- Mortgage demand from homebuyers amazes again, now up 13% annually despite rising rates (CNBC)

- The Rally in Cyclical Stocks Is Just Getting Started. Citi, Chevron, and 38 Other Stocks to Play the Rebound. (Barron’s)

- AMC to reopen theaters globally in July (CNBC)

- Six things to watch at the Federal Reserve meeting (Financial Times)

- Why Occidental Stock May Have More Upside (Barron’s)

- Hong Kong’s dollar peg faces new scrutiny as security law looms (Financial Times)

- Value and growth investments gap at 25-year high (Financial Times)

- BofA Securities Upgrades Occidental Petroleum (OXY) to Buy; ‘Moving up the risk curve’ (Street Insider)

- Gundlach Warns Rising Rates May Lead Fed to Yield-Curve Control (Yahoo! Finance)

- 3 Ways to Play the Most Hated Stock Market Rally in History (Barron’s)

- Coronavirus Obliterated Best African-American Job Market on Record (Wall Street Journal)

- Hassett Sees Another Stimulus Bill From Congress Before August Recess (Wall Street Journal)

Tag: Value Investor

Be in the know. 20 key reads for Saturday…

- OPEC+ Agrees to Extend Output Cuts as Quota Cheats Offer Penance (Bloomberg)

- Selloff reminiscent of an older bear market: Oakmark’s Nygren (CNBC)

- A Booming Stock Market Could Come Back to Bite the Recovery (Bloomberg)

- Can Big Business Fix Racial Injustice? It Has to Try. (Barron’s)

- 3 Stocks That Could Benefit When Dining Out Returns (Barron’s)

- Here are the 10 most under and overbought S&P 500 stocks, according to Goldman (MarketWatch)

- How the U.S. dollar’s ‘almost silent slide’ is juicing the stock-market rally (MarketWatch)

- These stocks rose by double digits Friday as underperforming sectors bounced back (MarketWatch)

- American Airlines stock adds to its tally of records with a weekly gain of over 75% (MarketWatch)

- Minneapolis-based U.S. Bancorp to spend over $115 million to address ‘economic and racial inequities’ (MarketWatch)

- Antibody Drugs Could Help Curb the Pandemic. What Investors Need to Know. (Barron’s)

- Occidental Stock Rockets 30% Higher (Barron’s)

- Amid U.S.-China Tensions, Active Managers Are Buying (Barron’s)

- U.S. Unemployment Rate Fell to 13.3% in May (Wall Street Journal)

- Home Prices Are Rising, Along With Post-Lockdown Demand (New York Times)

- Bears Thwarted Again by Stock Market That Believes in Recovery (Bloomberg)

- These 25 Photos Show Why Things Were Designed The Way They Were (Fetch Sport)

- Meet the estate agents turning themselves into superstars (Financial Times)

- The Art of Being Alone (Farnam Street)

- Jamie Dimon: Fed is bringing out the bazooka (YouTube)

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

This week’s Stock Market theme song is Morgan Wallen’s “Chasin’ You.” Managers who were dramatically underweight equities – and missed the rally – were reluctantly forced to succumb to Morgan’s lyrics this week. They scrambled to gain equity exposure and chased the stock market rally: Continue reading “The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…”

