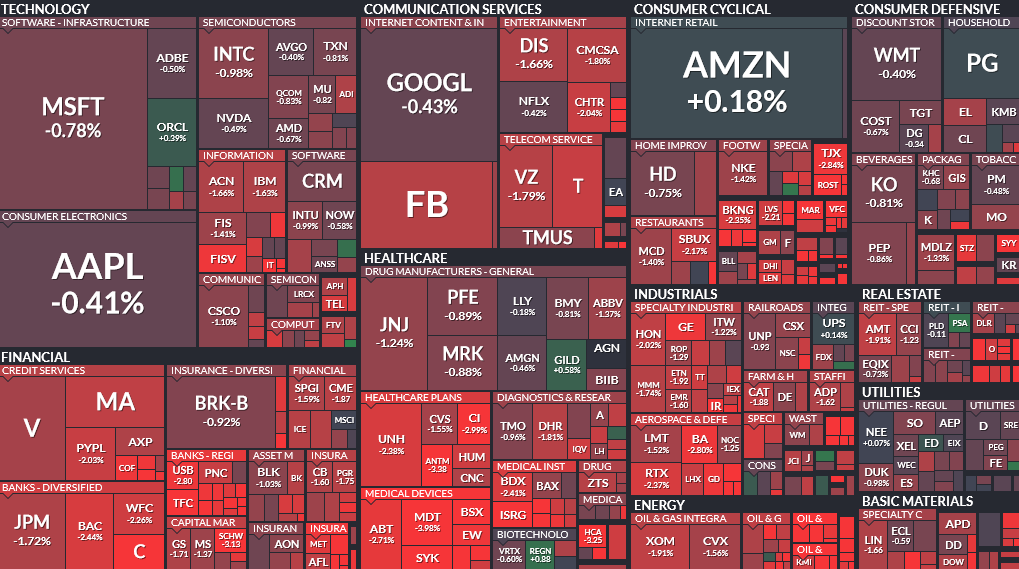

Data Source: Finviz

Tag: StockMarket

Be in the know. 20 key reads for Wednesday…

- A Tiff A Tariff. The Energy Report (Phil Flynn)

- The Tiny Bank That Got Pandemic Aid to 100,000 Small Businesses New York Times)

- ‘Welcome to the age of copper’: Why the coronavirus pandemic could spark a red metal rally (CNBC)

- Low Expectations for Tomorrow: Bank Dividends in Peril With Crisis Veterans Warning of Trouble (Bloomberg)

- Mnuchin Says U.S. May Emerge From Recession by End of Year (Bloomberg)

- Sweden’s Covid Expert Says ‘World Went Mad’ With Lockdowns (Bloomberg)

- The US could slam tariffs on $3.1 billion of European goods, with products like olives, beer, gin, and planes on the list. (Business Insider)

- Hospitals must disclose actual prices for tests and procedures, court rules (MarketWatch)

- Dell Explores Spinoff of $50 Billion Stake in VMware (Wall Street Journal)

- Global Economy Shows Signs of Pulling Out of Its Slump (Wall Street Journal)

- Treasury Dept. May Consider Extending Tax Filing Deadline a Second Time (Wall Street Journal)

- The Coronavirus Savings Glut (Wall Street Journal)

- Housing Market’s Green Shoots (Wall Street Journal)

- Property Owner Simon Sees Buying Tenants as a Way to Boost Malls (Wall Street Journal)

- Walt Disney (DIS) PT Raised to $135 at Morgan Stanley as the Firm Envisions ESPN DTC Product (Street Insider)

- China has picked up its ‘game’ on trade with U.S., Trump adviser says (Reuters)

- The housing market rebound continues (Yahoo! Finance)

- Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor by Seth Klarman, (Capital Allocators)

- Record number of US companies seek relief on loan terms (Financial Times)

- Barron’s on MarketWatch: Japan discovers the problem with yield-curve control — that it works too well (MarketWatch)

Tom Hayes – Cheddar TV Appearance – 6/23/2020

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 23, 2020

Thanks to Brad Smith, Nora Ali and Francesca Conti for having me on your show:

