Data Source: Finviz

Tag: StockMarket

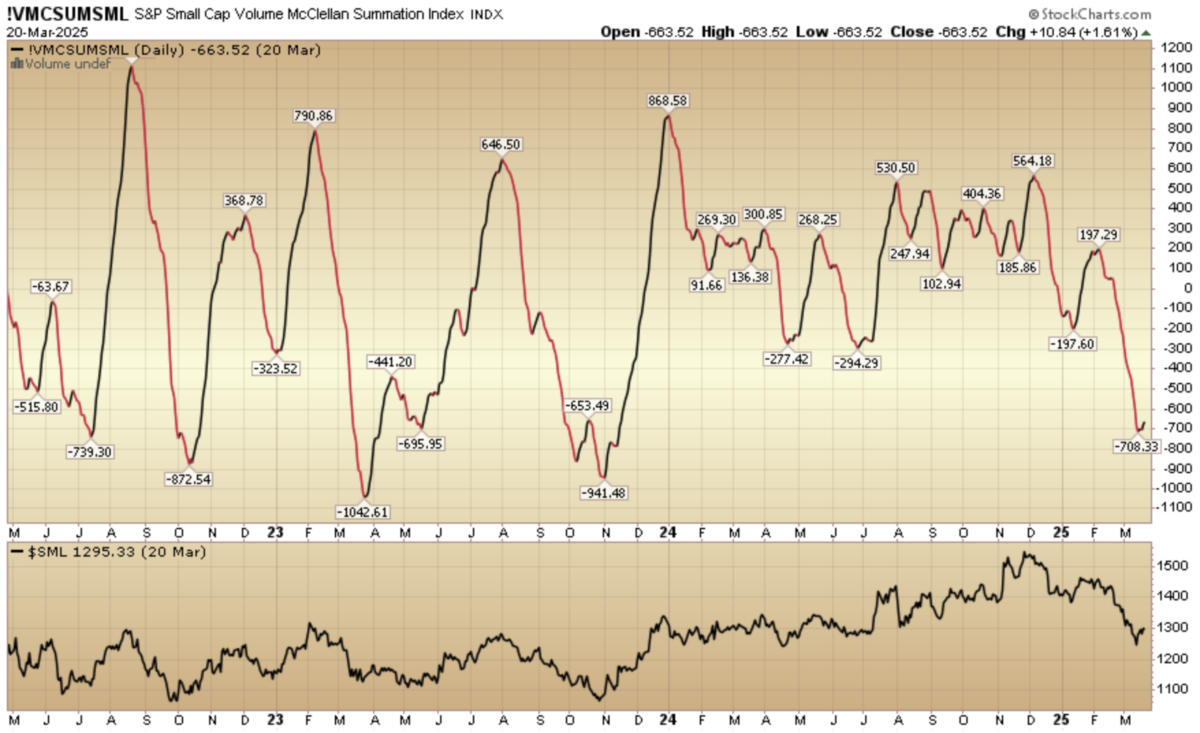

Indicator of the Day (video): S&P Small Cap Volume Summation Index

Our Applied Stock Market Indicator of the Day is:

S&P Small Cap Volume Summation Index

Quote of the Day…

Tom Hayes – Fox Business Appearance – Varney & Co. – 3/21/2025

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 21, 2025

Be in the know. 14 key reads for Friday…

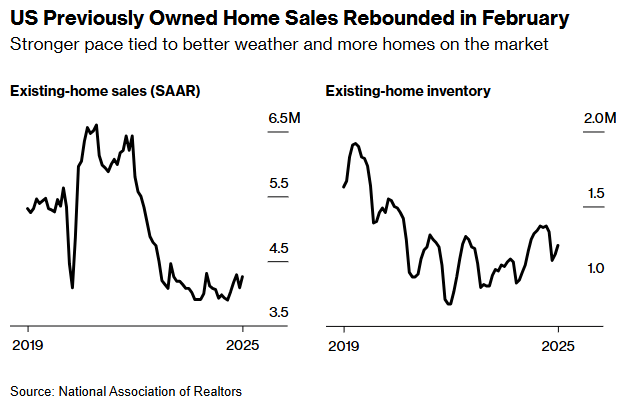

- Home Sales Rose 4.2% in February, Beating Expectations (wsj)

- ASOS Expects In-Line Revenue, Earnings Ahead of Views (wsj)

- Japan’s Inflation Slows Less Than Expected, Backing BOJ Hikes (bloomberg)

- Disney’s Robotic Droids Are the Toast of Silicon Valley (wsj)

