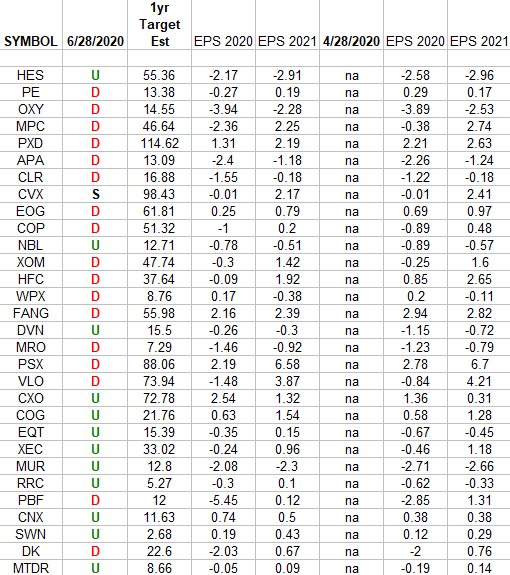

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2020 and 2021 estimates were: 4/28/2020 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Tag: StockMarket

Tom Hayes – NJNN TV Appearance – 6/28/2020

NJNN TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 28, 2020

Be in the know. 25 key reads for Sunday…

- Americans Hold Huge Pile of Cash That’s Key to Economic Recovery (Bloomberg)

- Boeing 737 MAX certification flight tests to begin Monday: sources (Fox Business)

- What The Black Death And Spanish Flu Tell Us (Podcast) (Bloomberg)

- The Word of the Day Is Cautious (Futures Mag)

- Well-Known Energy Companies Highlight Goldman Sachs Stocks to Buy Under $10 (24/7 Wall Street)

- Masks Could Help Stop Coronavirus. So Why Are They Still Controversial? (Wall Street Journal)

- Gilead is about to start trials of an inhaled version of Remdesivir (Gilead)

- Jim Cramer: Memo to Texas – No Mask, No Success, Period (TheStreet)

- Christmas in July: NASDAQ’s Mid-Year Rally (Almanac Trader)

- Pandemic Real Estate Boom? Medieval History Says Yes (Wall Street Journal)

- What Type Of Yacht Does Rande Gerber Escape To In The Summer? (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Bentley Rolls the Final Mulsanne Off the Production Line (Robb Report)

- John F. Kennedy’s Former Winter White House in Palm Beach Sells (Architectural Digest)

- This Reinforced 1971 Plymouth Road Runner Packs A V10 From A Viper (The Drive)

- The Donkervoort D8 GTO-JD70 Is an Absurdly Fast Dutch Roadster (Maxim)

- Old Drugs Could Reveal a New Way to Attack the Coronavirus (Wired)

- Will Ferrell’s Best Comedy in Years Is Here (The Atlantic)

- The people who get the best coaches aren’t the ones who need them most (Michael Lewis)

- The best rubs you can buy for grilled steak, chicken, pork and fish (CNET)

- Tesla Model Y – Jay Leno’s Garage (YouTube)

- ‘The Profit’ Host Marcus Lemonis on Bringing Small Businesses Back After Lockdown (Guest Column) (Variety)

- AstraZeneca makes another vaccine supply agreement (BioPharma)

- Credit managers race to hire distress experts (Pensions and Investments)

- Many Will Pay Later If the Government Doesn’t Borrow Freely Now (Barron’s)

Be in the know. 20 key reads for Saturday…

- 7 Beaten-Up Housing Stocks Poised For Growth (Barron’s)

- Continental Resources Founder Harold Hamm Bought Up the Oil Stock (Barron’s)

- ETF Fund Flows (ETF.com)

- Sterling has not become an emerging market currency (Financial Times)

- Berkshire Hathaway Is Now a Deep Value Stock (Guru Focus)

- Jeremy Siegel on the Stock Market Under Covid-19 (Bloomberg)

- Why You Feel At Home In A Crisis (Farnam Street)

- Boyar’s Presentation from The 2020 Contrarian Investment Conference (Boyar Value)

- Blank Check Company Backed by Former State Street Exec Eyeing Asset Management Deals (Institutional Investor)

- The US Marine Corps’ New Weapon Can Electrocute Targets from 100 Feet Away (Futurism)

- Jeremy Strong’s Succession Inspiration (Vanity Fair)

- Covid-19 Is a Puzzle That Wall Street Can’t Solve (Wall Street Journal)

- Gap will sell Kanye West’s Yeezy line (CNN Business)

- Nike’s COVID-related sales decline is a bump on the path to long-term growth, analysts say (MarketWatch)

- Opinion: These 5 giant stocks are driving the U.S. market now, but watch out down the road (MarketWatch)

