Data Source: Finviz

Tag: StockMarket

Be in the know. 15 key reads for Tuesday…

- Value will trump highflying growth stocks if this bond-market indicator bounces back, says Bill Gross (MarketWatch)

- JPMorgan’s Earnings Were Surprisingly Strong. It’s a Positive Sign for Other Banks. (Barron’s)

- Coronavirus Spending Pushes U.S. Budget Deficit to $3 Trillion for 12 Months Through June (Wall Street Journal)

- Ford Reveals New Bronco After 24 Years Off the Market (Wall Street Journal)

- Hospitals Stock Up on Covid-19 Drugs to Prepare for Second Wave in Fall (Wall Street Journal)

- 12 Stocks That Could Take Off—If You’re Willing to Bet Everyone Else Is Wrong (Barron’s)

- U.S. Consumer Prices Climb by Most Since 2012 on Higher Gasoline (Bloomberg)

- BofA Clients Keep Tight Grip on Cash Amid Ebullient Stock Rally (Bloomberg)

- JPMorgan’s Record Trading Helps Ease the Pandemic’s Toll (Bloomberg)

- OPEC+ Risks Triggering Another Oil Price Slump (Bloomberg)

- Wells Fargo reports $2.4 billion loss for the quarter, cutting dividend (CNBC)

- Citigroup shares rise after bank reports better-than-expected earnings (CNBC)

- Robert Shiller warns that urban home prices could decline (CNBC)

- Opinion: The No. 1 market-timer of the 1980s and 1990s has this message for today’s buy-and-hold investors (MarketWatch)

- Boeing awarded nearly $23B Air Force contract for F-15EX fighter jet program (Fox Business)

July Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

210 Managers overseeing $570B AUM responded to this month’s BofA survey.

OUTLOOK:

•72% expect stronger global growth. This is up 11 percentage points from last month (highest level since January 2014).

•36% – the highest figure recorded – expect the global economy to get “a lot stronger” and profits to improve in the next 12 months.

•Conviction in the recovery is low, just 14% saying it will be ‘V’ shaped, 30% say ‘W’ Shaped – up from 21% last month. 44% expect a “U” shaped recovery.

•37% of respondents see higher global consumer price inflation in the next 12 months, but only 5% said inflation will be a lot higher.

•71% still think that the stock market is overvalued (down from 80%).

•The percentage of investors expecting the euro to appreciate also rose in July.

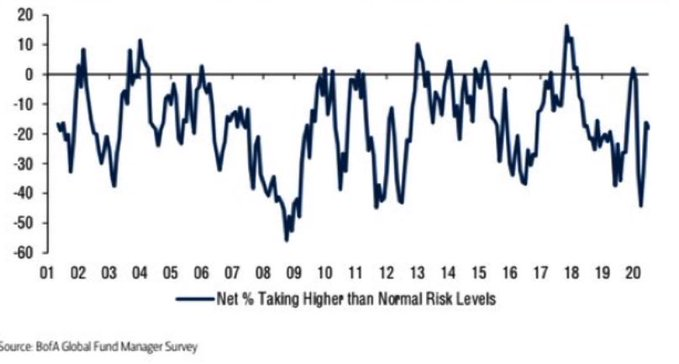

•Wall Street’s $24 trillion rally yet to elicit “greed.”

•54% say the Federal Reserve will not inplement yield curve control in September.

SENTIMENT:

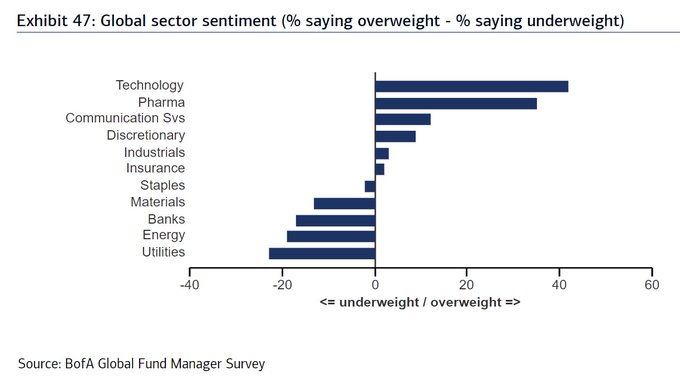

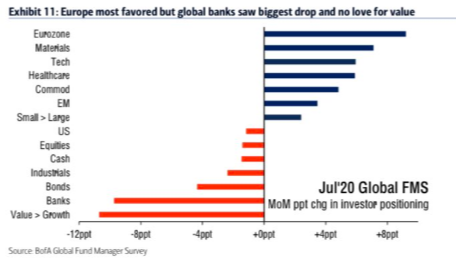

POSITIONING:

