- Guy Fieri raised $20 million for restaurant workers amid pandemic (New York Post)

- Battered Builder Stocks Could Be Hot Properties Again (Barron’s)

- A Stock to Bet on a Recovery in Gambling (Barron’s)

- 9 Value Stocks Investors Are Buying While Buffett Waits (Barron’s)

- Walmart and other superstores continue coronavirus-fueled hiring spree (New York Post)

- Mad Dash for Small-Business Loans Slows Down to Glacial Pace (Bloomberg)

- When United Pawned Old Jets, Bond Traders Sent a Stark Warning (Bloomberg)

- Fresh Coronavirus Wave Won’t Require Shutdown, White House Says (Bloomberg)

- ‘Survival Mode’: How Billionaire Bosses Tackle the Pandemic (Bloomberg)

- Bain Capital makes $1bn bet on Japan’s nursing homes (Financial Times)

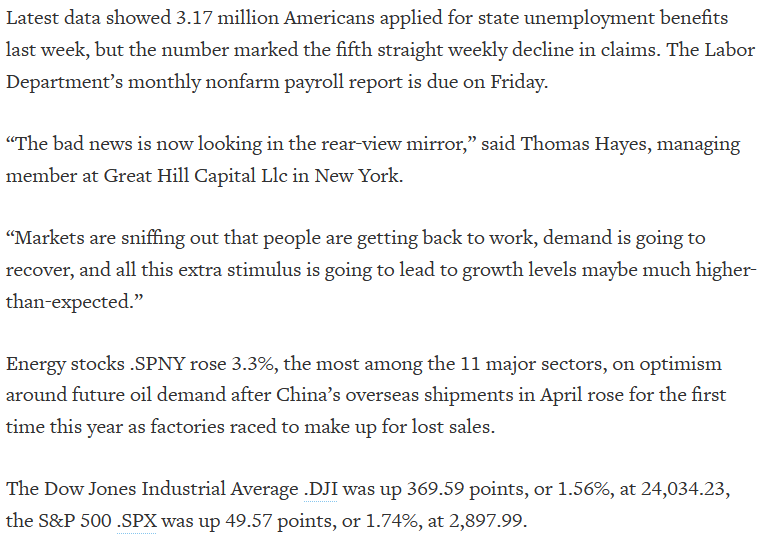

- ‘We’ve seen the lows in March’ for stocks, says man who called Dow 20,000 in 2015, ‘and we will never see those lows again’ (MarketWatch)

- New study claims vitamin D deficiency may impact coronavirus mortality rates (MarketWatch)

- Royal Caribbean’s stock rallies after COVID-19-related business and liquidity update (MarketWatch)

- Elon Musk Says He’ll Be Working on the Tesla Assembly Line Today (Futurism)

- Leading Cause of Death in U.S.? Hint: It Isn’t Covid-19 (Wall Street Journal)

- Rolls-Royce Cullinan: A Bid for Rich Millennial Buyers (Wall Street Journal)

- If Charlie Munger Didn’t Quit When He Was Divorced, Broke, and Burying His 9 Year Old Son, You Have No Excuse (joshuakennon)

- Ariel Investments Chairman John Rogers: We’re buying stocks, ‘leaning in looking for opportunities’ (Yahoo! Finance)

- An Apology for Small-Cap Value (Verdad)

- Warren Buffett Berkshire Hathaway Annual Meeting Transcript 2020 (Rev)

Tag: StockMarket

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 29

Article referenced in podcast above:

The Chainsmokers “Don’t Let Me Down” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 19

Article referenced in podcast above:

