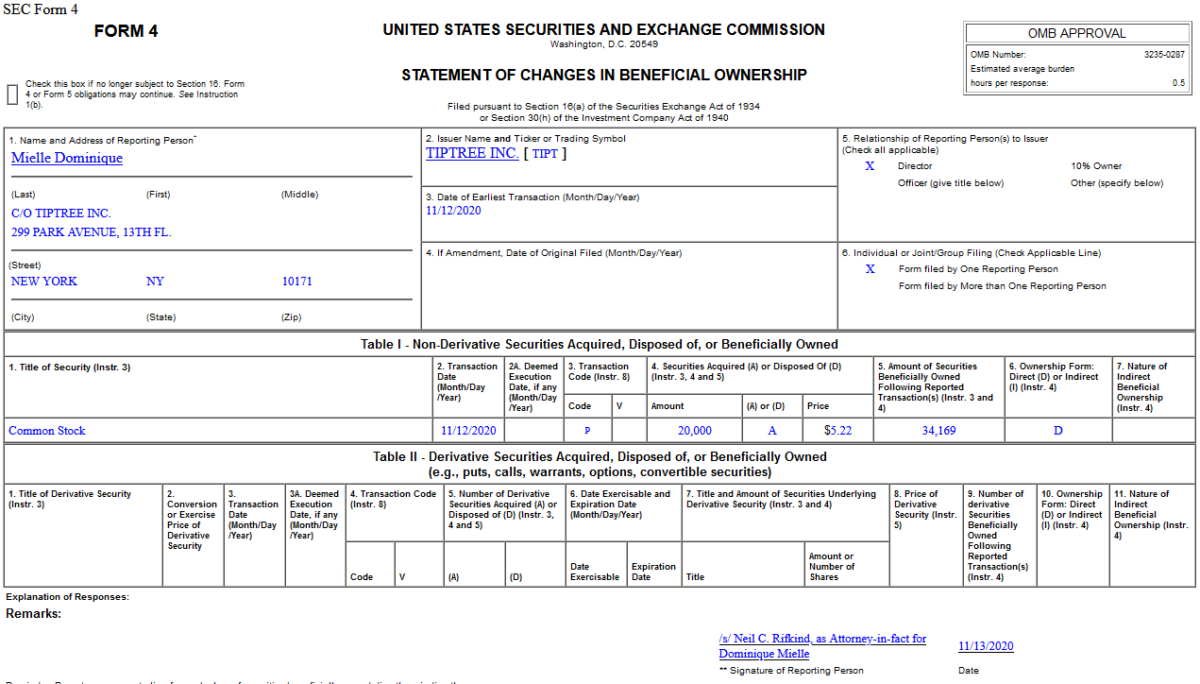

On Nov 12, 2020, Dominique Mielle – Director of Tiptree Inc. (TIPT) – purchased 20,000 shares of TIPT at $5.22. Her out of pocket cost was $104,400.

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 17 key reads for Friday…

- Why Value Stocks’ Gains Might Be Real This Time (Barron’s)

- Stocks in these 11 industries are set to rocket higher once a COVID-19 vaccine is approved, UBS says (Business Insider)

- Disney’s Stream Is Floating an Awfully Big Ship (Wall Street Journal)

- Apple doc ‘Becoming You’ shows what happens when parents don’t coddle kids (New York Post)

- Why healthcare stocks are the best value sector to buy right now, according to a Goldman Sachs stock chief (Business insider)

- Markets Are Already Pricing a Successful Moderna Vaccine Shot (Bloomberg)

- DoorDash makes U.S. IPO filing public, reveals rapid revenue growth (Reuters)

- Palantir boosts its full-year revenue outlook (Fox Business)

- Betting Odds, Picks For 2020 Masters Tournament: DeChambeau, Johnson And Tiger (Benzinga)

- We’ll Be Home For Christmas. The Energy Report 11/13/2020 (Phil Flynn)

- 15 Stocks That Held Up Amid This Week’s Wild Swings (Barron’s)

- Quant Shock That ‘Never Could Happen’ Hits Wall Street Models (Bloomberg)

- ‘Help is coming — and it’s coming soon’: Dr. Fauci outlines when COVID-19 vaccine will be available to all Americans (MarketWatch)

- It’s Time to Get ‘Aggressive’ on Bank Stocks. Here’s Why. (Barron’s)

- Pfizer’s Vaccine Is a Pick-Me-Up for Value Stocks (Wall Street Journal)

- Scanwell Aims to Offer Instant At-Home Covid Antibody Test (Wall Street Journal)

- Oil Forecasters’ Gloom Eclipsed by Vaccine Hope (Wall Street Journal)

Where is money flowing today?

