Data Source: Finviz

Tag: StockMarket

Be in the know. 20 key reads for Friday…

- Disney Eyes Key Step To Reopen Florida Parks As Rival Gets OK (Investor’s Business Daily)

- Deere Crushed Earnings Estimates. Its Stock Is Flying. (Barron’s)

- Scoring tickets to NYC drive-in movies is now a competitive sport (New York Post)

- Americans use their stimulus checks to splurge at Walmart, Target and Best Buy (New York Post)

- Rise of S.U.V.s: Leaving Cars in Their Dust, With No Signs of Slowing (New York Times)

- U.S.-China tensions are flaring on a new front: the financial markets (CNBC)

- Why one strategist says these hard-hit stocks will rebound — even if there’s a second wave to the pandemic (MarketWatch)

- States reopen after coronavirus lockdowns: More beaches, casinos open ahead of Memorial Day holiday weekend (MarketWatch)

- Opinion: As the economy reopens, these three indicators will show the strength of the recovery (MarketWatch)

- A Few Big Stocks Are Driving Market Gains. That’s an Opportunity. (Barron’s)

- Western Digital Stock Has Fallen Far Enough. ‘Risks Are to the Upside.’ (Barron’s)

- Why one analyst thinks now is the time to buy cruise stocks (Yahoo! Finance)

- 10 Forces Driving the Stock Market Gains and the Economic Recovery (24/7 Wall Street)

- Elon Musk Is the Hero America Deserves (Bloomberg)

- China vows to push ahead with ‘phase one’ US trade deal amid renewed tensions (CNBC)

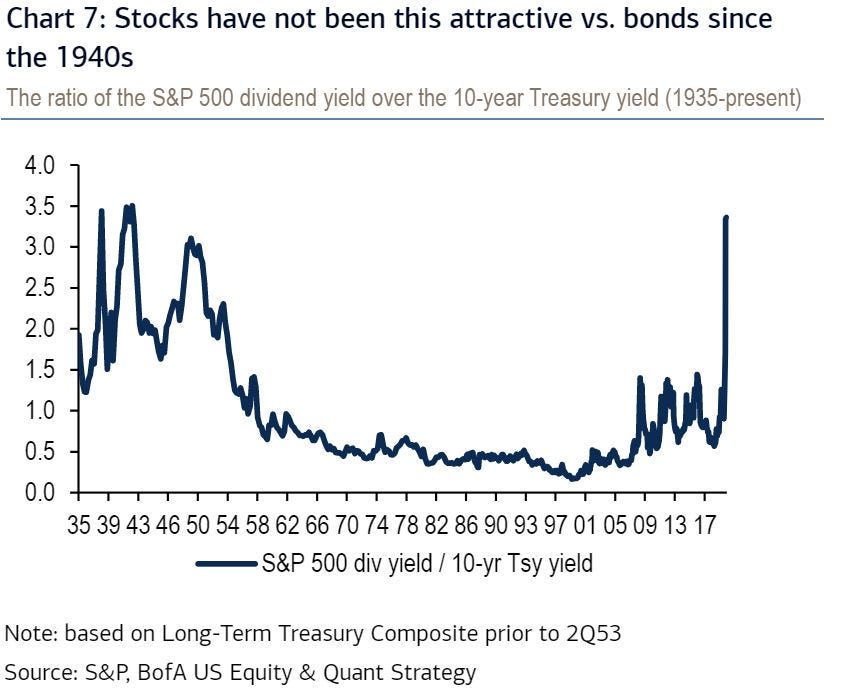

- BANK OF AMERICA: Stocks haven’t been this attractive relative to bonds in 70 years, suggesting further gains are coming (Business Insider)

- Fauci Calls Moderna’s Coronavirus Vaccine Candidate ‘Quite Promising’ (Benzinga)

- Royal Caribbean hopes to resume cruises as soon as August, but the CEO says only if it’s safe (CNBC)

- Michael Burry Could Profit on Selloff Bets (Yahoo! Finance)

- China promises more spending to help revive economy, won’t set growth target (MarketWatch)

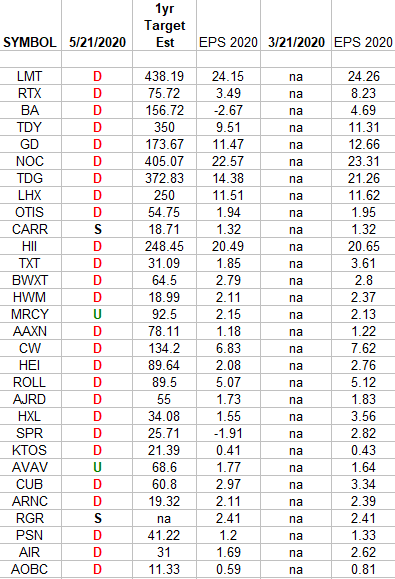

Defense & Aerospace Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Defense & Aerospace Sector ETF (ITA). Continue reading “Defense & Aerospace Earnings Estimates/Revisions”

