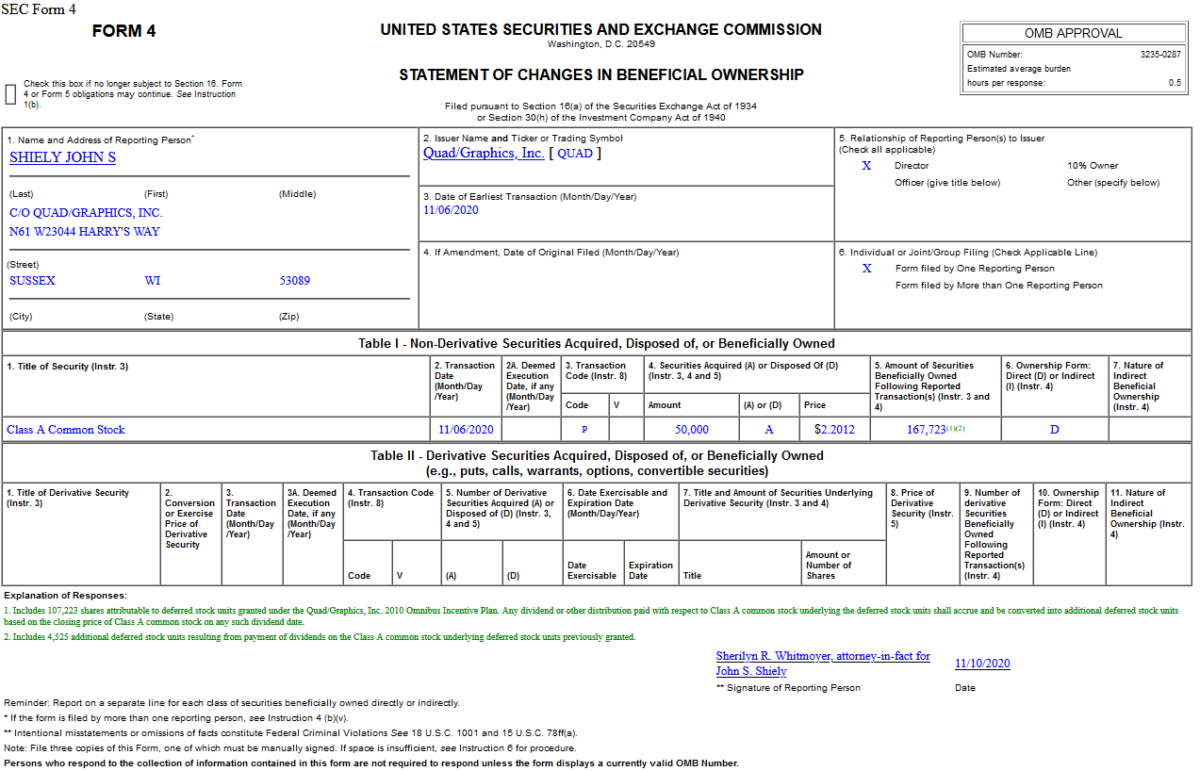

On Nov 6, 2020, John Shiely – Director of Quad/Graphics, Inc. (QUAD) – purchased 50,000 shares of QUAD at $2.20. His out of pocket cost was $110,060.

Tag: StockMarket

Where is money flowing today?

Data Source: finviz

Be in the know. 20 key reads for Tuesday…

- US banks in line for windfall after Covid-19 vaccine progress (Financial Times)

- Berkshire Appears to Have Sold $4 Billion of Apple Stock in Third Quarter (Barron’s)

- Pfizer’s Vaccine News Sends Stock Market’s Biggest 2020 Losers Soaring (Barron’s)

- Eli Lilly Covid Antibody Drug Gets Emergency FDA Clearance (Bloomberg)

- EU hits Amazon with antitrust charges for distorting competition in online retail markets (CNBC)

- Homebuilder DR Horton posts 81% sales spike (Fox Business)

- Vaccine Has Wall Street Ready to Suit Back Up (Wall Street Journal)

- Bank Stocks Break Out on Upbeat Covid-19 Vaccine Data (Barron’s)

- CureVac’s stock is up 8% as it shares additional Phase 1 data about its COVID-19 vaccine candidate (MarketWatch)

- Ulta Beauty shop-in-shops coming to 100 Target stores in 2021 (MarketWatch)

- While the Pandemic Wrecked Some Businesses, Others Did Fine. Even Great. (New York Times)

- Pfizer, Eli Lilly Breakthroughs Provide Hope for Ending Pandemic (Bloomberg)

- Stanley Druckenmiller says he wouldn’t want to be short market, sees stock rotation continuing (CNBC)

- 12 Stocks Are Still Cheap After Huge Vaccine And Election Rally (Investor’s Business Daily)

- Boeing (BA) Surges on Vaccine News and Likely 737 MAX Ungrounding (streetinsider)

- Pfizer COVID-19 vaccine could be given by the end of the year, says Fauci (MarketWatch)

- Why Vaccine News Is Such Good News for GE Stock (Barron’s)

- Want to travel at 600 mph in a tube? It could happen (USA Today)

- Here are the 2 big signals that stocks need to keep moving higher, says Credit Suisse’s top equity strategist (MarketWatch)

- Small caps break to record high for first time since 2018 (CNBC)

Tom Hayes – Quoted in Reuters article – 11/9/2020

Thanks to Medha Singh and Shivani Kumaresan for including me in their article on Reuters today. You can find it here:

Be in the know. 10 key reads for Monday…

- Pfizer’s Covid Vaccine Prevents 90% of Infections in Study (Bloomberg)

