- 21 Cheap Stocks With Above-Average Growth Prospects (Barron’s)

- Global Stocks Advance on Signs of Slowing Virus as Powell Interview Adds Cheer (Barron’s)

- Moderna Reports Positive Vaccine News (Barron’s)

- Fed’s Powell tells ‘60 Minutes’ he’s not out of ammunition to fight the recession (MarketWatch)

- Work-from-home productivity pickup has tech CEOs predicting many employees will never come back to the office (MarketWatch)

- Barron’s Picks And Pans: Cisco, Gilead, Netflix, Wayfair And More (Yahoo! Finance)

- Hertz appoints new CEO to lead car rental giant (Fox Business)

- Dwayne ‘The Rock’ Johnson ‘very proud’ of his daughter joining WWE New York Post)

- Dan Bilzerian Pushes Party Brand From a Social Distance (Bloomberg)

- Brent at one-month high, U.S. oil tops $31 as restrictions ease (Street Insider)

Tag: StockMarket

Be in the know. 20 key reads for Sunday…

- 5 COVID-19 Casualty Stocks to Buy With Big-Time Upside Potential (24/7 Wall Street)

- Retest Possible, But Bottom Likely In as Jobless Claims Trend Lower (Almanac Trader)

- Oil Futures Pricing in Tighter Supplies (Futures Mag)

- Hedge Fund and Insider Trading News: Barry Rosenstein, Jim Simons, Marshall Wace LLP, Selwood Asset Management, Pantera Capital, Vivint Smart Home Inc (VVNT), Penn National Gaming, Inc (PENN), and More (InsiderMonkey)

- Space Force unveils flag; Trump touts ‘super-duper missile’ (AP)

- President Trump unveils new vaccine effort ‘Operation Warp Speed’ (OANN)

- This Art Installation Of A Giant Wave In South Korea Is Honestly Pretty Chill (digg)

- Saudi wealth fund boosts U.S. holdings with stakes in Citi, Boeing, Facebook (OANN)

- Brabham Automotive Unleashes BT62 Race Car (Maxim)

- Seth Klarman: Top 10 Holdings (Q1 2020) (The Acquirers Multiple)

- Rethinking Fear (Farnam Street)

- 2020 Ferrari F8 Tributo review: Somehow, it got better (cnet)

- A Strategy for Reopening New York City’s Economy (Manhattan Institute)

- Reopening Sports: Does MMA Point The Way? (NPR Planet Money)

- Young Bulls and Old Bears (The Irrelevant Investor)

- Major tax benefits for Tesla if Elon Musk moves production from California (Fox Business)

- Maximilian Schneider Designs a 21st Century Batmobile Dubbed The Koenigsegg Konigsei Concept (Luxuo)

- Your Ultimate Grill Buying Guide—Tested and Approved (Popular Mechanics)

- “Poison Pills” Make Comeback at Hollywood Firms Bracing for Hostile Takeovers (Hollywood Reporter)

- Stock Market Keeping Score in the Three-Front War Against the Virus (Yardeni)

Be in the know. 25 key reads for Saturday…

- Newly Flush PNC Could Kick Off the Next Round of Bank M&A (Barron’s)

- Oil Market Dazzled With a Swift Delivery of Supply Cuts (Bloomberg)

- Slash tax rate in half for corporations returning to US, White House adviser suggests (New York Post)

- McConnell says next stimulus must have coronavirus liability protections (New York Post)

- Appaloosa buys Twitter, Netflix stakes, exits Caesars, cuts Facebook position (TheFly)

- TSA Preparing to Check Passenger Temperatures at Airports Amid Coronavirus Concerns (Wall Street Journal)

- Wells Fargo Has Lost $220 Billion in Market Value Under Fed Cap (Bloomberg)

- Inside the Science and Companies Racing to Develop a Covid-19 Vaccine (Barron’s)

- John Malone Has a Great Investing Record. Here’s How to Play Along. (Barron’s)

- How Investors Should Evaluate Energy Bonds — And the Funds That Own Them (Barron’s)

- This Economist Sees a ‘Regime Change’ Favoring Stockpickers (Barron’s)

- Assessing the stock market after one of the fastest declines and subsequent comebacks in history (CNBC)

- On Furlough From the Kingdom, Disney Workers Try to Keep the Magic Alive (Wall Street Journal)

- Michael Jordan Didn’t Manage People, He Lit Them on Fire (Wall Street Journal)

- Car Makers See Chinese Market Picking Up (Wall Street Journal)

- Bill Murray drinks, jokes with Guy Fieri on Nacho Showdown: ‘Truth is, he’s a redhead’ (USA Today)

- Google Antitrust Lawsuit Being Drafted by U.S Justice Department (Bloomberg)

- Next coronavirus aid package expected to become reality ‘in June at the earliest,’ as House passes its bill (MarketWatch)

- Is this the pullback you’ve been waiting for? (QuantifiableEdges)

- JPMorgan Bets on a Dash for the Suburbs (Institutional Investor)

- What Happens to Stocks After a Big Up Month? (A Wealth of Common Sense)

- Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years (CNBC)

- Loeb’s Third Point Builds Stake in Disney, Exits Campbell Soup (Bloomberg)

- Saudi wealth fund snaps up $7.7bn of blue-chip stocks (Financial Times)

- How bank hedging jolted investors into talk of negative rates (Financial Times)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 30

Article referenced in podcast above:

The Thomas Rhett “Beer Can’t Fix” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 20

Article referenced in podcast above:

The Thomas Rhett “Beer Can’t Fix” Stock Market (and Sentiment Results)…

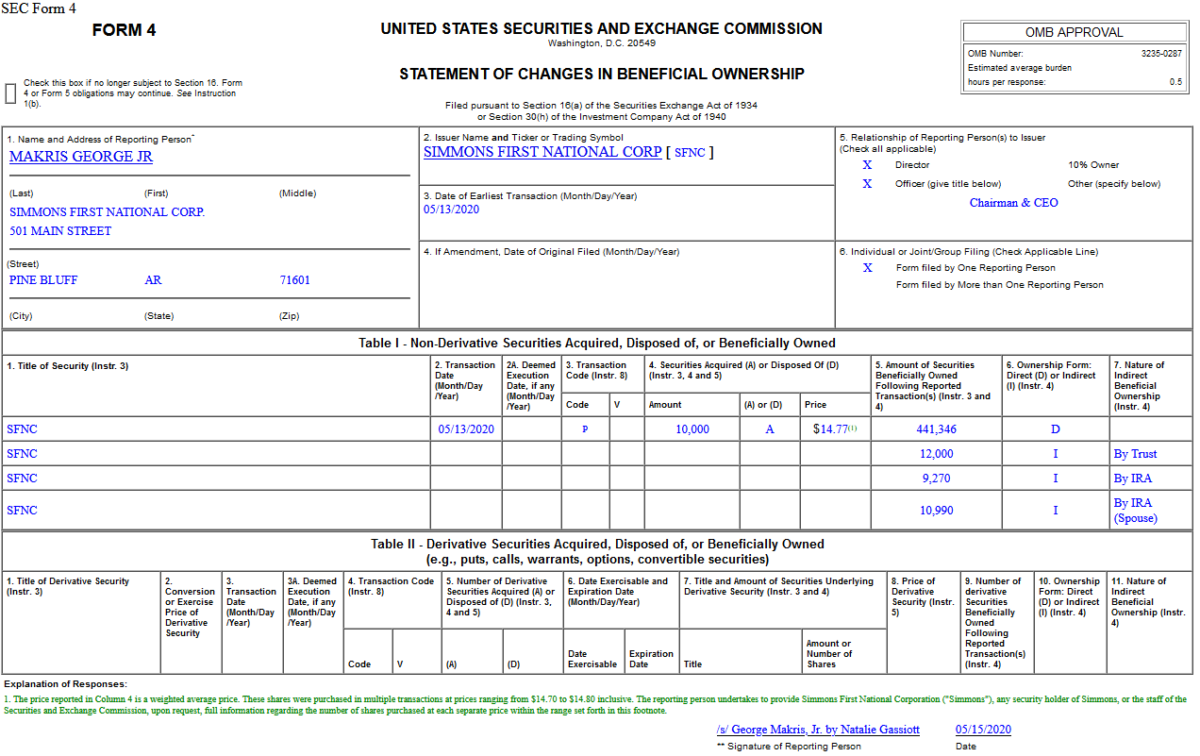

Insider Buying in Simmons First National Corporation (SFNC)

On May 13, 2020, George Makris – Chairman & CEO of Simmons First National Corporation (SFNC) – purchased 10,000 shares of SFNC at $14.77. His out of pocket cost was $147,700.

