Family to 180 MPH (The Drive)

- Elon Musk Is Reportedly Heading to Texas for a Tax Break (gizmodo)

- Here are 3 under-the-radar market story lines that could surprise investors in 2021 (CNBC)

Be in the know. 25 key reads for Saturday…

- Energy stocks propel S&P 500 to new record (Financial Times)

- Airbnb’s IPO Will Be Hot. Its Stock Will Be Worth the Price. (Barron’s)

- Ignore the ‘top callers,’ there’s still ‘easy money’ to be made this year, hedge-fund manager says (MarketWatch)

- Howard Marks Outlines Investment Opportunities, Risks (Barron’s)

- The ‘Elevation’ Stock Market (Seeking Alpha)

- The Boeing MAX 737 Jet Is Carrying Passengers Again. What It Means for the Stock. (Barron’s)

- Oil prices up 5 straight weeks to 9-month high after OPEC+ deal to only slowly unwind output cuts (MarketWatch)

- Move Over, Millennials! Baby Boomers Are Fueling Latest Stock Rally (Barron’s)

- The Top 30 Stocks Over the Last 30 Years… (Compound Advisors)

- China Recently Unveiled Its Latest 5-Year Plan. Here are the Highlights. (Barron’s)

- Stimulus Optimism Grows, and Congress Gets Job-Market Alert (Bloomberg)

- U.S. sells more than $175 billion in weapons to foreign governments, nearly 3% higher than last year (CNBC)

- Nordstrom shares soar with one analyst group upbeat about the luxury retailer’s post-COVID prospects (MarketWatch)

- In Greenwich, Connecticut, money is no object. Real estate there is on fire (CNN Business)

- Small Cap Rotation, Reopening, and Reversion (royce)

- Review: The Ghost is more modest and simple, but it’s still a Rolls-Royce (CNN Business)

- Equity Put/Call Ratio at Historical Extreme, but… (QuantifiableEdges)

- SpaceX Will Launch Remote Controlled Racecars to Lunar Surface (futurism)

- Daniel Ek, CEO of Spotify — The Art of Seeing Around Corners, Two-Year Missions, Top Books, and the Essence of Fire Soul (#484) (Tim Ferriss)

- Warren Buffett: How Fisher’s Scuttlebutt Method Changed My Life (acquirersmultiple)

- Secrets of the Market Wizards with Jack Schwager (investorhour)

- Comparative Roaring ’20s (yardeni)

- Small Cap Rotation, Reopening, and Reversion (Royce)

- Explore Or Exploit? How To Choose New Opportunities (Farnam Street)

- Value Investing: A History (investoramnesia)

Tom Hayes – One America News Network (OAN) TV Appearance – 12/4/2020

One America News Network (OAN) TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 4, 2020