- Tesla Wins as County Blinks First in Standoff Over Plant (Barron’s)

- Fed spells out terms of TALF rescue facility, potentially paving way to unleash funds in weeks (MarketWatch)

- Hedge Funds, Go Home — Japan Is Closing the Door (Bloomberg)

- Steve Cohen, Jeff Bezos Achieve Scroll Fame at Robin Hood Telethon (Bloomberg)

- Hedge Fund That Never Loses Bets Big on South Africa Debt (Bloomberg)

- House Democrats unveil new $3 trillion coronavirus relief bill (CNBC)

- Gilead strikes deal to make remdesivir coronavirus treatment in 127 countries (CNBC)

- What Doesn’t Kill Fast Food Makes It Stronger (Wall Street Journal)

- The Emerging-Market Debt Trap (Wall Street Journal)

- Live Nation to issue $800 million of bonds that mature in 2027 (MarketWatch)

- Boyd Gaming is offering $500 million of senior notes that mature in 2025 (MarketWatch)

- Royal Caribbean pledges 28 ships as collateral for $3.3 bln bond offering (Reuters)

- CNBC’s Jim Cramer: Elon Musk may be a ‘zealot’ but he’s ‘dead right’ about his decision to break the rules (MarketWatch)

- China will step up macro-economic adjustments to offset pandemic impact – state TV (Reuters)

- Powell Says Washington Will Need to Spend More to Battle Downturn (Wall Street Journal)

Tag: StockMarket

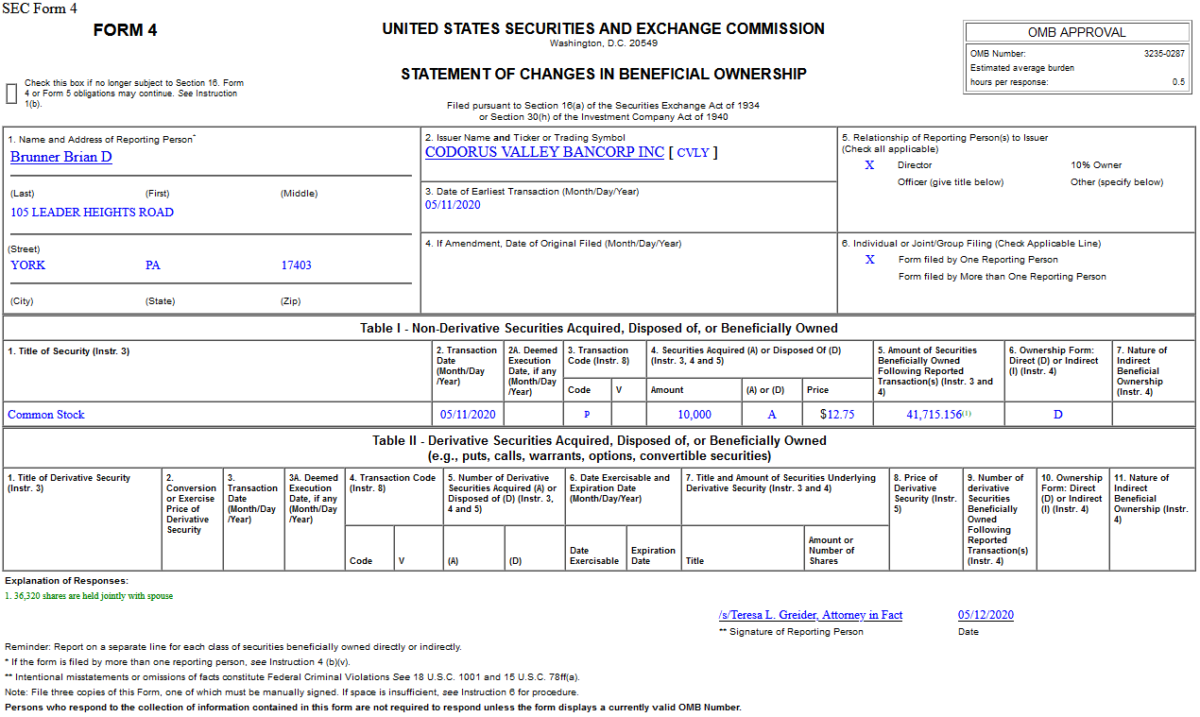

Insider Buying in Codorus Valley Bancorp, Inc. (CVLY)

On May 11, 2020, Brian Brunner – Director of Codorus Valley Bancorp, Inc. (CVLY) – purchased 10,000 shares of CVLY at $12.75. His out of pocket cost was $127,500.

Where is money flowing today?

