One America News Network (OAN) TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 26, 2020

Tag: StockMarket

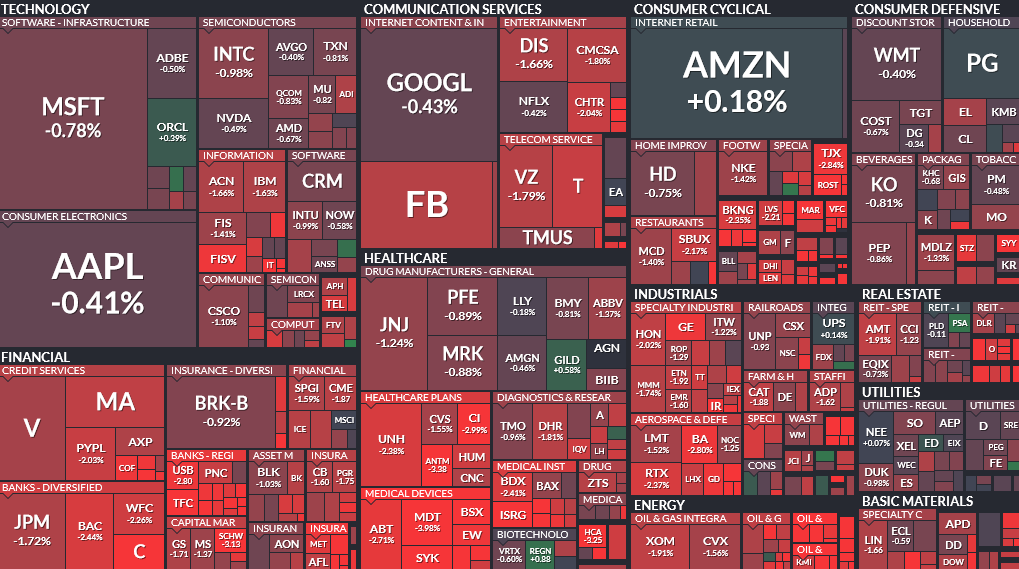

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Friday…

- Fed Stress Test Finds U.S. Banks Healthy Enough to Withstand the Coronavirus Crisis (Wall Street Journal)

- FDIC to Lift Postcrisis Curb on Banks (Wall Street Journal)

- Banks Get Easier Volcker Rule and $40 Billion Break on Swaps (Bloomberg)

- Fed puts restrictions on bank dividends after test finds some banks could be stressed in pandemic (CNBC)

- ECB’s Lagarde says we’ve probably passed the worst of the coronavirus crisis (CNBC)

- Ford unveils new F-150 as tech-savvy pickup with hands-free driving, integrated power generator (CNBC)

- Two European Airport Stocks Are Ready to Take Off (Barron’s)

- Why one strategist is actually encouraged by a spike in new U.S. coronavirus cases (MarketWatch)

- Race for a COVID-19 vaccine has drug makers scaling up manufacturing — before one is developed (MarketWatch)

- Don’t Fault Florida Yet for Its Handling of Covid-19 (Bloomberg)

- Once the Center of the Coronavirus Crisis, Europe Now Looks Ahead With Hope (Wall Street Journal)

- Connecticut Plans to Reopen Schools in the Fall (Wall Street Journal)

- Kanye West Signs Multiyear Deal to Sell New Yeezy Line at Gap (Bloomberg)

- The 2021 Ford F-150 Aims to Double as a Rolling Office (Wall Street Journal)

- Top Energy Analyst Upgrades 3 Stocks With Big Potential Upside (24/7 Wall Street)

