- New U.S. Coronavirus Cases Slip to Lowest Since Late June (Wall Street Journal)

- A Third of People Tested in Bronx Have Coronavirus Antibodies (Wall Street Journal)

- 8 Restaurant Stocks That Are Worth the Risk (Barron’s)

- Former GE CEO Jeff Immelt Buys Up Bloom Energy Stock (Barron’s)

- Fund managers are more optimistic on stocks than any time since the pandemic began (MarketWatch)

- U.S. tells universities to shed China share holdings ahead of potential delisting: report (MarketWatch)

- The Next Stimulus Bill Still Hasn’t Arrived. Why the Market Doesn’t Care (Barron’s)

- Fund Managers Believe This Is a Whole New Cycle (Institutional Investor)

- Oracle’s Ellison steps out of character with approach for TikTok (Financial Times)

- Investors increasingly unsettled by ‘overvalued’ markets (Financial Times)

- 4 Top Companies Benefit From More Americans Driving on Vacation This Summer (24/7 Wall Street)

- Warren Buffett’s $113 billion Apple stake and $147 billion cash pile now account for over half of Berkshire Hathaway’s entire market value (Business Insider)

- The narrative driving markets is about to get challenged on Wednesday — here’s why (MarketWatch)

- Target reports a monster quarter — profits jump 80%, same-store sales set record (CNBC)

- Jim Cramer: A U.S. dollar rally might be in the cards, according to the charts (CNBC)

- Democrats, GOP Probe for a Path Forward on Stimulus Talks (Bloomberg)

- Trump Team Sees Path to Pared-Down $500 Billion Stimulus Deal (Bloomberg)

- Walmart Flexes Its Scale to Power Through Pandemic (Wall Street Journal)

- Simon, the Biggest U.S. Mall Owner, Shows Two Sides: Innovator and Traditionalist (Wall Street Journal)

- The ‘Everything Bubble’ Isn’t Everything, and Maybe Not Even a Bubble (Wall Street Journal)

Tag: StockMarket

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 4,011 contracts of Sept. 2021 $170 strike calls (or the right to buy 401,100 shares of JPMorgan Chase & Co. (JPM) at $170). The open interest was just 155 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

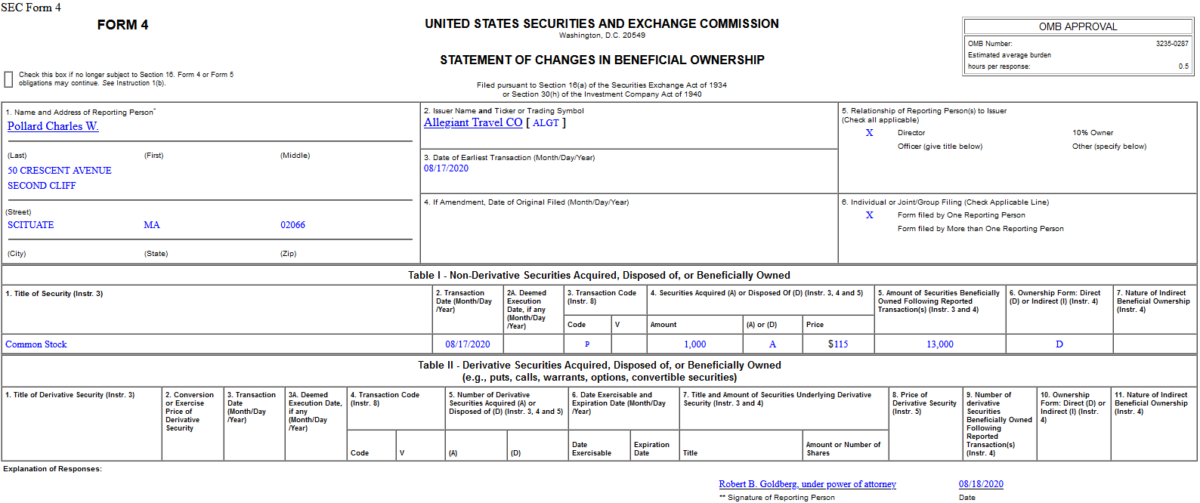

Insider Buying in Allegiant Travel Company (ALGT)

On August 17, 2020, Thomas Gibson – Director of Allegiant Travel Company (ALGT) – purchased 1,000 shares of ALGT at $115. His out of pocket cost was $115,000.

Where is money flowing today?

Data Source: Finviz

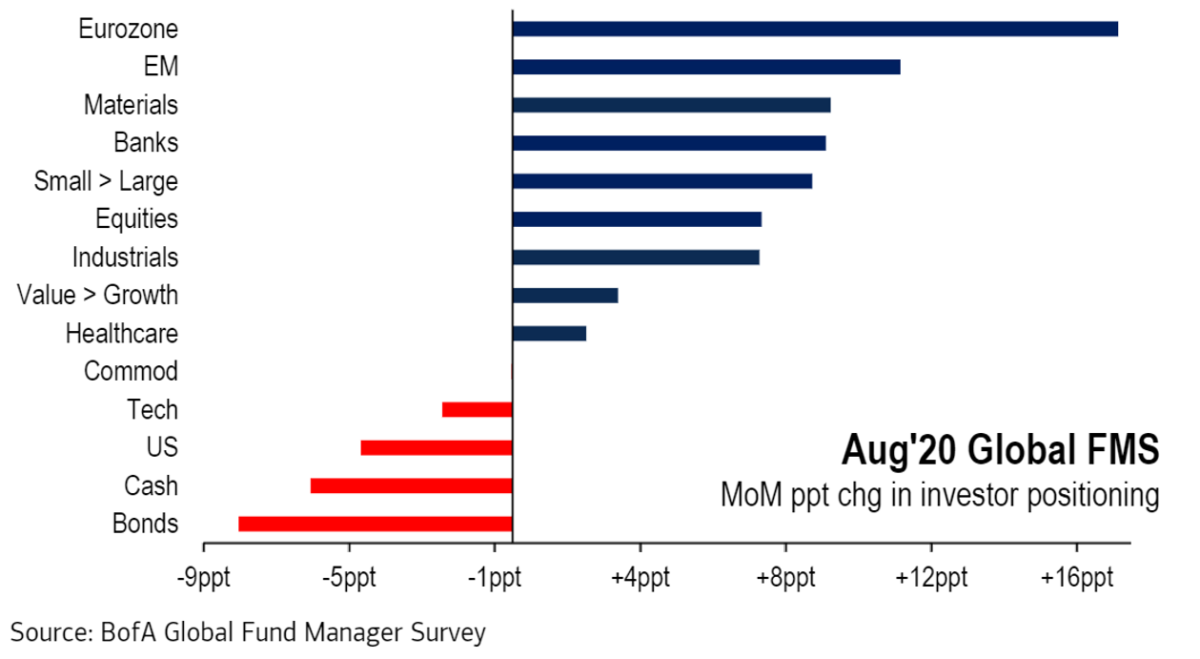

August Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing $500B AUM responded to this month’s BofA survey. Continue reading “August Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 10 key reads for Tuesday…

- Big Deals Return as Mergers Show Signs of a Rebound. Here’s Why. (Barron’s)

- Oracle (Yes, Oracle) Reportedly Enters Bidding for TikTok’s U.S. Unit (Barron’s)

- The Storied French Brand Delage Returns, Aiming at Both Road and Track (Barron’s)

- Worried About Inflation? Bonds and Gold Don’t Care (Bloomberg)

- Walmart second-quarter results crush estimates, as e-commerce sales jump 97% (CNBC)

- Home Depot quarterly sales soar 23% as consumers take on more DIY projects in pandemic (CNBC)

- Kohl’s shares jump as quarterly sales hold up better than expected in pandemic (CNBC)

- Wealthier parents are more likely to send their kids back to physical classrooms — here’s why (MarketWatch)

- Bank of America Clients With $489 Billion Finally Trust This Bull Market (Bloomberg)

- Gilead announces another cancer deal (MarketWatch)

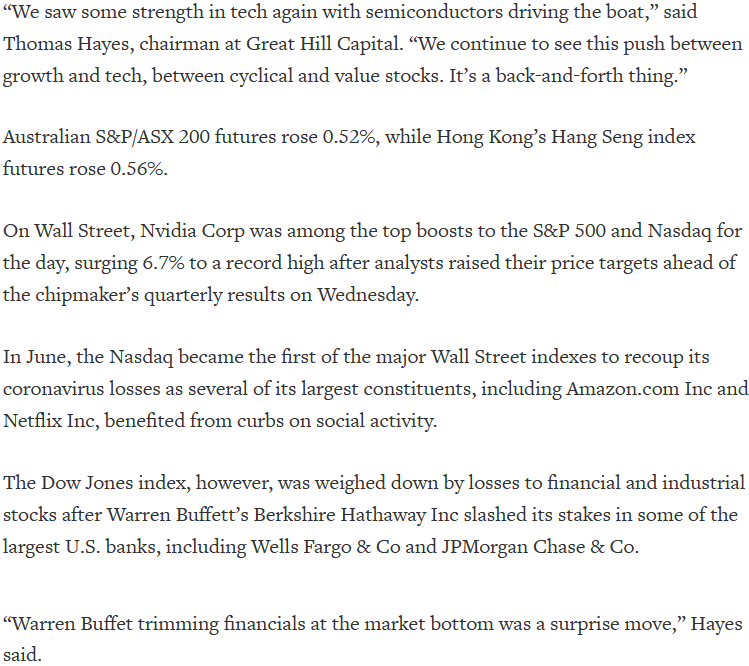

Tom Hayes – Quoted in Reuters article – 8/17/2020

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here:

