- How Fed Could Goose Economy via Yield-Curve Control (Bloomberg)

- JPMorgan provides 5 charts that suggest the stock market still has ‘plenty of room’ to rise from current levels (Business Insider)

- Ride the Travel Rebound With 7 Less Risky Stocks (Barron’s)

- Saudis transfer $40bn to back wealth fund’s spending spree (Financial Times)

- Disney World gets green light to reopen July 11 (CNBC)

- ‘Return-to-work’ bonuses of $450 a week, second stimulus checks: What’s being discussed in DC (CNBC)

- Trump’s China Response Leaves Room to De-Escalate Tensions (Bloomberg)

- The Really Big Stock Bull Case Says Fed Stimulus Doesn’t Go Away (Bloomberg)

- Texas Is Showing the World How to Reopen Cautiously (Bloomberg)

- Defense Stocks Lockheed, Northrop, L3Harris Just Below Buy Points In Coronavirus Market Rally (Investor’s Business Daily)

- How to Assess U.S. Threat to Delist Chinese Stocks (Barron’s)

- The Market’s Rally Could Linger for a Few Weeks. That Doesn’t Mean We’re in the Clear. (Barron’s)

- Casinos and Theme Parks Are Reopening This Summer. It Could Be Good News for Airlines. (Barron’s)

- 3 Airline Stocks That Can Benefit From a Pickup in Domestic Travel (Barron’s)

- Americans Are Getting Back on the Road. 3 Stocks to Buy. (Barron’s)

- Why the Stock Market Shrugged Off Escalating U.S.-China Tension This Week (Barron’s)

- U.S. oil futures up 88% in May, biggest monthly rise on record (MarketWatch)

- Plan to Save World’s Crops Lives in Norwegian Bunker (Wall Street Journal)

- William Lyon Built Homes in California and Survived Busts (Wall Street Journal)

- The Best James Bond Book for Summer—Especially This Summer (Wall Street Journal)

- Remote Work Could Spark Housing Boom in Suburbs, Smaller Cities (Wall Street Journal)

- Why is the U.S. stock market ignoring a brewing crisis in Hong Kong? (MarketWatch)

- Uneven Stock Recovery Divides Real-Estate Industry (Wall Street Journal)

- Elon Musk: “We Want to Be a Leader in Apocalypse Technology” (Futurism)

- Secretary Madeleine Albright — Optimism, the Future of the US, and 450-Pound Leg Presses (#437) (Tim Ferriss)

Tag: StockMarket

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 32

Article referenced in podcast above:

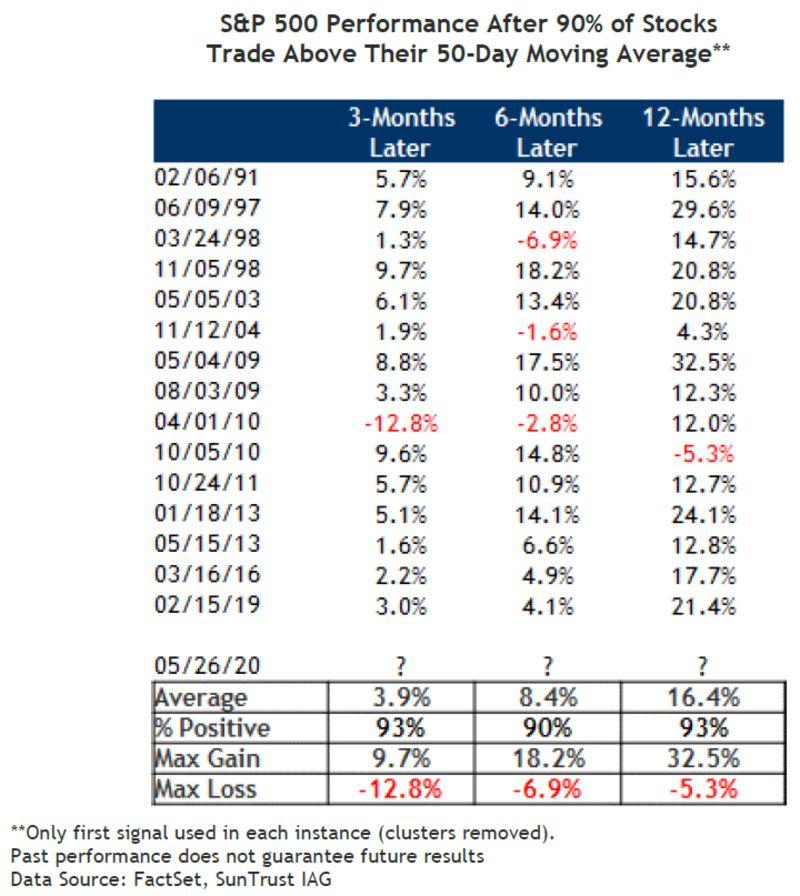

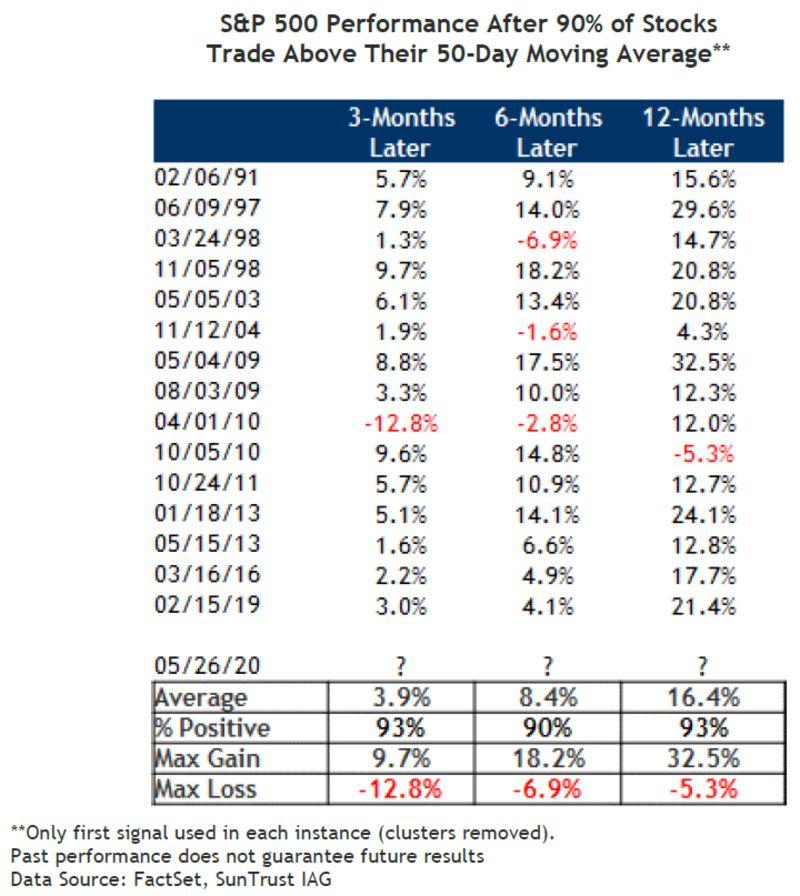

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 22

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Friday…

- Here’s what the Fed will do next, according to a Goldman Sachs economist (MarketWatch)

- BAE Systems Stock Should Be on Investors’ Radar. Here’s Why. (Barron’s)

- The Market May Have Gotten Ahead of Itself. But Cyclicals Still Look Cheap. (Barron’s)

- Sales Challenges Prove that Luxury Carmakers Aren’t Covid-Immune (Barron’s)

- Tesla’s Elon Musk just scored this massive payday (Fox Business)

- The Dirty Secret of Asset Management: It’s Doing…Okay? (Institutional Investor)

- How investors learnt to love the rally in stocks (Financial Times)

- Alan Jackson is the latest country star to play outdoor drive-in concerts (USA Today)

- Scientists Question Study Linking Malaria Drugs to Covid Risks (Bloomberg)

- Americans Have Stopped Thinking the Economy Is Getting Worse (Bloomberg)

- Sweden’s Economy Grew Last Quarter, Adding to Covid-19 Debate (Bloomberg)

- Mnuchin’s $29 Billion Loan Fund Untapped as Airlines Eye Rebound (Bloomberg)

Unusual Options Activity – Expedia Group, Inc. (EXPE)

Data Source: barchart

Today some institution/fund purchased 8,950 contracts of Jan 2022 $110 strike calls (or the right to buy 895,000 shares of Expedia Group, Inc. (EXPE) at $110). The open interest was just 217 prior to this purchase. Continue reading “Unusual Options Activity – Expedia Group, Inc. (EXPE)”