The Chainsmokers “Don’t Let Me Down” Stock Market (and Sentiment Results)…

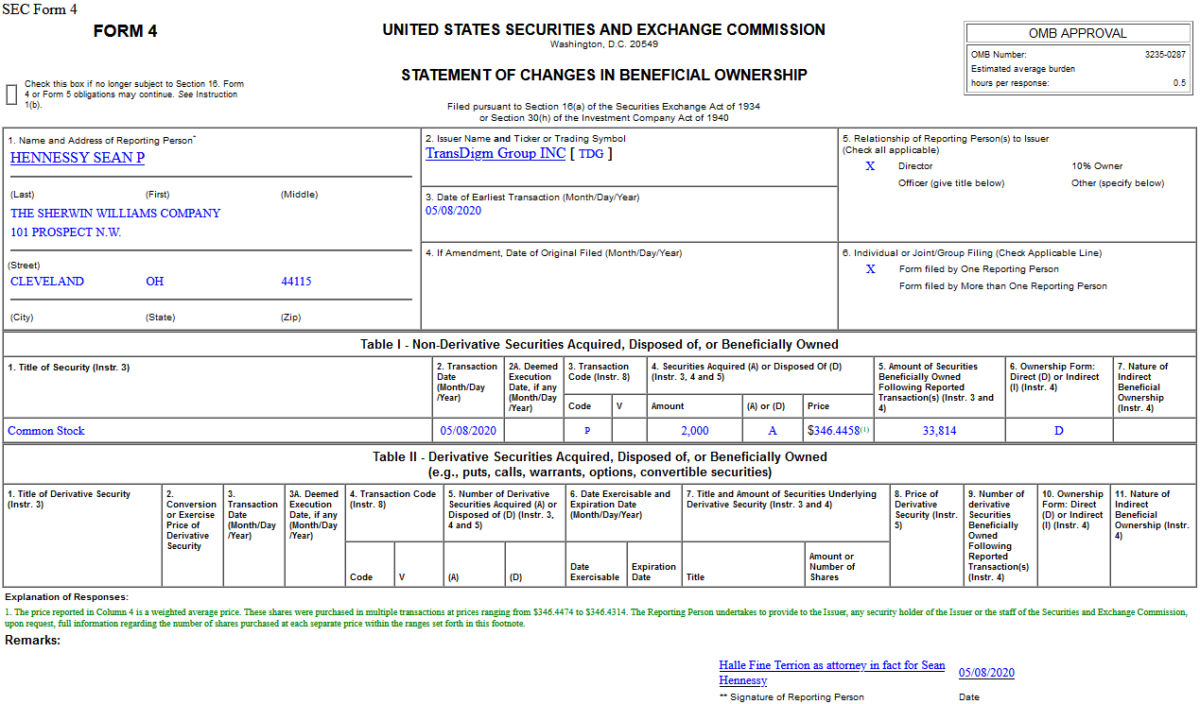

Insider Buying in TransDigm Group Incorporated (TDG)

On May 8, 2020, Sean Hennessy – Director of TransDigm Group Incorporated (TDG) – purchased 2,000 shares of TDG at $346.45. His out of pocket cost was $692,892.

Where is money flowing today?

Data Source: Finviz

Bloomberg (Turkey) Appearance on Thursday (video)

Be in the know. 17 key reads for Friday…

- Global Equities Hold Gains as Jobs Figures Land (Barron’s)

- Why China’s Tech Stocks Are Rallying (Barron’s)

- Insurance Stocks Are Cheap. Lincoln Could Double, J.P. Morgan Says. (Barron’s)

- Norwegian Cruise Line CEO: ‘We expect to sail sometime in 2020’ (CNBC)

- Hertz Seeks Lender Leniency or Faces Bankruptcy Within Weeks (Bloomberg)

- Turning Oil Wells Back on Is Trickier Than Shutting Them Off (Bloomberg)

- ‘Who am I to be bold?’: Warren Buffett’s lack of stock purchases worries billionaire investor Leon Cooperman (Business Insider)

- The Defense Haven Isn’t Overcrowded Yet (Wall Street Journal)

- Royal Caribbean Cruises (RCL) says booked position for 2021 within historical ranges (Street Insider)

- What Americans Will Do With Their 11-Year-Old Cars (24/7 Wall Street)

- Top U.S., China trade officials agree to strengthen cooperation (Reuters)

- A Disney resort will partially reopen in America surprisingly soon (Fox Business)

- Michigan governor says auto plants can reopen Monday (MarketWatch)

- Chess Is the New King of the Pandemic (Wall Street Journal)

- Liberty Global, Telefonica to Combine U.K. Units, Creating $39 Billion Giant (Wall Street Journal)

- China’s Auto Market Rumbles Back to Growth (Wall Street Journal)