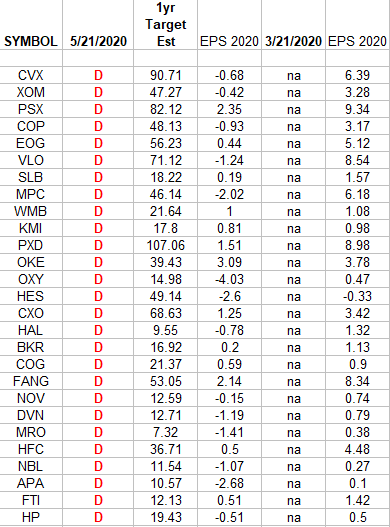

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Unusual Options Activity – Kohl’s Corporation (KSS)

Data Source: barchart

Today some institution/fund purchased 1,141 contracts of Jan 2021 $25 strike calls (or the right to buy 114,100 shares of Kohl’s Corporation (KSS) at $25). The open interest was just 548 prior to this purchase. Continue reading “Unusual Options Activity – Kohl’s Corporation (KSS)”

Where is money flowing today?

Data Source: Finviz

Quote of the Day…

Be in the know. 30 key reads for Thursday…

- All 50 States Have Now Taken Steps to Reopen (Wall Street Journal)

- Shopping Malls Are Reopening, but Visits Are Still Way Down (Barron’s)

- “Leave My Mom Out Of It”: Virtual Debate Between Caruso-Cabrera And AOC Turns Ugly (ZeroHedge)

- Coronavirus live updates: Italian PM says ‘worst is behind us;’ Elvis Presley’s Graceland to reopen (CNBC)

- Boeing Stock Will Rebound. Look Beyond Covid-19. (Barron’s)

- The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)… (ZeroHedge)

- Lowe’s Did What Home Depot Couldn’t (Barron’s)

- Oil prices extend climb toward highest level since March as demand and supply seen taking steps toward recovery (MarketWatch)

- This could be the next signal for the S&P 500 to climb past 3,000, says Standard Chartered (MarketWatch)

- Airline Stocks Rally as Carriers Plan June Restart and State Bailouts Ease Fears (Barron’s)

- Fed Minutes Outline Potential Next Steps to Fight Crisis (Barron’s)

- 5 Restaurant Stocks That Are Still Worth Buying (Barron’s)

- More Analysts See Oil Demand Exceeding Supply Later This Year. That’s a Bullish Sign for Oil. (Barron’s)

- Contact Tracing Takes a High-Tech Step Forward (Barron’s)

- The Dow Is Up — and the Number of Stocks In Up Trends Is Too (Barron’s)

- Can You Get Covid-19 Twice? (Wall Street Journal)

- TikTok parent company valued at over $110B (New York Post)

- Coronavirus Shut Down the ‘Experience Economy.’ Can It Come Back? (New York Times)

- China’s Xi Seeks to Portray Unity and Pivot to Economy Under Coronavirus Shadow (Wall Street Journal)

- When Will Big Concerts Finally Return After Covid? (Think 2021) (Wall Street Journal)

- Andrea Bocelli Wants to Get Back to Work (Wall Street Journal)

- U.S. Raises Ante in Vaccine Race With $1.2 Billion for Astra (Bloomberg)

- Trump Points Finger at China’s Xi, Escalating Fight Over Virus (Bloomberg)

- Disney and Universal to Begin Submitting Florida Reopening Plans (Bloomberg)

- Young Join the Rich Fleeing America’s Big Cities for Suburbs (Bloomberg)

- Starbucks U.S. same-store sales have recovered more than 60% from last year, summer menu announced (MarketWatch)

- 2.4 million more file for unemployment, but weekly number steadily decreasing (Fox Business)

- Why Texas Roadhouse Could Be A Big Post-Shutdown Winner (Yahoo! Finance)

- Trump admin. gives energy companies temporary breaks on royalty rates, rent (Fox Business)

- Why Magic Johnson, Mark Cuban Are Connecting Minority-Owned Businesses With Millions In PPP Loans (Benzinga)

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

Continue reading “The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Data source: Finviz