- Pfizer, BioNtech say Covid-19 vaccine is 90% effective (CNBC)

- A 30-Year Look At Value Vs Growth (ETF.com)

- Homebody in a Hoodie: Hedge Fund Founder Builds Quant Paradise (Bloomberg)

- Berkshire Hathaway Is Increasingly Betting on Itself. That Should Cheer Shareholders. (Barron’s)

- A ‘growth bomb’ is brewing in the US with consumers sitting on $2.5 trillion in savings — and it’s poised to give the economy a huge boost, one Wall Street chief strategist says (Business Insider)

- Warren Buffett’s Berkshire Hathaway swings back into action, spending a net $4.8 billion on stocks and a record $9 billion on buybacks in the 3rd quarter (Business Insider)

- Biden and transition team ready to move on cabinet picks (Financial Times)

- Rebounding Corporate Profits Fortify Stock Market Rally (Wall Street Journal)

- The Cure for Oil. The Energy Report 11/09/2020 (Phil Flynn)

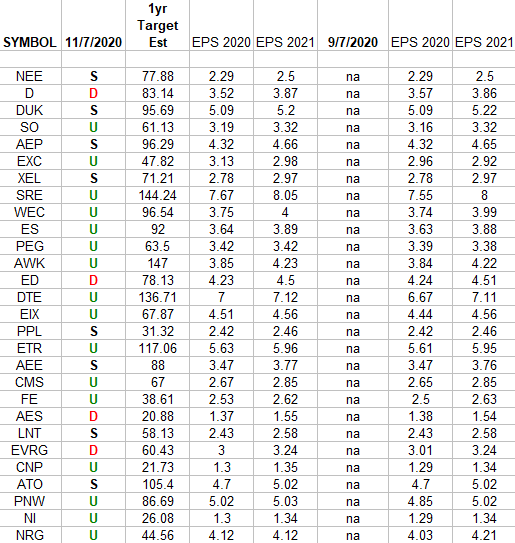

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

Be in the know. 12 key reads for Sunday…

- Kamala Harris Makes History: What The First Female Vice President-Elect Means For Women (Forbes)

- America’s Richest Self-Made Women (Forbes)

- Ray Dalio on the Decline of Real Interest Rates (Podcast) (Bloomberg)

- Here’s What A Biden Presidency Means for You. (Barron’s)

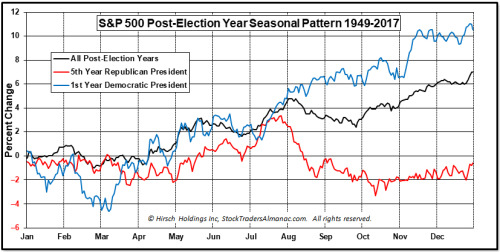

- S&P 500 Post-Election Year Seasonal Pattern (Almanac Trader)

- Winners and Losers During Trump’s Presidency (Bespoke)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Behind the Wheel of The Completely Insane $2.4 Million Pagani Huayra Roadster (Maxim)

- klein vision releases video of the maiden flight of its transforming AirCar (designboom)

- Ferrari F40 vs. McLaren P1 Drag Race Shows What a Difference 25 Years Can Make (thedrive)

- 20 Things Most People Learn Too Late In Life (medium)

- Michael Mauboussin On Valuing Intangible Assets (Podcast) (Bloomberg)

Be in the know. 25 key reads for Saturday…

- Bill Miller: There’s a lot to buy out there: Legendary investor Bill Miller (CNBC)

- Why the election result is the ‘best of both worlds’ for stocks, according to JPMorgan’s quant guru (Business Insider)

- Can Warren Buffett Forecast the Stock Market? (Morningstar)

- If you had to own one company for a generation.. (dividendgrowthinvestor)

- DuPont Is Materially Undervalued (Morningstar)

- Common Probability Errors to Avoid (Farnam Street)

- Traveling Back in Time: Historical Resources (investoramnesia)

- GAMCO CEO Mario Gabelli on how he’s assessing the micro and macro landscape (CNBC)

- Are Value Investors Just Missing Growth Stocks? (behavioralvalueinvestor)

- Long Term + Value = Winning Potential (Miller Value)

- Why Millennials Should Own Value Stocks (Oakmark)

- Dot-Com Redux: Is This Tech “Bubble” Different? (CFA Institute)

- Reminiscences of a Stock Operator by Edwin Lefèvre (novelinvestor)

- Factored In? (humbledollar)

- Berkshire Buybacks Hit Record $9 Billion in Third Quarter. Operating Earnings Miss Mark. (Barron’s)

- No Stimulus? This Expansion Still Looks Self-Sustaining, Says One Economist (Barron’s)

- Here’s a Timeshare Pitch That’s Worth a Listen: The Investment Case for Marriott Vacations (Barron’s)

- Apollo Could Thrive With or Without CEO Leon Black. What’s at Stake for Investors. (Barron’s)

- Opinion: How sharp investors use a CEO’s annual shareholder letter as a secret door to superior stocks (MarketWatch)

- Opinion: This veteran stock investor is sticking to his strategy no matter who wins the 2020 presidential election (MarketWatch)

- Matthew McConaughey and the Art of Livin’ (Vanity Fair)

- The president for the next four years gets a surprisingly strong jobs market (CNBC)

- The Last 4 Days Show Nice Momentum (quantifiableedges)

- Intel’s Success Came With Making Its Own Chips. Until Now. (Wall Street Journal)

- Dish Network Stems Pay-TV Defections (Wall Street Journal)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 55

Article referenced in VideoCast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 45

Article referenced in podcast above: