- Here’s How Good Bank Earnings Were Without Accounting Changes (Barron’s)

- EU leaders reach $2 trillion deal on recovery plan after marathon summit (CNBC)

- The cyclical rotation is here, Jefferies analysts say. For real this time. (MarketWatch)

- Ford unveils electric Mustang Mach-E race car with 1,400 horsepower (CNBC)

- The stock market is positioned to rally if it can clear this low bar, fund manager argues (MarketWatch)

- Lockheed Martin’s stock rallies after profit and sales beat, raised outlook (MarketWatch)

- Gilead Sciences to pay $300 million for nearly half of Tizona, has option to buy the rest for $1.25 billion (MarketWatch)

- Warren Buffett’s dealmaker closed the biggest ‘blank-check’ takeover ever this month. Here’s why he may owe the Berkshire Hathaway chief for the deal. (Business Insider)

- Morgan Stanley warns tech stocks are unusually vulnerable to earnings disasters over the next few weeks. (Business Insider)

- Chicago Fed national activity index rose to record 4.11 in June from 3.5 in prior month (MarketWatch)

- Bill Miller’s Miller Value Partners 2nd-Quarter Market Letter (gurufocus)

- oronavirus Vaccine Data Raises Hope for Trio of Candidates (Wall Street Journal)

- 10 states where coronavirus-fueled unemployment is rebounding fastest (Fox Business)

- Retail Sales Rebound in Canada, Recouping All of Pandemic Losses (Bloomberg)

- IBM Works to Reshape Business as Coronavirus Uncertainty Lingers (Wall Street Journal)

Tag: StockMarket

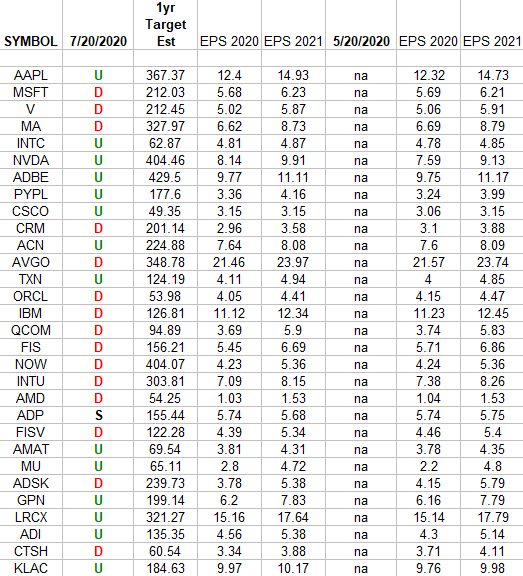

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

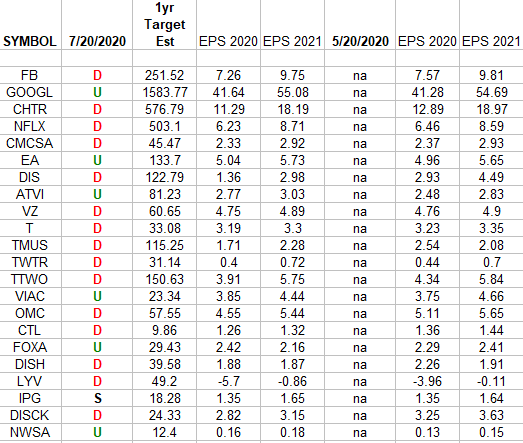

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

Where is money flowing today?

Data source: Finviz

Tom Hayes – Quoted in Reuters article – 7/20/2020

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Be in the know. 8 key reads for Monday…

- Barron’s Picks And Pans: Dollar General, IAC, Wells Fargo And More (Benzinga)

- Congress to Start Negotiations on Next Round of Coronavirus Aid (Wall Street Journal)

- Face Masks Really Do Matter. The Scientific Evidence Is Growing. (Wall Street Journal)

- Halliburton’s stock swings higher after reporting surprise profit but revenue that missed expectations (MarketWatch)

- High-Yield Hunger Should Give Cruise Lines a Lifeline Through at Least Mid-2021 (Barron’s)