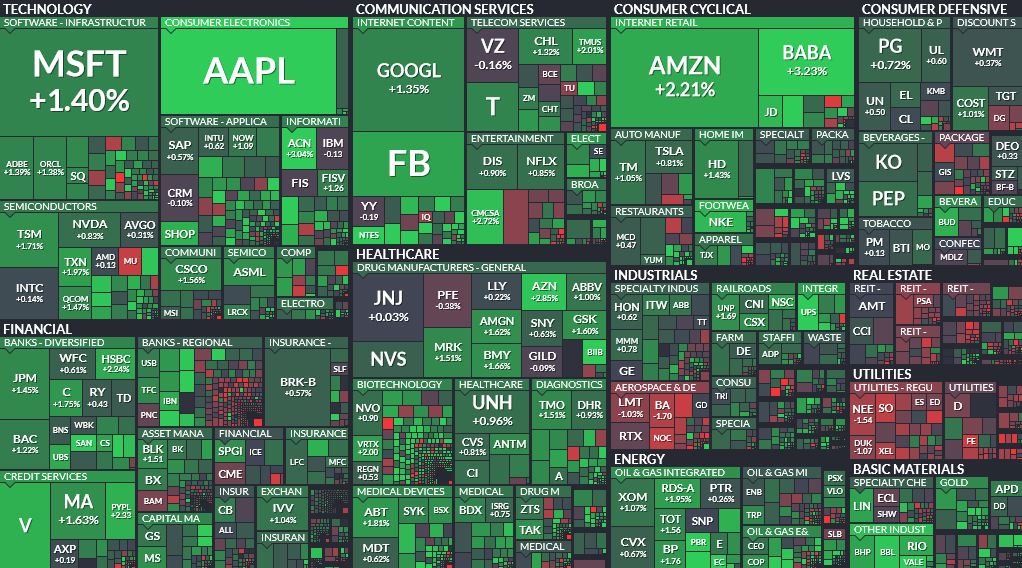

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Quoted in Reuters article – 6/23/2020

Thanks to Devik Jain, Medha Singh and Pawel Goraj for including me in their article on Reuters today. You can find it here:

Be in the know. 20 key reads for Tuesday…

- 5 Oil & Gas Stocks That Have Shown They Can Grow Safely (Barron’s)

- The U.S. Economy Is About Halfway Back to Normal, a Weekly Virus-Recovery Indicator Says (Barron’s)

- Trump supports second ‘very generous’ coronavirus stimulus package (New York Post)

- Trump says ‘China trade deal is fully intact’ (Street Insider)

- Gilead Sciences (GILD) will acquire 49.9% equity interest in Pionyr Immunotherapeutic for $275 million (Street Insider)

- Gilead to Begin Human Testing of Inhaled Version of Covid-19 Drug Remdesivir (Wall Street Journal)

- A Weaker Dollar Is Just What the World Needs (Bloomberg)

- Hotel stocks: Bull and bear cases for buying into the travel rebound (CNBC)

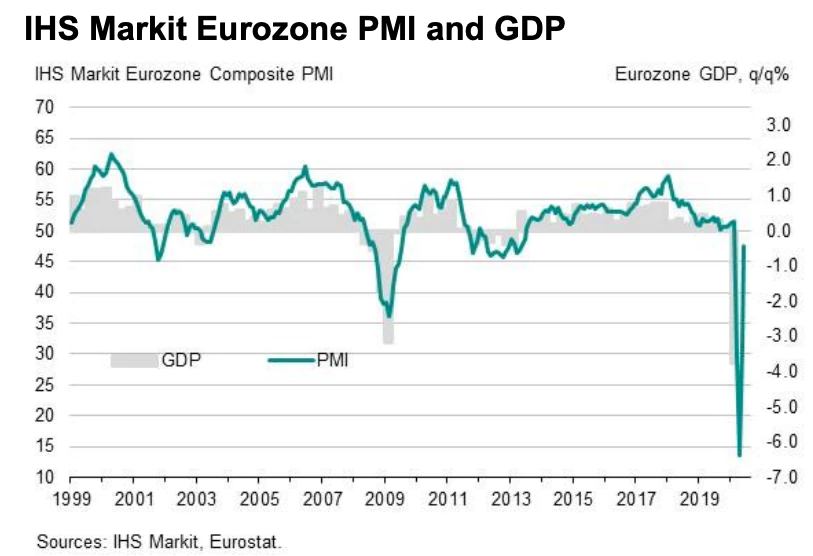

- European Economic Data Is V-Shaped, but the Economy Isn’t Wall Street Journal)

- European stocks lifted by PMI numbers (Financial Times)

- Tesla Analyst Estimates ‘Staggering’ 650K Cybertruck Preorders (Benzinga)

- Photo from Pixabay.

