- Showtime’s ‘Billions’ Is Back With More Financial Schemes Than Ever (Wall Street Journal)

- This CEO’s Formula For Building Success Is So Simple (Investor’s Business Daily)

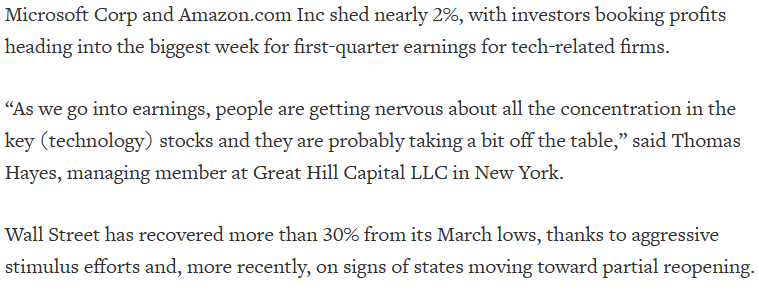

- Stocks Pause After Strong Rally (Barron’s)

- Health Care Was Biggest Drag on GDP (Barron’s)

- Cash-hungry firms are turning to convertible bonds (fnLondon)

- Justin Amash Discloses Purchases of Disney Stock (Barron’s)

- You’d Be Surprised Who Can Beat Buffett and Icahn (Barron’s)

- China’s nonmanufacturing PMI hits 3-month high (MarketWatch)

- Two Mortgage REITs Are Benefiting From Fed-Backed Market (Barron’s)

- Elon Musk slams ‘fascist’ coronavirus lockdowns in Tesla earnings call (New York Post)

- Kraft Heinz Sticks With Its Dividend. Earnings Were Strong. (Barron’s)

- 35 Stocks to Buy if the Economy Recovers in a V-Shape (Barron’s)

- U.S. Explores Emergency-Use Approval for Gilead Drug After Study Found It Helped Recovery From Covid-19 (Wall Street Journal)

- Fed’s Powell Says More Spending Will Be Needed From Congress (Wall Street Journal)

- Steven Mnuchin Says U.S. Aims to Get Back Its Money From Fed Programs (Wall Street Journal)

- The Bad News Won’t Stop, but Markets Keep Rising (New York Times)

- Fed Suggests Tough Road Ahead as It Pledges to Help Insulate Economy (New York Times)

- Gilead CEO Says Over 50,000 Remdesivir Courses Ready to Ship (Bloomberg)

- Warren Buffett to Break Silence at Virtual Woodstock for Capitalists (Bloomberg)

- Coronavirus pushed Twitter to a record 24% growth in daily users last quarter (Business Insider)

Tag: StockMarket

The “High Hopes” Stock Market (and Sentiment Results)…

This week’s theme song for the Stock Market is “High Hopes” by, Panic! At The Disco. These hopes are rooted in three factors we will discuss in detail this week: Stimulus/Aid Continue reading “The “High Hopes” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Southwest Airlines Co. (LUV)

Data Source: barchart

Today some institution/fund purchased 2,911 contracts of Jan 2022 $30 strike calls (or the right to buy 291,100 shares of Southwest Airlines Co. (LUV) at $30). The open interest was just 1,597 prior to this purchase. Continue reading “Unusual Options Activity – Southwest Airlines Co. (LUV)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- ‘Trolls World Tour’ Breaks Digital Records and Charts a New Path for Hollywood (Wall Street Journal)

- Simon Property to Reopen 49 Malls (Wall Street Journal)

- Boeing’s stock surges after wider-than-expected loss and revenue miss, but free cash flow beat (MarketWatch)

- ‘Will You Help Save My Brother?’: The Scramble to Find Covid-19 Plasma Donors (New York Times)

- China’s Factories Are Back. Its Consumers Aren’t. (New York Times)

- Rhode Island Pushes Aggressive Testing, a Move That Could Ease Reopening (New York Times)

- Icahn’s ‘Beautiful Trade’ Pays Off Early With Malls Forced Shut (Bloomberg)

