- Warren Buffett’s Berkshire Can Acquire Nearly 25% of Bank of America (Barron’s)

- For the First Time Ever, Uncle Sam’s Aid to U.S. Tops Quarterly GDP (Barron’s)

- Investors Are Too Wary as Earnings Reports Come in Strong (Barron’s)

- SPACs Are All the Rage, but These Private-Equity-Like Vehicles Are Complicated. Here’s What You Need to Know. (Barron’s)

- Warren Buffett Buys Bank of America Stock as Others Hedge. Who’s Right? (Barron’s)

- Microsoft Is Reportedly in Talks to Acquire TikTok (Barron’s)

- How to Invest in China’s Consumer Comeback (Barron’s)

- AT&T Director Stephen Luczo Buys Big Block of Stock (Barron’s)

- Why Brazil’s Stock Market Struggles to Rebound (Barron’s)

- Thinking For Oneself (Farnam Street)

- Berkshire Hathaway’s Great Transformation (Rational Walk)

- China Tries Its Favorite Economic Cure: More Construction (New York Times)

- What Bill Gates and Warren Buffett talk about during COVID-19 (Yahoo! Finance)

- Coronavirus Vaccine Trials Advance in Race for Covid-19 Protection (Bloomberg)

- Elon Musk says ‘China rocks’ while U.S. is full of ‘complacency and entitlement’ (CNBC)

- A Wall Street chief strategist breaks down the 4-part ‘superfecta’ that will keep stocks soaring (Business Insider)

- Ford already bombarded with 150,000 reservations for upcoming SUV (Fox Business)

- Gilead Analysts Downplay Q2 Miss Amid Remdesivir’s COVID-19 Opportunity (Benzinga)

- Private-Equity Firms Discuss Bid for Kansas City Southern (Wall Street Journal)

- A Beloved Connecticut Getaway, Refreshed and Waiting for Summer (Wall Street Journal)

Tag: StockMarket

Unusual Options Activity – Royal Dutch Shell plc (RDS-A)

Data Source: barchart

Today some institution/fund purchased 989 contracts of Jan 2022 $20 strike calls (or the right to buy 989,000 shares of Royal Dutch Shell plc (RDS-A) at $20). The open interest was just 221 prior to this purchase. Continue reading “Unusual Options Activity – Royal Dutch Shell plc (RDS-A)”

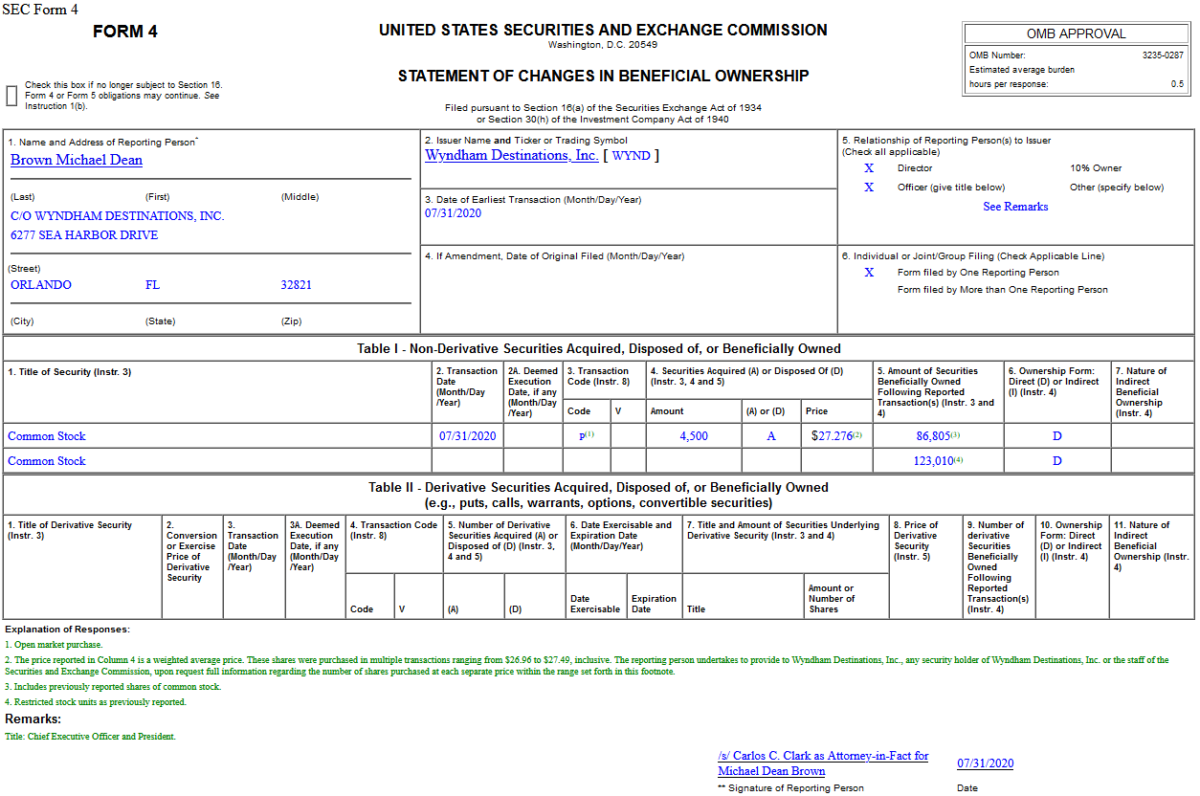

Insider Buying in Wyndham Destinations, Inc. (WYND)

On July 31, 2020, Dean Brown – CEO of Wyndham Destinations, Inc. (WYND) – purchased 4,500 shares of WYND at $27.27. His out of pocket cost was $122,724.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Friday…

- U.S. consumer spending rises for second straight month in June (Reuters)

- Berkshire has spent more than $1.7 billion on 71.5 million Bank of America shares since July 20, including the latest purchases, according to regulatory filings. (Street Insider)

- Cruise Lines Test the Waters, Launching Sailings in Europe and Asia With Limited Capacities (Barron’s)

- Pandemic boost for Big Tech set to drive Wall St. higher (Street Insider)

- Caterpillar (CAT) Tops Q2 EPS by 20c, Revenues Beat (Street Insider)

- These relief benefits expire today as negotiations on next aid package stall (Fox Business)

- Charles Payne: Herman Cain was an American patriot, and an inspiration (Fox Business)

- Nvidia in talks to buy Arm from SoftBank for more than $32bn (Financial Times)

- How Apple’s stock split will change the pecking order in the 124-year old Dow Jones Industrial Average (MarketWatch)

- China manufacturing activity rises in July (MarketWatch)

- Ford Earnings Were Way, Way, Way Better Than Feared (Barron’s)

- Auto-Parts Retail Goes Full Throttle (Wall Street Journal)

- A $3 Million Ferrari Tests a World Without the Pebble Beach Auctions (Bloomberg)

- Opinion: Mortgage applications for suburban homes are surging as buyers try to escape the coronavirus pandemic (MarketWatch)

- ViacomCBS to Bulk Up Streaming Service (Wall Street Journal)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 41

Article referenced in VideoCast above:

The Garth Brooks, “Friends in Low Places” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 31

Article referenced in podcast above:

The Garth Brooks, “Friends in Low Places” Stock Market (and Sentiment Results)…

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 1,600 contracts of Jan 2022 $25 strike calls (or the right to buy 160,000 shares of Citigroup Inc. (C) at $25). The open interest was just 428 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Thursday…

- Disclosure-Shy Warren Buffett Must Really Like Bank of America Stock (Barron’s)

- Value Investors Believe Their Long Winter May Soon End (Bloomberg)

- Meet the New Fed Policies, Same as the Old Ones (Barron’s)

- Buy stock dips because the S&P 500 could ‘easily’ reach 3,500 next year, says Credit Suisse (MarketWatch)

- 5 Value Stocks In The Financial Services Sector (Yahoo! Finance)

- J&J begins first human clinical trials of single-dose coronavirus vaccine (FoxBusiness)

- CEOs Of Amazon, Apple, Facebook And Google Defend Companies During Congressional Antitrust Testimony (Benzinga)

- Fed plans for ‘the worst’ as it waits for Congress to act (Financial Times)

- FDA Nears Decision Authorizing Covid-19 Treatment With Convalescent Plasma (Wall Street Journal)

- Coronavirus Shifts Pricing Power to UPS and FedEx, and They Are Using It (Wall Street Journal)