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Monday…

- Cyclical Stocks Are Leading the Latest Leg of the Market’s Recovery (Wall Street Journal)

- Goldman Boosts S&P 500 Target by 20% as Strategists Catch Up (Bloomberg)

- Markets should be pricing in would-be Biden win already — they’re not (New York Post)

- Home Depot Braced for Covid Pain—Then Americans Remodeled (Wall Street Journal)

- Low Rates Push Homebuilder Optimism to Highest Since 1998 (Bloomberg)

- PBOC Adds Cash to Ease Liquidity Stress With Rate Unchanged (Yahoo! Finance)

- Oil Flows. The Energy Report (Price Group)

- 6 Stocks to Buy Now That Should Capitalize on the Economic Recovery (24/7 Wall Street)

- Stock Rally Gives Commodities New Shine (Wall Street Journal)

- Interior Secretary to Approve Oil Drilling Program in Alaska’s Arctic Refuge (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

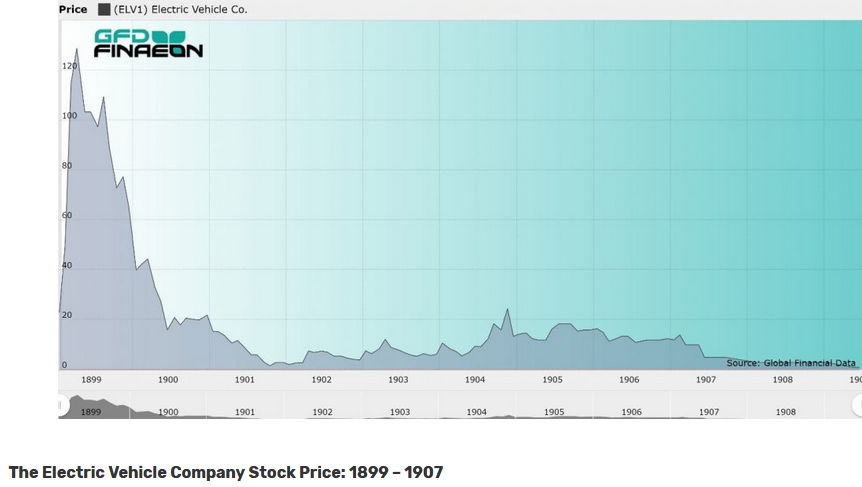

- Speculation & Innovation: The long history of electric cars (Investor Amnesia via The Big Picture)

- Top 10 Yachts Scheduled To Be At The Upcoming 2020 Cannes Yachting Festival (Forbes)

- The Master and the Prodigy (Project Syndicate)

- DOLLY PARTON Steers Her Empire Through the Pandemic — and Keeps It Growing (Billboard)

- Hedge Fund and Insider Trading News: John Thaler, Jim Simons, Jeffery Smith, Ray Dalio, Red Rock Resorts Inc (RRR), Zoom Video Communications Inc (ZM), and More (Insider Monkey)

- Another Roaring Twenties May Be Ahead (Yardeni)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The 22 most expensive houses in the world (James Edition)

- The 2020 Ferrari F8 Spider Is a 710-Horsepower Smile Generator (Men’s Journal)

- Here’s How Well A 2021 Ford Bronco Sport Can Go Off-Road In The Toughest Terrain In America (Digg)

- Principles for Building Better Health Insurance (Manhattan Institute)

- The 1918 Flu Faded in Our Collective Memory: We Might ‘Forget’ the Coronavirus, Too (Scientific American)

- In coronavirus housing market, ‘better to be seller than buyer’ (Fox Business)

- The Economics of Gods and Mortals (NPR Planet Money)

- Think the Founding Fathers Were a Bunch of Old Men? Think Again (How Stuff Works)

- We Flattened the Curve. Our Kids Belong in School. (The Atlantic)

- Over 100 AMC Movie Theaters Reopen Aug. 20 (PC Mag)

- Yachting Vacations Are More Convenient and Affordable Than You Think (Just Luxe)

- Here’s One Way to Make Fusion Reactors Much Better (Popular Mechanics)

- “She Sticks Her Finger Right Into the Socket”: How ‘Ozark’ Star Julia Garner Became a Scene-Stealer and Emmy Favorite (Hollywood Reporter)