- Wall Street’s 6 Favorite Defense Stocks for Memorial Day (Barron’s)

- Small caps outperform after recessions, so ‘you have history on your side,’ money manager says (CNBC)

- Global Stocks Rally on Recovery Hopes and Vaccine News (Barron’s)

- Mike Tyson nears boxing return as another $20 million opportunity emerges (New Yoork Post)

- Classic Car Auctions Upended by Coronavirus (New York Times)

- Oil Gains on Optimism Market May Balance in Coming Weeks (Bloomberg)

- Six Flags’ stock surges after plan to reopen first theme park on June 5 (MarketWatch)

- What Hedge Funds Own – and What It Says About the Market (Barron’s)

- Stanley Ho, ‘King of Gambling’ Who Built Macau, Dies at 98 (Bloomberg)

- Square’s Co-Founder: A Recession Is a Great Time to Start a Company (Wall Street Journal)

Tag: StockMarket

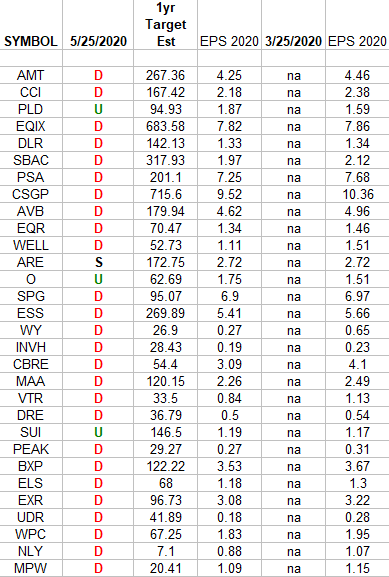

Real Estate Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “Real Estate Earnings Estimates/Revisions”

Be in the know. 10 key reads for Memorial Day…

- James Bond’s Car Comes to Life With Oil-Slick Sprayer, but No Ejector Seat (New York Times)

- NYSE’s Floor to Reopen With Masks, Waivers and Handshake Ban Wall Street Journal)

- Cyclical Stocks Are Staging Comeback (Wall Street Journal)

- The Secret to Searing a Bistro-Quality Steak (Wall Street Journal)

- As Passengers Disappeared, Airlines Filled Planes With Cargo (New York Times)

- Global Oil Demand Has Yet to Peak, Energy Watchdog Predicts (Bloomberg)

- Germany’s Ifo Index rises above forecasts in May (MarketWatch)

- Covid-19 Patients Not Infectious After 11 Days: Singapore Study (Bloomberg)

- China warns audit plans will drive companies from US exchanges (Financial Times)

- ‘Never waste a crisis’: inside Saudi Arabia’s shopping spree (Financial Times)

Be in the know. 10 key reads for Sunday…

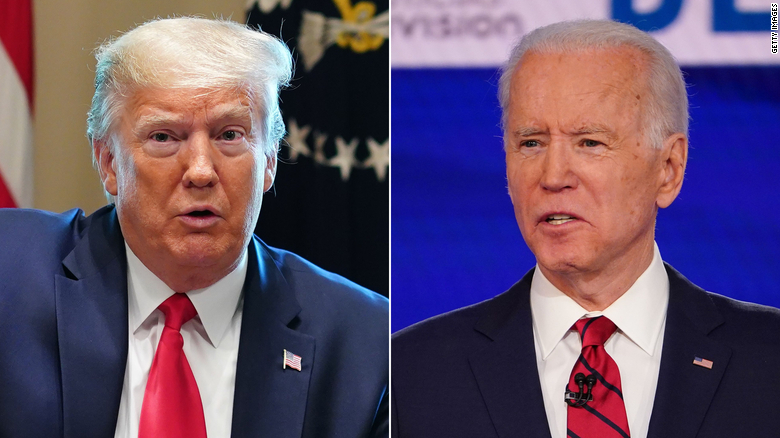

- Election-Year June: Candidate Clarity Boosts Performance (Almanac Trader)

- Disneyland to feature ‘modified’ experience for guests upon reopening amid pandemic (OAN)

- Triumph Celebrates James Bond With Special Edition Scrambler 1200 (Maxim)

- Southeastern: The Exceptional Opportunity in Small-Cap Value (Advisor Perspectives)

- Stocks Are Up But The Economy’s Down (NPR Planet Money)

- The Coronavirus Vaccine Is on Track to Be the Fastest Ever Developed (The New Yorker)

- Gut Microbes May Be Key to Solving Food Allergies (Scientific American)

- The Billionaire, an African Mine and a Spy Network (Bloomberg)

- The Sprint to Raise a $1.75 Billion Credit Fund During a ‘Maelstrom’ (InstitutionalInvestor)

- The top 9 shows on Netflix and other streaming services this week (BusinessInsider)

Be in the know. 25 key reads for Saturday…

- Fauci warns overextending coronavirus lockdowns could cause ‘irreparable damage’ (New York Post)

- Two Stocks Nelson Peltz May Be Buying Now (Barron’s)

- China stands by pledge to implement US trade deal despite tensions (New York Post)

- ‘My Head Is About to Explode’: Virus Jargon Is Schooling Traders (Bloomberg)

- Scientists Say That Yes, You Can Have Fun This Summer. Just Do It Outside (Bloomberg)

- Alibaba sees China retail volume growing near pre-pandemic level (MarketWatch)

- China’s Hard Line on Hong Kong Could Mean Big Changes for Investors (Barron’s)

- Lockdowns Are Costing Us. It’s Time to Be Smart. (Barron’s)