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Value Stocks Look Cheaper Than Ever. How to Play a Rebound. (Barron’s)

- ‘Stealth Bailout’ Shovels Millions of Dollars to Oil Companies (Bloomberg)

- TikTok Raises Profile As Digital Ad Rival To Snap, Facebook, Google (Investor’s Business Daily)

- The Oil Market Is Changing Its Tune (Barron’s)

- GE Stock Dropped Again. Here’s What’s Going Right. (Barron’s)

- Factory Output in China Surged in April (Barron’s)

- NYSE Will Partially Reopen Its Trading Floor (Barron’s)

- Meet the trikini, beach fashion’s answer to coronavirus (New York Post)

- McDonald’s Details What Dining In Will Look Like (New York Times)

- Elon Musk’s Boring Company completes second tunnel in Las Vegas (USA Today)

- Wealthy Travelers Are Starting to Book Year-End Vacations (Bloomberg)

- Are We Asking Too Much of Testing? (Bloomberg)

- Drive-in theaters have become a safe haven for moviegoers. Here’s what it’s like to visit one (CNBC)

- Who’s on The Hook for Skipped Mortgage Payments? (Wall Street Journal)

- Economic Shock of Virus Hit Lower-Income Households Harder, Fed Finds (Wall Street Journal)

- Time for GE to Bring Good Things Back to Life (Wall Street Journal)

- Oil back at early April highs as demand shows signs of picking up (Street Insider)

- PPP Loans Under $2 Million Get A Significant Waiver From SBA (Yahoo! Finance)

- Ross to Bartiromo: Taiwan manufacturer hopes to bring supply chain to this state (Fox Business)

- Investors warn Covid-19 crisis is paving the way for inflation (Financial Times)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 1,422 contracts of Jan 2021 $17.50 strike calls (or the right to buy 142,200 shares of Wells Fargo & Company (WFC) at $17.50). The open interest was just 285 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

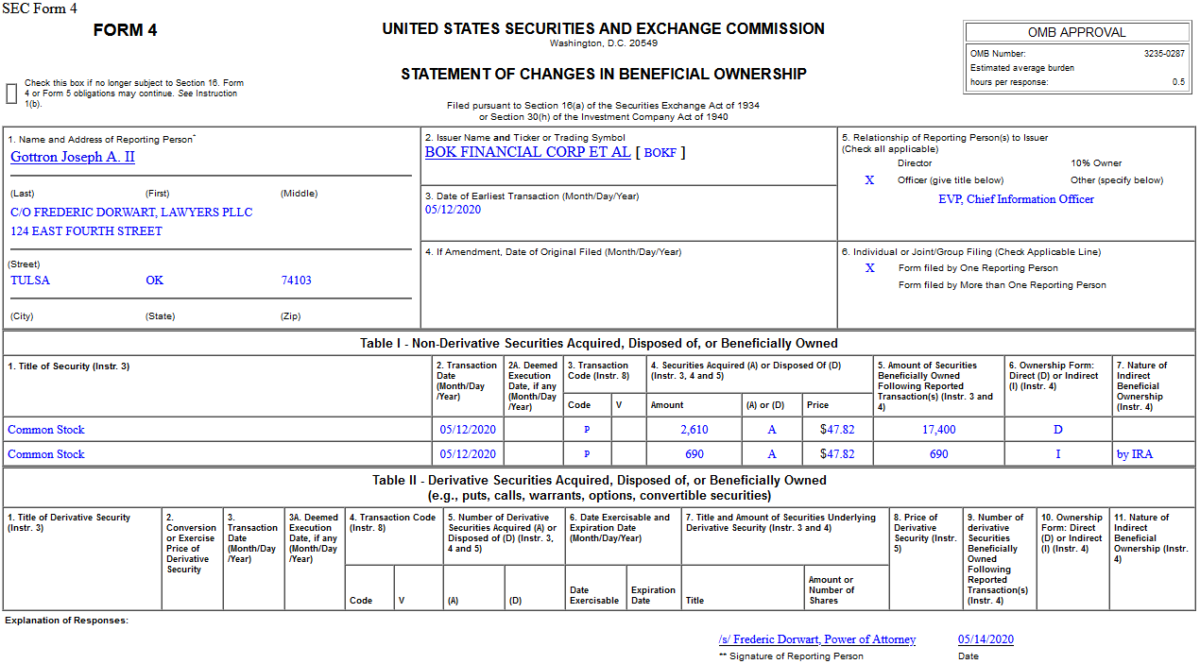

Insider Buying in BOK Financial Corporation (BOKF)

On May 12, 2020, Joseph Gottron – EVP & CIO of BOK Financial Corporation (BOKF) – purchased 2,610 shares of BOKF at $47.82. His out of pocket cost was $124,810.