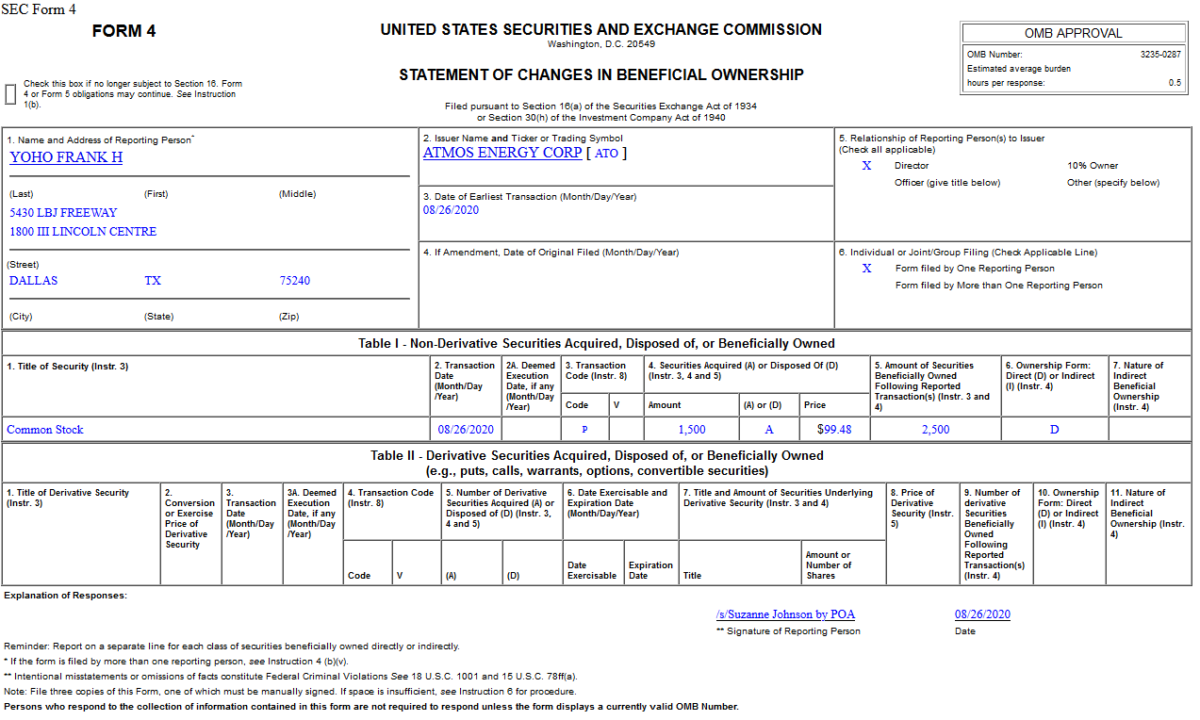

On Aug 26, 2020, Frank Yoho – Director of Atmos Energy Corporation (ATO) – purchased 1,500 shares of ATO at $99.48. His out of pocket cost was $149,220.

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Tom Hayes – The Claman Countdown – Fox Business Appearance – 8/25/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – August 25, 2020

Be in the know. 20 key reads for Wednesday…

- A ‘powerful force’ will determine what happens next in the stock market, Wharton professor predicts (MarketWatch)

- U.S. durable goods orders rose jumped 11.2% in July, vs 4.3% increase expected (CNBC)

- Volatility Traders Pounce on Stock Market Angst Before Election (Bloomberg)

- Ex-Trump adviser Gary Cohn seeks $600 million for blank-check company IPO (CNBC)

- Mortgage demand from homebuyers spikes 33% annually, signaling no end to summer spree (CNBC)

- Ant Group’s $200 Billion Hill Could Soon Become Mountainous (Wall Street Journal)

- Watch for Coca-Cola Bottler’s Stock to Pop (Barron’s)

- NIO Stock Gets an Upgrade and 1,500% Price Target Increase. Here’s Why. (Barron’s)

- Powell may be the headliner, but here are the other key central bankers set to speak at Jackson Hole (MarketWatch)

- What to Expect From Jerome Powell’s ‘Jackson Hole’ Speech (Barron’s)

- What to Know About Palantir, the Latest Tech Company to File to Go Public (Barron’s)

- KFC drops ‘Finger Lickin’ Good’ slogan amid COVID-19 fears (New York Post)

- Fed Seen Holding Rates at Zero for Five-Years Plus in New Policy (Bloomberg)

- Luxury home contracts hit record quarter for Toll Brothers (Fox Business)

- Framework review complete, Fed’s Powell starts hard sell for higher inflation (Reuters)

- Booming trend powers Dick’s Sporting Goods to record earnings and sales (Fox Business)

- Why Dow’s shake-up is bad for stocks added to it and less bad for those booted (MarketWatch)

- It’s Time to Open New York’s Offices (Wall Street Journal)

- Inside Ant Group’s Giant Valuation: One Billion Alipay Users and Big Profit Margins (Wall Street Journal)

- GM Uses Salaried Employees to Fill Vacancies at Missouri Pickup-Truck Plant (Wall Street Journal)

Tom Hayes – Yahoo! Finance Appearance – 8/25/2020

Yahoo! Finance – Thomas Hayes – Chairman of Great Hill Capital – August 25, 2020

Thanks to Akiko Fujita and Sarah Smith for having me on your show:

Unusual Options Activity – Antero Resources Corporation (AR)

Data Source: barchart

Today some institution/fund purchased 3,710 contracts of Jan 2022 $4.50 strike calls (or the right to buy 371,000 shares of Antero Resources Corporation (AR) at $4.50). The open interest was just 650 prior to this purchase. Continue reading “Unusual Options Activity – Antero Resources Corporation (AR)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 18 key reads for Tuesday…

- Alibaba’s Ant Group files for blockbuster dual listing in Hong Kong, Shanghai (Reuters)

- Paul Ryan-chaired Executive Network Partnering sets IPO terms with plan to raise about $300 million (MarketWatch)

- U.S. Stock Market Bulls From UBS to BofA See More Gains Ahead (Bloomberg)

- Why 5 Legacy Tech Dividend Stocks May Be the Best Buys Now (24/7 Wall Street)

- U.S., China reaffirm commitment to Phase 1 trade deal in phone call (Reuters)

- UFC’s Dana White, a $1M Trump donor, gets key RNC speaker slot (Fox Business)

- Opinion: Exxon getting booted from the Dow Jones Industrial Average may be a blessing in disguise for its investors (MarketWatch)

- Gilead’s Remdesivir-Like Compound To Be Studied By NIH For Efficacy Against COVID-19 (Benzinga)

- Steve Cohen out to gobble up Hollywood big fish with new management company (New York Post)

- Salesforce, Amgen and Honeywell added to Dow in major shake-up to the average (CNBC)

- 4 Energy Stocks Left Behind in the Rally With Strong Balance Sheets (MarketWatch)

- Home prices show signs of recovery, rising 4.3% in June, according to Case-Shiller index (CNBC)

- More than half of states are now approved for the extra $300 per week in unemployment insurance (CNBC)

- Powell set to deliver ‘profoundly consequential’ speech, changing how the Fed views inflation (CNBC)

- Big Pharma Needs a Covid-19 Vaccine to Redeem Its Reeling Reputation (Bloomberg)

- 10 Cheap, Overlooked Stocks With Plenty of Upside (Barron’s)

- New Thinking on Covid Lockdowns: They’re Overly Blunt and Costly (Wall Street Journal)

- Oil Companies Brace for Twin Gulf Coast Storms (Wall Street Journal)

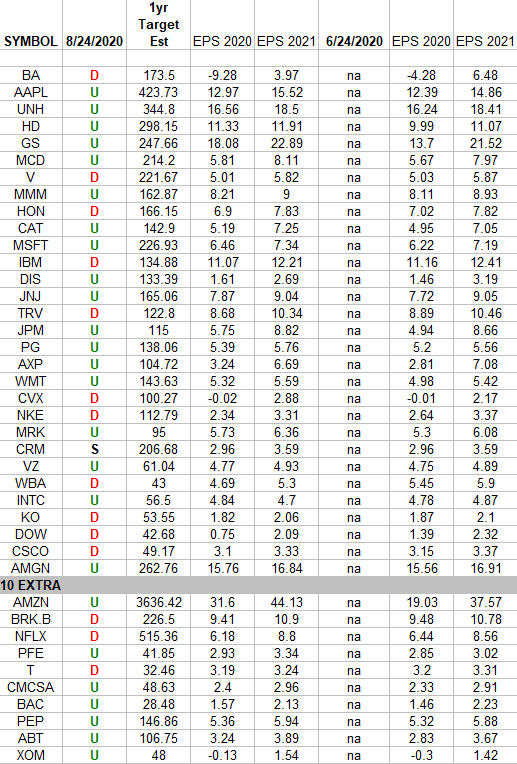

DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 10 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions”

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 2,176 contracts of Feb 2021 $90 strike calls (or the right to buy 217,600 shares of Gilead Sciences, Inc. (GILD) at $90). The open interest was 945 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”