- Global Stocks Climb on Central Bank and Reopening Hopes (Barron’s)

- British stocks join global rally as Johnson returns to work (MarketWatch)

- U.S. Debates How Quickly It Can Reopen (Wall Street Journal)

- DraftKings shares surge as company goes public despite sports shutdown (New York Post)

- Coronavirus: Steven Mnuchin says economy will rebound over the summer (USA Today)

- Cuomo Announces Phased Plan to Reopen New York; Deaths Drop (Bloomberg)

- Private Equity Firms Fight for Lifeline Deals in Buffett-Goldman Redux (Bloomberg)

- Goldman Says Narrow Breadth in S&P 500 a Bad Sign for Stocks (Bloomberg)

- ‘One of the most ridiculous deals that I’ve ever seen’: Carl Icahn blasted Occidental Petroleum’s $10 billion financing from Warren Buffett again (Business Insider)

- Wall Street Quants Are Turning Their Skills to the Virus Fight (Bloomberg)

- Berkshire Investors Will Get to Quiz Buffett, Abel at Annual Meeting Bloomberg)

- Despite Market Carnage, Arena Sees Opportunity in Airlines, Oil, and Gas (Institutional Invvestor)

- How Jamie Dimon went from getting fired to becoming a banking leader (Fox Business)

- How Fed Intervention Saved Carnival (Wall Street Journal)

- ‘The Soul of an Entrepreneur’ Review: Doing It for Themselves (Wall Street Journal)

- The Doctor Will Zoom You Now (Wall Street Journal)

- Investors Eye Fed Emergency Lending Program That Brought Rich Returns in 2009 (Wall Street Journal)

- Barron’s Picks And Pans: Albertsons, Carnival, Harley-Davidson And More (Yahoo! Finance)

- Some States Ease Lockdowns (Wall Street Journal)

- Pandemic Triggers a Wave of Distress (Wall Street Journal)

Tag: StockMarket

Be in the know. 20 key reads for Sunday…

- The Next Round of Bailouts Will Name Names (New York Times)

- For charitable givers, CARES Act offers big tax breaks (InvestmertNews)

- Big Biotechs Make a Big Statement (StockCharts)

- Time to Consider Herd Immunity For New York City And The Rest Of The Country (Insider Monkey)

- ECRI Weekly Leading Index Update: WLIg Inches Up (Advisor Perspectives)

- John Cena Is Just Getting Started (Men’s Journal)

- Jerry Seinfeld Spoofs James Bond in Netflix Trailer for ’23 Hours To Kill’ (Maxim)

- Bugatti Divo Will Be Delivered This Year (TheDrive)

- Chris Whalen on PPP Loans (Podcast) (Bloomberg)

- Pennsylvania’s Comeback from Coronavirus Shutdowns Could Determine the Outcome of the 2020 Presidential Race (Manhattan Institute)

- When Is It Safe To Ease Social Distancing? Here’s What One Model Says For Each State (NPR)

- How The Fed Fights Coronavirus (NPR Planet Money)

- Explore the Fascinating History of Soul Food (Mental Floss)

- Why Exercise Is So Good For You (Scientific American)

- How The Crisis Pushed The Fed Into New Territory (Podcast) (Bloomberg)

- Trump: Apple CEO sees coronavirus V-shaped economic recovery (Fox Business)

- Sweden keeping open during coronavirus protects its economy (Fox Business)

- Apple and Google’s new contact tracing tool is almost ready. Just don’t call it a contact tracing tool. (recode)

- Phased Opening for NYSE Floor Talked (Traders Magazine)

- The New Koenigsegg Gemera: The World’s First, Four-Seater Mega-GT (JustLuxe)

Be in the know. 30 key reads for Saturday…

- This respected market-timing model just flashed a bullish four-year outlook for stocks (MarketWatch)

- Kanye West Vaults From Broke to Billions With Yeezy in Demand ()

- It’s the Physical Market That’s Broken, Not the Futures (Futures)

- As States Reopen, Hold Your Breath (Investors Business Daily)

- Stocks Could Gain 15% in the Next Year, Experts Say (Barron’s)

- Yes, Stocks Have Rallied. Just Don’t Get Complacent. (Barron’s)

- Covid Is Changing How We Eat. These Food Stocks Are Benefiting the Most. (Barron’s)

- Is That Jerry Jones on a…Yacht? Riding the Seas of the NFL’s ‘Virtual’ Draft. (Wall Street Journal)

- 4 ‘Oily Industrial’ Stocks to Buy After Oil’s Collapse (Barron’s)

- The Shock of Subzero Oil Will Shake the U.S. Energy Industry. 4 Stocks Worth a Look. (Barron’s)

- The Oil Market Has Gotten Weird. Here’s How Investors Can Make Sense of It. (Barron’s)

- Mnuchin Says Federal Government Might Take Stakes in Energy Companies (Barron’s)

- Trump pulls punches and clings to his China trade deal as backlash against Beijing grows (CNBC)

- Some Oil Producers Have Secret Weapon in Hedging (Wall Street Journal)

- Gilead Poised to Upend Market With Its First Covid-19 Study Data (Bloomberg)

- Mortgage bailout balloons by half a million more loans in one week (CNBC)

- Saudis Begin Curbing Oil Output Ahead of OPEC+ Start Date (Bloomberg)

- Famed ‘Big Short’ investor Steve Eisman explains why he’s betting big on major US banks (Business Insider)

- “Without Them, I Don’t Know What We’d Do†(Vanity Fair)

- Why stocks rebound before the economy (USA Today)

- ‘Capitalism as we know it will likely be changed forever’ and 9 other lasting implications of coronavirus, according to billionaire Leon Cooperman (MarketWatch)

- In the Coronavirus Era, the Force Is Still With Jack Dorsey (Vanity Fair)

- Why We Focus on Trivial Things: The Bikeshed Effect (Farnam Street)

- Apple Aims to Sell Macs With Its Own Chips Starting in 2021 (Bloomberg)

- Which Kind of Investor Could You Aspire to Be: Graham, Fisher, Lynch, Greenblatt, or Marks? (Focused Compounding)

- Bill Miller 1Q 2020 Market Letter (Miller Value)

- Facebook Announces Video Calls for Up to 50 People – Zoom Shares Tank (TheStreet)

- Autocrats see opportunity in disaster (The Economist)

- Will Coronavirus Wreck The Classic Car Market? (ZeroHedge)

- Change in Electricity Consumption (The Reformed Broker)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 27

Article referenced in VideoCast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 17

Article referenced in podcast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

Unusual Options Activity – Newell Brands Inc. (NWL)

Data Source: barchart

Today some institution/fund purchased 521 contracts of Jan 2022 $15 strike calls (or the right to buy 52,100 shares of Newell Brands Inc. (NWL) at $15). The open interest was just 168 prior to this purchase. Continue reading “Unusual Options Activity – Newell Brands Inc. (NWL)”

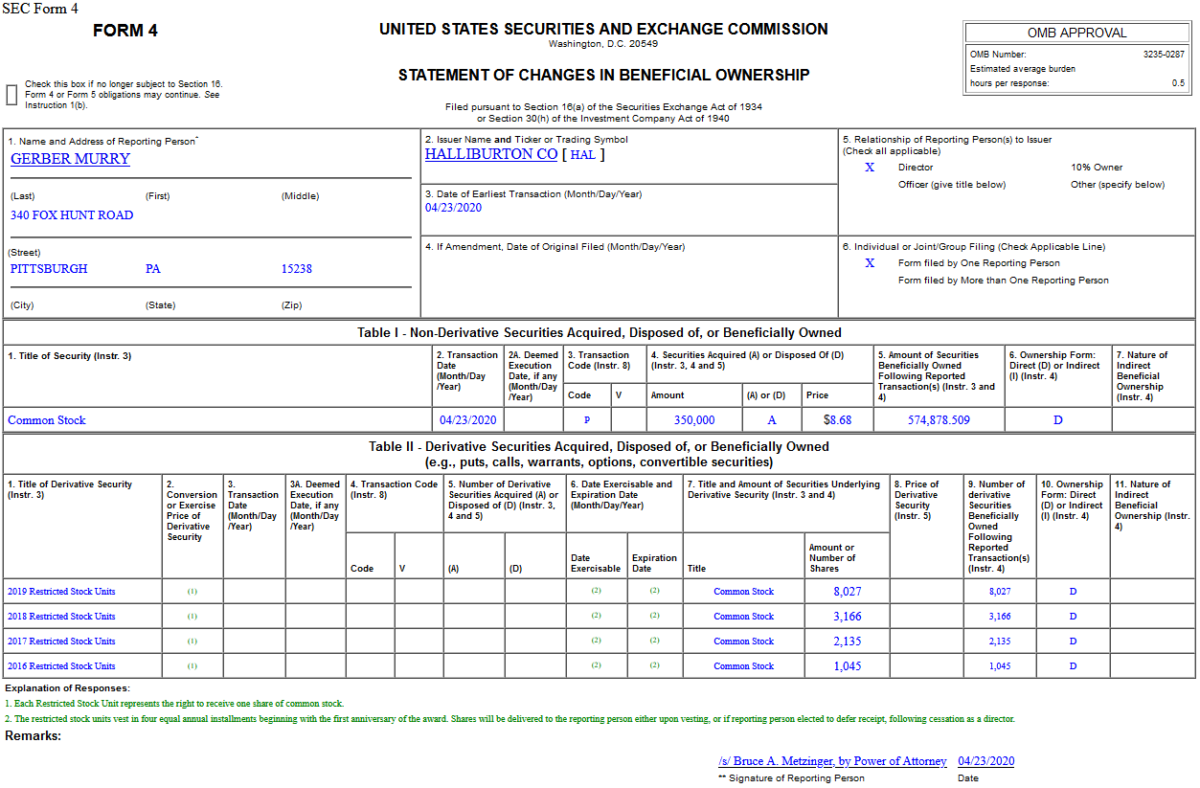

Insider Buying in Halliburton Company (HAL)

On April 23, 2020, Murry Gerber – Director of Halliburton Company (HAL) – purchased 350,000 shares of HAL at $8.68. His out of pocket cost was $3,038,000.

Where is money flowing today?

Data Source: Finviz

Quoted in Reuters article Friday:

Thanks to Shreyashi Sanyal and Nivedita C for including me in their article on Reuters. You can find it here:

Be in the know. 10 key reads for Friday…

- U.S. Stock Futures Climb on More Coronavirus Aid (Barron’s)

- Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance)

- How Tanker Companies Like Teekay Are Profiting From the Oil Glut (Barron’s)

- This Famous Poker Player Can Help Investors Play a Tough Hand (Barron’s)

- Mustang Cobra Jet destroys quarter mile at 170 mph, all electric (USA Today)

- Don’t Try to Prepare for the Next Black Swan. You Can’t. (Wall Street Journal)

- Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance)

- Oil world zeroes in on Cushing, Oklahoma (Financial Times)

- Hedge Funds’ Favorite Stocks Were Hit Hardest in the Coronavirus Crash (Institutional Investor)

- Oxford scientists reveal coronavirus vaccine timeline as human trial begins (MarketWatch)