Data Source: Finviz

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Thursday…

- Wells Fargo Has Potential, Because ‘a Broken Bank Can Be Fixed’ (Barron’s)

- Gilead Is Testing an Inhaled Version of Its Covid-19 Drug (Barron’s)

- Warren Buffett Gives Another $2.9 Billion to Charity (New York Times)

- U.S. Initial Jobless Claims Fell Last Week by More Than Forecast (Bloomberg)

- The coronavirus has given investors a ‘once-in-a-lifetime opportunity,’ says hedge-fund billionaire (MarketWatch)

- Former Fox News Anchor Shepard Smith Joins CNBC to Host Evening Newscast (Wall Street Journal)

- Costco (COST) June U.S. Comps Increase 11% (StreetInsider)

- Walmart Forays Into Health Insurance In A Bid To Expand Health Care Offerings (Benzinga)

- Fed withdraws from repo market after 10 months (Financial Times)

- The AC/DC “Back in Black” Stock Market (and Sentiment Results)…(ZeroHedge)

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

This week we chose AC/DC’s “Back in Black” as our theme song for the Stock Market. Of the major indices, so far the Nasdaq is the first one to make it out of the Red and Back in Black: Continue reading “The AC/DC “Back in Black” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- Walgreens stock rises on plans to open 700 primary care practices (MarketWatch)

- Banks Could Get $24 Billion in Fees From PPP Loans (Wall Street Journal)

- Can Biotechs Make it to the Finish in the Covid-19 Vaccine Race? (Barron’s)

- Disney Stock Is Undervalued by Nearly 30%, Analyst Says (Barron’s)

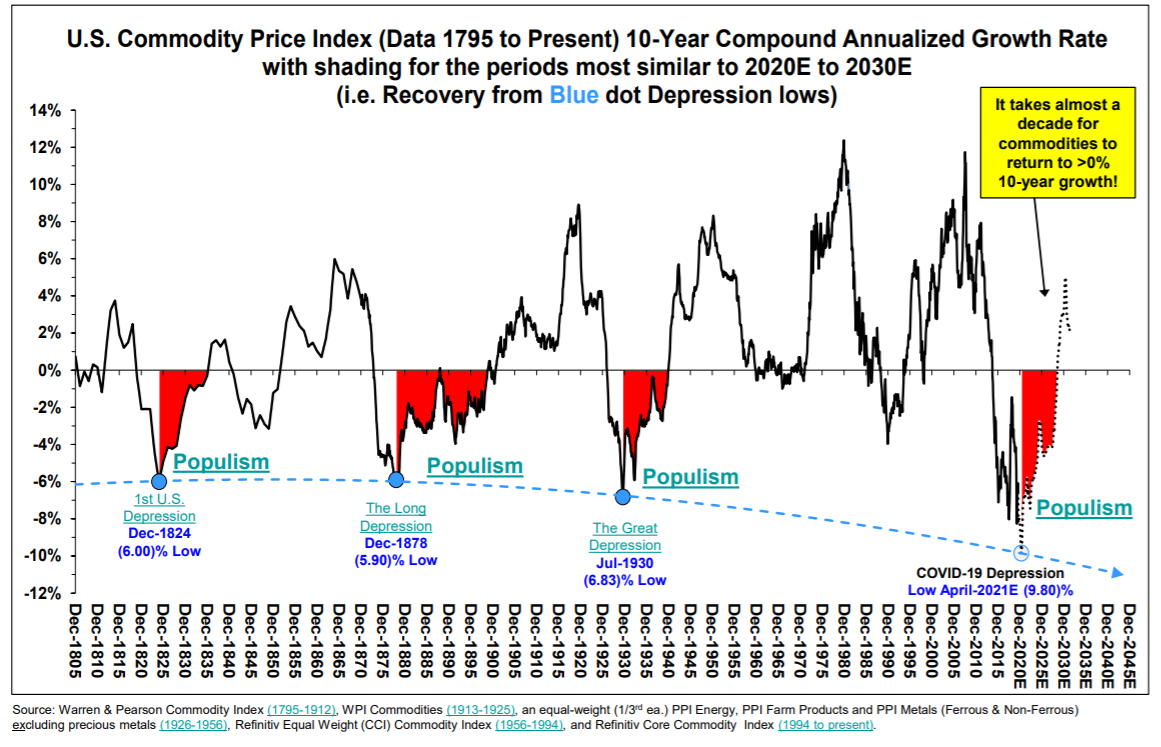

- This fascinating chart shows the link between commodity prices and populism (MarketWatch)

- Here’s how much money banks earned for distributing PPP funds (New York Post)

- Walmart launching a subscription service for less than $100 a year (USA Today)

- Chubb’s Pandemic Estimate Could Buffer Insurers (Wall Street Journal)

- Homebuyer mortgage demand spikes 33% as rates set another record low (CNBC)

- What Wall Street Pros Will Look for This Earnings Season (Bloomberg)

- Taylor Morrison shares soar premarket after home builder says June was its best ever sales month (MarketWatch)

- Morgan Stanley Sees Multiple COVID-19 Vaccine Makers with Pivotal Data Before Year End, Supporting ‘V’ Shaped Recovery (StreetInsider)

- Biogen (BIIB) Completes Submission of BLA to FDA for Aducanumab as Treatment for Alzheimer’s Disease (StreetInsider)

- Big economies face surging debt, have time to put house in order, Barclays says (Reuters)

- Herd Immunity May Be Closer Than You Think (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Tuesday…

- 10 stock picks from Jefferies for investors who want to be ‘trendy’ as the economy recovers (MarketWatch)

- Dividend Stocks With Solid Payout Prospects (Barrons)

- Here’s one ‘remarkable’ difference between COVID-19 and the 1918 Spanish flu (MarketWatch)

- Novavax shares soar 38% premarket on news of $1.6 billion in funding for COVID-19 vaccine candidate (MarketWatch)

- Regeneron’s stock gains on $450 million manufacturing deal with U.S. for experimental COVID-19 treatment (MarketWatch)

- Gilead Will Make a Profit on Remdesivir This Year, Says Analyst (Barron’s)

- Behind Oil’s Rise Is a Historic Drop in U.S. Crude Output (Wall Street Journal)

- Elon Musk’s red satin Tesla ‘short shorts’ sell out in minutes (New York Post)

- The Next Energy Battle: Renewables vs. Natural Gas (New York Times)

- Economists call for more direct cash payments tied to the health of the economy (Reuters)

- Disney+ Sees Massive Surge In Downloads During ‘Hamilton’ Weekend (Benzinga)

- Revisiting Coronavirus Vaccine Timelines: Moderna Denies Delay, Pfizer Advances Project Lightspeed And More (Benzinga)

- Peter Thiel’s Palantir Confidentially Files To Go Public (Benzinga)

- Warren Buffett’s Bet Is a Midstream Buying Signal (Wall Street Journal)

- Samsung says its second quarter profits likely rose 23% (CNBC)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/6/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 6, 2020

Unusual Options Activity – Discovery, Inc. (DISCA)

Data Source: barchart

Today some institution/fund purchased 1,910 contracts of Jan 2021 $27.50 strike calls (or the right to buy 191,000 shares of Discovery, Inc. (DISCA) at $27.50). The open interest was 849 prior to this purchase. Continue reading “Unusual Options Activity – Discovery, Inc. (DISCA)”