Data Source: Finviz

Tag: Stocks

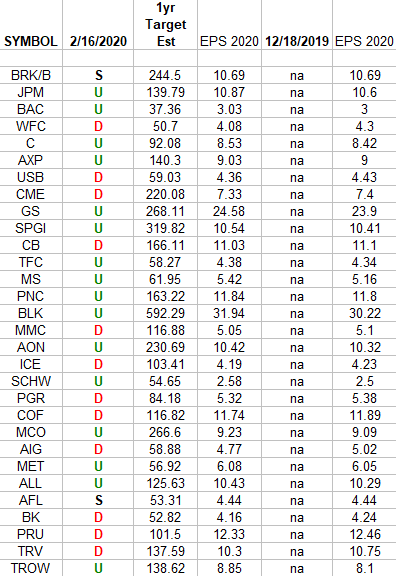

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 17

Article referenced in VideoCast above:

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

Where is money flowing today?

Data Source: Finviz

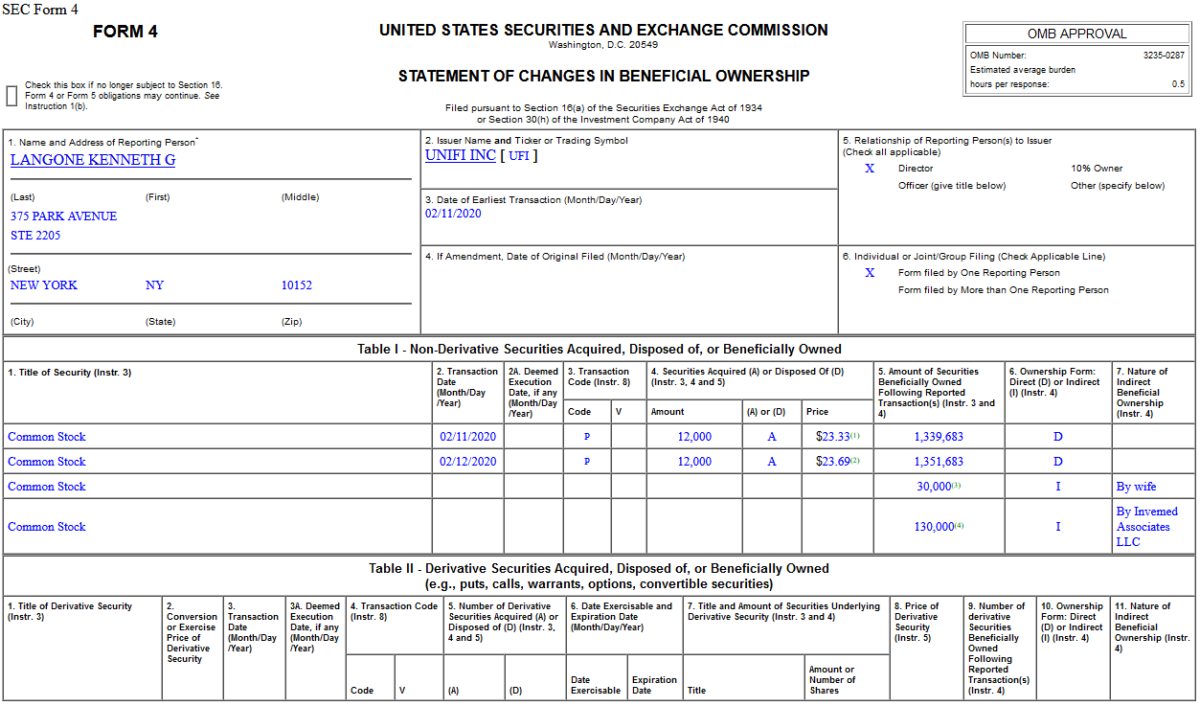

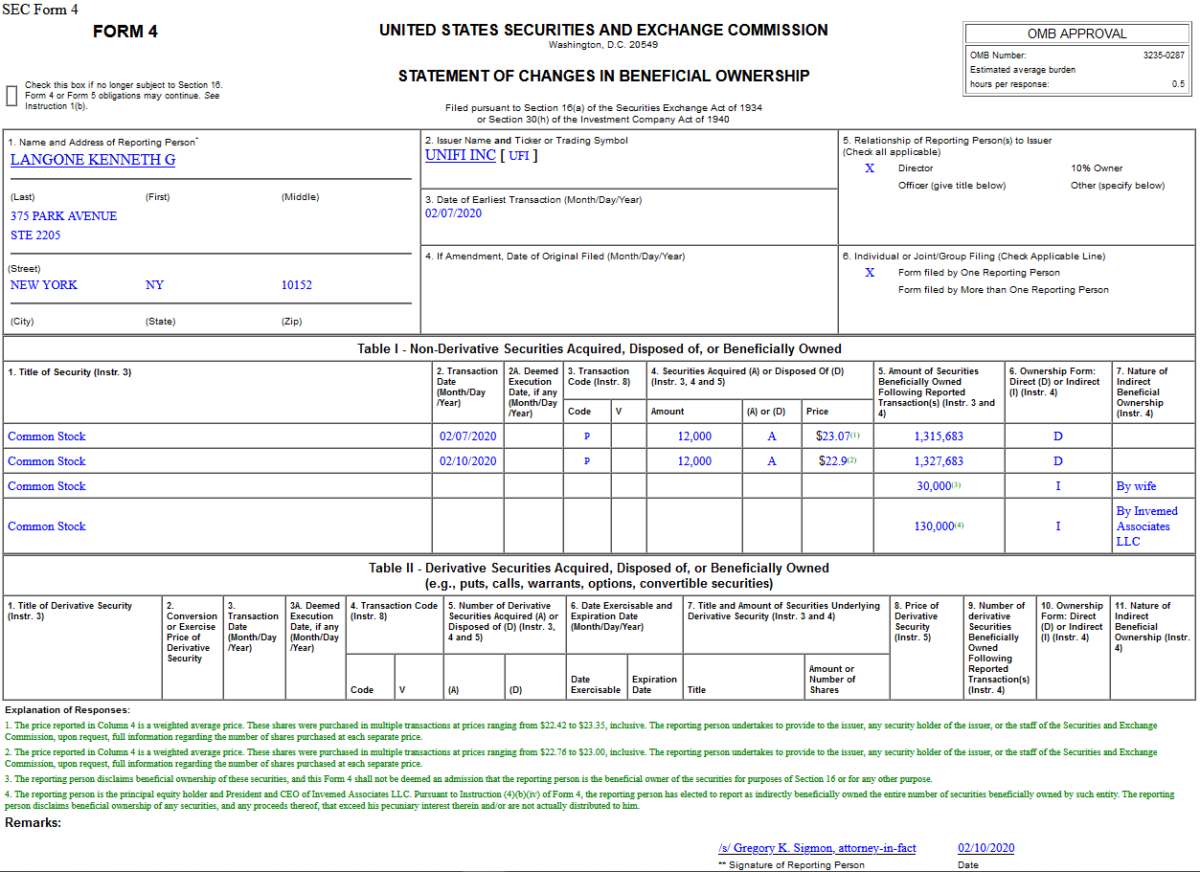

Insider Buying in Unifi, Inc. (UFI)

On Feb 12, 2020, Billionaire Kenneth Langone – Director of Unifi, Inc. (UFI) – purchased another 24,000 shares of UFI at ~$23.51. His out of pocket cost was $564,240. Continue reading “Insider Buying in Unifi, Inc. (UFI)”

Be in the know. 10 key reads for Thursday…

- Eight Stocks Wall Street Loves for Valentine’s Day (Barron’s)

- What Denny’s CEO Tells Himself In The Mirror Every Day (Investor’s Business Daily)

- Charlie Munger Talks About Chinese Companies, Poor Investment Choices, And Why He Would Never Buy Tesla Stock (Benzinga)

- The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)… (ZeroHedge)

- Kraft Heinz’s Earnings Were Only OK. Why Investors Should Be Happy. (Barron’s)

- Value-Oriented Dividend Stocks Will Pay Investors Who Wait, Strategist Says (Barron’s)

- Time for a cut? OPEC Sees Coronavirus Weighing Heavily on Oil Demand (Wall Street Journal)

- Hedging Strategy Likely Exacerbated Oil’s Fall (Wall Street Journal)

- Trump’s Rosy Economic Growth Forecast Isn’t Crazy (Bloomberg)

- 5 Contrarian Dividend Stocks to Buy as Market Rips to All-Time Highs (24/7 Wall Street)

Where is money flowing today?

Data Source: Finviz

Insider Buying in Unifi, Inc. (UFI)

On Feb 7-10, 2020, Billionaire Ken Langone – Director of Unifi, Inc. (UFI) – purchased 24,000 shares of UFI at ~$22.99. His out of pocket cost was $551,640.

Where is money flowing today?

Data Source: Finviz

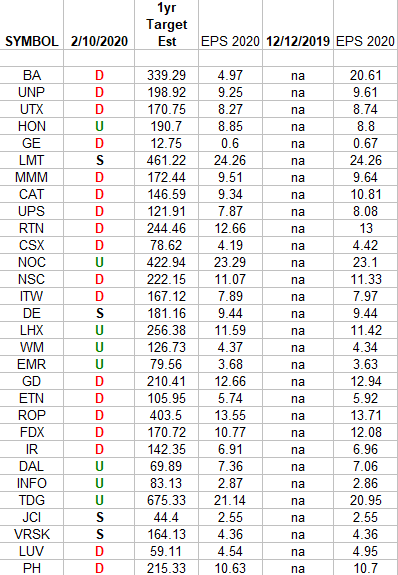

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 2/10/2020 has a letter that represents the movement in 2020 earnings estimates since the most recent print (12/12/2019). Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”