- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results) (ZeroHedge)

- Sweet Success: WhIsBe Is Bringing His $60,000 Vandal Gummy Bears To Art Week Miami (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Politics Aside, what could happen to markets in the event of impeachment in the House? (Almanac Trader)

- Episode 773: Slot Flaw Scofflaws (NPR Planet Money)

- Making Sense of the Genome, at Last (Nautilus)

- Fed Adds $72.8 Billion to Markets, Balance Sheet Moves to $4.07 Trillion (Wall Street Journal)

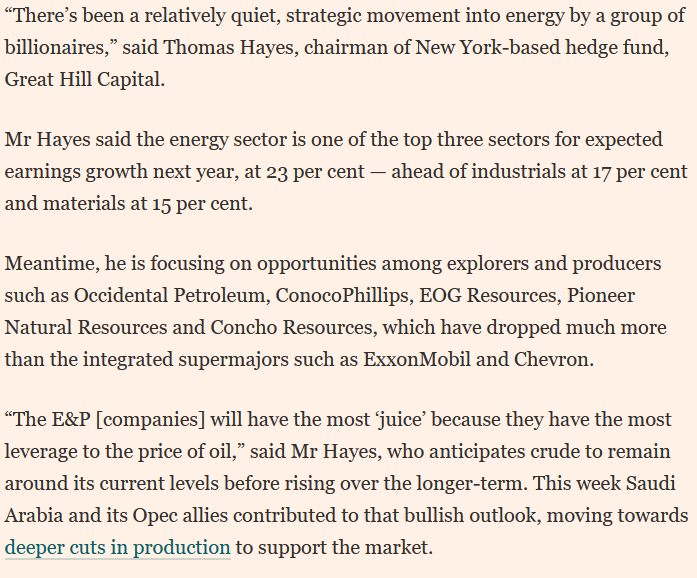

- This wealth manager picked a home-run stock in 2019. Here’s what he likes for 2020 (MarketWatch)

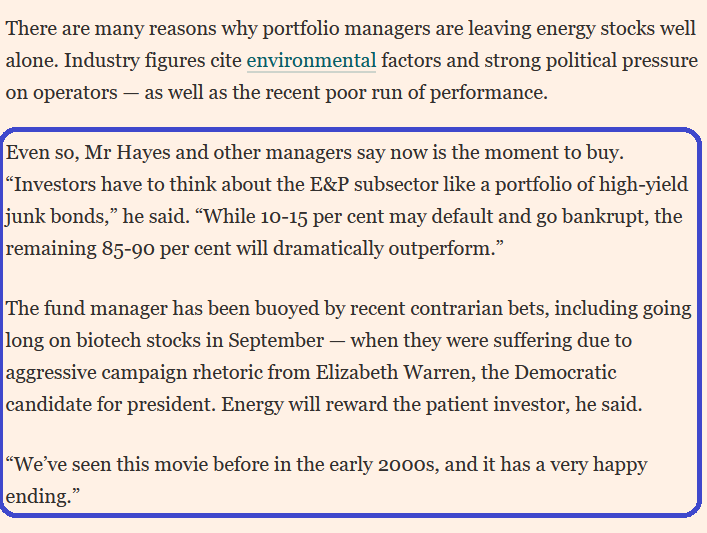

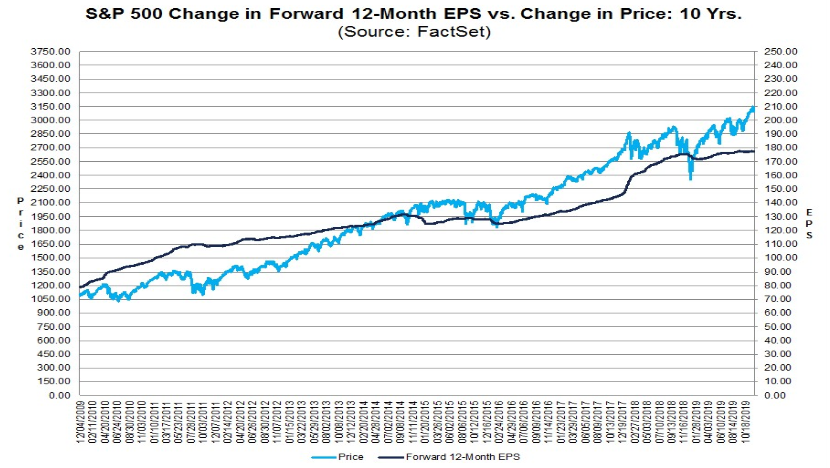

- S&P 500 Melt-Up Is So Hot It’s Making Cheerleaders Into Skeptics (Bloomberg)