- Amateur Traders Pile Into Asian Stocks, Making the Pros Nervous (Bloomberg)

- Markets Bombed, Investors Carried On (Wall Street Journal)

- Here are the key questions for the stock market heading into the second half of the year (CNBC)

- Meet Barron’s 25 Top CEOs (Barron’s)

- Magellan Midstream Has a Vital Pipeline Network and an Attractive Yield (Barron’s)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 36

Article referenced in VideoCast above:

The Luke Combs, “When It Rains It Pours” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 26

Article referenced in podcast above:

The Luke Combs, “When It Rains It Pours” Stock Market (and Sentiment Results)…

Tom Hayes – One America News Network (OAN) TV Appearance – 9/15/2020

One America News Network (OAN) TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 26, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Friday…

- Fed Stress Test Finds U.S. Banks Healthy Enough to Withstand the Coronavirus Crisis (Wall Street Journal)

- FDIC to Lift Postcrisis Curb on Banks (Wall Street Journal)

- Banks Get Easier Volcker Rule and $40 Billion Break on Swaps (Bloomberg)

- Fed puts restrictions on bank dividends after test finds some banks could be stressed in pandemic (CNBC)

- ECB’s Lagarde says we’ve probably passed the worst of the coronavirus crisis (CNBC)

- Ford unveils new F-150 as tech-savvy pickup with hands-free driving, integrated power generator (CNBC)

- Two European Airport Stocks Are Ready to Take Off (Barron’s)

- Why one strategist is actually encouraged by a spike in new U.S. coronavirus cases (MarketWatch)

- Race for a COVID-19 vaccine has drug makers scaling up manufacturing — before one is developed (MarketWatch)

- Don’t Fault Florida Yet for Its Handling of Covid-19 (Bloomberg)

- Once the Center of the Coronavirus Crisis, Europe Now Looks Ahead With Hope (Wall Street Journal)

- Connecticut Plans to Reopen Schools in the Fall (Wall Street Journal)

- Kanye West Signs Multiyear Deal to Sell New Yeezy Line at Gap (Bloomberg)

- The 2021 Ford F-150 Aims to Double as a Rolling Office (Wall Street Journal)

- Top Energy Analyst Upgrades 3 Stocks With Big Potential Upside (24/7 Wall Street)

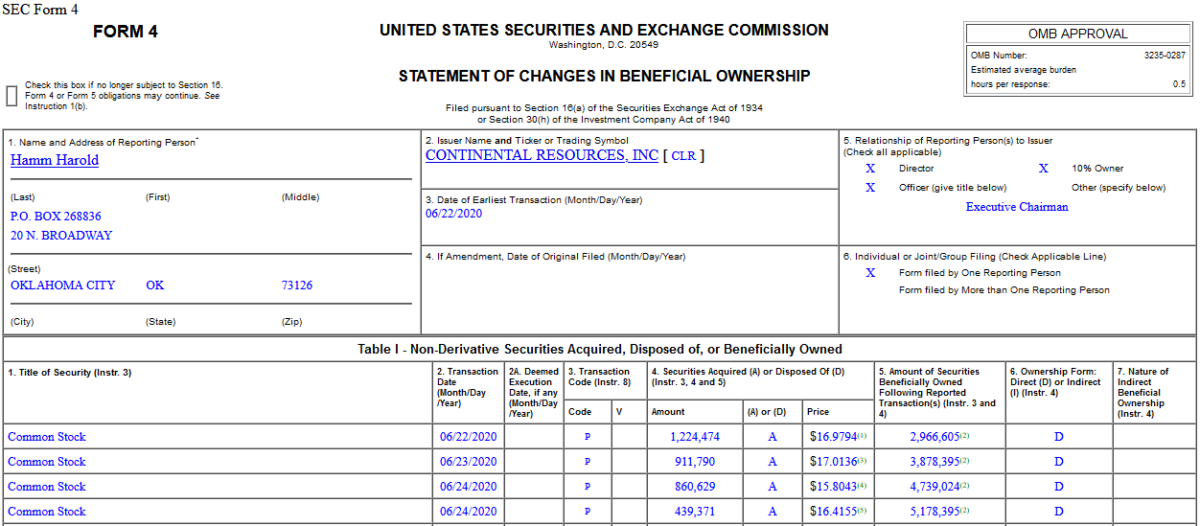

Insider Buying in Continental Resources, Inc. (CLR)

On June 22-24, 2020, Harold Hamm – Director of Continental Resources, Inc. (CLR) – purchased 3,436,264 shares of CLR at $16.01-17.01. His out of pocket cost was $57,117,798.