- China Economy Grows 4.9% In Q3, Extending Virus Recovery (Barron’s)

- Big Contrarian Investor Sells AT&T and Gold Stocks. They Bought Wells Fargo. (Barron’s)

- Speculators Reverse Big Nasdaq Short (Bloomberg)

- Conoco to Buy Concho for $9.7 Billion to Create Shale Giant (Bloomberg)

- Pelosi gives White House 48 hours to reach coronavirus stimulus deal before election (CNBC)

- U.S. Army Medical Research and Development (USAMRDC) Develops COVID-19 Vaccine Candidate (SpFN) Now in Clinical Trials (TrialSiteNews)

- Stalemate. The Energy Report 10/19/2020 (Phil Flynn)

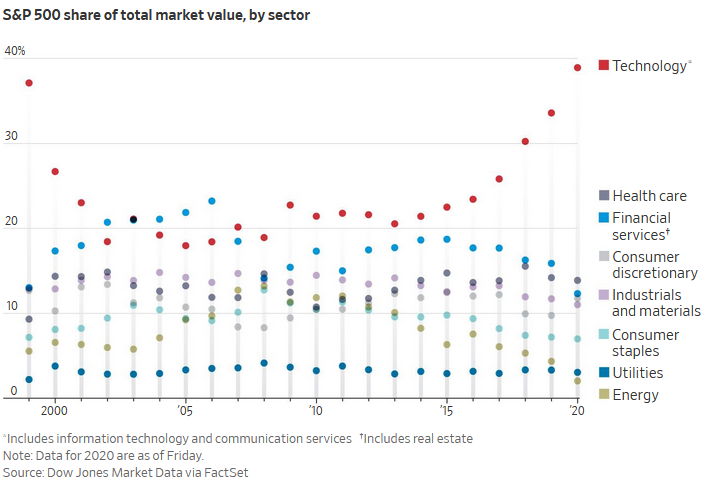

- Tech’s Influence Over Markets Eclipses Dot-Com Bubble Peak (Wall Street Journal)

Tag: StockMarket

Be in the know. 15 key reads for Sunday…

- Pfizer COVID-19 vaccine rolls off production line amid hopes for emergency approval (New York Post)

- Will New York Go for Another Wall Streeter as Mayor? (New York Times)

- Waiting to pass stimulus until after the election is a mistake, says economist Mark Zandi (Fortune)

- This year’s ‘October surprise’ could impact your portfolio for years to come (Fortune)

- Amazon Pays Big Bucks For Eddie Murphy’s ‘Coming 2 America’ (Maxim)

- A suspected-banksy with a hula-hooping girl appears in Nottingham (designboom)

- Valuing Exxon (Insider Monkey)

- The ‘I’m An Accountant’ Stock Market, And Sentiment Results (SeekingAlpha)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- ‘How are you going to learn properly?’: JPMorgan CEO Jamie Dimon warns over increasing negatives of working from home (fn London)

- The Mad, Mad World of Niche Sports Among Ivy League–Obsessed Parents (The Atlantic)

- COVID & Global Valuations (Verdad)

- The Master Plan: Biotech player turned Ottawa Senators owner Eugene Melnyk faces off against COVID-19 (Financial Post)

- Don’t Fight T-Fed (Yardeni)

- The Phil Flynn Energy Report Riding the waves (futuresmag)

Be in the know. 35 key reads for Saturday…

- Breaking Big Tech (Advisor Perspectives)

- U.S. Money Managers Like the Outlook for Stocks, According to Barron’s Poll (Barron’s)

- GE’s stock gets a big boost after news that Boeing’s 737 MAX could fly again this year (MarketWatch)

- Bill Miller 3Q 2020 Market Letter (Miller Value)

- Why Read? Advice From Harold Bloom (Farnam Street)

- The 2020 Aston Martin Vantage Coupe is the Entry Level to the James Bond Fantasy Life (Barron’s)

- Look Who’s Really Chasing Hot Stocks Like Zoom (Wall Street Journal)

- Forget the Rent, Collect the Yield: Why Investors Looking to Retire Early Should Consider REITs (Barron’s)

- Here are Wall Street’s favorite stocks for an election-relief rally (MarketWatch)

- Looking for Yield? Mortgage REITs Offer Double-Digit Returns. (Barron’s)

- Pfizer says earliest U.S. filing for COVID-19 vaccine would be late November (Reuters)

- Trump says: ‘I’m ready to sign a big, beautiful stimulus’ — but many Americans are not banking on it (MarketWatch)

- Google now lets you search for a song by humming or singing its tune (New York Post)

- Warren Buffett plowed $5 billion into Bank of America during the debt crisis. Here’s the story of how the investor helped the bank and made a fortune in the process. (Business Insider)

- The wealthiest 1% of Americans will drive positive household demand for stocks in 2021, Goldman Sachs says (Business Insider)

- Mark Cuban on stalled stimulus negotiations: All of Congress is ‘complicit in the problem’ (CNBC)

- In Reversal, Twitter Is No Longer Blocking New York Post Article (New York Times)

- Stock-market bulls are counting on the consumer staying strong — should they? (MarketWatch)

- Behind the Stability in China’s Currency: Beijing’s Hidden Hand (Barron’s)

- An Analyst Plays Matchmaker With Chevron and Exxon (Barron’s)

