Data Source: Finviz

Tag: Stocks

Be in the know. 5 key reads for Wednesday…

- Nothing scares Jeffrey Gundlach more than Bernie Sanders (MarketWatch)

- Starbucks, Lowe’s and 6 Other Consumer Stocks That Could Shine in 2020 (Barron’s)

- 3 Oil Stocks to Buy and 1 to Avoid in 2020, According to an Analyst (Barron’s)

- Iran’s Forewarned Strikes Give Trump a Path to Avert All-Out War (Bloomberg)

- Here’s What Could Take the Dow Up to 32,000 in 2020 (24/7 Wall Street)

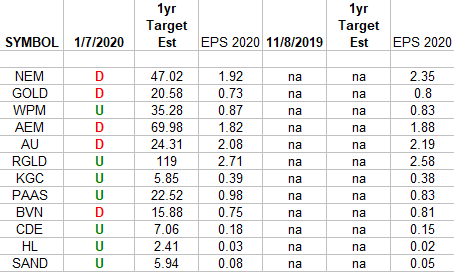

Gold Miners Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Gold Miner Sector ETF (GDX) top US holdings. Continue reading “Gold Miners Earnings Estimates/Revisions”

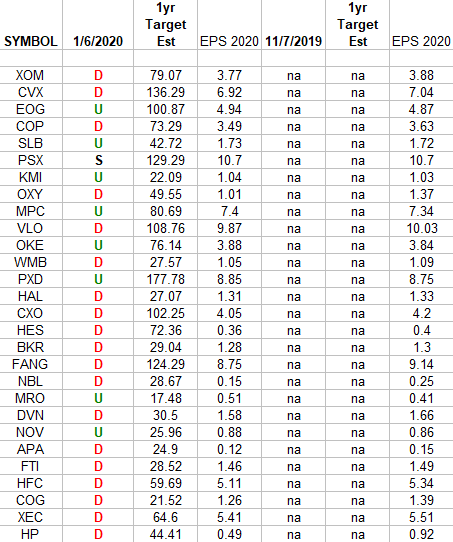

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

Be in the know. 7 key reads for Monday…

- U.S. Consumer Tech Sales Projected to Increase 4% in 2020. These Trends Will Drive the Growth. (Barron’s)

- ‘Bad’ Manufacturing Data Contained Good News for Industrial Stocks. Here’s Why. (Barron’s)

- UK economy boosted by ‘greater Brexit clarity’ after conservative win (Fox Business)

- Barron’s Picks And Pans: Amazon, Dine Brands, Walgreens And More (Yahoo! Finance)

- Top Energy Stocks for January 2020 (Investopedia)

- Don’t laugh: Here’s why the ‘great rotation’ from bonds to stocks could finally happen in 2020 (MarketWatch)

- Here’s how the Dow and S&P 500 perform in years after they ring up gains of 20% (MarketWatch)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 10

Article referenced in VideoCast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

Podcast – Hedge Fund Tips with Tom Hayes – Episode 1

Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

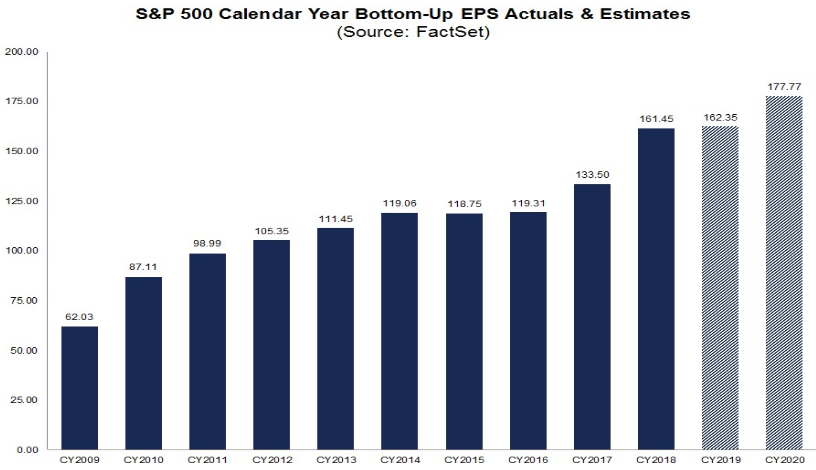

2020 Earnings Estimates: US down modestly, Europe UP

Data Source: Factset

S&P 500 Earnings:

This week, 2020 EPS estimates came down from 178.24 to 177.77. While this is a drop of 26bps, the 2020 Earnings Growth rate stayed up at 9.6% due to a slight down-tick in 2019 estimated results. Q4 2019 Estimates have dropped 10bps (from -1.4% to -1.5% since 12/20). Continue reading “2020 Earnings Estimates: US down modestly, Europe UP”

Where is money flowing today?

Data Source: FinViz