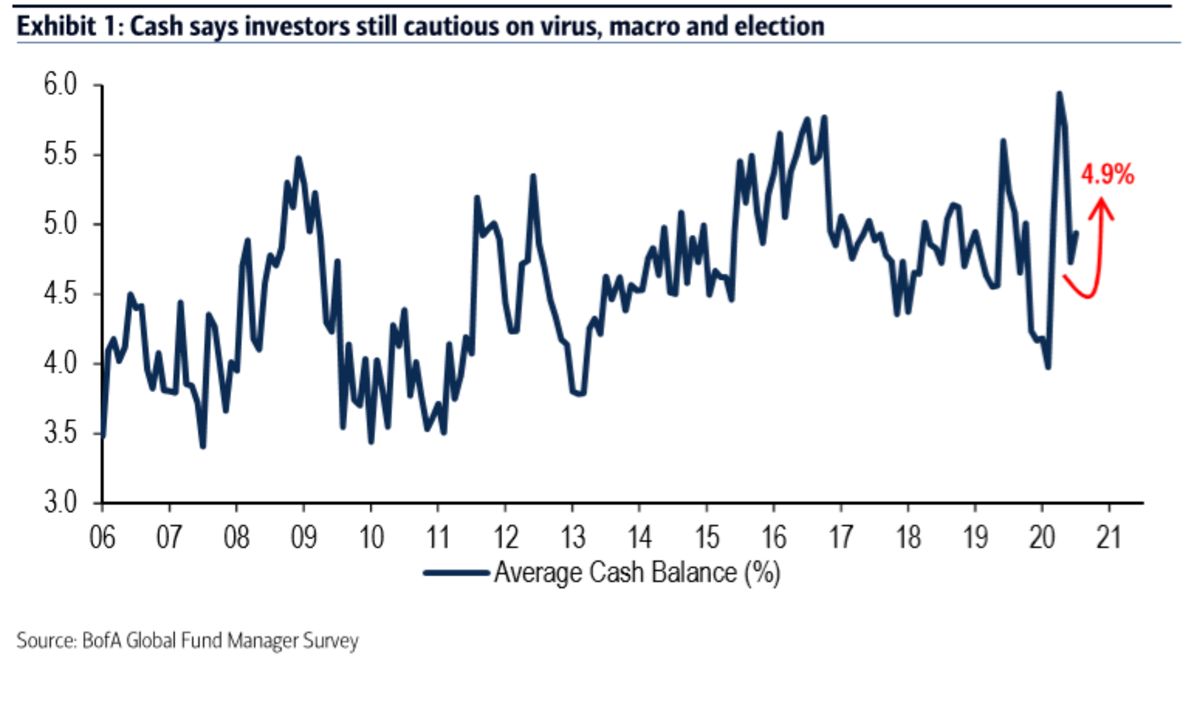

•Cash up to 4.9% from 4.7%. This is down from April/May, but still on the high side. (10-year average is 4.7%)

•Cash up to 4.9% from 4.7%. This is down from April/May, but still on the high side. (10-year average is 4.7%)

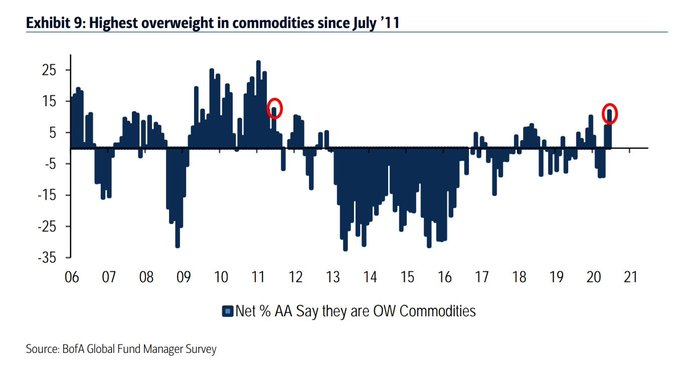

•Allocation to commodities was the highest in July since 2011 at Net 12% of respondents.