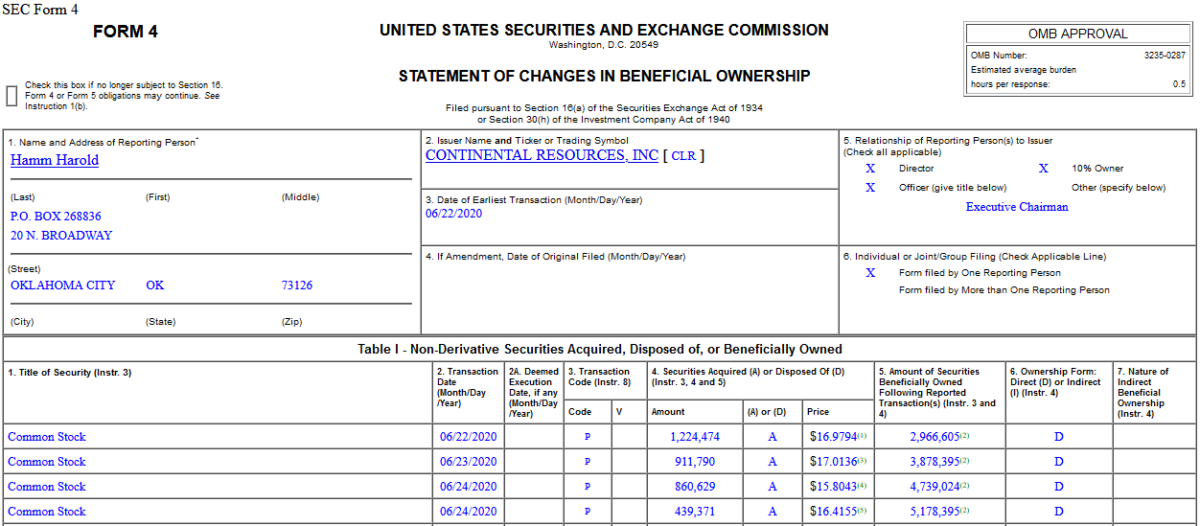

Insider Buying in Continental Resources, Inc. (CLR)

On June 22-24, 2020, Harold Hamm – Director of Continental Resources, Inc. (CLR) – purchased 3,436,264 shares of CLR at $16.01-17.01. His out of pocket cost was $57,117,798.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Hospitals Sued to Keep Prices Secret. They Lost. (New York Times)

- LeBron James Gets $100 Million Investment to Build Media Empire (Bloomberg)

- One Biohacker’s Improbable Bid to Make a DIY Covid-19 Vaccine (Bloomberg)

- No Apps, Just Old-School Contact Tracing in Japan (Bloomberg)

- A $60 million painting will test the art market’s resilience during the pandemic (CNBC)

- Toughened Bank Stress Tests Are Today. Don’t Expect Clarity on Dividends. (Barron’s)

- The Urgency of Returning to Full Employment (Wall Street Journal)

- How to Lose a Billion Dollars Without Really Trying (Institutional Investor)

- Opinion: Bank stocks may ‘rally powerfully’ once investors realize their concerns are overblown (MarketWatch)

- Is July 15th still tax day? Treasury may consider delaying deadline to Sept. 15, Mnuchin says (USA Today)

- U.S. durable-goods orders rebound 15.8% in May (MarketWatch)

- Bank Shares Jump in Rocky Session (Wall Street Journal)

- Baltic index up for 20th session on stronger vessel demand (Reuters)

- Southwest Airlines May Have Just Started a Fare War (Yahoo! Finance)

- Race for a COVID-19 vaccine has drug makers scaling up manufacturing — before one is developed (MarketWatch)

The Luke Combs, “When It Rains It Pours” Stock Market (and Sentiment Results)…

Yesterday the market got hit on all fronts: Continue reading “The Luke Combs, “When It Rains It Pours” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Today some institution/fund purchased 1,750 contracts of Jan. 2022 $77.5 strike calls (or the right to buy 175,000 shares of Las Vegas Sands Corp. (LVS) at $77.5). The open interest was just 768 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- A Tiff A Tariff. The Energy Report (Phil Flynn)

- The Tiny Bank That Got Pandemic Aid to 100,000 Small Businesses New York Times)

- ‘Welcome to the age of copper’: Why the coronavirus pandemic could spark a red metal rally (CNBC)

- Low Expectations for Tomorrow: Bank Dividends in Peril With Crisis Veterans Warning of Trouble (Bloomberg)

- Mnuchin Says U.S. May Emerge From Recession by End of Year (Bloomberg)

- Sweden’s Covid Expert Says ‘World Went Mad’ With Lockdowns (Bloomberg)

- The US could slam tariffs on $3.1 billion of European goods, with products like olives, beer, gin, and planes on the list. (Business Insider)

- Hospitals must disclose actual prices for tests and procedures, court rules (MarketWatch)

- Dell Explores Spinoff of $50 Billion Stake in VMware (Wall Street Journal)

- Global Economy Shows Signs of Pulling Out of Its Slump (Wall Street Journal)

- Treasury Dept. May Consider Extending Tax Filing Deadline a Second Time (Wall Street Journal)

- The Coronavirus Savings Glut (Wall Street Journal)

- Housing Market’s Green Shoots (Wall Street Journal)

- Property Owner Simon Sees Buying Tenants as a Way to Boost Malls (Wall Street Journal)

- Walt Disney (DIS) PT Raised to $135 at Morgan Stanley as the Firm Envisions ESPN DTC Product (Street Insider)

- China has picked up its ‘game’ on trade with U.S., Trump adviser says (Reuters)

- The housing market rebound continues (Yahoo! Finance)

- Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor by Seth Klarman, (Capital Allocators)

- Record number of US companies seek relief on loan terms (Financial Times)

- Barron’s on MarketWatch: Japan discovers the problem with yield-curve control — that it works too well (MarketWatch)