Data Source: Finviz

Tag: Stocks

Be in the know. 15 key reads for Thursday…

- 10 Undervalued Energy Stocks for 2020 (24/7 Wall Street)

- Biotech Stocks Are In a Position to Break Out in 2020, Analysts Say (MarketWatch)

- Opinion: Takeaway from Abu Dhabi money conference: So much money is looking to find a home (MarketWatch)

- BOJ to begin lending ETFs to prop up market liquidity (Reuters)

- The J. Paul Getty (Energy) Stock Market (and Sentiment Results) (ZeroHedge)

- Oil Stocks To Buy As Prices Rebound: Here Are U.S. Shale, Market Cap Leaders (Yahoo! Finance)

- Think the Dow Is OId-Fashioned? It Beat the S&P 500 Over 5 Years. (Barron’s)

- The Best Cars—Including Two Electric Vehicles—I Drove in 2019 ()

- Tesla shares close at a record high. Next stop $420? (CNBC)

- ‘I couldn’t have been more wrong’: Legendary investor Stanley Druckenmiller reveals a mistake he made that cost him major market returns (Business Insider)

- The ‘ultimate smart money indicator’ is signalling a big move in the stock market by the end of the week (MarketWatch)

- China says in touch with U.S. on signing of Phase 1 trade deal (Reuters)

- Biotech Analysts See Deals, Drug Data Carrying 2020 Performance (Yahoo! Finance)

- Investors Pony Up More Than $2B for Distressed Fund (Institutional Investor)

- US House poised to approve USMCA trade deal (Financial Times)

The J. Paul Getty (Energy) Stock Market (and Sentiment Results)

In 1965, J. Paul Getty – once the richest man in America – published his book, “How To Be Rich.” His intent with this book was to lay out his “formula” for success and pass it on to future generations.

Continue reading “The J. Paul Getty (Energy) Stock Market (and Sentiment Results)”

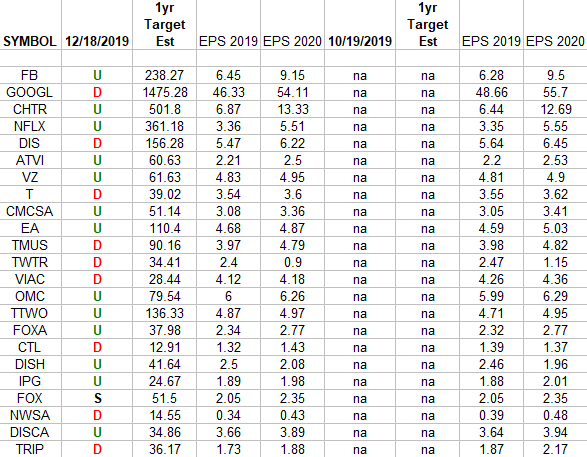

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Wednesday…

- DuPont Has Narrowed Its Focus. Analyst Sees a Winner for 2020. (Barron’s)

- 8 Oil Stocks Goldman Sachs Says to Buy in 2020 (Barron’s)

- Stanley Druckenmiller Is Embracing Risk Again, Just ‘Timidly’ (Bloomberg)

- U.S. Energy Chief Shrugs Off Permian Oil Slowdown as a ‘Pause’ (Barron’s)

- Saturday before Christmas expected to be the biggest U.S. shopping day of 2019 (Reuters)

- Why Fund Managers Are Cranking Up the Risk (Institutional Investor)

- Trump adviser hints at next big trade deal (Fox Business)

- The U.S. housing market is taking off: Morning Brief (Yahoo! Finance)

- A Berkshire Hathaway decade in review: Here are the biggest takeaways from Warren Buffett’s annual shareholder letters (Business Insider)

- Dollar Is Poised to Weaken Just in Time (Bloomberg)

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Tuesday…

- The Two Countries Dictating Oil Prices In 2020 (Yahoo! Finance)

- The Trade Deal Doesn’t Fix Everything. The Market Doesn’t Care. (Barron’s)

- Animal-Care Provider Zoetis and 6 More Companies Are Raising Dividends (Barron’s)

- Global Economy Shows Signs of Regained Footing (Wall Street Journal)