- Chevron picks Noble in biggest U.S. energy deal since the oil crash (CNBC)

- The U.S. Dollar Index Is Poised to Plunge (Barron’s)

- How quickly is Europe’s economy rebounding? (Financial Times)

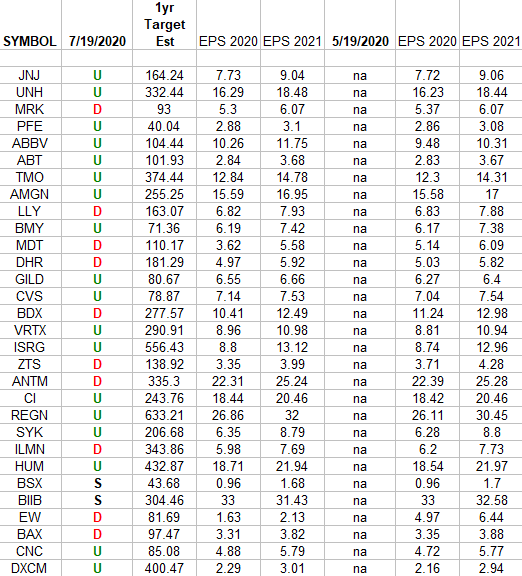

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 10 key reads for Sunday…

- Wells Fargo Stock Has Been Beaten Down. It Could Be a Buy. (Barron’s)

- COVID-19 Data/Testing (and commentary) (Hedge Fund Tips)

- From 1720 to Tesla, FOMO Never Sleeps (Wall Street Journal)

- Rep. John Lewis, Civil Rights Icon and ‘Conscience of Congress,’ Dies at 80 (Time)

- Mortgage Loan Servicer Ocwen Soars on Net Income (24/7 Wall Street)

- G20 officials pledge to keep cooperating to bolster global economy (Reuters)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The risks of keeping schools closed far outweigh the benefits (Economist)

- A Conversation With Gary Cohn (NPR Planet Money)

- Ben Bernanke and Janet Yellen Give Republicans in Congress a Lesson on Coronavirus Economics (The New Yorker)

Quote of the Day…

Be in the know. 20 key reads for Saturday…

- Walgreens and 3 Other Companies That Raised Dividends This Week (Barrons)

- Are You Ready for a Cyclical Reversion? (WisdomTree)

- European Leaders Seek Historic Virus Bailout Deal at First Gathering in Months (Wall Street Journal)

- Sunscreen Chemicals Accumulate in Body at High Levels (Wall Street Journal)

- ‘Let’s Go Fly, for God’s Sake.’ Behind American Airlines Chief’s All-In Strategy (Wall Street Journal)

- N95 Face Mask Makers Ramp Up Production to Meet U.S. Covid-19 Demand (Wall Street Journal)

- Where to Find the Finest Fish Tacos (Wall Street Journal)

- FTC Considering Deposing Top Facebook Executives in Antitrust Probe (Wall Street Journal)

- Press a Button and This Plane Lands Itself (Wall Street Journal)

- Mnuchin Calls for Congress to Pass More Stimulus This Month (New York Times)

- Which stores require masks? See the full list. (USA Today)

- Banksy tags coronavirus-inspired graffiti as Italy returns his stolen artwork to France (USA Today)

- Here’s why all of the S&P 500’s gains since April came after the market closed: JP Morgan (MarketWatch)

- Travel Is Bouncing Back, but Tourists Stick Close to Home (Wall Street Journal)

- WHO Says Brazil’s Covid-19 Curve Has Plateaued (Bloomberg)

- Netflix Goes All-In With Ryan Gosling, Chris Evans, and the Russo Brothers (Vanity Fair)

- Watch a 3D Printer Spit Out an Entire Two-Story House (Futurism)

- Sam Zell talks REITs – NYU Summer Series (YouTube)

- The Complete Breakdown of Berkshire Hathaway’s Subsidiaries (vintagevalueinvesting)

- How Can We Be Sure That Value Investing Will Continue To Work? (Forbes)