- Elon Musk Joins the Lockdown Rebels (Bloomberg)

- Saudi Prince’s Year of Prestige Is Unraveling in Front of Him (Bloomberg)

- Weekly mortgage applications to buy a home make a strong recovery (CNBC)

- Pfizer coronavirus vaccine could be ready for emergency use by this fall (New York Post)

- Starbucks expects to reopen 90 percent of its stores by June (New York Post)

- Oil price jumps 15% after reports that a key measure of storage demand was 2 million barrels lower than expected. (Business Insider)

- Arthritis drug may help fight severe coronavirus cases, study finds (New York Post)

- Much of U.S. economy still plugging along despite coronavirus pain (Reuters)

- Home-buying interest spikes to highest level in weeks, showing signs of recovery (Fox Business)

- Stock futures jump after positive data on Gilead coronavirus treatment (CNBC)

- U.S. Economy Shrinks at 4.8% Pace due to Coronavirus (GDP) (Bloomberg)

- Gilead Remdesivir Trial for Covid-19 Has Met Primary Endpoint (Bloomberg)

- IHOP parent Dine Brands shares jump after earnings beat (MarketWatch)

Quoted in Reuters article Tuesday:

Thanks to Shreyashi Sanyal and Nivedita C for including me in their article on Reuters. You can find it here:

Click Here to View The Full Article on Reuters

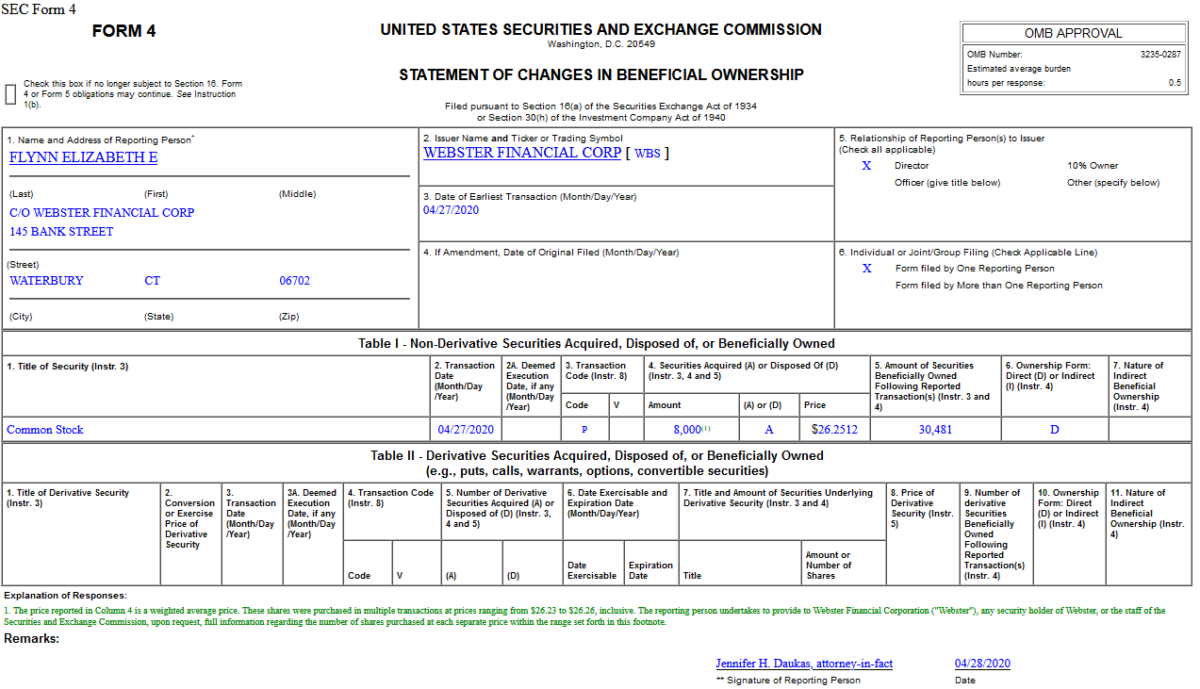

Insider Buying in Webster Financial Corporation (WBS)

On April 27, 2020, Elizabeth Flynn – Director of Webster Financial Corporation (WBS) – purchased 8,000 shares of WBS at $26.25. Her out of pocket cost was $210,010.

Where is money flowing today?

Data Source: Finviz

Be in the know. 30 key reads for Tuesday…

- Pfizer Earnings, Sales Top; Dow Jones Drug Giant Rises (Investor’s Business Daily)

- Chevron Stock Could Have a Record Month (Barron’s)

- Investors to Get a Peek at Buffett’s Potential Successor (Barron’s)

- The Fed Made It Easier for Municipalities to Borrow (Barron’s)

- Caterpillar’s Earnings Missed Expectations. The Stock Is Rising Anyway. (Barron’s)

- Best Movies You Can Stream at Home This Week (24/7 Wall Street)

- Pfizer said sales of Eliquis, hospital products rose in Q1 on COVID-19 demand (MarketWatch)

- No Junk Debt Is Too Risky: How Fed’s Action Changed Everything (Bloomberg)

- Tesla asks employees to return to work before coronavirus lockdown ends (New York Post)

- Warren Buffett to answer questions online at Berkshire Hathaway’s annual meeting Saturday (USA Today)

- Texas Is Open, California’s Closed and States Go Their Own Way (Bloomberg)

- Warren Buffett will soon tell us what he really thinks about stocks, investing and the coronavirus pandemic (MarketWatch)

- 3M’s Earnings Were Strong. Health Care, Masks Boosted Sales. (MarketWatch)

- Fed has simple goal this week — project confidence in face of the unknown (MarketWatch)

- PepsiCo adjusted earnings rise as consumers stock up, but company yanks outlook (CNBC)

- Confused by the tax implications of the CARES Act? Here’s a breakdown. CNBC)

- Allbirds debuts its first running shoe. To succeed, it must face rivals like Nike—and a pandemic (CNBC)

- One group of small-cap stocks could outperform, Oppenheimer says (CNBC)

- Raymond James Has 5 Stocks to Buy Now If We Have a Snapback V Recovery (24/7 Wall Street)

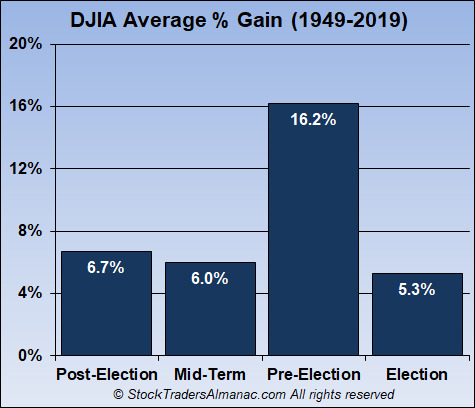

- This is Still an Election Year (Almanac Trader)

- The most important chart to support an economic re-opening (Yahoo! Finance)

- Secret group of billionaires, scientists work to find modern A-bomb for virus (Fox Business)

- The Value Investor Who Sold Lysol Stock — And Bought Oil (Institutional Investor)

- How Kim’s sister could be next in line to rule North Korea (Financial Times)

- Warren Buffett offers his 2 best pieces of advice for aspiring young investors (Yahoo! Finance)

- Opinion: Investors have $5.1 trillion hiding out in the shares of five companies, which will be tested this week (MarketWatch)

- Coronavirus Relief Often Pays Workers More Than Work (Wall Street Journal)

- ‘Trolls World Tour’ Breaks Digital Records and Charts a New Path for Hollywood (Wall Street Journal)

- Consensus Is Emerging That Children Are Less Vulnerable to Coronavirus (Wall Street Journal)

- Japan’s Coronavirus Cases Fall Sharply Without Compulsory Measures (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz