This week’s Stock Market theme song is Morgan Wallen’s “Chasin’ You.” Managers who were dramatically underweight equities – and missed the rally – were reluctantly forced to succumb to Morgan’s lyrics this week. They scrambled to gain equity exposure and chased the stock market rally: Continue reading “The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…”

Tag: StockMarket

Tom Hayes – BBC News World Appearance – 6/3/2020

BBC News World Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 3, 2020

Thank you Mariko Oi and Derek Cai for having me on BBC News World tonight to discuss the China/US travel bans and potential resolution.

Where is money flowing today?

Data Source: Finviz

Quote of the Day…

Be in the know. 25 key reads for Wednesday…

- ADP Employment Change (May) -2.76M vs -9M Expected (StreetInsider)

- Gilead developing inhaled remdesivir usable outside of hospitals (New York Post)

- Trump Administration Escalates Global Fight Over Taxing Tech (New York Times)

- Small banks and small businesses turned out to be a good combination when it came to PPP loans (USA Today)

- Eurozone services PMI climbs to 30.5 in May (MarketWatch)

- Restaurant bookings have fully recovered in Germany in a sign that activity rebounds quickly as lockdowns ease (MarketWatch)

- Here’s what the ECB has been buying with the special pandemic asset-purchase program that it is set to expand (MarketWatch)

- Barron’s Daily: Good News Stock Investors — the Dollar Is Slumping (MarketWatch)

- Gilead’s stock upgraded on high hopes for remdesivir revenue (MarketWatch)

- The No. 1 thing Americans are spending their stimulus checks on — even more than shopping at Costco, Walmart and Target (MarketWatch)

- Saudi, Russia reach deal on oil cuts, raising pressure for compliance (Reuters)

- China drives global oil demand recovery out of coronavirus collapse (Reuters)

- Boeing jumps after Third Point reveals stake in monthly report (TheFly)

- Real Estate Investors View Small Cities as Big Opportunities (Institutional Investor)

- China Caixin service PMI up sharply in May (MarketWatch)

- What Happened in 1968 Can Show Us Why the Market Is Rising Now (Barron’s)

- Lyft Says Ride Volumes Picked Up Smartly in May (Barron’s)

- Boeing and Airbus Will Benefit First From an Aerospace Recovery (Barron’s)

- A Relative Calm as U.S. Cities Undergo Curfews (Wall Street Journal)

- How many small businesses in US are now fully or partially open (Fox Business)

- Mortgage demand from homebuyers jumps 18%, as interest rates set another record low (CNBC)

- Heart Drugs Show Promise With Covid-19 Complications (Wall Street Journal)

- British Pound Climbs on Optimism Over EU Trade Talks (Wall Street Journal)

- Fed Promised to Buy Bonds but Is Finding Few Takers (Wall Street Journal)

- Coronavirus Stimulus Funds Are Largely Spoken for Wall Street Journal)

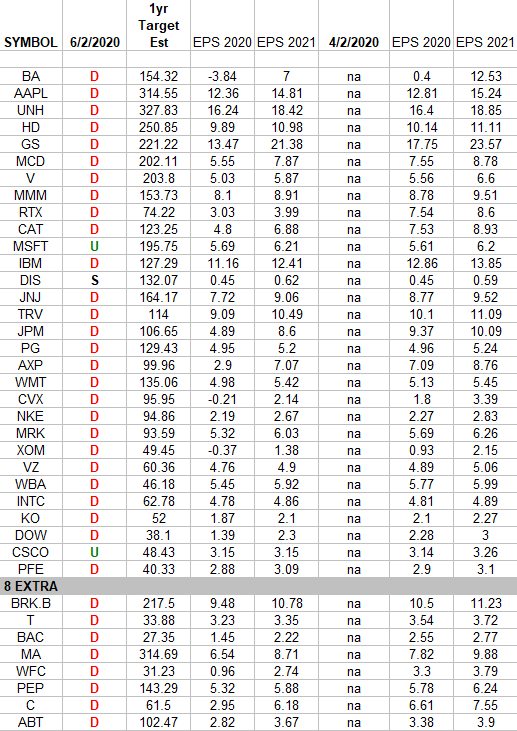

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

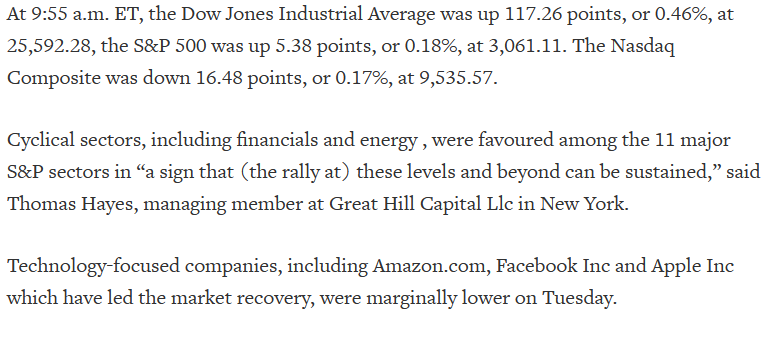

Quoted in Reuters article Tuesday:

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 20 key reads for Tuesday…

- New coronavirus losing potency, top Italian doctor says (Reuters)

- Why Protests Rarely Rattle Markets (Barron’s)

- Coty shakes off Kylie Jenner problem, surges 20 percent after KKR buys stake (New York Post)

- American Exporters Sell Soy to China Despite Rising Tensions (Bloomberg)

- Pound Advances on Glimmer of Optimism Around Latest Brexit Talks (Bloomberg)

- Investment banks are torn on which way the market is heading. Citi warns stocks are ‘way ahead of reality,’ but JPMorgan says they can climb higher. (Business Insider)

- The pandemic leads to a running boom in America: Morning Brief (Yahoo! Finance)

- Oil prices rise ahead of OPEC+ meeting on output cuts (Reuters)

- EasyJet to restart flights to 75% of route network by August (BBC)

- Oil Prices Mixed As OPEC Tries To Get Ahead Of New Flash Point (Investor’s Business Daily)

- Citi Option Trader Bets Nearly $1M On Long-Term Upside (Benzinga)

- The Buy-Side Trader Is Getting Outsourced in Coronavirus Crisis (Bloomberg)

- One in Four U.S. Covid-19 Deaths Are in Nursing Homes, Data Shows (Wall Street Journal)

- The Lancet’s Politicized Science on Antimalarial Drugs (Wall Street Journal)

- Buy Lilly, AbbVie and Merck, J.P. Morgan Says (Barron’s)

- Las Vegas Casinos Reopen This Week. The Stocks May Reap Different Fortunes. (Barron’s)

- Norwegian Cruise Stock Has Tumbled. The Company Has a New Top Investor. (Barron’s)

- Here Are Six Dividend Stocks With Solid Payout Prospects—and a Built-In Exit Strategy (Barron’s)

- Morgan Stanley Thinks a V-Shaped Recovery Is Possible (Barron’s)

- Who Can Get a Loan Through the Paycheck Protection Program? (Barron’s)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/1/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 1, 2020