- Party Like It’s 1983 (Wall Street Journal)

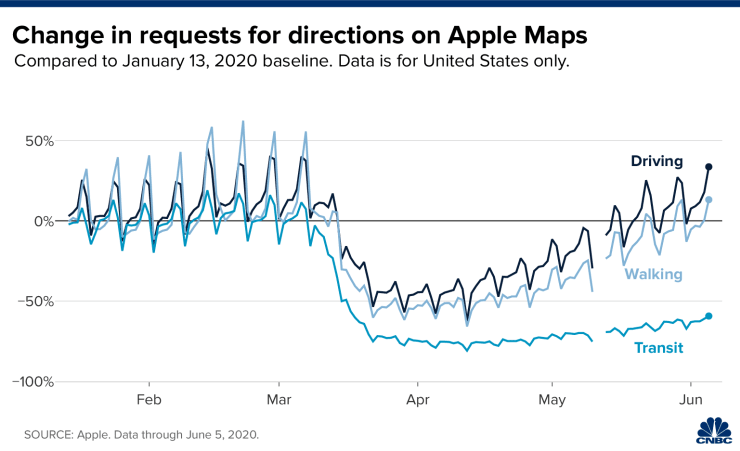

- Five charts that track the U.S. economy amid reopening progress (CNBC)

- Hospitals Got Bailouts and Furloughed Thousands While Paying C.E.O.s Millions (New York Times)

- Chimerica Isn’t Dead, but the Pandemic Wounded It (Wall Street Journal)

- Oil prices motor to levels not seen in months as OPEC+ extends historic cuts (Fox Business)

- AstraZeneca contacted Gilead over potential megamerger: Bloomberg News (Street Insider)

- Las Vegas Is Open for Business Again: 4 Top Gaming Stocks (24/7 Wall Street)

- New York City reopens under Phase One on Monday (New York Post)

- Bull, bear, bull, bear and now a new bull market — whatever’s next, these stocks will outperform, strategist says (MarketWatch)

- Japan Bankruptcies Hit Lowest Since the 1960s: What Gives? (Bloomberg)

- Fed Debates Whether to Reinforce Low-Rate Pledge With Yield Caps (Wall Street Journal)

- Saudi Arabia’s Secret Plans to Unveil Its Hidden da Vinci—and Become an Art-World Heavyweight (Wall Street Journal)

- U.S. Fed’s Main Street lending facility likely to start with a whimper (Reuters)

- Stanley Druckenmiller says he’s been ‘humbled’ by market comeback, underestimated the Fed (CNBC)

- New CEO Bought Stock in UPS (Barron’s)

- Barron’s Daily: Travel Stocks Continue Their Rebound. Not Even a Tropical Storm Can Stop the Rally. (Barron’s)

- HP Stock Is Slumping. The CEO and a Director Made the First Insider Buys in Years. (Barron’s)

- Emerging-Market Rally Seen Unstoppable as Traders Turn to Powell (Bloomberg)

Tag: StockMarket

Be in the know. 10 key reads for Sunday…

- Move Over, Moderna: Why Pfizer May Be The Better Bet To Deliver A Vaccine By Fall (Forbes)

- First CRISPR gene editing trial in cancer patients points to safety of technique in medical treatments (FirstPost)

- CT: Indoor dining, gyms, movie theaters, small weddings and events to reopen June 17, three days early (News Times)

- Hennessey Unleashes Fastest C8 Corvette Stingray Yet (Maxim)

- The Business Of Antibody Tests (NPR Planet Money)

- Ferrari 812 Superfast Review: One of the Best Engines of All Time (TheDrive)

- Michael Jordan pledges $100M to promote racial equality (Fox Business)

- California Gov. Gavin Newsom Reveals TV, Film Production Can Restart June 12 (Hollywood Reporter)

- Ariel founder: ‘Black people are locked out’ (Pensions & Investments)

- Baker Hughes: US rig count down 17 units to 284 (Oil & Gas journal)

Be in the know. 20 key reads for Saturday…

- OPEC+ Agrees to Extend Output Cuts as Quota Cheats Offer Penance (Bloomberg)

- Selloff reminiscent of an older bear market: Oakmark’s Nygren (CNBC)

- A Booming Stock Market Could Come Back to Bite the Recovery (Bloomberg)

- Can Big Business Fix Racial Injustice? It Has to Try. (Barron’s)

- 3 Stocks That Could Benefit When Dining Out Returns (Barron’s)

- Here are the 10 most under and overbought S&P 500 stocks, according to Goldman (MarketWatch)

- How the U.S. dollar’s ‘almost silent slide’ is juicing the stock-market rally (MarketWatch)

- These stocks rose by double digits Friday as underperforming sectors bounced back (MarketWatch)

- American Airlines stock adds to its tally of records with a weekly gain of over 75% (MarketWatch)

- Minneapolis-based U.S. Bancorp to spend over $115 million to address ‘economic and racial inequities’ (MarketWatch)

- Antibody Drugs Could Help Curb the Pandemic. What Investors Need to Know. (Barron’s)

- Occidental Stock Rockets 30% Higher (Barron’s)

- Amid U.S.-China Tensions, Active Managers Are Buying (Barron’s)

- U.S. Unemployment Rate Fell to 13.3% in May (Wall Street Journal)

- Home Prices Are Rising, Along With Post-Lockdown Demand (New York Times)

- Bears Thwarted Again by Stock Market That Believes in Recovery (Bloomberg)

- These 25 Photos Show Why Things Were Designed The Way They Were (Fetch Sport)

- Meet the estate agents turning themselves into superstars (Financial Times)

