Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 1, 2020

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Quote of the Day…

Be in the know. 20 key reads for Monday…

- Wall Street and Fed fly blind as coronavirus upends annual stress tests (Reuters)

- Chinese manufacturing output surged the most in 9 years in May, signaling a coronavirus recovery. (Business Insider)

- OPEC+ to Discuss Short Extension of Oil Output Cuts (Bloomberg)

- Russians claim to have an effective treatment for the coronavirus, which hospitals will start using this month (CNBC)

- Coronavirus May Be a Blood Vessel Disease, Which Explains Everything (Medium)

- Tesla CEO Elon Musk Makes History With SpaceX (Barron’s)

- Not All Cyclicals Are Created Equal. These 7 Are Resilient. (Barron’s)

- Dollar Slides as Investors Regain Confidence in Global Economy (Wall Street Journal)

- Tenants Largely Stay Current on Rent, for Now (New York Times)

- Record Ratings and Record Chaos on Cable News (New York Times)

- Wuhan’s Mass Testing May Have Eradicated the Coronavirus (Bloomberg)

- The Unusual Ambitions of Chamath Palihapitiya (Institutional Investor)

- Women-led hedge funds beat male rivals in coronavirus crisis (Financial Times)

- Nio CEO Says Tesla An Ally In Increasing Sales, Remains Bullish On Chinese EV Market Growth (Benzinga)

- Yale Epidemiologist: Hydroxychloroquine Should Be ‘Widely Available And Promoted Immediately’ As Standard Treatment (ZeroHedge)

- Barron’s Picks And Pans: Cheniere Energy, Delta Air Lines, Extended Stay And More (Benzinga)

- Goldman Sachs bets against the dollar as economies reopen (CNBC)

- 7 Cyclical Stocks That Can Ride Out the Coronavirus Slump (Barron’s)

- Europeans Want to Travel Again. What That Means for Booking Stock. (Barron’s)

- Remote Work Could Spark Housing Boom in Suburbs, Smaller Cities (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

- SpaceX Speeding Astronauts to Space Station in Landmark Trip (Bloomberg)

- An Encouraging EIA Report (Futures Mag)

- Howard Marks: Get Used to Uncertainty (Institutional Investor)

- Powell says Fed ‘strongly committed’ to helping US economy (Financial Times)

- Under Pressure (The Reformed Broker)

- Latest memo from Howard Marks: Uncertainty II (OakTree)

- Lockdowns vs. the Vulnerable (Wall Street Journal)

- When Safety Proves Dangerous (Farnam Street)

- Top Value Managers Share Stock Ideas (Validea)

- Typical June Trading: Early Gains Tend to Fade After Mid-Month (Almanac Trader)

- Gordon Murray Says the Hotly Anticipated T.50 Will Be the Lightest Supercar Ever Made (Robb Report)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- 2021 Dodge Challenger ACR Is Being Benchmarked Against the Viper: Report (The Drive)

- The Beige Book And The Pig Farmer (NPR Planet Money)

- “We are about to see the best economic data we’ve seen in the history of this country,” says a top former economic adviser to Obama. (POLITICO)

- How sugar can temporarily sabotage your immune system (CNET)

- Ryan Gosling’s ‘Wolfman’ Gears Up at Universal as Director Decision Nears (EXCLUSIVE) (Variety)

- A Giant Pension Bought Citigroup and CVS Stock. Here’s What It’s Selling. (Barron’s)

- Watch Musk, Leno Test Drive the Tesla Cybertruck (Popular Mechanics)

- Netflix comedy ‘Space Force’ shows real military branch’s struggle to be taken seriously (NBC News)

Be in the know. 25 key reads for Saturday…

- How Fed Could Goose Economy via Yield-Curve Control (Bloomberg)

- JPMorgan provides 5 charts that suggest the stock market still has ‘plenty of room’ to rise from current levels (Business Insider)

- Ride the Travel Rebound With 7 Less Risky Stocks (Barron’s)

