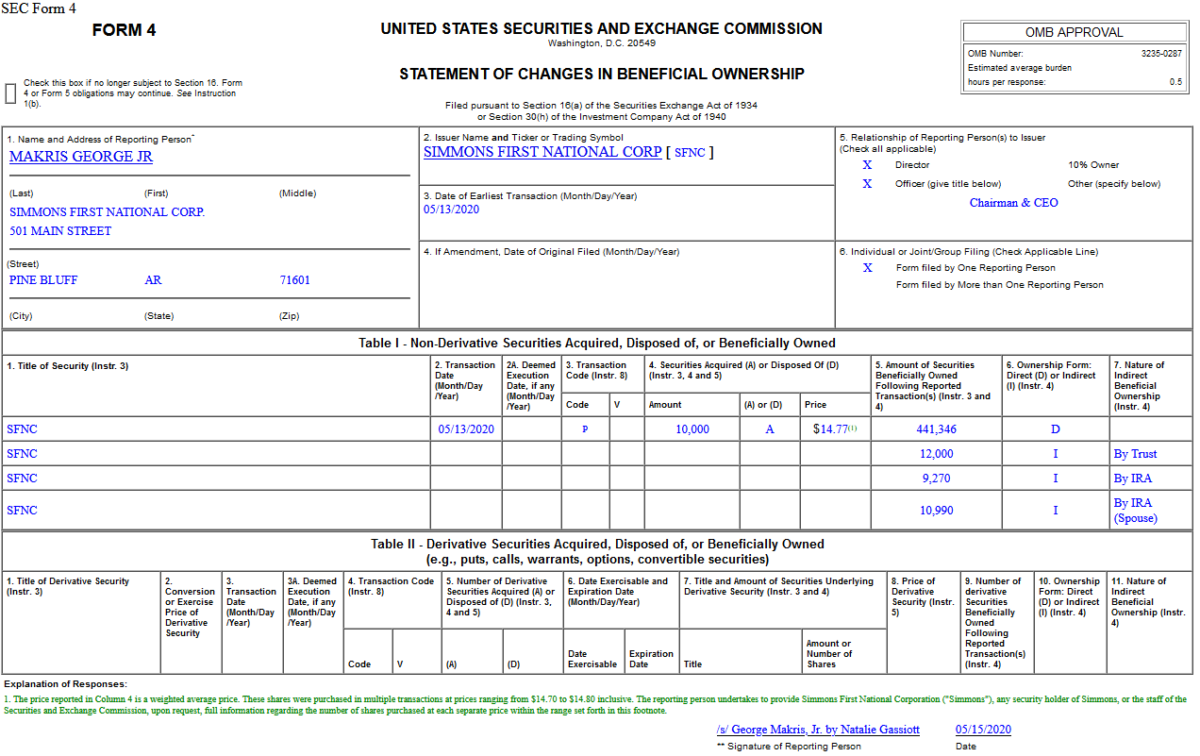

On May 13, 2020, George Makris – Chairman & CEO of Simmons First National Corporation (SFNC) – purchased 10,000 shares of SFNC at $14.77. His out of pocket cost was $147,700.

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Value Stocks Look Cheaper Than Ever. How to Play a Rebound. (Barron’s)

- ‘Stealth Bailout’ Shovels Millions of Dollars to Oil Companies (Bloomberg)

- TikTok Raises Profile As Digital Ad Rival To Snap, Facebook, Google (Investor’s Business Daily)

- The Oil Market Is Changing Its Tune (Barron’s)

- GE Stock Dropped Again. Here’s What’s Going Right. (Barron’s)

- Factory Output in China Surged in April (Barron’s)

- NYSE Will Partially Reopen Its Trading Floor (Barron’s)

- Meet the trikini, beach fashion’s answer to coronavirus (New York Post)

- McDonald’s Details What Dining In Will Look Like (New York Times)

- Elon Musk’s Boring Company completes second tunnel in Las Vegas (USA Today)

- Wealthy Travelers Are Starting to Book Year-End Vacations (Bloomberg)

- Are We Asking Too Much of Testing? (Bloomberg)

- Drive-in theaters have become a safe haven for moviegoers. Here’s what it’s like to visit one (CNBC)

- Who’s on The Hook for Skipped Mortgage Payments? (Wall Street Journal)

- Economic Shock of Virus Hit Lower-Income Households Harder, Fed Finds (Wall Street Journal)

- Time for GE to Bring Good Things Back to Life (Wall Street Journal)

- Oil back at early April highs as demand shows signs of picking up (Street Insider)

- PPP Loans Under $2 Million Get A Significant Waiver From SBA (Yahoo! Finance)

- Ross to Bartiromo: Taiwan manufacturer hopes to bring supply chain to this state (Fox Business)

- Investors warn Covid-19 crisis is paving the way for inflation (Financial Times)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 1,422 contracts of Jan 2021 $17.50 strike calls (or the right to buy 142,200 shares of Wells Fargo & Company (WFC) at $17.50). The open interest was just 285 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

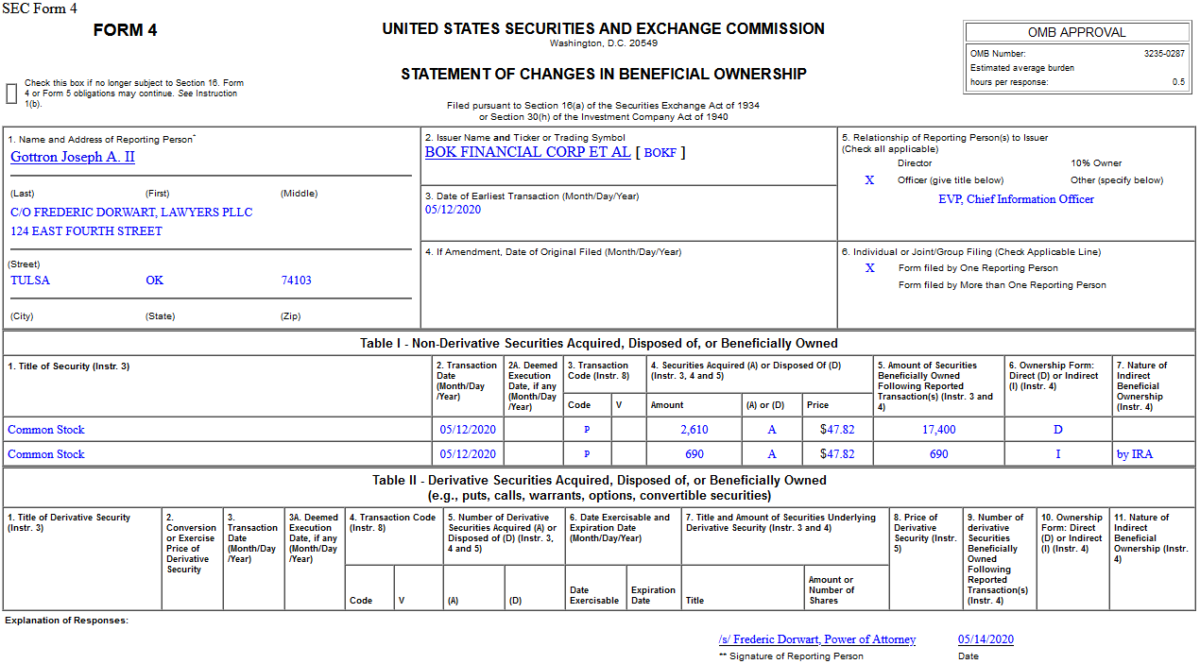

Insider Buying in BOK Financial Corporation (BOKF)

On May 12, 2020, Joseph Gottron – EVP & CIO of BOK Financial Corporation (BOKF) – purchased 2,610 shares of BOKF at $47.82. His out of pocket cost was $124,810.

Where is money flowing today?

Data Source: Finviz

Be in the know. 17 key reads for Thursday…

- 13 Stock Ideas From Top Value Managers (Barron’s)

- Gilead’s Remdesivir Is a Rare Example of Foresight in This Pandemic (Bloomberg)

- What’s Good for Banks Isn’t Necessarily Good for Bankers (Wall Street Journal)

- Deals Aren’t Dead. Here Are 12 Stocks That Could Become Buyout Targets (Barron’s)

- Green Shoots for the Economy and 5 More Things to Know (Barron’s)

- As Stock Buybacks Disappear, Dividends Stand to Gain (Barron’s)

- As States Reopen, Home Purchase Applications Rise for the Fourth Week in a Row (Barron’s)

- Mnuchin Seeks to Assuage Investors After Powell’s Gloomy Outlook (Bloomberg)

- Trump Says He Disagrees With Fauci’s Concerns Over Reopening (Bloomberg)

