Data Source: Finviz

Tag: StockMarket

Be in the know. 10 key reads for Wednesday…

- DuPont Has Narrowed Its Focus. Analyst Sees a Winner for 2020. (Barron’s)

- 8 Oil Stocks Goldman Sachs Says to Buy in 2020 (Barron’s)

- Stanley Druckenmiller Is Embracing Risk Again, Just ‘Timidly’ (Bloomberg)

- U.S. Energy Chief Shrugs Off Permian Oil Slowdown as a ‘Pause’ (Barron’s)

- Saturday before Christmas expected to be the biggest U.S. shopping day of 2019 (Reuters)

- Why Fund Managers Are Cranking Up the Risk (Institutional Investor)

- Trump adviser hints at next big trade deal (Fox Business)

- The U.S. housing market is taking off: Morning Brief (Yahoo! Finance)

- A Berkshire Hathaway decade in review: Here are the biggest takeaways from Warren Buffett’s annual shareholder letters (Business Insider)

- Dollar Is Poised to Weaken Just in Time (Bloomberg)

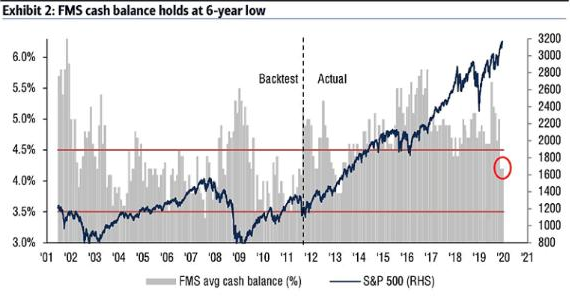

Bank of America – Global Fund Manager Survey Results

Data Source: Bank of America

Each month, Bank of America conducts its survey of Global Fund Managers. This month’s survey was held between December 6-12 and solicited responses from 247 money managers representing $745 Billion AUM. Continue reading “Bank of America – Global Fund Manager Survey Results”

Where is money flowing today?

Data Source: Finviz

Quote of the day…

Be in the know. 10 key reads for Tuesday…

- The Two Countries Dictating Oil Prices In 2020 (Yahoo! Finance)

- The Trade Deal Doesn’t Fix Everything. The Market Doesn’t Care. (Barron’s)

- Animal-Care Provider Zoetis and 6 More Companies Are Raising Dividends (Barron’s)

- Global Economy Shows Signs of Regained Footing (Wall Street Journal)

- Upbeat Chinese Economic Data Buoy Commodities (Wall Street Journal)

- This year’s really big rally doesn’t mean 2020 needs to be a down year, history shows (CNBC)

- UK unemployment falls to lowest level since 1975 (BBC)

- US Single-Family Building Permits Reach 12-Year High (Zero Hedge)

- Worst to First in 2020 (Oil Stocks)? (Yahoo! Finance)

- 7 Greatly Undervalued Dow Stocks for Upside and Dividends in 2020 (24/7 Wall Street)

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Today some institution/fund purchased 501 contracts of Jan 24, 2020 strike calls (or the right to buy 50,100 shares of Gilead Sciences, Inc. (GILD) at $70). The open interest was just 178 prior to this purchase.

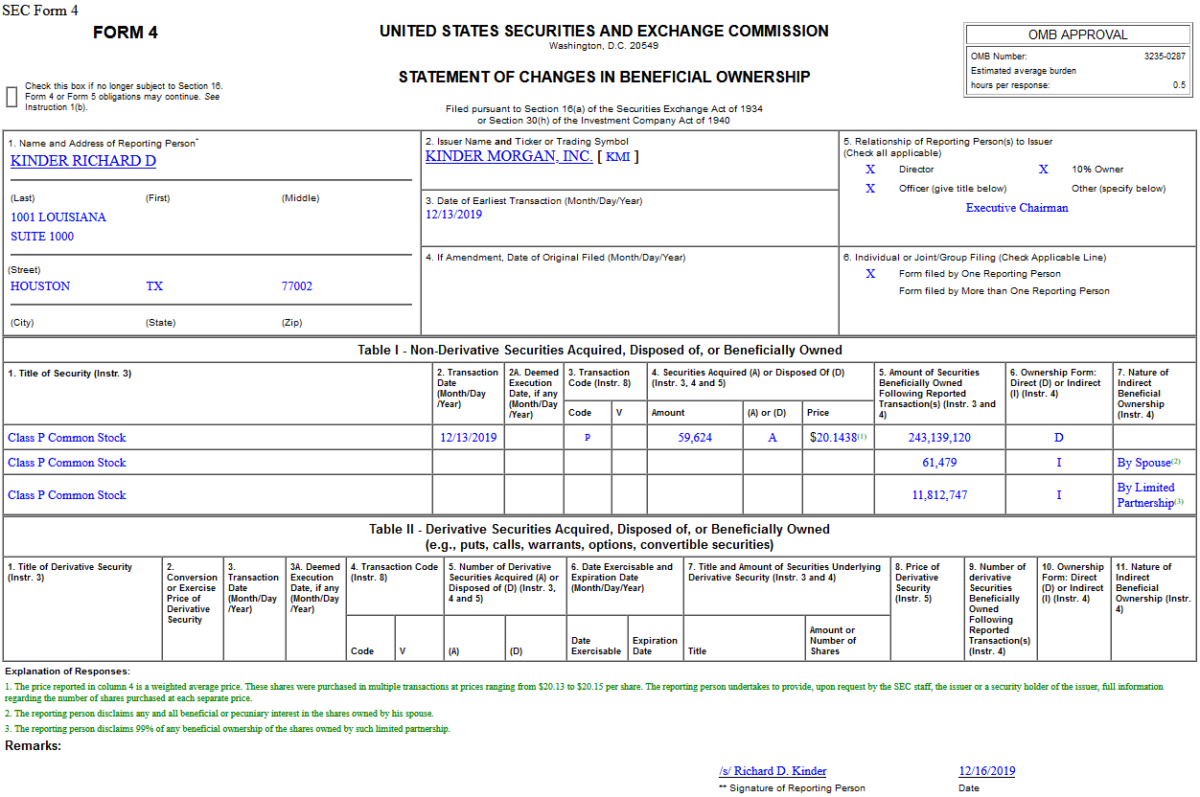

Insider Buying in Kinder Morgan, Inc. (KMI)

After buying $130M of his own stock this year, Billionaire – Richard Kinder decided he needed another $1.2M. On Dec. 13, 2019, Richard Kinder – Executive Chairman of Kinder Morgan, Inc. (KMI) – purchased 59,624 shares of KMI at $20.14. His out of pocket cost was $1,201,054.

Where is money flowing today?

Data source: Finviz