•Big jump was seen in European equity exposure driven by the European Union’s fiscal policies. Currently 16% net overweight allocation to Euro equities (up 9%).

•Allocation to U.S. equities declined 1 percentage point to net 21% overweight; the U.S. remains the survey’s most popular region

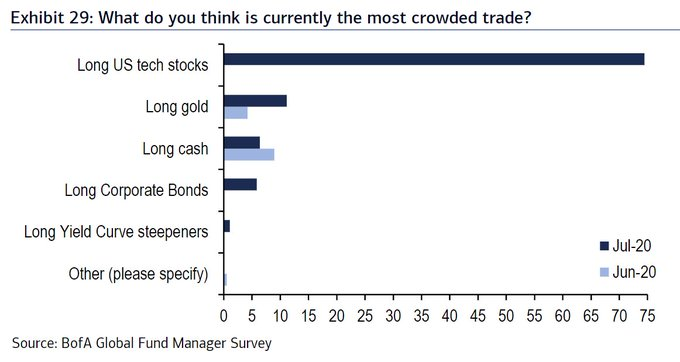

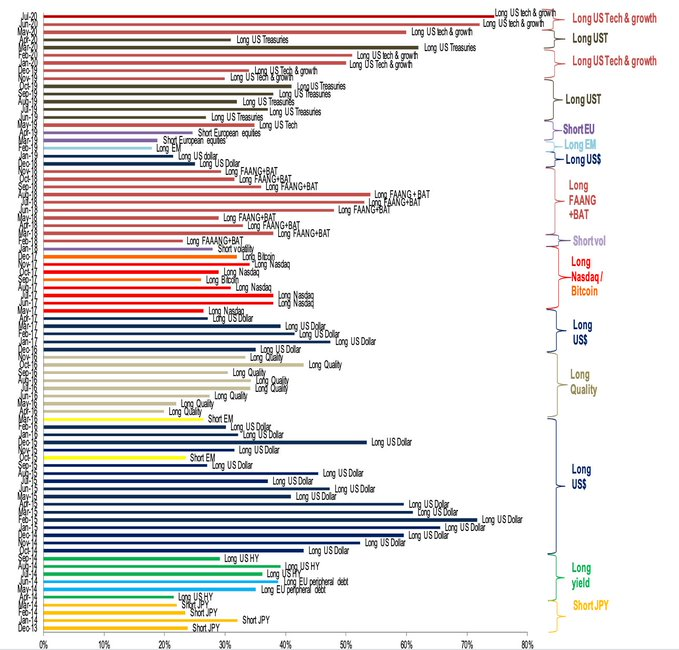

MOST CROWDED TRADE:

•74% say long US tech stocks are the most “crowded trade” – the most in the survey’s history.

BIGGEST TAIL RISKS:

1. 2nd wave of COVID infections as a top tail risk (52% of respondents).

2. US Elections – Blue Wave. Despite this risk, 34% plan to take no action ahead of the election. 31% are reducing risk, 15% are buying volatility and 13% are selling the U.S. dollar.

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/13/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 13, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Monday…

- Warren Buffett may have bought back more than $5 billion in Berkshire Hathaway stock in recent weeks (Business Insider)

- Barron’s Daily: Merger Monday Is Back (Barron’s)

- Stocks are resilient because investors have been braced for much worse COVID-19 news, says strategist (MarketWatch)

- Pfizer, BioNTech stocks surge after COVID-19 vaccine candidates get Fast Track designation (MarketWatch)

- Income rates: How much you need to make to be in the top 1% in every state (USA Today)

- Blank-Check Boom Gets Boost From Coronavirus (Wall Street Journal)

- Wall Street’s Earnings Forecast: Cloudy With a Chance of Turbulence (Wall Street Journal)