Data source: Finviz

Be in the know. 21 key reads for Thursday…

- Overall Consumer Prices Were Unchanged in October (Barron’s)

- Companies with more women in management have outperformed their more male-led peers, according to Goldman Sachs (Business Insider)

- 6 Bank Stocks That Could Be Winners in 2021 (Barron’s)

- The Louis Armstrong, “What a Wonderful World” Stock Market (and Sentiment Results)… (ZeroHedge)

- AC/DC’s Wild Ride on the ‘Highway to Hell’ (Wall Street Journal)

- Alibaba Sets ‘Singles Day’ Sales Record (Wall Street Journal)

- Hollywood gets back to work as film permits rise 24 percent (New York Post)

- U.S. Initial Jobless Claims Decline by the Most in Five Weeks (Bloomberg)

- Moderna Poised to Take Vaccine Spotlight With Data Due (Bloomberg)

- Oil CEOs believe a demand recovery is coming, but volatility is here to stay (CNBC)

- ‘Help is coming — and it’s coming soon’: Dr. Fauci outlines when COVID-19 vaccination will be available to all Americans (MarketWatch)

- Energy Assault. The Energy Report 11/12/2020 (Phil Flynn)

- Google releases predictions of popular holiday gifts (USA Today)

- The stock market’s fear gauge is approaching a key technical level that could signal further upside for equities, Fundstrat’s Tom Lee says (Business Insider)

- Nissan Is an Unlikely Pandemic Winner (Wall Street Journal)

- Landowners in America: These people own the most land in the U.S. (USA Today)

- Bridgewater’s Dalio Sees Governments Banning Bitcoin Should It Become ‘Material’ (Yahoo! Finance)

- Rob Arnott Sees Value Recovery Taking Root After Worst Meltdown Since 1931 (Institutional Investor)

- Consumer Sentiment Edges Higher – BofA Securities (Street Insider)

- American Airlines restarts China flights, bringing U.S. weekly total to 10 (Fox Business)

- Buy Raytheon, Spirit Because of Pfizer’s Vaccine News, Analyst Says. Here’s How Far Those Stocks Can Run. (Barron’s)

The Louis Armstrong, “What a Wonderful World” Stock Market (and Sentiment Results)…

This week, we chose Louis Armstrong’s, “What a Wonderful World” as the theme song to capture market sentiment. Continue reading “The Louis Armstrong, “What a Wonderful World” Stock Market (and Sentiment Results)…”

Tom Hayes – The Claman Countdown – Fox Business Appearance – 11/11/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – November 11, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 30 key reads for Wednesday…

- Wells Fargo says banks are the best economy comeback trade, tells clients to get ‘aggressive’ (CNBC)

- Goldman Sachs has just boosted its S&P 500 target. Here’s why (MarketWatch)

- Why Vince Vaughn Tried to Avoid Sequels Until Wedding Crashers 2 (MovieWeb)

- 12 Beaten-Up Stocks That Won’t Blow You Up (Barron’s)

- What’s in Store for Stocks, Stimulus, Trade, and Other Issues During a Biden Presidency (Barron’s)

- The Small-Cap Rally is Just Getting Started (Barron’s)

- FDA Authorizes Eli Lilly’s Covid Antibody Drug (Barron’s)

- Oil Prices Continue Their Rally. And Market Watchers Think There’s Room to Run. (Barron’s)

- The Stock Market Gained 10% Over Just 6 Days. Here’s What History Says Happens Next. (Barron’s)

- Pfizer’s News Ignited the Markets. How to Invest for a Post-Vaccine World. (Barron’s)

- Oil Prices Continue Their Rally. And Market Watchers Think There’s Room to Run. (Barron’s)

- Bank Stocks Still Have Room to Run Even With Challenges, Analyst Says (Barron’s)

- Lyft’s Revenues Top Estimates. It Still Expects a Profit in ‘21. (Barron’s)

- The Future Is Now for Industrials, as Renewable Power, Connectivity and Automation Converge (Barron’s)

- Alibaba Shatters Singles Day Sales Record At $56B — With Another 24 Hours To Go (Benzinga)

- Rocket Companies Revenue Up 163% In Record Q3 (Benzinga)

- Ackman places new bet against corporate credit (Financial Times)

- “It’s The Roaring ’20s Again”: Goldman Now Expects The S&P To Hit 4,600 In 2022 (ZeroHedge)

- U.S. Job Openings Are Rising Closer to Prepandemic Levels (Wall Street Journal)

- Lael Brainard’s Steady Rise Could Culminate in Treasury Secretary Post (New York Times)

- Why a Trump Loss May Be No Match for Rupert Murdoch’s Realpolitik (New York Times)

- The Covid-Winter Backyard: Fire Pits, Pizza Ovens and Patio Heaters (Wall Street Journal)

- Cyclical Stocks Power Dow Industrials Higher (Wall Street Journal)

- China Targets Alibaba, Other Homegrown Tech Giants With Antimonopoly Rules (Wall Street Journal)

- Theater Chains Are Loving This Summer Preview (Wall Street Journal)

- Parler, MeWe, Gab gain momentum (USA Today)

- The Global Rich Are Rushing to Buy U.K. Country Estates (Bloomberg)

- CEO sells stock worth $5.6 mln on same day as Pfizer’s COVID-19 vaccine update (Reuters)

- Billionaire investor Ray Dalio believes Ant’s IPO suspension was reasonable — and says not investing in China is ‘very risky’ (Business Insider)

- ‘The greatest hole-in-one in history’ just happened at the Masters, and it has to be seen to be believed (MarketWatch)

Tom Hayes – CGTN Global Business Appearance – 11/10/2020

CGTN Global Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – November 10, 2020