- ViacomCBS Shares Rise on Earnings Beat, Despite Slumping Revenue (Wall Street Journal)

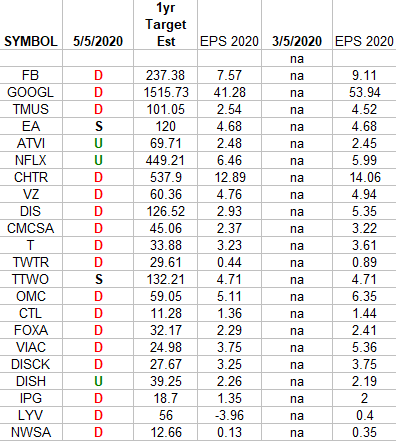

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

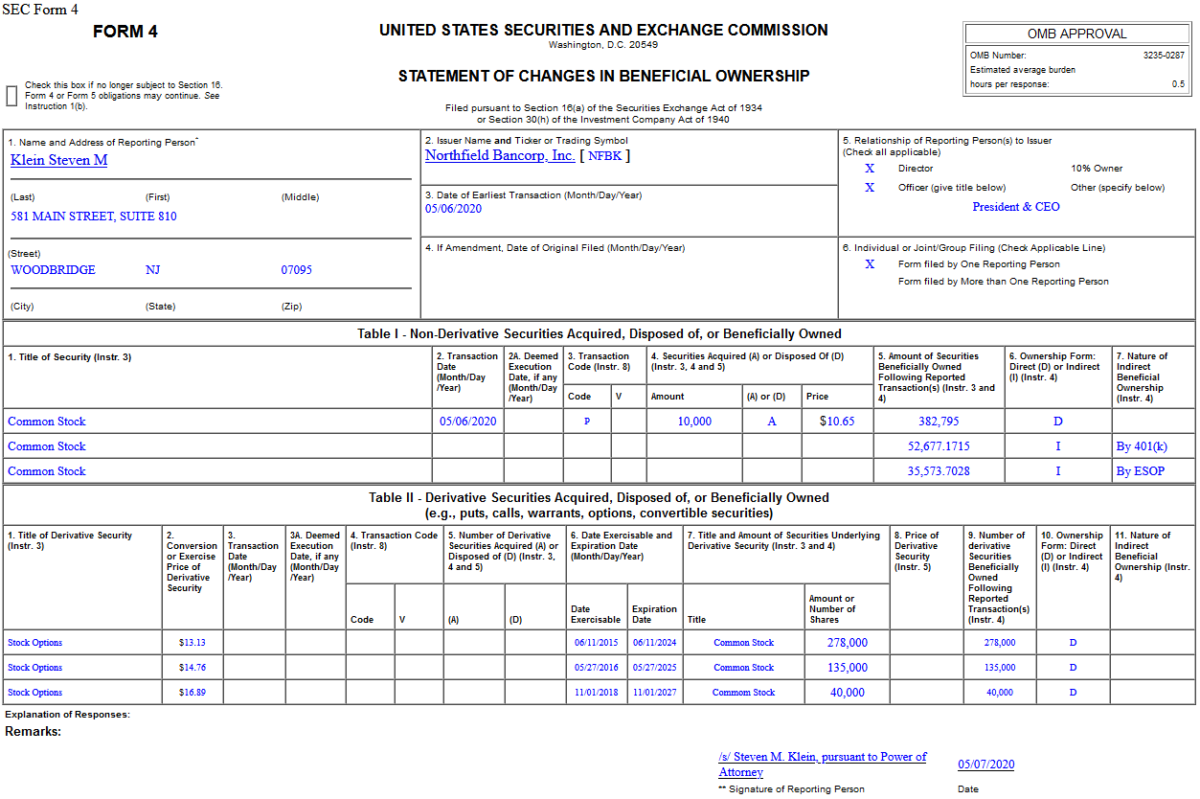

Insider Buying in Northfield Bancorp, Inc. (NFBK)

On May 6, 2020, Steven Klein – President & CEO of Northfield Bancorp, Inc. (NFBK) – purchased 10,000 shares of NFBK at $10.65. His out of pocket cost was $106,500.

Quoted in Reuters article Thursday:

Thanks to Nivedita C and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters