- Beijing Virus Outbreak Contained, Top China Expert Say (Bloomberg)

- We will dress up again (Financial Times)

- TikTok’s U.S. Revenues Expected to Hit $500 Million This Year (The Information)

- Initial Jobless Claims 1.5M vs 1.29M Expected (Street Insider)

- BoE Buying by $125 Billion to Counter Virus Crisis (Bloomberg)

- Wall Street giants including the CEOs of Goldman and Blackstone are pouring money into the campaign to defeat AOC in a June primary. (Business Insider)

- China Pledges Faster Credit Growth as Economy Faces Virus Return (Bloomberg)

- BP raises nearly $12 billion in first hybrid bonds issue (Reuters)

- Initial jobless claims continue to trend lower (Yahoo! Finance)

- Banks rush to borrow record €1.3tn at negative rates from ECB (Financial Times)

- Boaz Weinstein Is Making Bank. He’s Not Happy That You Know About It. (Institutional Investor)

- How Strict Are Airlines About Face Masks in Flight? (Wall Street Journal)

Tag: StockMarket

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…

This week’s stock market theme song is Drake’s “Toosie Slide.” We chose this song to capture sentiment as the market has been consolidating its gains in “Drake style” for the past 51 days: Continue reading “The Drake “Toosie Slide” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 949 contracts of Sept. 2021 $52.50 strike calls (or the right to buy 94,900 shares of Citigroup Inc. (C) at $52.50). The open interest was just 226 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

Tom Hayes – Yahoo! Finance TV Appearance – 6/17/2020

Yahoo! Finance TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 17, 2020

Thanks to Melody Hamm and Sarah Smith for having me on your show:

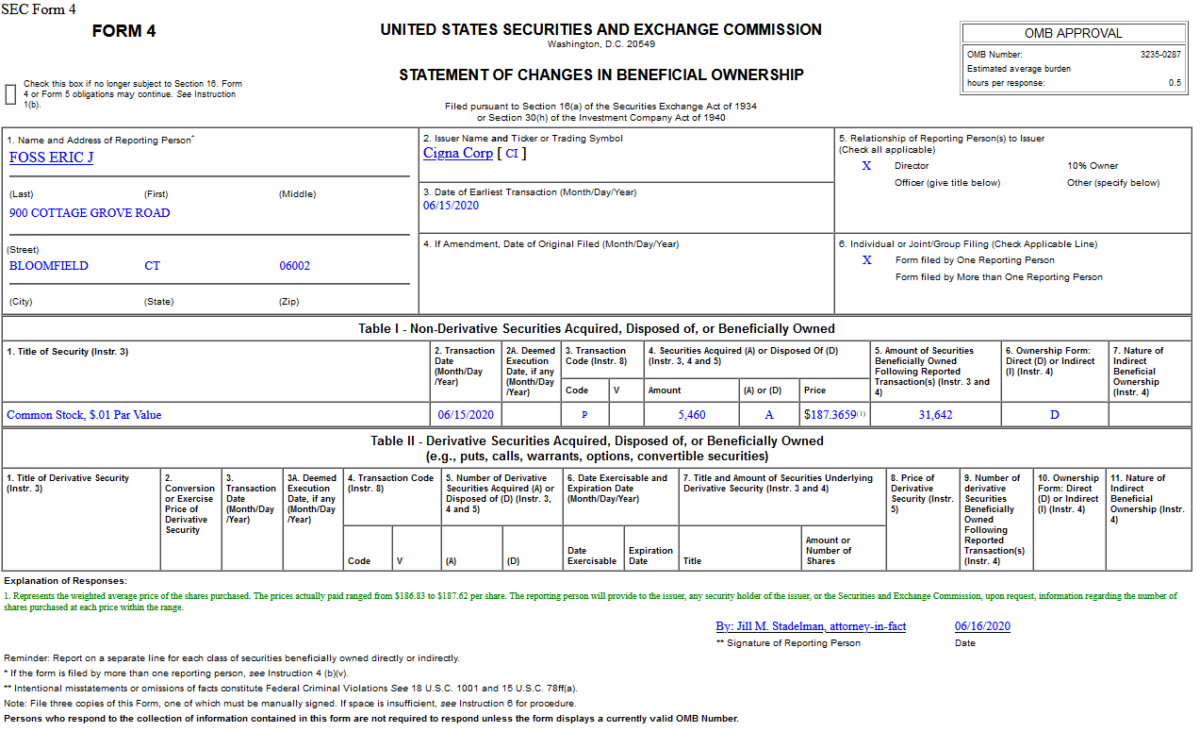

Insider Buying in Cigna Corporation (CI)

