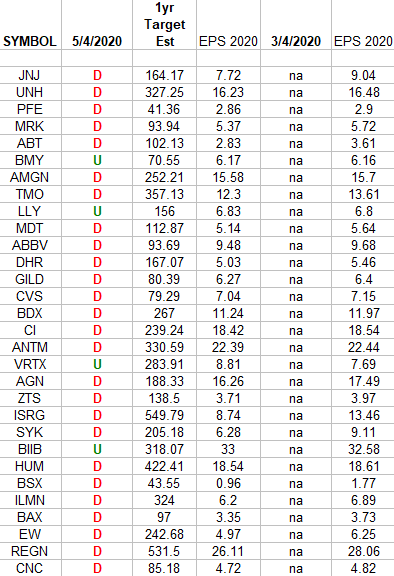

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Monday…

- Buffett’s Chance for a Blockbuster Deal Faded When Fed Stepped In (Bloomberg)

- The subtle tone shift from Warren Buffett every investor must note: Morning Brief (Yahoo! Finance)

- Global Stocks Slump on U.S.-China Trade Tensions (Barron’s)

- Buffett Was Cautious in the First Quarter (Barron’s)

- Warren Buffett’s Optimistic? Pessimistic? No, Realistic (New York Times)

- Warren Buffett tells investors to ‘Bet on America,’ buying stocks for long-term gain (USA Today)

- President Says More Help Likely for Out-of-Work Americans (Bloomberg)

- Buffett on coronavirus, airlines and more: Watch the 5 best moments from the Berkshire meeting (CNBC)

- Here are Warren Buffett’s 25 best quotes from Berkshire Hathaway’s annual meeting, where he discussed airlines, coronavirus, and bailouts (Business Insider)

- ‘Billions’ Creator Shares Story On How The Show Saved His Career (Benzinga)

- Trump says it was right to close US, but it’s time to reopen for economy’s sake (Fox Business)

- Liberty Global and Telefónica in advanced talks to create £28 billion U.K. (MarketWatch)

- Owl Rock Looks to Raise $1.5 Billion for Opportunistic Debt Fund (Bloomberg)

- How Big Data Is Attacking the Coronavirus (Wall Street Journal)

- Brazil Doubles Down on Reform (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

- Coronavirus Prompts Biggest U.S. Manufacturing Pullback Since Last Recession (Wall Street Journal)

- What Would You Risk for a Faster Cure? (Wall Street Journal)

- Investors Bet Oil Crash Will Weaken Middle East Currency Pegs (Wall Street Journal)

- Rising Natural Gas Prices Are a Hot Bet (Wall Street Journal)

- Sicily Wants To Lure Tourists By Helping Pay For Flights And Hotels Post-Lockdown (Forbes)

- Bill Ackman: Getting Back Up [The Knowledge Project Ep. #82] (Farnam Street)

- Hedge Fund and Insider Trading News: Ray Dalio, Bill Ackman, Citadel LLC, Tudor Investment Corporation, Unity Bancorp, Inc. (UNTY), Guardant Health Inc (GH), and More (Insider Monkey)

- The ‘Armortruck’ SUV Is An Apocalypse-Ready Supertruck (Maxim)

- 7 Warren Buffett Stocks With 60% Upside (U.S. News and World Report)

- Donald Trump’s Best Friend, Billionaire Casino Mogul Phil Ruffin, Sees A Hidden Jackpot In The Pandemic ()

- Goldman Sachs Has Its Top Oil Stocks to Buy Ahead of a Second-Half Recovery (24/7 Wall Street)

- A Strategy for Reopening New York City’s Economy (Manhattan Institute)

- The Double Life of Damian Lewis (GQ)

- UFC President Dana White’s quarantine routine includes Trump calls, family time (Fox Business)

- OPEC Production Cuts Start Today (Futures Mag)

- Warren Buffett built up cash and bought only small amounts of stock during the market rout (CNBC)

- Tim Cook On Warren Buffett: ‘I Don’t Think There’s A Better Teacher’ (Benzinga)

- Why BJ’s, Ulta Stock Are Retail Buys Right Now (MarketWatch)

- Berkshire Hathaway First Quarter Earnings (Berkshire Hathaway)

- Carl Icahn, who’s made a large bulk of his fortune in energy, has a new play in the industry (CNBC)

Be in the know. 30 key reads for Saturday…

- When Buffett Was a Quant (Verdad)

- Buffett: Why Smart People Do Dumb Things (Novel Investor)

- Small caps had best month in nearly a decade and if history is a guide it may signal a broader market rally, analysts say (MarketWatch)

- Volatility Provides Greater Value Opportunities (Miller Value)

- Performance After 10% Up Months (Quantifiable Edges)

