- 5 Oil & Gas Stocks That Have Shown They Can Grow Safely (Barron’s)

- The U.S. Economy Is About Halfway Back to Normal, a Weekly Virus-Recovery Indicator Says (Barron’s)

- Trump supports second ‘very generous’ coronavirus stimulus package (New York Post)

- Trump says ‘China trade deal is fully intact’ (Street Insider)

- Gilead Sciences (GILD) will acquire 49.9% equity interest in Pionyr Immunotherapeutic for $275 million (Street Insider)

- Gilead to Begin Human Testing of Inhaled Version of Covid-19 Drug Remdesivir (Wall Street Journal)

- A Weaker Dollar Is Just What the World Needs (Bloomberg)

- Hotel stocks: Bull and bear cases for buying into the travel rebound (CNBC)

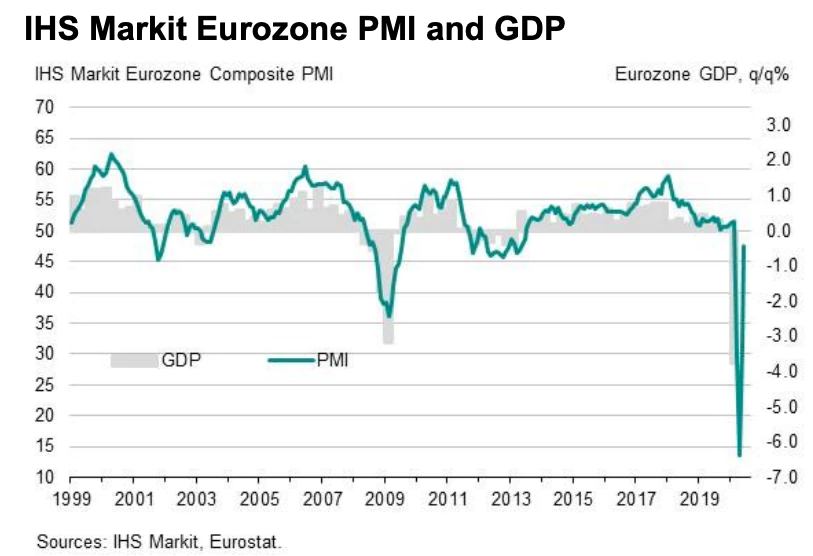

- European Economic Data Is V-Shaped, but the Economy Isn’t Wall Street Journal)

- European stocks lifted by PMI numbers (Financial Times)

- Tesla Analyst Estimates ‘Staggering’ 650K Cybertruck Preorders (Benzinga)

- Photo from Pixabay.

- BofA Bullish On Allegiant, Southwest, Says Leisure Travel Recovering (Benzinga)

- BofA Upgrades Concho Resources, Cimarex Energy On Improving Oil Outlook (Benzinga)

- Schwarzman Sees ‘Big V’ Economic Rebound in Next Few Months (Yahoo! Finance)

- Kansas City Southern volumes are ‘improving’ off of early-May bottom; stock gains (MarketWatch)

- Europe’s economy bounced back sharply in June (Business Insider)

- As States Reopen, Workers, Executives Want Government to Make Masks Mandatory (Wall Street Journal)

- Rally in Raw Materials Signals Economic Rebound (Wall Street Journal)

- Coronavirus Cash Needs Prompt Companies to Rethink Investments (Wall Street Journal)