- Are Banks Afraid of Covid-19? Watch How Much They Set Aside for Loan Losses This Week (Wall Street Journal)

- Bank Earnings: Main Street Blues vs. Wall Street Boom (Wall Street Journal)

- Fed’s Support for Corporate Debt Has Been a Wall Street Bonanza (Bloomberg)

- These ignored stocks may be poised to rebound (Yahoo! Finance)

- Alibaba’s Jack Ma sells $9.6B worth of shares, stake dips to 4.8% (Fox Business)

Be in the know. 15 key reads for Sunday…

- Bill Miller on the Classical Value Portfolio (Podcast) (Bloomberg)

- Connecticut Bet Big on the Suburbs. That Might Finally Pay Off. (Wall Street Journal)

- Fed, Treasury Disagreements Slowed Start of Main Street Lending Program (Wall Street Journal)

- People complain that going to the shore is a careless act during a pandemic, but the science so far suggests otherwise. (The Atlantic)

- Should Value Investors Buy General Dynamics (GD) Stock? (Insider Monkey)

- Kanye West’s Plans for Wyoming Mansion Approved (Architectural Digest)

- Kanye West is not running for President…yet (Fortune)

- President Trump to introduce executive order on immigration reform (OAN)

- This Aston Martin DB5 Comes With a Rear Smoke Screen and Twin Front ‘Machine Guns’ (Maxim)

- Mansory Unleashes Carbon Fiber-Bodied 710 HP Ford GT (Maxim)

- 2021 Ford Bronco Finally Leaks Ahead of Its Big TV Debut on Monday Night (TheDrive)

- Flying Taxis Are Coming. Inside the Scramble to Find Them a Place to Land. (Robb Report)

- Welcome to the Czech Republic – Incredible Culture and Stunning Beauty (thelifeofluxury)

- How To Build a Treehouse (Popular Mechanics)

- Investment banking activity witnessed robust quarter: Thomas B. Michaud (Fox Business)

Be in the know. 20 key reads for Saturday…

- Lichtenstein Nude Leads Christie’s $421 Million Live-Stream Auction (Bloomberg)

- Wall Street Forges a New Relationship to Data in Coronavirus Age (Bloomberg)

- What to expect as banks report earnings: more loan pain but plenty of fee income (MarketWatch)

- Hedge Fund Tips Podcast/VideoCast: Cyclicals, The Election and Buffett (ZeroHedge)

- Gilead Says New Analysis Suggests Remdesivir Reduces Covid-19 Deaths (Barron’s)

- 37 Stocks to Buy for the Second Half of 2020, According to Barron’s Roundtable Experts (Barron’s)

- How Barron’s Roundtable Panelists’ 2020 Stock Picks Have Performed So Far This Year (Barron’s)

- The Tanger Outlets CEO Thinks Online Shopping Is Overrated. Now He’s Betting on It. (Wall Street Journal)

- How to Visit the National Parks Safely in the Summer of Covid-19 (Wall Street Journal)

- German Biotech Sees Its Coronavirus Vaccine Ready for Approval by December (Wall Street Journal)

- Jair Bolsonaro: The rightwing leader may emerge politically stronger from the pandemic (Financial Times)

- Disney World to Reopen as Coronavirus Cases Surge in Florida (Bloomberg)

- Goodbye, extra $600: Unemployment benefits won’t exceed former wages in next stimulus bill, Treasury’s Mnuchin says (MarketWatch)

- Here’s what Trump’s back-to-work bonus could look like (Fox Business)

- Hedge Funds Would Get to Keep Lots of Trades Secret in SEC Plan (Bloomberg)

- The latest Corvette is great, but wait until you see what comes next (CNN Business)

- Warren Buffett bets big with $10 billion Dominion Energy deal—What it means (CNBC)

- Emerging Markets Rally as Economies Reopen in the Second Quarter (Advisor Perspectives)

- A contrarian take on recovery prospects (Andreessen Horowitz)

- Bill Miller: The Economy, What The Pandemic Has & Has Not Changed (YouTube)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 38

Article referenced in VideoCast above:

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 28

Article referenced in podcast above:

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…