Data Source: Finviz

Tag: StockMarket

Be in the know. 15 key reads for Wednesday…

- Opinion: Insiders in these 2 market sectors are spending the most money to buy more of their company’s stock (MarketWatch)

- Banks’ trading bonanza just keeps going — markets units to see 20% revenue surge (fn london)

- Debt investors let borrowers go back to the future (Financial Times)

- Jim Cramer: A Zweig Wave Is One That’s Definitively Worth Surfing (TheStreet)

- U.K. approves use of life-saving coronavirus drug dexamethasone in ‘biggest breakthrough yet’ (MarketWatch)

- The Worst Is Over. Where to Find Promising Stocks. (Barron’s)

- U.S. home construction rebounds 4.3% in May (CNBC)

- ‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch)

- Moderna Is Racing Toward a Covid-19 Vaccine, but the Field Is Getting Crowded (Barron’s)

- Keep an eye on these infrastructure stocks, with possible $1 trillion Trump plan on deck: Traders (CNBC)

- Mortgage applications to buy a home surge to the highest in 11 years as rates hit a survey low (Business Insider)

- A Maserati Straight Out of a Vintage-Car Lover’s Dreams (Wall Street Journal)

- Investors Are Sitting on the Biggest Pile of Cash Ever (Wall Street Journal)

- If Inflation Is Coming, the Market Isn’t Ready (Wall Street Journal)

- Oil Demand Is Headed for Record Rebound in 2021 (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 35 key reads for Tuesday…

- Retail Sales Surge as Shoppers Emerge From Lockdown (Barron’s)

- Steroid dexamethasone reduces deaths among patients with severe COVID-19: trial shows (Street Insider)

- 10-year Treasury yield climbs above 0.75% on recovery in U.S. retail sales and report of $1 trillion infrastructure spending plan (MarketWatch)

- European stocks rally on central bank action and U.S. data (MarketWatch)

- A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch)

- Oil prices rally as IEA report points to record appetite for crude next year (MarketWatch)

- ‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch)

- U.K. and EU Want a Quick Brexit. They Just Disagree on Everything Else. (Barron’s)

- Bluebird and Crispr Show Promise for Sickle-Cell Cures (Barron’s)

- 10 REITs With Strong Rent Collection and Lower Debt (Barron’s)

- Dividend Stocks Set to Benefit From the Search for Yield (Barron’s)

- Retail Traders Are Beating Hedge Funds (Barron’s)

- Fed Will Amass Corporate Bond Portfolio Using Index Approach Wall Street Journal)

- Airlines Are Losing Money. They Will Still Buy a Lot of Planes (Wall Street Journal)

- iRobot Cleans Up (Wall Street Journal)

- Apple price target raised to $400 from $310 at Cit (TheFly)

- BofA boosts Disney target to $146, sees ‘compelling’ entry point (TheFly)

- Lennar Corp. (LEN) Tops Q2 EPS by 51c, Offers Guidance (Street Insider)

- Major US airlines may ban passengers who don’t wear face masks (New York Post)

- Hedge fund coach claims ‘Billions’ trolling her by dressing character in favorite outfit (New York Post)

- Trump to Sign Executive Order on Policing (Wall Street Journal)

- Fannie, Freddie Tap Wall Street Banks to Advise on Recapitalization (Wall Street Journal)

- The coronavirus pandemic can’t stop Americans from buying pickups USA Today)

- BofA Survey Finds 78% of Investors See Market as ‘Overvalued’ (Bloomberg)

- Supply Chains of 2020 Needing Repair Now Are the Banks of 2008 (Bloomberg)

- Oil Rises Above $40 on U.S. Stimulus and Tighter Supplies (Bloomberg)

- Light, Fast, and Powerful, the Porsche 718 Also Runs Under $100,000 (Bloomberg)

- Ford unveils 2021 Mustang Mach 1 as new global ‘pinnacle’ of pony car lineup CNBC)

- 10 tech stocks left behind by the market’s furious rally (MarketWatch)

- Investors Approaching Retirement Face Painful Decisions (Wall Street Journal)

- Bank of Japan pledges $1tn in coronavirus loans (Financial Times)

- More Market Makers To Be Allowed Back On The NYSE Floor Wednesday (Benzinga)

- Tesla Says Model S Long Range Plus Finally Received 402 Miles Rating From EPA, Confirms $5,000 Price Cut (Benzinga)

- How Tiger Funds Navigated the Market Volatility (Institutional Investor)

- Fed’s Powell set to reiterate long U.S. economic recovery, call for more fiscal support (Reuters)

June Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Bank of America surveyed 212 mutual fund, hedge fund and pension fund managers with $598 billion under management during the week ending June 11. Continue reading “June Bank of America Global Fund Manager Survey Results (Summary)”

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Quoted in Reuters article – 6/15/2020

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Be in the know. 22 key reads for Monday…

- How the Pandemic Has Changed What Home Buyers Want. (Barron’s)

- Goldman Says Mom-and-Pop’s Stock Picks Are Trouncing Wall Street (Bloomberg)

- Why Investors Shouldn’t Worry About Last Week’s Fall (Barron’s)

- Lilly Is Testing Its Arthritis Drug as a Coronavirus Treatment (Barron’s)

- Americans Are Driving Again. What That Means for Auto Stocks. (Barron’s)

- Get Ready for the ‘Mother of All Bidding-War Seasons’ (Barron’s)

- Hedge fund Elliott Management shifts to elephant hunting as fund size balloons (CNBC)

- Warren Buffett says this is ‘by far the best book on investing ever written’ (CNBC)

- A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch)

- China’s factory output perks up but consumers stay cautious (Reuters)

- Big money may soon be chasing the ‘Robinhood’ investor (Yahoo! Finance)

- Retail investors top Wall Street pros as stock market recovers from coronavirus selloff (Fox Business)

- Barron’s Picks And Pans: Chevron, Goldman Sachs, Progressive And More (Benzinga)

- AstraZeneca Strikes Deal With Four EU Countries Over 400M Coronavirus Vaccine Doses (Benzinga)

- Source image: Unsplash.com

- ByteDance Explores Partnership With Singapore’s Lee Business Family For Digital Banking License: Report (Benzinga)

- Morgan Stanley Economists Double Down on V-Shape Global Recovery (Bloomberg)

- Singapore to Ease Virus Curbs, Resume Most Activities Friday (Bloomberg)

- China a Bright Spot for U.S. in Gloomy Global Trade Picture (Wall Street Journal)

- Signs of a V-Shaped Early-Stage Economic Recovery Emerge (Wall Street Journal)

- Kudlow Urges Replacing Unemployment-Benefit Boost With Return-to-Work ‘Bonus’ (Wall Street Journal)

- ‘Billions’ Recap, Season 5, Episode 7: Axe Capital on Drugs, a Scandal and a Firing (Wall Street Journal)

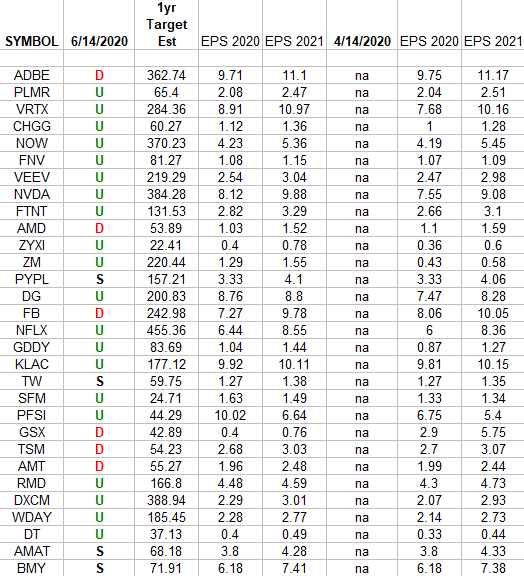

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

Be in the know. 12 key reads for Sunday…

- JPMorgan’s Kolanovic Drops Caution on Stocks, Says Buy the Dip (Bloomberg)

- Second Wave Fears Won’t Crush Oil Demand (Futures Mag)

- 2 Energy Stocks to Buy in June 2020 (Insider Monkey)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Here’s Proof That the 2021 Ford Bronco Has a Seven-Speed Manual and Crawler Gear (The Drive)

- The Cost Of Contact Tracing (NPR)

- A Guy Named Craig May Soon Have Control Over a Large Swath of Utah (New Yorker)

- Two Investors Search The Globe For An Investment Edge (Podcast) (Bloomberg)

- Joe Rogan Got Ripped Off by Spotify? (Marker)

- Why the Worst Is Over for Mortgage-Backed Securities, Maybe (Chief Invesment Officer)

- Fresh OPEC+ cuts point to crude and condensate supply deficits through 2021 (Oil & Gas Journal)

- Bond Moves Up (Variety)