Data Source: Finviz

Quote of the Day…

Be in the know. 15 key reads for Tuesday…

- Saudis to make further oil supply cut to ‘encourage’ peers (Financial Times)

- Shanghai Disneyland Reopens With Strict Safety Procedures (New York Times)

- Investors Are Terrified of Chinese Stocks. How to Profit From Their Fear. Barron’s)

- Chinese investment in US drops to lowest level since 2009 (USA Today)

- Trump orders federal retirement money invested in Chinese equities to be pulled (Fox Business)

- China announces new tariff waivers for some U.S. imports (Reuters)

- The Fed Is Buying E.T.F.s Today (New York Times)

- Simon to reopen half of its malls within a week as states begin to reopen (New York Post)

- Palm Beach is new escape for New Yorkers looking to dodge coronavirus (New York Post)

- Boeing Plans to Resume Building the 737 MAX This Month (Barron’s)

- A Movie Studio Could Buy AMC, Even if Amazon Isn’t Interested (Barron’s)

- Why Investors Should Consider Companies That Are Repaying Their Credit-Line Debt (Barron’s)

- ‘Feels like we’re at the bottom’: Some executives see signs of recovery in April (CNBC)

- Secret recipes for United Airlines’ stroopwafel, Disney’s beignets, more to make in quarantine (USA Today)

- AbbVie Stock Is ‘Unsustainably Cheap’ After Allergan Acquisition (Yahoo! Finance)

Where is money flowing today?

Be in the know. 10 key reads for Monday…

- PulteGroup (PHM) says recent sales trends have been more encouraging (Street Insider)

- Is (Systematic) Value Investing Dead? (AQR)

- Berkshire Hathaway Stock Has Rarely Been This Cheap (Barron’s)

- Marriott, Cisco, DraftKings, and Other Stocks to Watch This Week (Barron’s)

- 9 Value Stocks Investors Are Buying While Buffett Waits (Barron’s)

- Under virus pressure, Saudi Aramco may cut government payout (Reuters)

- AMC Entertainment’s stock soars after report Amazon has expressed buyout interest (Yahoo! Finance)

- One Sign That Outperforming Active Managers Will Continue to Outperform (Institutional Investor)

- Coronavirus crisis: does value investing still make sense? (Financial Times)

- America’s Smallest Stocks Are Staging a Comeback (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

- Shanghai Disneyland tickets sell out as park prepares to reopen (Fox Business)

- Southwest to raise $815 million through sale and leaseback of 20 planes (Reuters)

- The 22 Most Expensive Homes in the World for Sale (Robb Report)

- Order An Entire Meal From Texas Roadhouse And We’ll Guess How Old You Are (BuzzFeed) (It said I was 19!)

- R.I. teen creates non-profit org. to provide smart tech to patients isolated from loved ones (OANN)

- Little Richard, Founding Father of Rock Who Broke Musical Barriers, Dead at 87 (RollingStone)

- Why Ford Took The Bronco Off The Market – And Why It’s Bringing It Back (digg)

- Automobili Pininfarina Is Speeding Into a New Era of Hypercars (Maxim)

- This Weekend: NASCAR Makes Virtual Return to Historic North Wilkesboro Speedway (The Drive)

- Episode 998: Journey To The Center Of The Fed (NPR Planet Money)

- Bad Arguments and How to Avoid Them (Farnam Street)

- 7 Early Attempts at Self-Driving Cars (Mental Floss)

- MiB: Jim Bianco of Bianco Research (Bloomberg)

- Relocated UFC 249 could ‘bring sense of normalcy to people’ (Fox Business)

- Epidemics in World History, With Frank M. Snowden (CFR)

- Oil is the Comeback King (Futures Mag)

- The One Factor That Will Determine The Size Of India’s LNG Boom (OilPrice)

- Sam Zell: Nice Distressed Real Estate Bargains Are Ahead (Chief Investment Officer)

- Lawmakers urge punishment for banks that won’t back drillers (Pensions & Investments)

- Ferrari sales and other Luxury Cars beat Estimates as Global Car sales plummet (Luxuo)

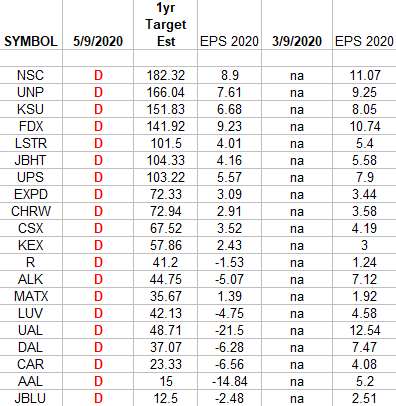

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

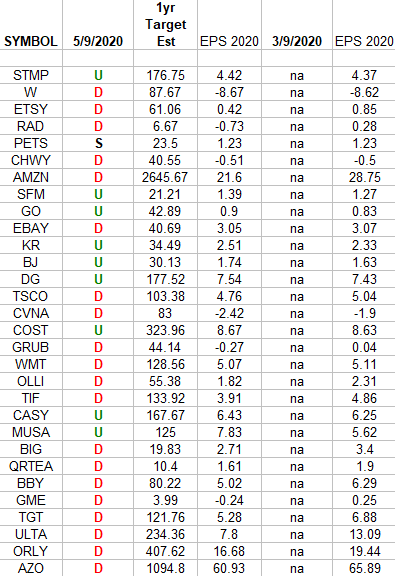

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”