- Clorox and Netflix Shares Have Prospered in the Pandemic. But the Risk Is Rising. (Barron’s)

- Hospitals Are Rationing Remdesivir (Wall Street Journal)

- Nevada Aims to Reopen Casinos June 4 (Wall Street Journal)

- U.S. Rig Count Collapse Continues Despite Soaring Oil Prices (OilPrice)

- Cooped-up Americans race to book vacations in reopened states (Financial Times)

- The fall and rise of Pierre Andurand, oil’s comeback kid (Financial Times)

- Spain’s Soccer League to Resume June 8 After Halt for Virus (Bloomberg)

- Why Delisting Chinese Firms Has Gained Traction in Washington (Bloomberg)

- Why the U.S. Has Shunned Negative Interest Rates (Bloomberg)

- ‘Big Short’ investor Michael Burry added these 5 new stocks to his portfolio in the first quarter (Business Insider)

- Trump administration warms up to sending out more virus relief money (CNBC)

- NHL Players’ Association approves going forward with 24-team playoff talks (CNBC)

- Gilead’s remdesivir improves time to recovery for COVID-19 patients in peer-reviewed results, NIAID says (MarketWatch)

- Kevin Hart — Life Lessons from a Comedic Powerhouse (#435) (Tim Ferriss)

- Three things you can’t do in this world (The Reformed Broker)

- Bill Miller’s Takeaways From Recent Market Volatility (YouTube)

- Dazed and Confused (CompoundAdvisors)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 31

Article referenced in podcast above:

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 21

Article referenced in podcast above:

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

Tom Hayes – The Claman Countdown – Fox Business Appearance – 5/22/2020

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – May 22, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Disney Eyes Key Step To Reopen Florida Parks As Rival Gets OK (Investor’s Business Daily)

- Deere Crushed Earnings Estimates. Its Stock Is Flying. (Barron’s)

- Scoring tickets to NYC drive-in movies is now a competitive sport (New York Post)

- Americans use their stimulus checks to splurge at Walmart, Target and Best Buy (New York Post)

- Rise of S.U.V.s: Leaving Cars in Their Dust, With No Signs of Slowing (New York Times)

- U.S.-China tensions are flaring on a new front: the financial markets (CNBC)

- Why one strategist says these hard-hit stocks will rebound — even if there’s a second wave to the pandemic (MarketWatch)

- States reopen after coronavirus lockdowns: More beaches, casinos open ahead of Memorial Day holiday weekend (MarketWatch)

- Opinion: As the economy reopens, these three indicators will show the strength of the recovery (MarketWatch)

- A Few Big Stocks Are Driving Market Gains. That’s an Opportunity. (Barron’s)

- Western Digital Stock Has Fallen Far Enough. ‘Risks Are to the Upside.’ (Barron’s)

- Why one analyst thinks now is the time to buy cruise stocks (Yahoo! Finance)

- 10 Forces Driving the Stock Market Gains and the Economic Recovery (24/7 Wall Street)

- Elon Musk Is the Hero America Deserves (Bloomberg)

- China vows to push ahead with ‘phase one’ US trade deal amid renewed tensions (CNBC)

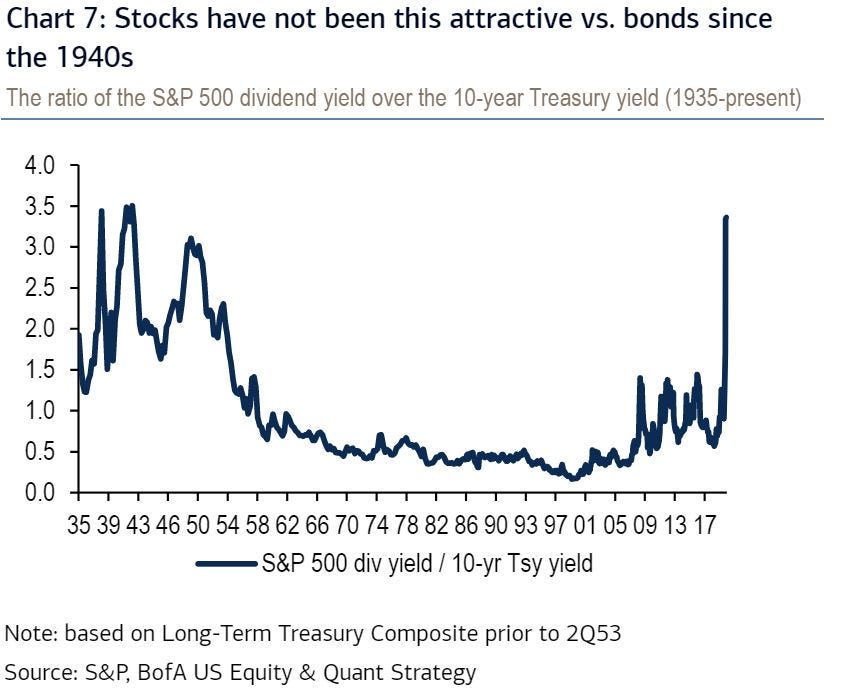

- BANK OF AMERICA: Stocks haven’t been this attractive relative to bonds in 70 years, suggesting further gains are coming (Business Insider)

- Fauci Calls Moderna’s Coronavirus Vaccine Candidate ‘Quite Promising’ (Benzinga)

- Royal Caribbean hopes to resume cruises as soon as August, but the CEO says only if it’s safe (CNBC)

- Michael Burry Could Profit on Selloff Bets (Yahoo! Finance)

- China promises more spending to help revive economy, won’t set growth target (MarketWatch)