- JD.com’s Successful Ecommerce Sale Bodes Well for China (Barron’s)

- How to Play Biotech’s Next Big Runup (Barron’s)

- SPAC in the Middle of a Boom for New Stocks (Barron’s)

- Fuel Prices Will Rebound in Different Stages (Barron’s)

- Goldman Sachs Stock Is Poised to Shine Again (Barron’s)

- Picasso’s ‘Head of a Sleeping Woman’ Available for the First Time in Decades (Barron’s)

- Oil Prices Rise Above $40 on Demand Hopes (Wall Street Journal)

- May’s U.S. Jobs Rebound Was Widespread (Wall Street Journal)

- Covid-19 and the case against caution (Financial Times)

- John Paul DeJoria — From Homelessness to Building Paul Mitchell and Patrón Tequila (#441) (Tim Ferriss)

- The Anatomy of a Rally – Oaktree Capital (Howard Marks)

- Small Value Stocks: Peril and Opportunity (Morningstar)

- Seth Klarman on Relative Value and Relative Performance (gurufocus)

- Walter Schloss: His rules that beat the market (Monevator)

- Ben Graham: The Other Advantage of Diversification (Novel Investor)

- Small-Cap Valuations: Historic Opportunity or Overvalued? (WisdomTree)

- Jeremy Siegel on the Stock Market and Covid-19 (Podcast) (Bloomberg)

- SBA Opens Up New Grants And Loans For Small Businesses And Independent Contractors: The EIDL Program (Forbes)

- This Is Not Your Grandma’s Fried Chicken—It’s Better (The Daily Beast)

- These Michelada Ribs Are The Perfect Summer BBQ Recipe (Maxim)

Tag: StockMarket

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 35

Article referenced in VideoCast above:

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 25

Be in the know. 15 key reads for Friday…

- China to Accelerate U.S. Farm Purchases After Hawaii Talks (Bloomberg)

- What the Rush to Cash Means for the Stock Market (Barron’s)

- Anthony Bourdain’s Trick for Great Steak Tartare Isn’t About the Meat (Bloomberg)

- This fund manager whose biggest short was Wirecard says he is the most bullish toward stocks since 2009 (MarketWatch)

- Oil prices climb, head for roughly 10% weekly gain on optimism over global demand (MarketWatch)

- Biogen Can Bounce Back from Multiple-Sclerosis Blow (Wall Street Journal)

- This Cheap Hedge Could Save Investors Some Grief (Bloomberg)

- Rollerblading for Grown-Ups Is Back, and It’s Not Just Like Riding a Bike (Wall Street Journal)

- How Exactly Do You Catch Covid-19? There Is a Growing Consensus (Wall Street Journal)

- Waiting to buy that hot new 2020 mid-engine Corvette? Keep waiting. (USA Today)

- Oil Prices Rise Amid Supply Cuts (Wall Street Journal)

- Twitch’s Streaming Boom Is Jolting the Music Industry (Bloomberg)

- Second-half economic recovery ‘has begun’: Kevin Hassett (Fox Business)

- Mortgage rates drop to another record low — here’s why Americans may not want to wait too much longer before locking rates in (MarketWatch)

- Investors Edge Back Into Emerging Markets (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Thursday…

- Beijing Virus Outbreak Contained, Top China Expert Say (Bloomberg)

- We will dress up again (Financial Times)

- TikTok’s U.S. Revenues Expected to Hit $500 Million This Year (The Information)

- Initial Jobless Claims 1.5M vs 1.29M Expected (Street Insider)

- BoE Buying by $125 Billion to Counter Virus Crisis (Bloomberg)

- Wall Street giants including the CEOs of Goldman and Blackstone are pouring money into the campaign to defeat AOC in a June primary. (Business Insider)

- China Pledges Faster Credit Growth as Economy Faces Virus Return (Bloomberg)

- BP raises nearly $12 billion in first hybrid bonds issue (Reuters)

- Initial jobless claims continue to trend lower (Yahoo! Finance)

- Banks rush to borrow record €1.3tn at negative rates from ECB (Financial Times)

- Boaz Weinstein Is Making Bank. He’s Not Happy That You Know About It. (Institutional Investor)

- How Strict Are Airlines About Face Masks in Flight? (Wall Street Journal)

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…

This week’s stock market theme song is Drake’s “Toosie Slide.” We chose this song to capture sentiment as the market has been consolidating its gains in “Drake style” for the past 51 days: Continue reading “The Drake “Toosie Slide” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 949 contracts of Sept. 2021 $52.50 strike calls (or the right to buy 94,900 shares of Citigroup Inc. (C) at $52.50). The open interest was just 226 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

Tom Hayes – Yahoo! Finance TV Appearance – 6/17/2020

Yahoo! Finance TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 17, 2020

Thanks to Melody Hamm and Sarah Smith for having me on your show:

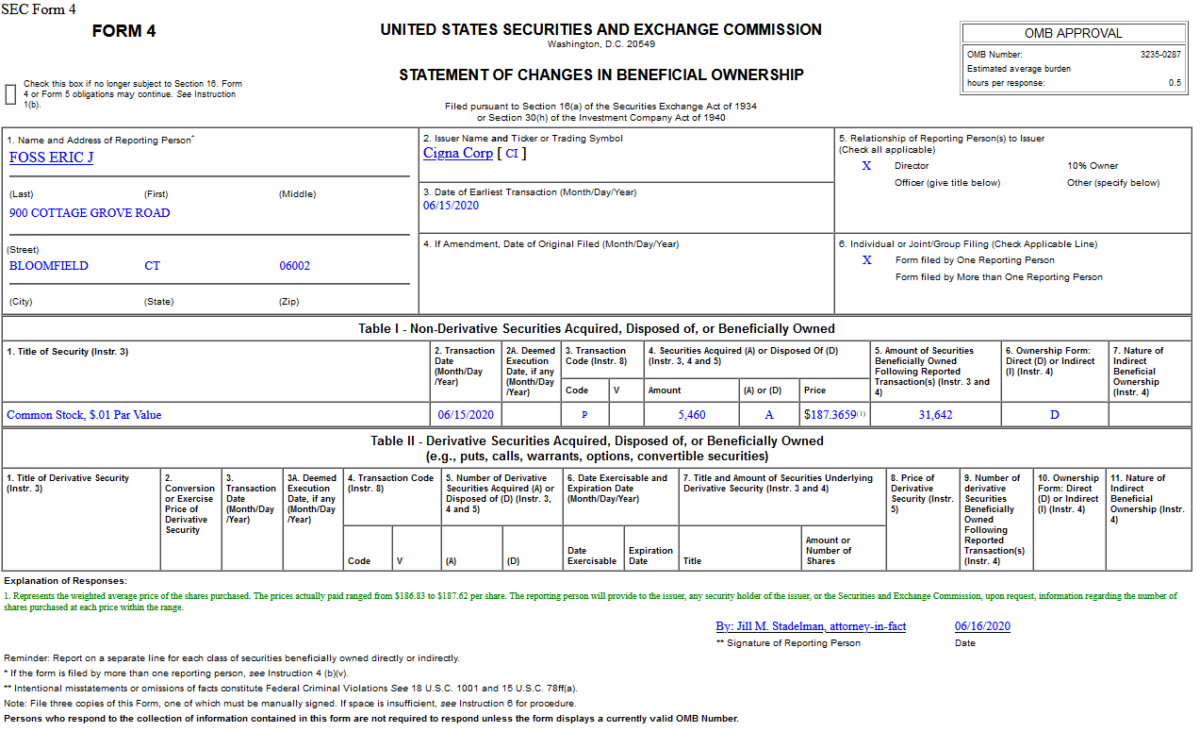

Insider Buying in Cigna Corporation (CI)

On June 15, 2020, Eric Foss – Director of Cigna Corporation (CI) – purchased 5,460 shares of CI at $187.37. His out of pocket cost was $1,023,018.