- Wisconsin Supreme Court strikes down state’s ‘stay-at-home’ order (CNBC)

- A London-based trading house bought 250,000 barrels of oil during the historic plunge below $0, and likely made a fortune. (Business Insider)

- U.S. weekly jobless benefits to stay elevated as coronavirus layoffs widen (Reuters)

- AbbVie’s Potential Is ‘Underappreciated,’ Says Morgan Stanley Analyst (Benzinga)

- The Swedish Model Trades More Disease for Less Economic Damage (Bloomberg)

- Oil Price Crash Could Hurt Trump in Texas, Help in Pennsylvania (Bloomberg)

- New York and New Jersey Start to Reopen Their Economies (Wall Street Journal)

- Fed TALF Revision Could Help Clear CLO Logjam (Wall Street Journal)

The Thomas Rhett “Beer Can’t Fix” Stock Market (and Sentiment Results)…

This week we chose Thomas Rhett’s “Beer Can’t Fix” song to capture the current theme of the Stock Market. After a near 35% rally off the March 23rd (spike) lows, we have been digesting the gains sideways for ~4 weeks now. Continue reading “The Thomas Rhett “Beer Can’t Fix” Stock Market (and Sentiment Results)…”

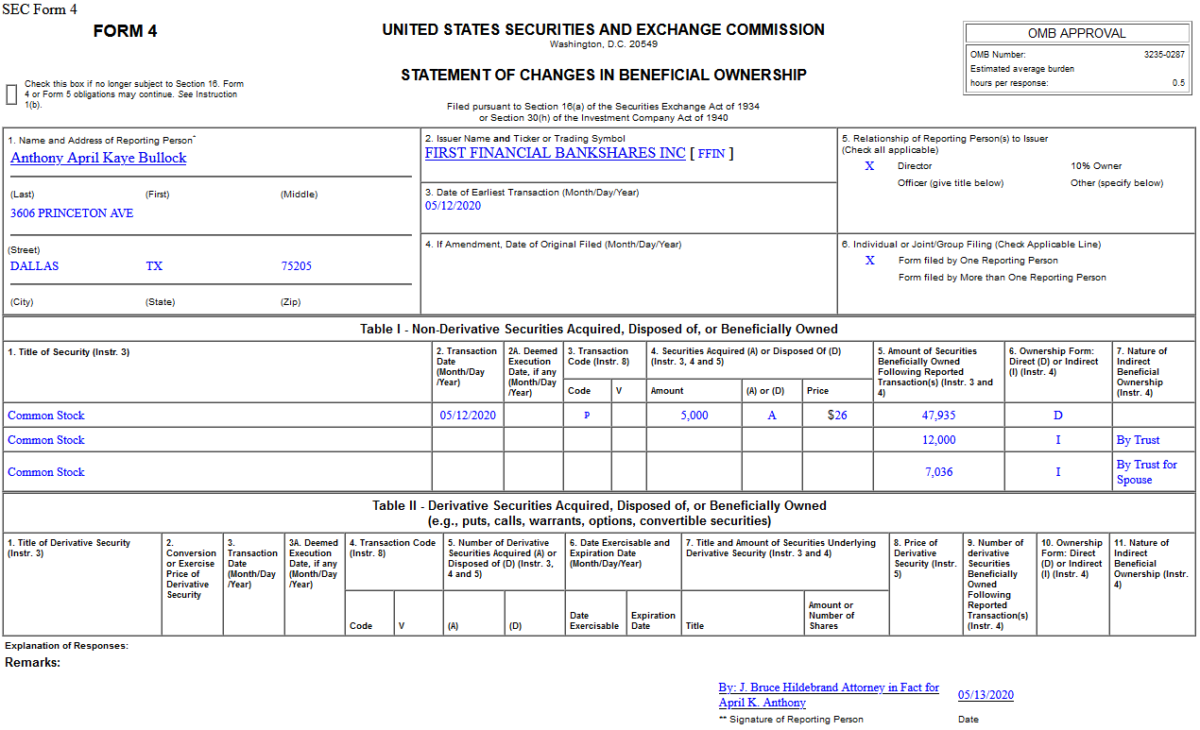

Insider Buying in First Financial Bankshares, Inc. (FFIN)

On May 12, 2020, April Anthony – Director of First Financial Bankshares, Inc. (FFIN) – purchased 5,000 shares of FFIN at $26. His out of pocket cost was $130,000.

Where is money flowing today?

Data source: Finviz