- Germany Set for Trillion-Euro Defense and Infrastructure Splurge (wsj)

- High-End Travel Bookings Are Up. It’s a Good Sign for the Economy. (barrons)

- BofA Says Tariff Risk Dismissed as Stocks Get ‘Monster’ Inflows (bloomberg)

- Jacobs’ QXO acquires Beacon in first step to build $50 billion revenue powerhouse (streetinsider)

- Malaysia Airlines Orders Up to 60 Boeing Jets to Revamp Fleet (bloomberg)

- Tech war: Chinese AI models led by DeepSeek catch up with US rivals at lower prices (scmp)

- Billions Flowed Into New Leveraged ETFs Last Year. Now They’re in Free Fall. (wsj)

- Hedge fund pessimism over Wall Street hits 5-year high, Goldman says (yahoo)

- Nike Forecast Steeper Fourth-Quarter Sales Drop in Early Days of Turnaround (wsj)

- FedEx Stock Drops. Trade Fears Take a Bite Out Of Business Activity. (barrons)

Tom Hayes – Guest on “MoneyShow MoneyMasters Podcast” – 3/20/2025

The “MoneyShow MoneyMasters Podcast” – Thomas Hayes – Chairman of Great Hill Capital – March 20, 2025

Where is money flowing today?

Data Source: Finviz

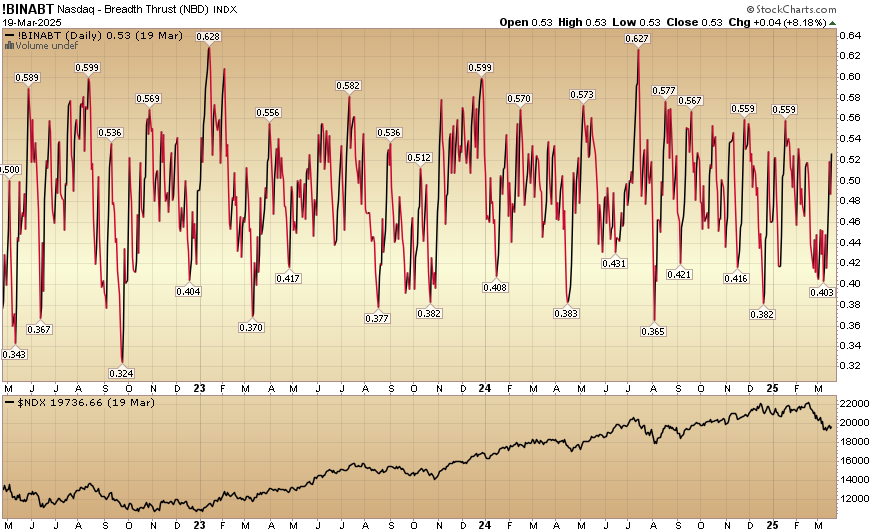

Indicator of the Day (video): Nasdaq – Breadth Thrust

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

Nasdaq – Breadth Thrust

Quote of the Day…

Be in the know. 16 key reads for Thursday…

- Building-Products Distributor QXO Clinches Deal for Beacon Roofing (wsj)

- China is tackling weak consumption with child care subsidies (cnbc)

- Boeing Sees Cash Flow Improve as Jet Factories Stabilize (bloomberg)

- Exclusive: Air India in talks for dozens of new widebody jets from Airbus, Boeing, sources say (reuters)

- BofA: Boeing’s March deliveries set for end of quarter surge (streetinsider)

- Fed Projections See an Economy Dramatically Reset by Trump’s Election (wsj)

- The Fed Pencils in 2 Rate Cuts. Anything Could Happen. (barrons)

- A Housing Expert Sizes Up the Outlook for Home Sales, Mortgage Rates, and Tariff Impacts (barrons)

- Is this the start of a period of European exceptionalism in markets? (ft)

- Hold the Obituary: Europe Comes to Life as U.S. Stumbles (wsj)

- US natural gas prices up on record flows to LNG export plants, cooler weather forecasts (reuters)

- Disney and Universal Prepare for a Theme Park Brawl. What’s at Stake in Orlando. (barrons)

- Temu-Owner PDD’s Revenue Misses Estimates as Expansions Slow (bloomberg)

- Nike’s Earnings Are Here. Expect News About Its Turnaround. (barrons)

- Signs of an Office Market Bottom: ‘The Worst Is Probably Over’ (nytimes)

- The Dream Team With a ‘Miracle’ Coach: Can Anyone Stop This Hockey Powerhouse? (wsj)