- BofA Bullish On Allegiant, Southwest, Says Leisure Travel Recovering (Benzinga)

- BofA Upgrades Concho Resources, Cimarex Energy On Improving Oil Outlook (Benzinga)

- Schwarzman Sees ‘Big V’ Economic Rebound in Next Few Months (Yahoo! Finance)

- Kansas City Southern volumes are ‘improving’ off of early-May bottom; stock gains (MarketWatch)

- Europe’s economy bounced back sharply in June (Business Insider)

- As States Reopen, Workers, Executives Want Government to Make Masks Mandatory (Wall Street Journal)

- Rally in Raw Materials Signals Economic Rebound (Wall Street Journal)

- Coronavirus Cash Needs Prompt Companies to Rethink Investments (Wall Street Journal)

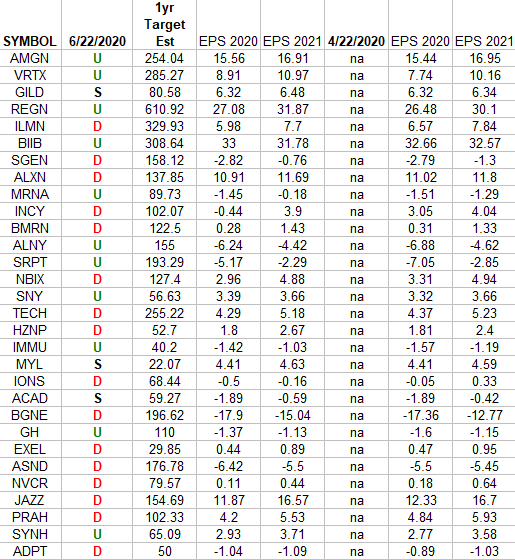

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

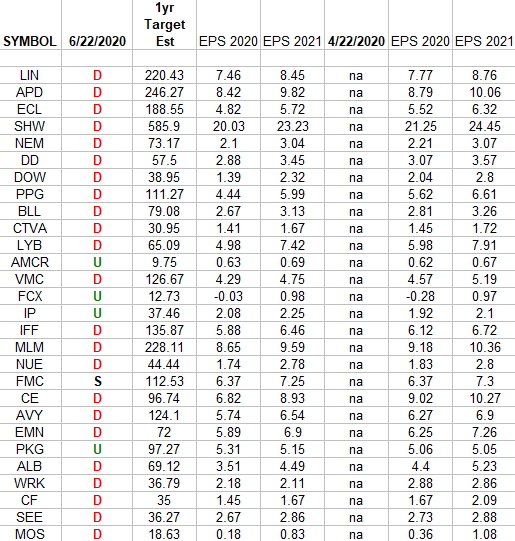

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2020 and 2021 estimates were: 4/22/2020 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Monday…

- U.S. banks are ‘swimming in money’ as deposits increase by $2 trillion amid the coronavirus (CNBC)

- China Investor Buys Record-Cheap Bank Stocks Nobody Else Wants (Bloomberg)

- ‘Fed story’ will win out over second virus wave and election fears, says UBS, so it’s time for investors to get off the sidelines (MarketWatch)

- BlackRock says it’s warming up to Europe, which it says may outgrow the U.S. in second half of the year (MarketWatch)

- Your blood type may determine your odds of contracting the coronavirus, study finds (MarketWatch)

- Wearing masks is ‘all we have’ to try to reduce the spread of coronavirus, former FDA commissioner says (MarketWatch)

- Fed to Assess How Banks React to Possible Covid-19 Scenarios (Wall Street Journal)

- Restaurant Reservations, Driving Directions and Other Indicators Wall Street Is Watching (Wall Street Journal)

- Pandemic Travel Patterns Hint at Our Urban Future (Bloomberg)

- Here are five charts that track how the U.S. economy is recovering from coronavirus (CNBC)

- Can the Fed’s Main Street loan program save midsize companies during COVID-19 crisis? (USA Today)

- Flavortown, Ohio? Thousands want Columbus renamed for native celebrity chef Guy Fieri (USA Today)

- Hedge Funds Exploit CLO Weakness Laid Bare by Corporate Distress (Bloomberg)

- The New Weapon in the Covid-19 War (Bloomberg)

- Google billionaire Sergey Brin has a secret charity that sends ex-military staff into disaster zones on a superyacht (Business Insider)

- UBS Upgrades Wal-Mart (WMT) to Buy; Entering Era of Amplified Earnings Growth (Street Insider)

- Foreign investors to be biggest buyers of US stocks: Goldman Sachs (FoxBusiness)

- How zero-fee trading helped Citadel cash in on retail trading boom (Financial Times)

- Live Nation announces drive-in concert series in 3 cities (Fox Business)

- Baltic index edges up on higher panamax, supramax rates (Reuters)