- Michael Lewis on the Crafts of Writing, Friendship, Coaching, Happiness, and More (#427) (The Tim Ferriss Show)

- The Billion Dollar Hedge Fund Club: Who’s Up, Who’s Down (Institutional Investor)

- Apollo Pivots Buyout Fund ‘Almost Entirely’ Into Distressed Mode (Institutional Investor)

- 10 Questions That Should Be Asked at Berkshire’s Annual Meeting (Morningstar)

- Gilead gets emergency FDA authorization for remdesivir to treat coronavirus, Trump says (CNBC)

- The Economic Recovery Rests on Getting Consumers to Spend. It Won’t Be Easy. (Barron’s)

- Stocks to Buy Now, According to Energy Roundtable Panelists (Barron’s)

- Retail Brands That Could Thrive Postpandemic (Barron’s)

- Big Tech’s Big Week: 5 Earnings Takeaways (Barron’s)

- The Non-Bailout: How the Fed Saved Boeing Without Paying a Dime (Bloomberg)

- Buffett Stays on Sidelines With Cash Rising to $137 Billion (Bloomberg)

- Insiders at Olive Garden’s Parent Bought Up Stock (Barron’s)

- 10 High-Yielding Energy Bonds Are Worth a Look (Barron’s)

- Inflation Insurance Is Cheap. Now May Be a Good Time to Buy. (Barron’s)

- Fortune Favors the Brave, Especially Now (Barron’s)

- Billionaire Malone Finds Love Match for Virgin Media (Bloomberg)

- Berkshire Hathaway Reports $49.7 Billion Quarterly Loss (Wall Street Journal)

- Remdesivir Affirms the American Way (Wall Street Journal)

- Wall Street’s Math Whizzes Face a Testing Time (Bloomberg)

- Covid Exit Won’t Just Depend on Finding Vaccine, but Making Billions of Doses (Bloomberg)

- Saudi Outlook Cut to Negative at Moody’s as Reserves Tumble (Bloomberg)

- Under Quarantine, Vintage Soloflexes Are Getting a Workout (Bloomberg)

- Goldman tells oil bulls to be patient, expects 3-stage oil rally after ‘violent rebalancing’ (Business Insider)

- Walmart expanding Express Delivery to 1K stores (USA Today)

- Macy’s to reopen 68 stores Monday with plan to open fully by June (USA Today)

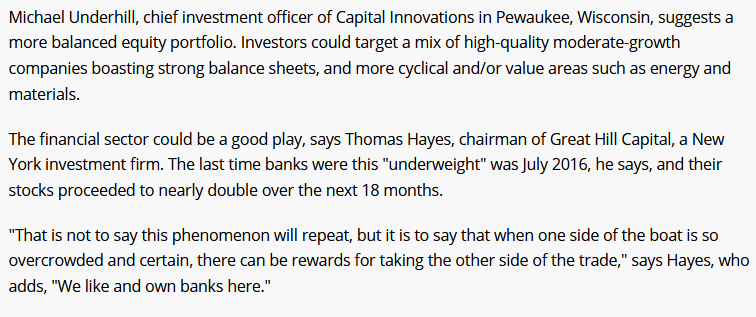

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 28

Article referenced in podcast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 18

Article referenced in podcast above:

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Friday…

- Apple sales, profits exceed expectations as Chinese market brightens (New York Post)

- The number of oil rigs in operation worldwide plunged in April, falling 22%. (Rig Count BH)

- ‘Burn. It. The. F#&!. Down.’ (Institutional Investor)

- Gilead says it can produce ‘several million’ rounds of remdesivir coronavirus treatments next year (CNBC)

- The U.S. Strategizes to Stabilize Oil Prices (Barron’s)

- Why It’s Time to Pick Winning Stocks (Barron’s)

- AbbVie tops earnings estimates, sticks with 2020 guidance (MarketWatch)

- Oil-Tanker Rates Crash as OPEC+ Cuts Near (Bloomberg)

- Oil traders turn to salt caves and train cars in storage crisis (Financial Times)

- Taco Bell Unveils At-Home Taco Kit Ahead Of Cinco De Mayo (Benzinga)

- Hard-hit energy companies’ bonds rise after Fed expands loan program (Yahoo! Finance)

- AstraZeneca and Oxford university agree deal to develop virus vaccine (Financial Times)

- Bill Gates thinks there are eight to 10 promising coronavirus vaccine candidates and one could be ready in as little as nine months. Business Insider)

- Get out! Populous cities lose appeal amid COVID (USA Today)

- Boeing borrows $25 billion instead of pursuing federal bailout amid coronavirus, 737 Max crises (USA Today)

My quotes in Kiplinger Thursday:

Thanks to Ellen Chang for including me in her article in Kiplinger today, “Sell in May and Go Away: Should You in 2020?”