Article referenced in podcast above:

Tag: StockMarket

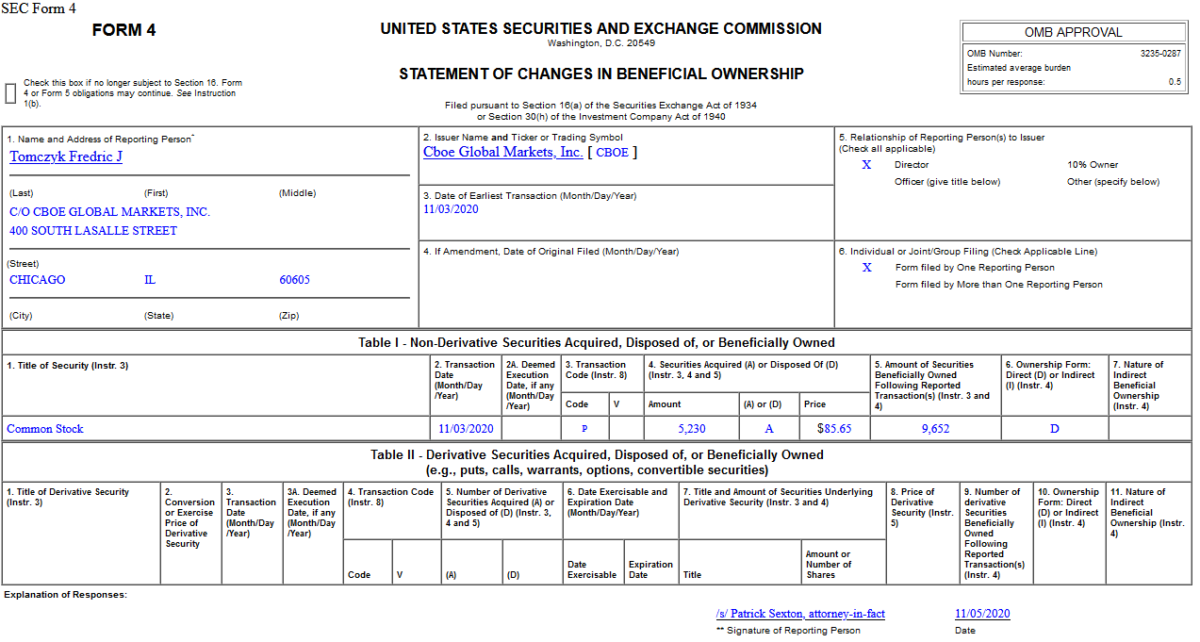

Insider Buying in Cboe Global Markets, Inc. (CBOE)

On Nov. 3, 2020, Fredric Tomczyk – Director of Cboe Global Markets, Inc. (CBOE) – purchased 5,230 shares of CBOE at $85.65. His out of pocket cost was $447,950.

Where is money flowing today?

Data source: Finviz

Be in the know. 10 key reads for Friday…

- Citi and Barclays Push Back Against the Reflation Doom and Gloom (Bloomberg)

- Unemployment Falls to 6.9% as Hiring Climbs More Than Expected (Barron’s)

- Why Danone Stock Could Be Appetizing to Investors (Barron’s)

- 6 S&P 500 Dividend Payers With Safe Yields Above 2% (Barron’s)

- The Fed Could Do a Little More. But a Stimulus Package Would Be Better. (Barron’s)

- Investments to Add to Your Portfolio in a Contested Election (Barron’s)

- The Boeing 737 MAX Will Come Back Soon. Wall Street Is Getting Ready. (Barron’s)

- Alibaba cloud growth outpaces Amazon and Microsoft as Chinese tech giant pushes for profitability (CNBC)

- Why the stock market is loving the prospect of a divided government (Business Insider)

- Carl Icahn boosts Xerox stake to over 14% (Yahoo! Finance)

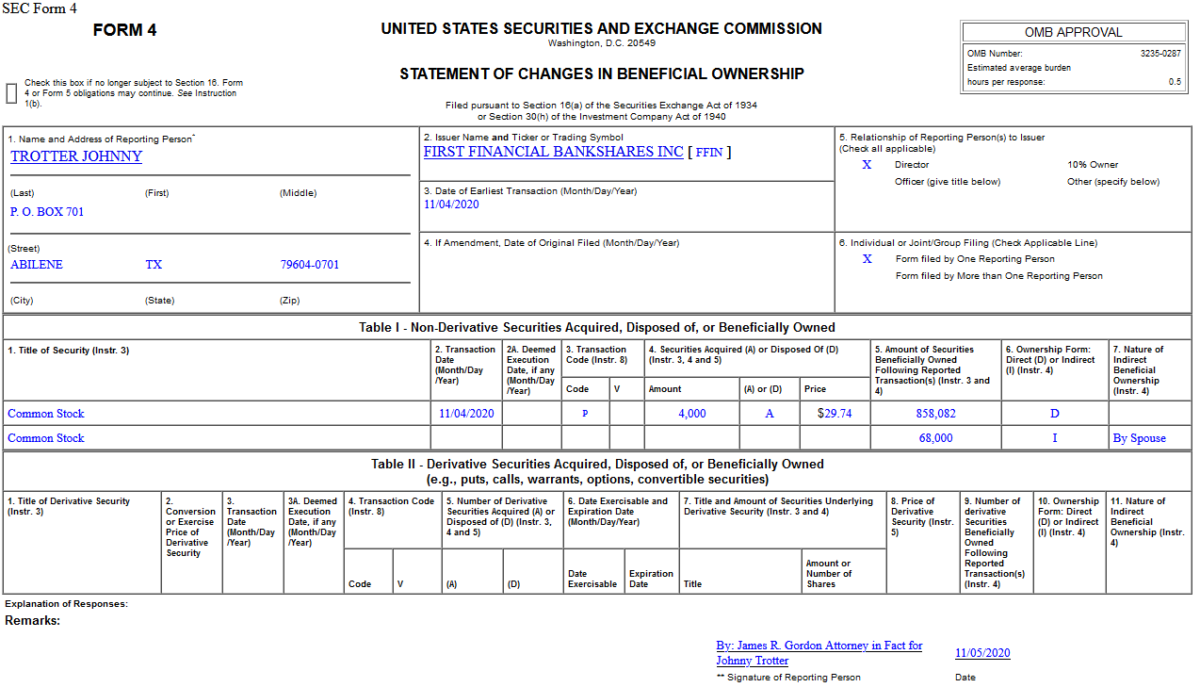

Insider Buying in First Financial Bankshares, Inc. (FFIN)

On November 4, 2020, Johnny Trotter – Director of First Financial Bankshares, Inc. (FFIN) – purchased 4,000 shares of FFIN at $29.74. His out of pocket cost was $118,960.

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Nasdaq #TradeTalks Appearance – 11/05/2020

Nasdaq #TradeTalks Appearance – Thomas Hayes – Chairman of Great Hill Capital – November 5, 2020

Be in the know. 15 key reads for Thursday…

- Don’t Be So Quick to Vote Out Financials (Wall Street Journal)

- Jeff Bezos Sells Another $3B Worth Of Amazon Shares (Yahoo! Finance)

- Amid Election Turmoil, Institutional Investors Stay Focused on the Pandemic (Institutional Investor)

- AstraZeneca-Oxford Covid Vaccine on Track for Year End, CEO Says (Bloomberg)

- These 7 ‘deeply out of favor stocks’ are worth a look right now, says contrarian manager (MarketWatch)

- Invesco Adds Trian’s Nelson Peltz and Two Others to Its Board. Here’s Why That’s Important. (Barron’s)

- What To Know About Investing Today, According To Joel Greenblatt (Barron’s)

- When the Election Could Be Decided, and Why Stocks Are Rising Now (Barron’s)

- Uber and Lyft Drivers in California Will Remain Contractors (New York Times)

- A split Congress will be ‘excellent’ for the economy and stock market, Wharton Professor Jeremy Siegel says (Bussiness Insider)

- Amid U.S. election uncertainty, Fed likely to lay low this week (Reuters)

- Stock futures jump as potential Washington gridlock signals less regulatory risk (Reuters)

- COVID-19 Vaccines To Generate over $10B Annual Revenue, Analyst Say (Benzinga)

- Oil and gas groups buoyed by fading fears of US ‘blue wave’ (Financial Times)

- Crude Inventory Data Shows Surprise Draw of 8 Million Barrels Last Week (Street Insider)

The “Knee Jerk” Stock Market (and Sentiment Results)…

It has been a whirlwind 48 hours. Since there is so much to discuss regarding the election and its implications, the stock market outlook, and the initial knee-jerk reaction of the stock market, I thought it would be more helpful to put the majority of this week’s article in video than print (so I could cover more ground in a shorter period of time). Continue reading “The “Knee Jerk” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance Appearance – 11/04/2020

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – November 4, 2020