- Walgreens Beats Estimates in Fiscal Q4, Returns to Profit (equities)

- Natural gas generators make up largest share of U.S. electricity generation capacity (eia)

- Boris Johnson throws down ‘no deal’ gauntlet to EU (Financial Times)

- Federal Reserve debates tougher regulation to prevent asset bubbles (Financial Times)

- ‘Value drought’ claims latest victim as growth stocks power on (Financial Times)

- The new Porsche Targa: is this the greatest 911 yet? (Financial Times)

- Will Value Stocks Overtake Growth Shares After The Election? (Investing.com)

- There’s More to Value Investing Than Low Prices (Morningstar)

- Buffett’s Disciples Should Pray for a Bond Bust (Bloomberg)

- Tale of Two Economies: Housing-Related Boom vs Pandemic-Challenged-Services Bust (Yardeni)

- Charlie Munger’s 10 Rules for Investment Success (DGS)

- Margin of Safety Still Matters (value stock geek)

- How to play on market’s reversion to the mean: Tobias Carlisle offers a few tips

(Economic Times) - Coming into Focus (Howard Marks)

- Elections and Markets (Investor Amnesia)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 52

Article referenced in VideoCast above:

The “I’m an Accountant” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 42

Article referenced in podcast above:

The “I’m an Accountant” Stock Market (and Sentiment Results)…

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Why Wells Fargo’s Stock Could Rise Over 50% (24/7 Wall Street)

- Harold Hamm hits back at ‘crazy’ shale claims (Financial Times)

- Why Goldman Sachs Is Bullish on Oilfield Services for Q3 Earnings and 2021 (24/7 Wall Street)

- Actually, Walgreens Did Prove Its Relevance on Earnings (24/7 Wall Street)

- Southern Connecticut—a Close Suburb of New York City—Sees Sales, Prices Surge (Mansion Global)

- Opinion: Biden will win, polls say. But the stock market is sending a different signal (MarketWatch)

- Dow Jones Futures Rise On Coronavirus Vaccine, Boeing 737 Max News; Zoom Video In Buy Zone, Apple, Amazon Set Up (Investor’s Business Daily)

- Mayra Joli, nodding lady at Trump town hall, is ex-beauty queen who ran for Congress (New York Post)

- Boeing 737 Max is safe to fly again, Europe’s aviation regulator says (CNBC)

- Retail sales rise 1.9% in September, vs 0.7% expected (CNBC)

- Pfizer, BioNTech Race to Meet Global Covid-19 Vaccine Needs (Wall Street Journal)

- Amazon, Facebook, and other tech stocks may be a ‘disaster waiting to happen,’ investor Bill Smead says (Business Insider)

- The stock market is sending mixed signals on who will win the presidential election, LPL says (Business Insider)

- Goldman Sachs says the market is due for a large but temporary rotation out of growth stocks (Business Insider)

- The IMF says vaccine progress could add $9 trillion to global income by 2025 and stage a faster recovery (Business Insider)

- These 3 sentiment indicators are giving off a bullish signal for the consumer and stock market, DataTrek says (Business Insider)

- Forget Biden Blue Wave and Trump Train – here’s the real winner that will drive stocks (fn London)

- Mortgage Lender IPOs Are Booming. Which Are the Best Buys? (Wall Street Journal)

- Large Managers Get the Money, but Small Managers Provide the Performance (Institutional Investor)

- Albertsons Wins Bankruptcy Auction for Kings and Balducci’s Stores (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Buy the worst? Here are 5 destroyed stocks for this bottom-fishing strategy (MarketWatch)

- Value Stocks Could Shine After U.S. Election, No Matter Who Wins (Bloomberg)

- Walgreens stock jumps after profit falls less than expected, revenue rises above forecasts (MarketWatch)

- Stocks Drop as Stimulus Hopes Fade (Barron’s)

- Small-Caps Point to Renewed Confidence in the Economy (Barron’s)

- Mnuchin says he’ll give ground on virus testing in stimulus negotiations with Pelosi (CNBC)

- China Drugmaker Gives Unproven Covid-19 Vaccine to Students Going Abroad (Wall Street Journal)

- Second Covid-19 Vaccine Approved by Russia (Wall Street Journal)

- Walmart CEO Doug McMillon to Congress: Get a stimulus deal done (CNBC)

- These stocks trading at discounts to their valuations may be worth buying, traders say (CNBC)

- Rockwell Automation to reverse salary cuts, restore 401 (k) match for U.S. employees in November (MarketWatch)

- $300B from 1st relief available for loans, stimulus checks says Mnuchin (FoxBusiness)

- Here’s How Much Investing $1,000 In Bank Of America At Great Recession Lows Would Be Worth Today (Benzinga)

- 10 Consumer Staples Stocks With Fat Dividends and Reasonable Valuations (Barron’s)

- ICON Study Evidencing Efficacy of Ivermectin Against COVID-19 Published in Peer Review Journal Chest (TrialSiteNews)

The “I’m an Accountant” Stock Market (and Sentiment Results)…

With the four major banks reporting earnings in the past 48 hours, the song that hit the mark for this week’s note is “I’m an Accountant” (by Rocky Paterra). This has been trending on TikTok for several weeks: Continue reading “The “I’m an Accountant” Stock Market (and Sentiment Results)…”