- Upbeat Chinese Economic Data Buoy Commodities (Wall Street Journal)

- This year’s really big rally doesn’t mean 2020 needs to be a down year, history shows (CNBC)

- UK unemployment falls to lowest level since 1975 (BBC)

- US Single-Family Building Permits Reach 12-Year High (Zero Hedge)

- Worst to First in 2020 (Oil Stocks)? (Yahoo! Finance)

- 7 Greatly Undervalued Dow Stocks for Upside and Dividends in 2020 (24/7 Wall Street)

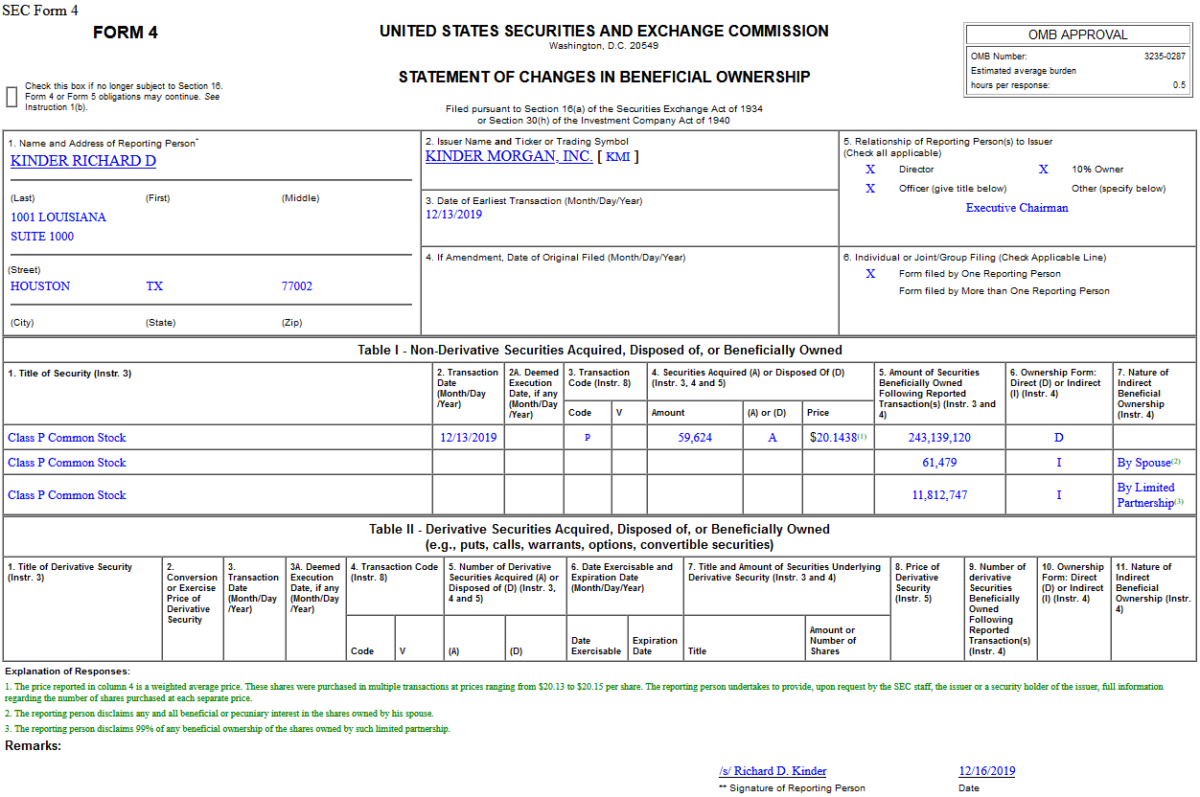

Insider Buying in Kinder Morgan, Inc. (KMI)

After buying $130M of his own stock this year, Billionaire – Richard Kinder decided he needed another $1.2M. On Dec. 13, 2019, Richard Kinder – Executive Chairman of Kinder Morgan, Inc. (KMI) – purchased 59,624 shares of KMI at $20.14. His out of pocket cost was $1,201,054.

Where is money flowing today?

Data source: Finviz