- The Art of Being Alone (Farnam Street)

- Jamie Dimon: Fed is bringing out the bazooka (YouTube)

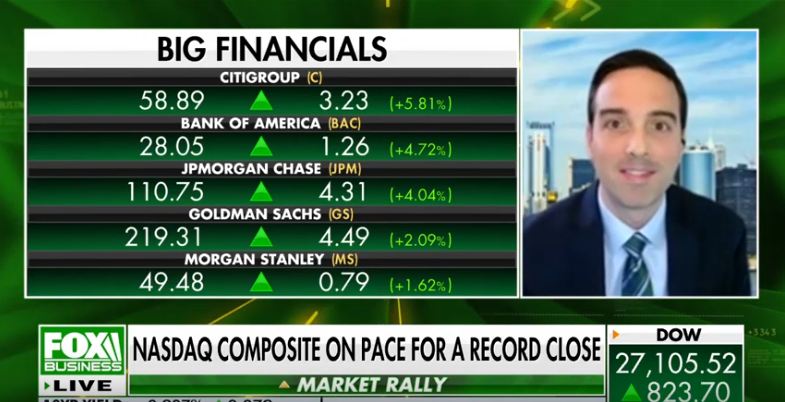

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/6/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 6, 2020

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 33

Article referenced in VideoCast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 23

Article referenced in podcast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Stocks Take Off as Jobs Come Back (Barron’s)

- China to Allow Foreign Airlines to Restore Some Flights After U.S. Pressure (Wall Street Journal)

- Time to Buy Emerging Markets? (Barron’s)

- Oil Rebounds as Market Waits for Production Cuts (Barron’s)

- Oil prices rise as OPEC+ seen setting stage for weekend meeting (MarketWatch)

- Casino Stocks Are Surging as Las Vegas Reopens (Barron’s)

- ‘Europe Finally Got the Message’: Leaders Act Together on Stimulus (New York Times)

- Researchers Retract Study Linking Malaria Pill to Heart Risk (Bloomberg)

- History Suggests the Handshake Will Survive the Pandemic (Bloomberg)

- Is the Coronavirus Really Getting Weaker? (Bloomberg)

- Trump Team Envisions Up to $1 Trillion for Next Stimulus Round (Bloomberg)

- Las Vegas Casinos Reopen With $30-a-Night Rooms on the Strip (Bloomberg)

- 10-year Treasury yield surges above 0.9% after better-than-expected jobs report (CNBC)

- The ‘Inconvenient Fact’ Behind Private Equity Outperformance (Institutional Investor)

- ‘The biggest payroll surprise in history’ — economists react to May jobs report (MarketWatch)

- India Stocks Set for Second Weekly Gain on Easing Lockdown (Bloomberg)

- European Central Bank Ramps Up Stimulus Program Beyond $1.5 Trillion (Wall Street Journal)

- Airlines Add Flights as Travel Slowed by the Coronavirus Starts to Pick Up (Wall Street Journal)

- Americans Are Saving More, but How Long Can It Last? (Wall Street Journal)

- Investors Climb Back Into Riskiest Emerging-Market Bonds (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Thursday…

- ECB to Spend Extra 600 Bn Euro on Emergency Bond Buys (Barron’s)

- Deutsche Bank Upgrades Wells Fargo (WFC) to Buy; Risks Priced In (Street Insider)

- The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)… (Zero Hedge)

- Friday’s Job Report Could Support Recovery Hopes (Barron’s)

- Consumer Spending Trickles Back as U.S. Reopens (Barron’s)

- Podcast: The Paycheck Protection Program Is Starting to Run Out (Barron’s)

- History Can Show Us Why the Market Is Rising Now (Barron’s)

- Pinterest Accelerates Tech Projects as Pandemic Boosts User Engagement (Wall Street Journal)

- Fed Expands Municipal Bond Program, Opening Door to Some Smaller Cities (New York Times)

- Beijing to Give $1.7 Billion in Vouchers to Boost Shopping (Bloomberg)

- Global GDP Tracker’s 2.3% Drop in May Shows Worst Over (Bloomberg)

- Fauci (the Horse) Loses Race Badly in the Mud at Belmont Park (Bloomberg)

- European Central Bank takes its pandemic bond buying to 1.35 trillion euros to try and prop up economy (CNBC)

- Here are the 9 economic relief programs the Fed is using to combat coronavirus fallout (Business Insider)

- An oil CEO says crude prices could surge 90% to $70 by fall because US firms have ‘over-cut production’ (Business Insider)

- Saudi Arabia and Russia push for an extension to output cuts, OPEC+ meeting this week still possible (CNBC)

- American Airlines (AAL) Increases Domestic Flying for Summer Travel Season, Begins Reopening Admirals Clubs and Increases Flexibility (Street Insider)

- 10 US Oil Companies Still Likely to Thrive in 2030 (24/7 Wall Street)

- 1.88 million workers file for unemployment benefits (Yahoo! Finance)

- Nio stock surges after company posts record-high deliveries for May (MarketWatch)

- Homebuilders will benefit from Millennials leaving cities: Expert (Fox Business)

- U.S. banks attract bargain hunters (Reuters)

- Locked-Up Journalists. Espionage Investigations. Constitutional Challenges. The Government’s Release of Economic Data Was Arcane and Complex — Until Now. (Institutional Investor)

- Gilead Analyst: Coronavirus Drug, Arcus Collaboration Make Biopharma A Buy (Benzinga)

- Royal Caribbean to offer up to $2 billion in bonds and convertible bonds that mature in 2023 (MarketWatch)