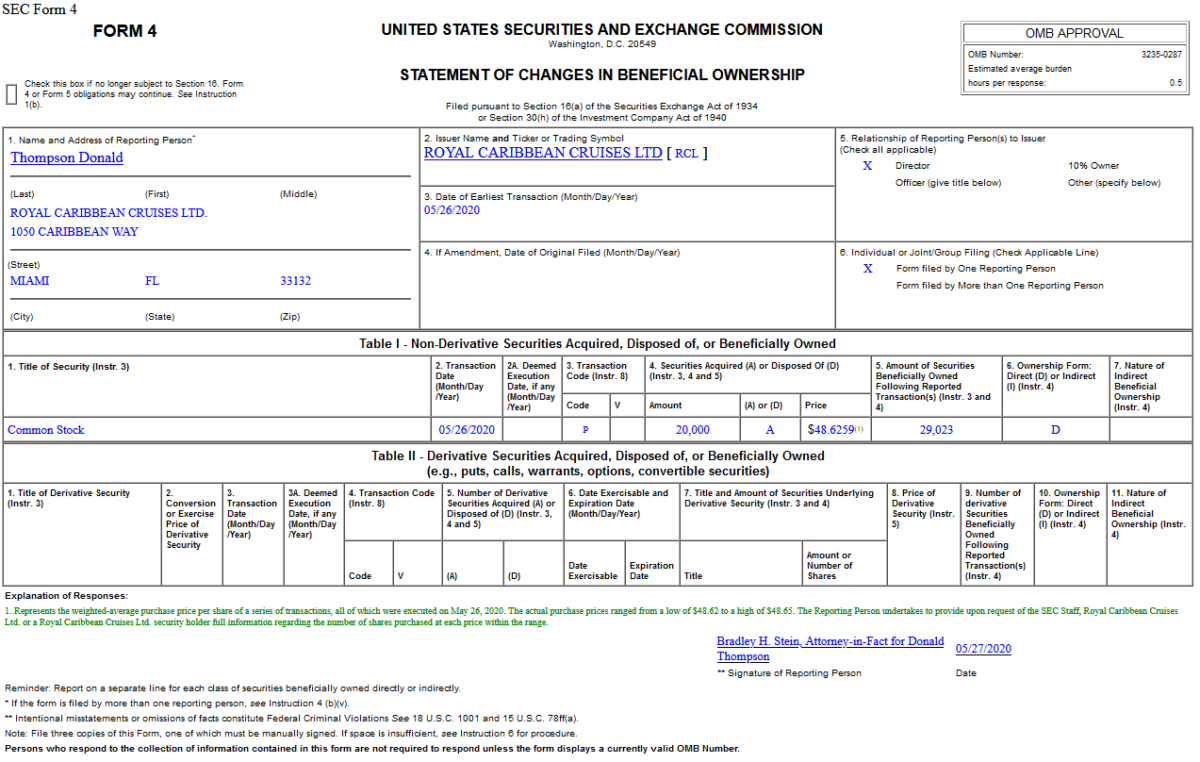

Insider Buying in Royal Caribbean Cruises Ltd. (RCL)

On May 26, 2020, Donald Thompson – Director of Royal Caribbean Cruises Ltd. (RCL) – purchased 20,000 shares of RCL at $48.63. His out of pocket cost was $972,518.

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Thursday…

- Boeing Restarts 737 Max Production As Massive Job Cuts Detailed (Investor’s Business Daily)

- The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)… (ZeroHedge)

- Vacation rentals around the world have jumped 127% since early April in a sign that people are slowly starting to travel again (Business Insider)

- Why Ackman Sold His Berkshire Hathaway Stake (Barron’s)

- Regal Owner Cineworld to Reopen Cinemas in July. That’s Not The Only Reason The Stock Is Soaring. (Barron’s)

- Battered Delta Stock Could Take Off. Here’s How to Play It. (Barron’s)

- Papa John’s second record sales month sends stocks soaring (New York Post)

- Apple Lands Martin Scorsese Movie Starring Leonardo DiCaprio and Robert DeNiro (Wall Street Journal)

- Facebook’s Mark Zuckerberg on Twitter fact-checking Trump: Companies shouldn’t serve as ‘arbiter of truth’ (USA Today)

- Roche Partners With Gilead in Covid Trial of Drug Combination (Bloomberg)

- Jamie Dimon Captures the Stock Market Moment (Bloomberg)

- With M&A Dead, Wall Street Bankers Keep Busy With Stock Sales (Bloomberg)

- Jobless claims rise over 2 million again but data offer glimmer of hope (MarketWatch)

- Bank of America CEO Brian Moynihan says U.S. economy starting to ‘come out of the hole’ (CNBC)

- Dollar General (DG) Tops Q1 EPS by 86c, Same-Store Sales Increased 21.7% (Street Insider)

- Toll Brothers (TOL) Tops Q2 EPS by 11c (Street Insider)

- 4 Dow Stocks to Buy Now That Have Lagged the Huge Rally (24/7 Wall Street)

- Ex-White House adviser Gary Cohn: Congress must act to help US recovery (Fox Business)

- Zuckerberg and Dorsey clash as Trump order looms (Financial Times)

- Hedge Funds Said One Thing. Their Portfolios Show Another. (Institutional Investor)

Where is money flowing today?

Data Source: Finviz