Tag: StockMarket

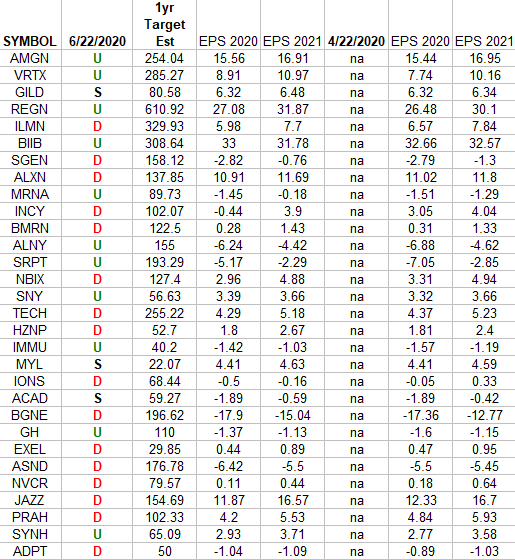

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

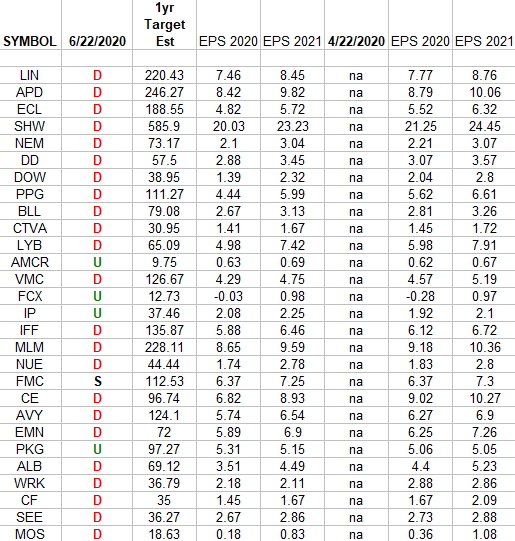

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2020 and 2021 estimates were: 4/22/2020 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Monday…

- U.S. banks are ‘swimming in money’ as deposits increase by $2 trillion amid the coronavirus (CNBC)

- China Investor Buys Record-Cheap Bank Stocks Nobody Else Wants (Bloomberg)

- ‘Fed story’ will win out over second virus wave and election fears, says UBS, so it’s time for investors to get off the sidelines (MarketWatch)

- BlackRock says it’s warming up to Europe, which it says may outgrow the U.S. in second half of the year (MarketWatch)

- Your blood type may determine your odds of contracting the coronavirus, study finds (MarketWatch)

- Wearing masks is ‘all we have’ to try to reduce the spread of coronavirus, former FDA commissioner says (MarketWatch)

- Fed to Assess How Banks React to Possible Covid-19 Scenarios (Wall Street Journal)

- Restaurant Reservations, Driving Directions and Other Indicators Wall Street Is Watching (Wall Street Journal)

- Pandemic Travel Patterns Hint at Our Urban Future (Bloomberg)

- Here are five charts that track how the U.S. economy is recovering from coronavirus (CNBC)

- Can the Fed’s Main Street loan program save midsize companies during COVID-19 crisis? (USA Today)

- Flavortown, Ohio? Thousands want Columbus renamed for native celebrity chef Guy Fieri (USA Today)

- Hedge Funds Exploit CLO Weakness Laid Bare by Corporate Distress (Bloomberg)

- The New Weapon in the Covid-19 War (Bloomberg)

- Google billionaire Sergey Brin has a secret charity that sends ex-military staff into disaster zones on a superyacht (Business Insider)

- UBS Upgrades Wal-Mart (WMT) to Buy; Entering Era of Amplified Earnings Growth (Street Insider)

- Foreign investors to be biggest buyers of US stocks: Goldman Sachs (FoxBusiness)

- How zero-fee trading helped Citadel cash in on retail trading boom (Financial Times)

- Live Nation announces drive-in concert series in 3 cities (Fox Business)

- Baltic index edges up on higher panamax, supramax rates (Reuters)

Quote of the Day…

Be in the know. 10 key reads for Sunday…

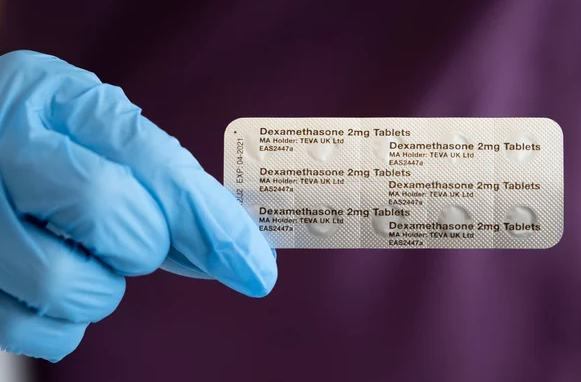

- This drug may be the secret behind Portugal’s low Covid-19 death rate (CNN)

- Oil’s road back to $40 signals economic and job snap back: Phil Flynn (Fox Business)

- The inside story of Netflix, the tiny tech company that took over Hollywood (ReCode)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Here’s the Two-Door 2021 Ford Bronco Testing Out in the Desert (TheDrive)

- For Sale: Number-Matching 1969 Dodge Charger Checks All the Right Boxes (TheDrive)

- Daymond John: Swimming With Sharks (NPR Planet Money)

- The Prophecies of Q (The Atlantic)

- Common Steroid Could Be Cheap and Effective COVID-19 Treatment (Scientific American)

- Chamath Palihapitiya On The Future Of Big Tech (Podcast) (Bloomberg)

- Powell’s Potent Put Powering Stock Market Meltup (Yardeni)

- How the B-29 Modernized the U.S. Air Force (Popular Mechanics)

Be in the know. 20 key reads for Saturday…

- JD.com’s Successful Ecommerce Sale Bodes Well for China (Barron’s)

- How to Play Biotech’s Next Big Runup (Barron’s)

- SPAC in the Middle of a Boom for New Stocks (Barron’s)

- Fuel Prices Will Rebound in Different Stages (Barron’s)

- Goldman Sachs Stock Is Poised to Shine Again (Barron’s)

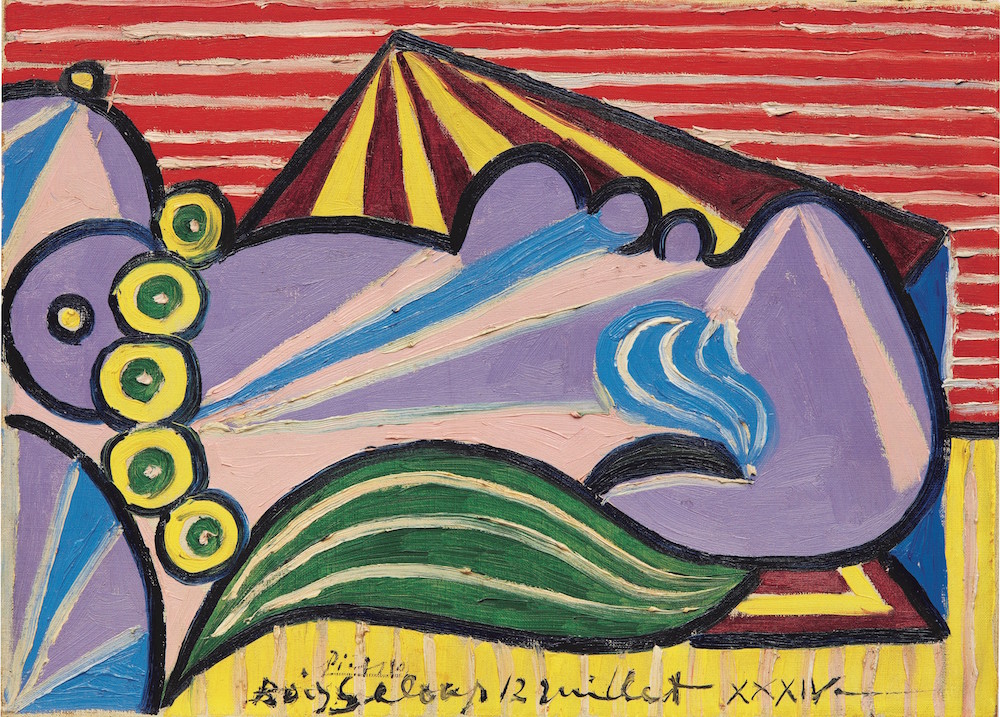

- Picasso’s ‘Head of a Sleeping Woman’ Available for the First Time in Decades (Barron’s)

- Oil Prices Rise Above $40 on Demand Hopes (Wall Street Journal)

- May’s U.S. Jobs Rebound Was Widespread (Wall Street Journal)

- Covid-19 and the case against caution (Financial Times)

- John Paul DeJoria — From Homelessness to Building Paul Mitchell and Patrón Tequila (#441) (Tim Ferriss)

- The Anatomy of a Rally – Oaktree Capital (Howard Marks)

- Small Value Stocks: Peril and Opportunity (Morningstar)

- Seth Klarman on Relative Value and Relative Performance (gurufocus)

- Walter Schloss: His rules that beat the market (Monevator)

- Ben Graham: The Other Advantage of Diversification (Novel Investor)

- Small-Cap Valuations: Historic Opportunity or Overvalued? (WisdomTree)

- Jeremy Siegel on the Stock Market and Covid-19 (Podcast) (Bloomberg)

- SBA Opens Up New Grants And Loans For Small Businesses And Independent Contractors: The EIDL Program (Forbes)

- This Is Not Your Grandma’s Fried Chicken—It’s Better (The Daily Beast)

- These Michelada Ribs Are The Perfect Summer BBQ Recipe (Maxim)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 35

Article referenced in VideoCast above:

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…