- Finland and Norway Avoid Covid-19 Lockdowns but Keep the Virus At Bay (Wall Street Journal)

- AstraZeneca’s Covid-19 Vaccine Shows Strong Immune Response in Older Adults (Barron’s)

- It’s Still Boom Times for Home Builders, October Data Show (Barron’s)

- FedEx driver caught slaying Mariah Carey’s ‘All I Want for Christmas’ (New York Post)

- Dow falls in late trading after NYC moves to close schools (New York Post)

- U.S. weekly jobless claims total 742,000, vs 710,000 estimate (but continuing claims fall) (CNBC)

- Billionaire investor Bill Ackman discussed his pandemic hedge, praised Trump, and explained his Berkshire Hathaway exit in a recent interview. Here are the 19 best quotes (Business Insider)

- 3 Dividend Oil Stocks For Investors To Consider (Benzinga)

- Vaccine arrival expected to trigger dollar slump in 2021 (Financial Times)

- Why value investing still works in markets (Financial Times)

- Jamie Dimon blames ‘childish behavior’ in Congress for coronavirus relief deadlock (Fox Business)

- This bond-market signal will tell investors when/if it’s time to sell stocks, says strategist (MarketWatch)

- FDA Clears First Covid-19 Test Performed Fully at Home (Wall Street Journal)

- Market’s Vaccine Euphoria Was Bad News for Momentum Funds (Wall Street Journal)

- Investors Bet Economic Recovery Won’t Spark Jump in Inflation (Wall Street Journal)

Tag: StockMarket

The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…

With yesterday’s weakness into the close, we chose AC/DC’s, “Thunderstruck” as the song to embody current stock market sentiment. The end of day sell off was precipitated by the NYC Mayor’s decision to close all schools. Continue reading “The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…”

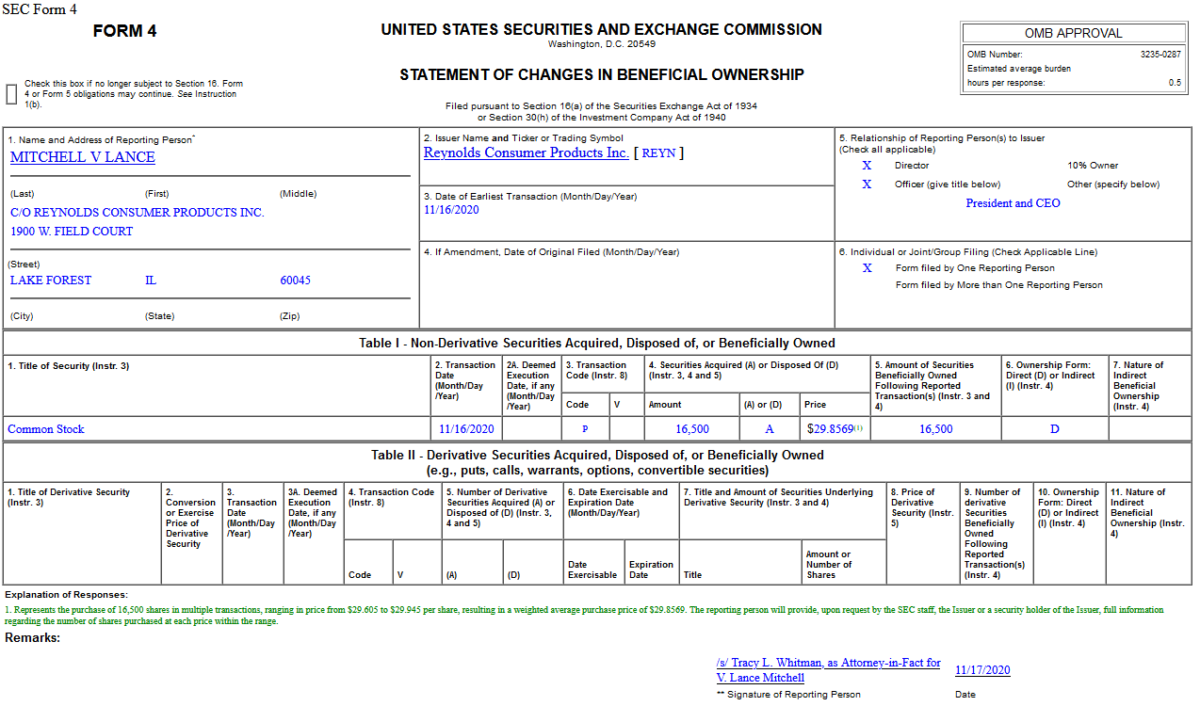

Insider Buying in Reynolds Consumer Products Inc. (REYN)

On November 16, 2020, Thomas Gibson – President & CEO of Reynolds Consumer Products Inc. (REYN) – purchased 16,500 shares of REYN at $29.86. His out of pocket cost was $492,639.

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Wednesday…

- Financial Stocks Rally as Jefferies Turns Bullish Through 2021 (Bloomberg)

- Opinion: Put bank stocks in the ‘buy’ pile if you think a coronavirus vaccine will help mend the economy (MarketWatch)

- Pfizer’s Final Analysis Shows Covid Vaccine is 95% Effective (Barron’s)

- The MAX Jet Is Back. It’s Good for More Stocks Than Boeing. (Barron’s)

- U.S. housing starts beat expectations in October (Reuters)

- Apple to Cut App Store Fees in Half for Most Developers (Yahoo! Finance)

- Hospitals may limit access to Eli Lilly COVID-19 treatment (New York Post)

- FDA Gives Nod To First COVID-19 At-Home Rapid Test (Benzinga)

- Rupert Murdoch’s News Corp Bids for Simon & Schuster (New York Times)

- Disappearing Tweets? Twitter Now Has a Feature for That (New York Times)

- Warren Buffett is Hiding Something Big (Street Insider)

- ‘The Squad’ pushes Biden to cancel student debt — here’s how they’d personally benefit (Fox Business)

- Tire Maker Michelin Could Get a Lift From More Drivers (Barron’s)

- How Bad Is Amazon Pharmacy for CVS and Walgreens? (Barron’s)

- Here’s why stocks can climb 15% next year, according to JPMorgan’s strategists (MarketWatch)

- ‘Keep the faith, trust the recovery’ — Morgan Stanley raises its S&P 500 target but says it won’t be a smooth ride (MarketWatch)

- The ECB May Loosen Its Dividend Ban, so Eurozone Banks Should Narrow the Gap With UBS, Goldman Sachs Says (Barron’s)

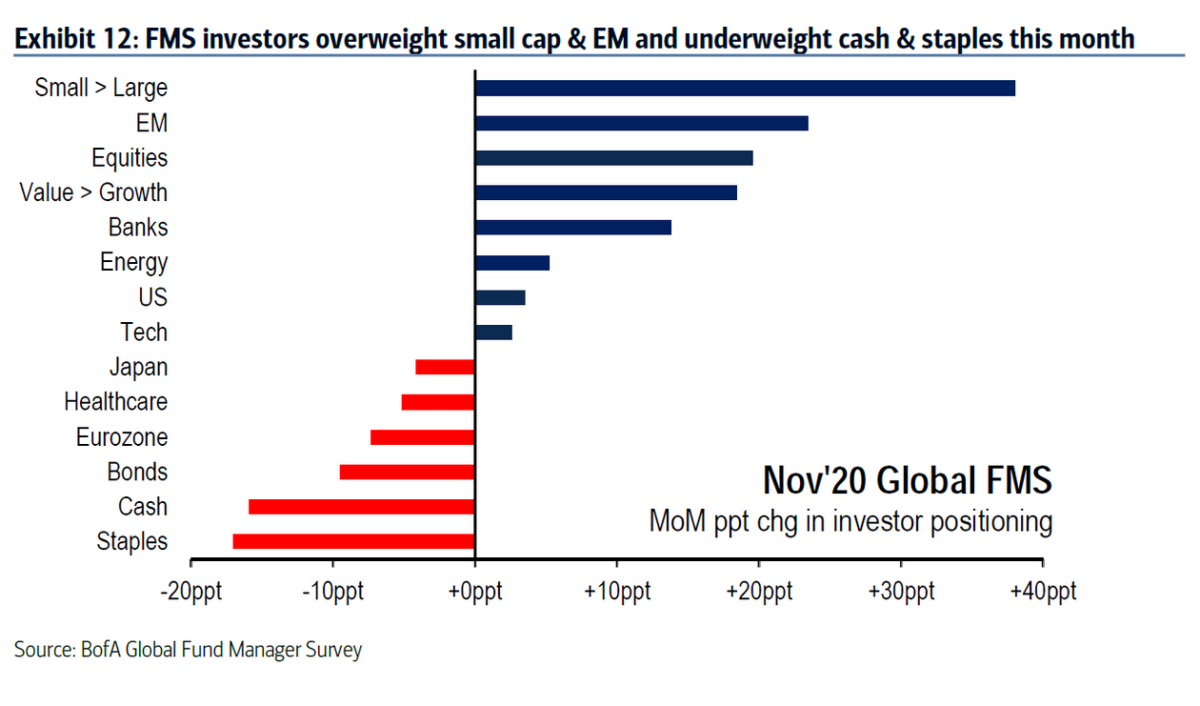

- Fund managers have hopped on the rotation-to-value trade, latest Bank of America survey shows (MarketWatch)

- Japan’s exports nearly back at pre-COVID levels (MarketWatch)

- U.S. Retail Sales Climbed at a Slower Pace in October (Wall Street Journal)

- Moderna and Pfizer Are Reinventing Vaccines, Starting With Covid (Wall Street Journal)

- Mortgage demand from homebuyers surges after election pause (CNBC)

- JPMorgan’s Jamie Dimon Says Congress Is Being ‘Childish’ on Stimulus (Bloomberg)

- Goldman Sachs says commodities poised for bull market (Reuters)

- Pfizer says it will seek U.S. emergency-use authorization within days for coronavirus vaccine (MarketWatch)

Where is money flowing today?

Data Source: Finviz

November Bank of America Global Fund Manager Survey Results (Summary)

190 Managers overseeing ~$526B AUM responded to this month’s BofA survey. Continue reading “November Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 28 key reads for Tuesday…

- This Is What Hedge Funds Bought And Sold In Q3: Complete 13F Summary (ZeroHedge)

- Exclusive: OPEC+ sees oil cut extension curbing 2021 rise in oil stocks, document shows (Reuters)

- Fed Could Buy More Bonds if Coronavirus Hits Too Hard (Barron’s)

- Warren Buffett’s Berkshire Hathaway Confirms Apple Stock Sale, Buys of Pfizer, Merck (Barron’s)

- The Stock Market Hit a New High Monday. Here’s Why It Can Keep Racing Higher. (Barron’s)

- Fund managers are believers in the rotating-to-value trade, latest Bank of America survey shows (MarketWatch)

- Vaccines Could Boost Economic Recovery in Emerging Markets. 8 Stocks That Have a Shot. (Barron’s)

- Warren Buffett Is (Mostly) In The Right Place At Right Time (Investor’s Business Daily)

- Multiplan Stock Has a Wild Few Days After Short Report, Earnings, and Wall Street Initiations (Barron’s)

- Imperial Brands Stock Climbs as Lockdown Boosts Tobacco Sales and Profit. 2021 Will Be Better. (Barron’s)

- China’s Lopsided Economic Recovery Continues. Expect Widening Global Trade Gaps. (Barron’s)

- Yamada sees the “FAANMG” tech leaders making tops and being vulnerable to declines of “bear-market proportions.” (Barron’s)

- Investors are losing patience with Big Tech over its lax attitude to harmful content (fnlondon)

