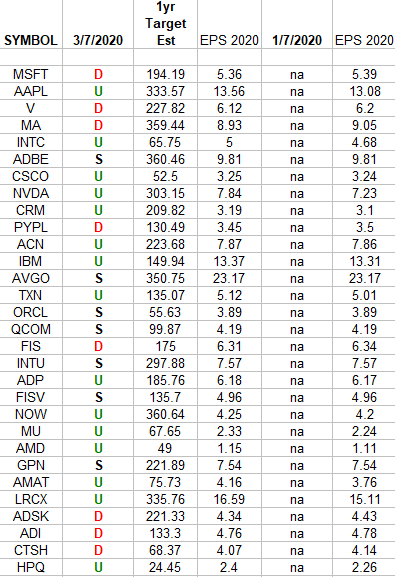

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

Tag: StockMarket

Be in the know. 10 key reads for Saturday…

- 11 Stocks and ETFs for a Post-Virus World (Barron’s)

- Volatility (ValueWalk)

- 12 Dividend Stocks to Buy Amid Turmoil in the Markets (Barron’s)

- Oil Plunges 8% as OPEC Can’t Find Agreement (Barron’s)

- How to Find a Bottom in Industrial Stocks Using Dividend Yields (Barron’s)

- Jack Welch Remembered by Businessweek’s Former Executive Editor (Bloomberg)

- These nine companies are working on coronavirus treatments or vaccines — here’s where things stand (MarketWatch)

- Using Models to Stay Calm in Charged Situations (Farnam Street)

- What Happens to Stocks After a Big Down Month? (A Wealth of Common Sense)

- Should I Sell My Stocks? (The Irrelevant Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 20

Article referenced in VideoCast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 10

Article referenced in podcast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

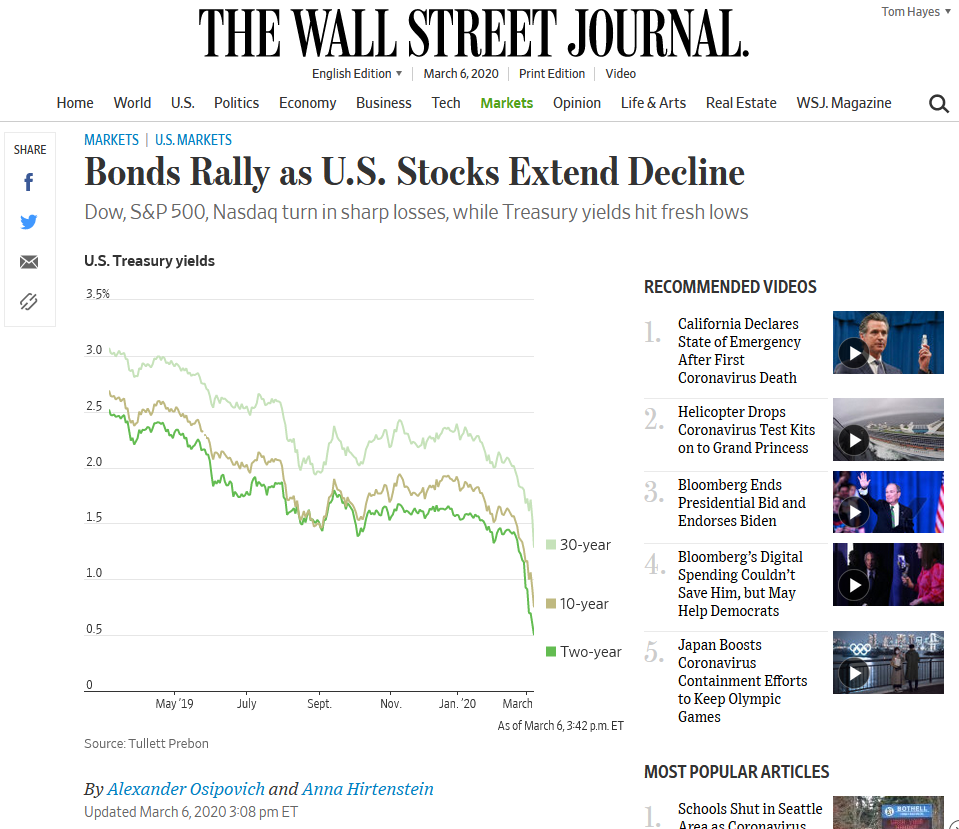

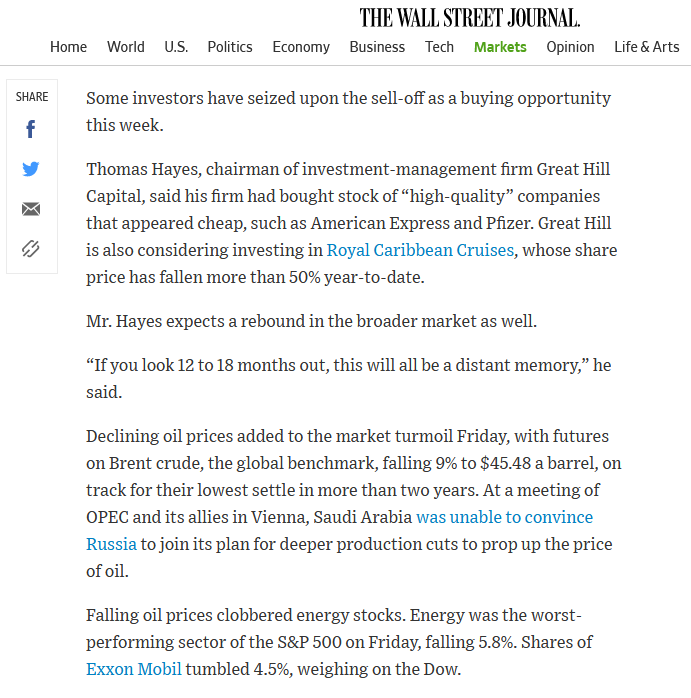

My quotes in the Wall Street Journal today:

Thanks to Alexander Osipovich for including me in his and Anna Hirtenstein’s article in the The Wall Street Journal today:

“Investors continued to pile into safe-haven assets Friday, pushing the yield on long-term U.S. government bonds to unprecedented levels.” You can read it here:

Click Here to View The Full Article at The Wall Street Journal

Be in the know. 10 key reads for Friday…

- Jim Cramer: I’m With Warren Buffett on This One (TheStreet)

- China Stocks Are Handily Beating U.S. Since Coronavirus Outbreak. Here’s Why (Bloomberg)

- Billionaire Sam Zell says he is buying some ‘ridiculously low’ stocks in the wild market swings (CNBC)

- ‘Bond King’ Gundlach says Fed panicked and short-term rates are ‘headed toward zero’ (CNBC)

- ValueAct’s Jeffrey Ubben buys BP and says oil company can be ‘part of the solution’ (CNBC)

- OPEC deal in jeopardy as Russia stalls over deepest round of supply cuts since 2008 (CNBC)

- Bullard Says Fed Watching Virus Fallout, Willing to Do More (Bloomberg)

- Fed’s Kaplan thinks U.S. can avoid coronavirus recession as Williams says central bank will keep using tools (MarketWatch)

- Can Gilead Change Its Dim Fortunes On An Immuno-Oncology Buyout? (Investors)

- Global equity outflows hit $23bn on coronavirus fears (Financial Times)

Unusual Options Activity – Neptune Wellness Solutions Inc. (NEPT)

Data Source: barchart

Today some institution/fund purchased 10,286 contracts of Jan. $2 strike calls (or the right to buy 1,028,600 shares of Neptune Wellness Solutions Inc. (NEPT) at $2). The open interest was just 1,984 prior to this purchase. Continue reading “Unusual Options Activity – Neptune Wellness Solutions Inc. (NEPT)”

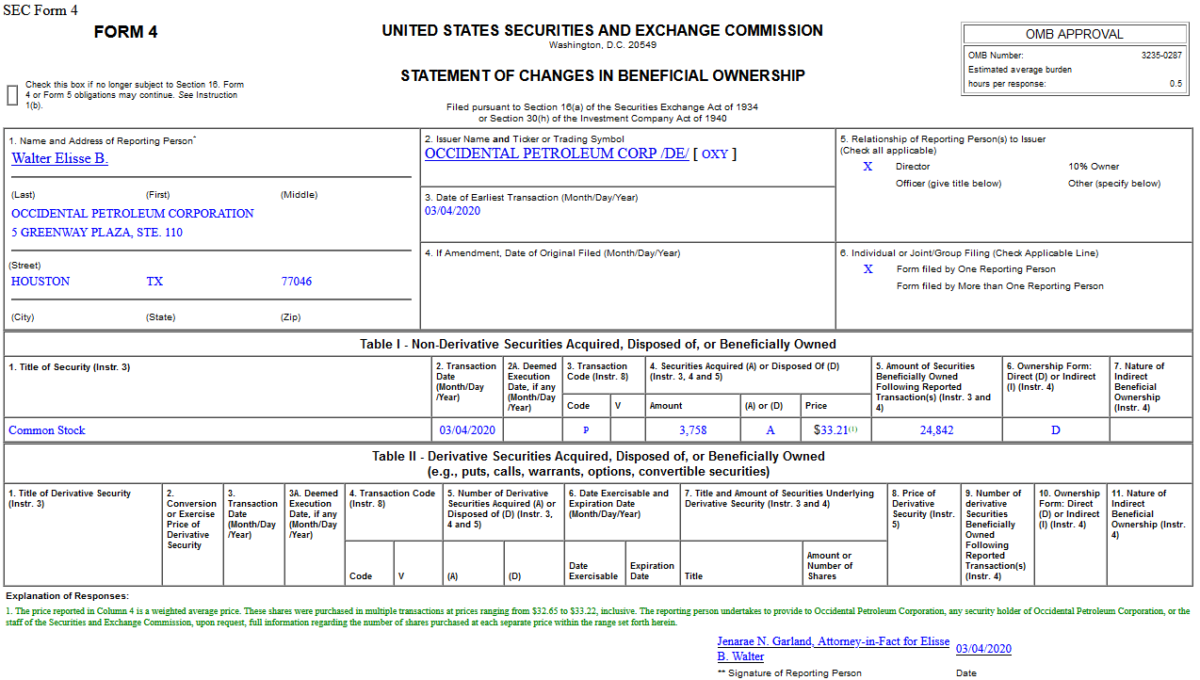

Insider Buying in Occidental Petroleum Corporation (OXY)

On March 4, 2020, Walter Elisse – Director of Occidental Petroleum Corporation (OXY) – purchased 3,758 shares of OXY at $33.21. His out of pocket cost was $124,803.

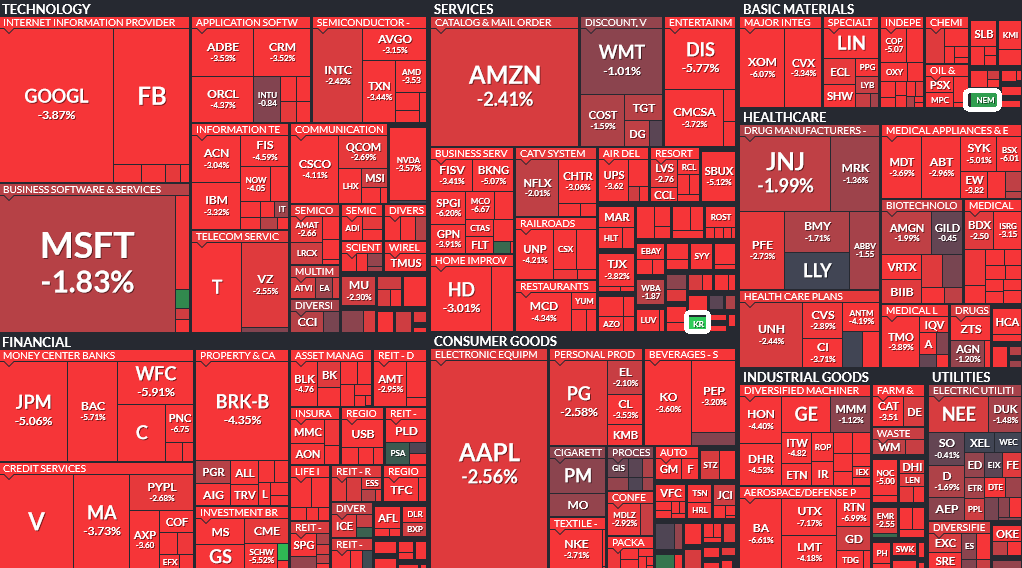

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Thursday…

- Be Like Warren Buffett in Times Like These. Here’s How. (Barron’s)

- Federal Reserve Retools Capital Rules for Largest U.S. Banks (Wall Street Journal)

- Market-Beating Bank CEOs Are a Rare Breed (Wall Street Journal)

- Cramer’s most trusted market indicator says to start buying stocks (CNBC)

- Larry Kudlow Says ‘We’re Not Going to Panic’ Over the Economy (Bloomberg)

- Capitulation Moment? ‘We are giving up on energy’, say Jefferies analysts, who compare beaten-down sector to ‘62 Mets (MarketWatch)

- Oil prices rise on report OPEC agrees 1.5 million barrel-per-day production cut (MarketWatch)

- Buffett-Backed 30-Year-Old Goes to War With Latin American Banks (Bloomberg)

- Exxon CEO sticks to spending targets despite oil downturn (Reuters)

- The Old Dominion “Snapback” Stock Market? (and Sentiment Results) (ZeroHedge)