On June 15, 2020, Eric Foss – Director of Cigna Corporation (CI) – purchased 5,460 shares of CI at $187.37. His out of pocket cost was $1,023,018.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- Opinion: Insiders in these 2 market sectors are spending the most money to buy more of their company’s stock (MarketWatch)

- Banks’ trading bonanza just keeps going — markets units to see 20% revenue surge (fn london)

- Debt investors let borrowers go back to the future (Financial Times)

- Jim Cramer: A Zweig Wave Is One That’s Definitively Worth Surfing (TheStreet)

- U.K. approves use of life-saving coronavirus drug dexamethasone in ‘biggest breakthrough yet’ (MarketWatch)

- The Worst Is Over. Where to Find Promising Stocks. (Barron’s)

- U.S. home construction rebounds 4.3% in May (CNBC)

- ‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch)

- Moderna Is Racing Toward a Covid-19 Vaccine, but the Field Is Getting Crowded (Barron’s)

- Keep an eye on these infrastructure stocks, with possible $1 trillion Trump plan on deck: Traders (CNBC)

- Mortgage applications to buy a home surge to the highest in 11 years as rates hit a survey low (Business Insider)

- A Maserati Straight Out of a Vintage-Car Lover’s Dreams (Wall Street Journal)

- Investors Are Sitting on the Biggest Pile of Cash Ever (Wall Street Journal)

- If Inflation Is Coming, the Market Isn’t Ready (Wall Street Journal)

- Oil Demand Is Headed for Record Rebound in 2021 (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 35 key reads for Tuesday…

- Retail Sales Surge as Shoppers Emerge From Lockdown (Barron’s)

- Steroid dexamethasone reduces deaths among patients with severe COVID-19: trial shows (Street Insider)

- 10-year Treasury yield climbs above 0.75% on recovery in U.S. retail sales and report of $1 trillion infrastructure spending plan (MarketWatch)

- European stocks rally on central bank action and U.S. data (MarketWatch)

- A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch)

- Oil prices rally as IEA report points to record appetite for crude next year (MarketWatch)

- ‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch)

- U.K. and EU Want a Quick Brexit. They Just Disagree on Everything Else. (Barron’s)

- Bluebird and Crispr Show Promise for Sickle-Cell Cures (Barron’s)

- 10 REITs With Strong Rent Collection and Lower Debt (Barron’s)

- Dividend Stocks Set to Benefit From the Search for Yield (Barron’s)

- Retail Traders Are Beating Hedge Funds (Barron’s)

- Fed Will Amass Corporate Bond Portfolio Using Index Approach Wall Street Journal)

- Airlines Are Losing Money. They Will Still Buy a Lot of Planes (Wall Street Journal)

- iRobot Cleans Up (Wall Street Journal)

- Apple price target raised to $400 from $310 at Cit (TheFly)

- BofA boosts Disney target to $146, sees ‘compelling’ entry point (TheFly)

- Lennar Corp. (LEN) Tops Q2 EPS by 51c, Offers Guidance (Street Insider)

- Major US airlines may ban passengers who don’t wear face masks (New York Post)

- Hedge fund coach claims ‘Billions’ trolling her by dressing character in favorite outfit (New York Post)

- Trump to Sign Executive Order on Policing (Wall Street Journal)

- Fannie, Freddie Tap Wall Street Banks to Advise on Recapitalization (Wall Street Journal)

- The coronavirus pandemic can’t stop Americans from buying pickups USA Today)

- BofA Survey Finds 78% of Investors See Market as ‘Overvalued’ (Bloomberg)

- Supply Chains of 2020 Needing Repair Now Are the Banks of 2008 (Bloomberg)

- Oil Rises Above $40 on U.S. Stimulus and Tighter Supplies (Bloomberg)

- Light, Fast, and Powerful, the Porsche 718 Also Runs Under $100,000 (Bloomberg)

- Ford unveils 2021 Mustang Mach 1 as new global ‘pinnacle’ of pony car lineup CNBC)

- 10 tech stocks left behind by the market’s furious rally (MarketWatch)

- Investors Approaching Retirement Face Painful Decisions (Wall Street Journal)

- Bank of Japan pledges $1tn in coronavirus loans (Financial Times)

- More Market Makers To Be Allowed Back On The NYSE Floor Wednesday (Benzinga)

- Tesla Says Model S Long Range Plus Finally Received 402 Miles Rating From EPA, Confirms $5,000 Price Cut (Benzinga)

- How Tiger Funds Navigated the Market Volatility (Institutional Investor)

- Fed’s Powell set to reiterate long U.S. economic recovery, call for more fiscal support (Reuters)

June Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Bank of America surveyed 212 mutual fund, hedge fund and pension fund managers with $598 billion under management during the week ending June 11. Continue reading “June Bank of America Global Fund Manager Survey Results (Summary)”