- Could the Fed act early? Yes, says this strategist who maps out the central bank’s possible next move (MarketWatch)

- The Fed Could Act If Covid Hits the Economy. Stocks Would be the Winner (Barron’s)

- The Dow just clinched its fastest bear-market recovery in 30 years (MarketWatch)

- Why ‘seriously underloved’ small-cap stocks have room to rise as vaccine progress sparks rotation (MarketWatch)

- Southwest Airlines Seizes the Moment as Rivals Struggle (Wall Street Journal)

- Moderna Vaccine Offers Possible Antidote to Deep-Freeze Problem (Bloomberg)

- Warren Buffett Likes Stocks Again (Bloomberg)

- BofA Says Market Is So Bullish It’s Time to Sell on Vaccine News (Bloomberg)

- DoorDash Loves the ’Burbs as Much as You Do (Wall Street Journal)

- Shipping Stocks Are Riding a Different Kind of Covid-19 Wave (Wall Street Journal)

- Airbnb’s Recovery May Be Worth Betting On (Wall Street Journal)

- Walmart Jumps After Smashing Expectations As Average Ticket Soars 24% (ZeroHedge)

- Amazon Starts Selling Prescription Drugs To Prime Customers (ZeroHedge)

- Boeing’s 737 Max is set to return to the skies as industry reels from pandemic (CNBC)

- ‘Everything points upward’: Wharton professor Jeremy Siegel says the economy and stock market will be stronger than expected in 2021 (Business Insider)

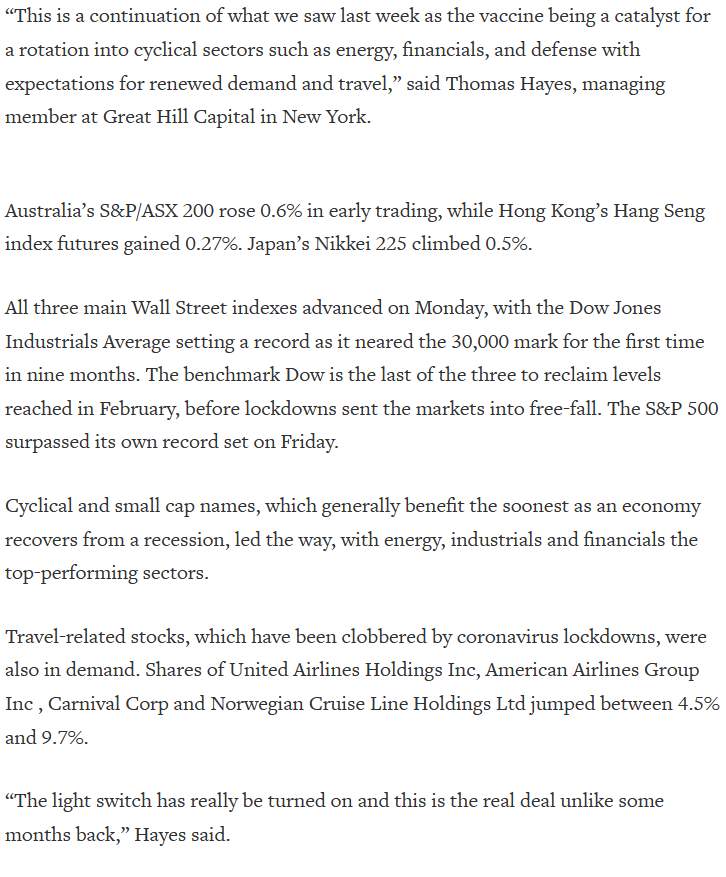

Tom Hayes – Quoted in 2 Reuters articles – 11/16/2020

Click Here to View The First Article on Reuters

Click Here to View The Second Article on Reuters

Thanks to Chibuike Oguh and Alun John for including me in their articles on Reuters today.

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 2,983 contracts of May $47.50 strike calls (or the right to buy 298,300 shares of Exxon Mobil Corporation (XOM) at $47.50). The open interest was just 1,711 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”