Article referenced in podcast above:

Tag: Technical Analysis

Hedge Fund Tips with Tom Hayes – Podcast – Episode 18

Article referenced in podcast above:

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 27

Article referenced in VideoCast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 17

Article referenced in podcast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 26

Article referenced in VideoCast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 16

Article referenced in podcast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Each week I attempt to pair the lyrics from a popular song to the current feeling and sentiment in the stock market. When you look at the data that has come out on the U.S. economy in recent days, one might suggest you need more than “Beer Goggles” to see the green shoots, you need “Whiskey Glasses!” Continue reading “The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…”

Be in the know. 20 key reads for Saturday…

- As Credit Markets Rebound, Neediest Borrowers Are Left Behind (Bloomberg)

- Majority of Americans who qualify for coronavirus aid are expected to receive direct deposits by April 15 (Business Insider)

- N.Y. Deaths Dip; Gilead Drug Shows Early Promise: Virus Update (Bloomberg)

- The Terrible Costs of Keeping—or Ending—the Lockdowns (Barron’s)

- Time to Hit ‘Buy It Now’ Button on eBay Stock (Barron’s)

- This Market Is Made For Warren Buffett. Why Has He Gone Quiet? (Barron’s)

- In the Face of a “Rare Mispricing,” an Oil-Services Bear Turns Bull (Barron’s)

- Fed’s Emergency Lending Has Peaked. At Least for Now. (Barron’s)

- Martin Scorsese Courts Apple and Netflix to Rescue Costly DiCaprio Film (Wall Street Journal)

- Apple, Google Bring Covid-19 Contact-Tracing to 3 Billion People (Bloomberg)

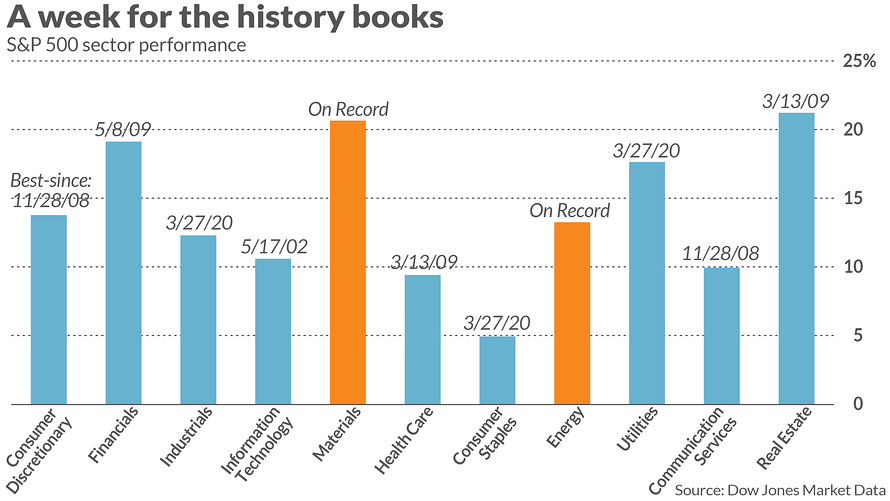

- 16 million people just got laid off but U.S. stocks had their best week in 45 years (MarketWatch)

- Ex-FDA commissioner says ‘widespread screening’ needed to reopen economy (CNN)

- The Asset Class That’s Not Getting Crushed by Coronavirus (Institutional Investor)

- The Relationship Between Earnings and Bear Markets (A Wealth of Common Sense)

- Markets Have Priced In the Lockdown Period. Now What? (Wall Street Journal)

- IRS Launches Registration Tool For Stimulus Checks (Forbes)

- Coronavirus: Is your auto insurer giving refunds? (ValueWalk)

- WEEKLY AND MONTHLY CHARTS SHOW IMPROVEMENT (John Murphy)

- America’s Best Trump Impersonator Has Some Thoughts About CNN And Dr. Fauci (Digg)

- Paul Walker’s 1969 Ford Mustang Boss 429 Is Headed to Auction (Maxim)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 25

Article referenced in VideoCast above:

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

Each week I try to tie the theme of the stock market to a song that embodies the feeling of the moment. The last month could best be defined by Rodney Atkins classic hit, “If You’re Going Through Hell…” The lyrics that follow, tell the whole story of where we are today: Continue reading “The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…”