- Saudis transfer $40bn to back wealth fund’s spending spree (Financial Times)

- Disney World gets green light to reopen July 11 (CNBC)

- ‘Return-to-work’ bonuses of $450 a week, second stimulus checks: What’s being discussed in DC (CNBC)

- Trump’s China Response Leaves Room to De-Escalate Tensions (Bloomberg)

- The Really Big Stock Bull Case Says Fed Stimulus Doesn’t Go Away (Bloomberg)

- Texas Is Showing the World How to Reopen Cautiously (Bloomberg)

- Defense Stocks Lockheed, Northrop, L3Harris Just Below Buy Points In Coronavirus Market Rally (Investor’s Business Daily)

- How to Assess U.S. Threat to Delist Chinese Stocks (Barron’s)

- The Market’s Rally Could Linger for a Few Weeks. That Doesn’t Mean We’re in the Clear. (Barron’s)

- Casinos and Theme Parks Are Reopening This Summer. It Could Be Good News for Airlines. (Barron’s)

- 3 Airline Stocks That Can Benefit From a Pickup in Domestic Travel (Barron’s)

- Americans Are Getting Back on the Road. 3 Stocks to Buy. (Barron’s)

- Why the Stock Market Shrugged Off Escalating U.S.-China Tension This Week (Barron’s)

- U.S. oil futures up 88% in May, biggest monthly rise on record (MarketWatch)

- Plan to Save World’s Crops Lives in Norwegian Bunker (Wall Street Journal)

- William Lyon Built Homes in California and Survived Busts (Wall Street Journal)

- The Best James Bond Book for Summer—Especially This Summer (Wall Street Journal)

- Remote Work Could Spark Housing Boom in Suburbs, Smaller Cities (Wall Street Journal)

- Why is the U.S. stock market ignoring a brewing crisis in Hong Kong? (MarketWatch)

- Uneven Stock Recovery Divides Real-Estate Industry (Wall Street Journal)

- Elon Musk: “We Want to Be a Leader in Apocalypse Technology” (Futurism)

- Secretary Madeleine Albright — Optimism, the Future of the US, and 450-Pound Leg Presses (#437) (Tim Ferriss)

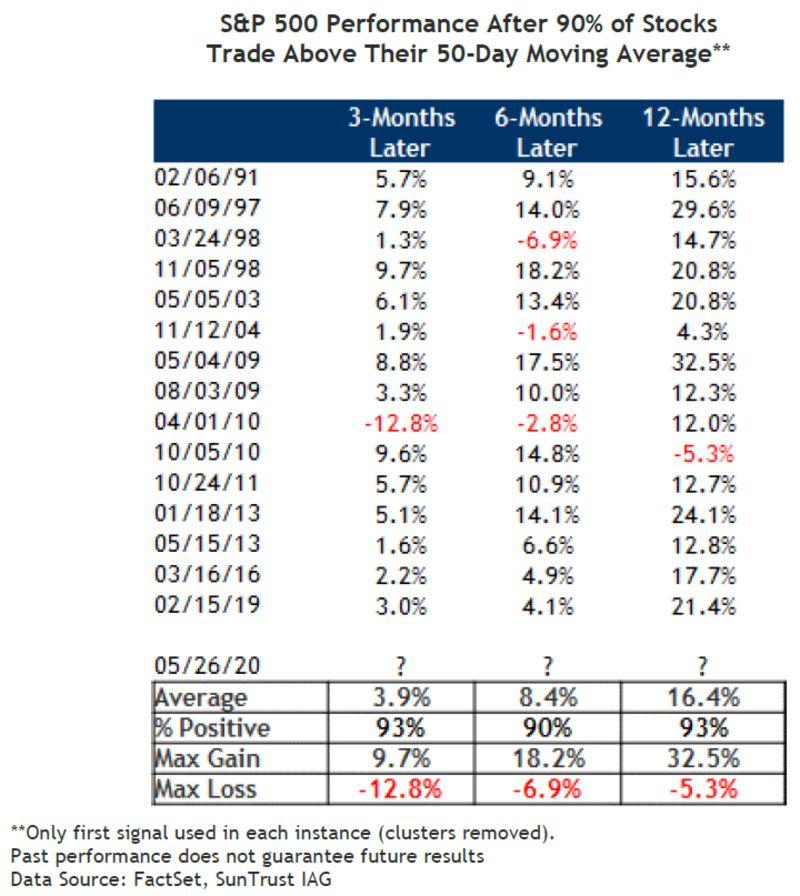

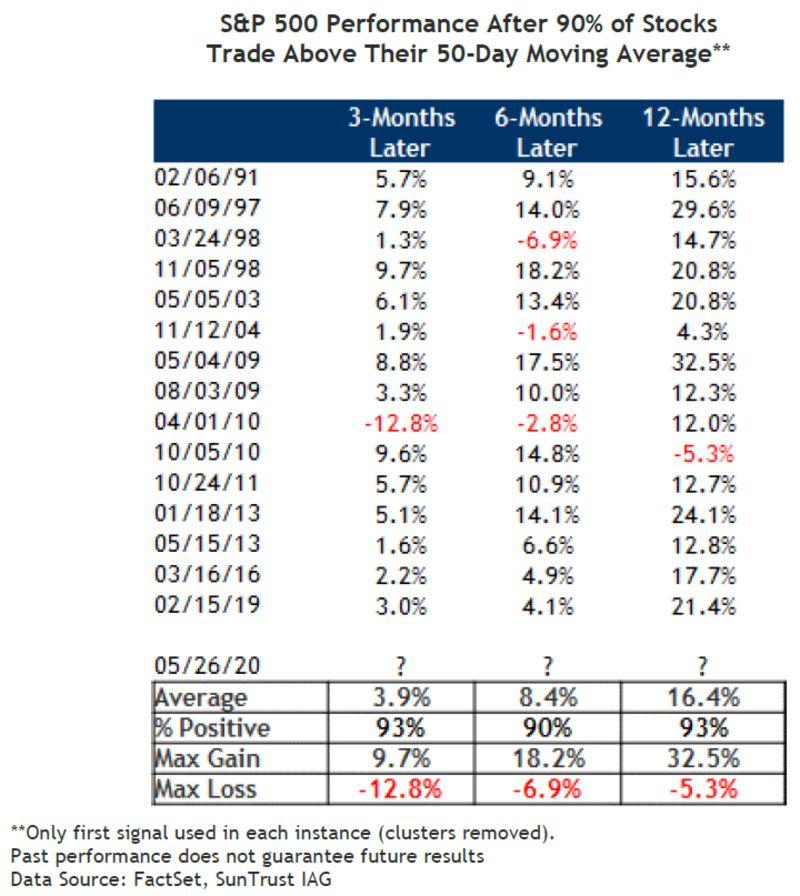

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 32

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 22

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Friday…

- Here’s what the Fed will do next, according to a Goldman Sachs economist (MarketWatch)

- BAE Systems Stock Should Be on Investors’ Radar. Here’s Why. (Barron’s)

- The Market May Have Gotten Ahead of Itself. But Cyclicals Still Look Cheap. (Barron’s)

- Sales Challenges Prove that Luxury Carmakers Aren’t Covid-Immune (Barron’s)

- Tesla’s Elon Musk just scored this massive payday (Fox Business)

- The Dirty Secret of Asset Management: It’s Doing…Okay? (Institutional Investor)

- How investors learnt to love the rally in stocks (Financial Times)

- Alan Jackson is the latest country star to play outdoor drive-in concerts (USA Today)

- Scientists Question Study Linking Malaria Drugs to Covid Risks (Bloomberg)

- Americans Have Stopped Thinking the Economy Is Getting Worse (Bloomberg)

- Sweden’s Economy Grew Last Quarter, Adding to Covid-19 Debate (Bloomberg)

- Mnuchin’s $29 Billion Loan Fund Untapped as Airlines Eye Rebound (Bloomberg)