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 32

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

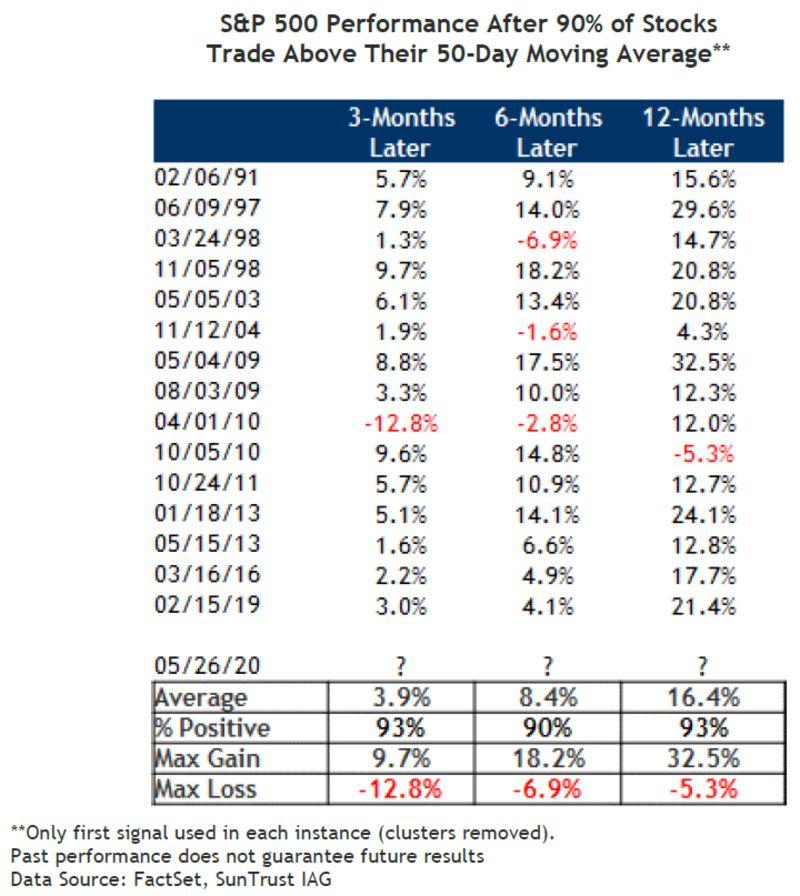

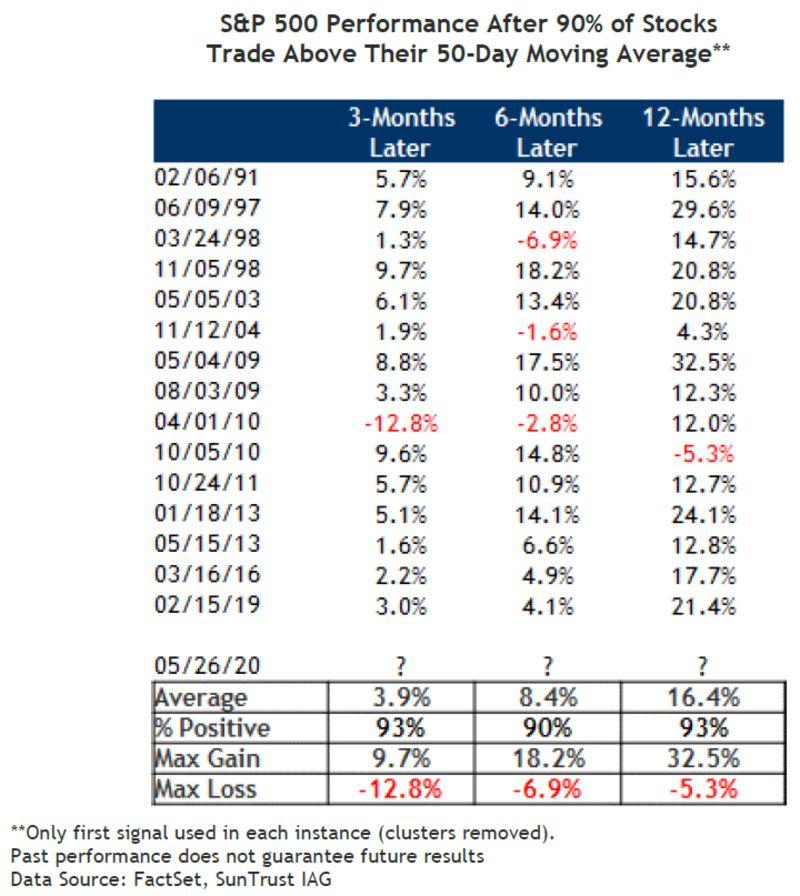

Added Data Table Referenced in this Episode:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 22

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 21

Article referenced in podcast above:

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

Continue reading “The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance TV Appearance – 5/19/2020

Yahoo! Finance TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – May 19, 2020

Be in the know. 10 key reads for Monday…

- 21 Cheap Stocks With Above-Average Growth Prospects (Barron’s)

- Global Stocks Advance on Signs of Slowing Virus as Powell Interview Adds Cheer (Barron’s)

- Moderna Reports Positive Vaccine News (Barron’s)

- Fed’s Powell tells ‘60 Minutes’ he’s not out of ammunition to fight the recession (MarketWatch)

- Work-from-home productivity pickup has tech CEOs predicting many employees will never come back to the office (MarketWatch)

- Barron’s Picks And Pans: Cisco, Gilead, Netflix, Wayfair And More (Yahoo! Finance)

- Hertz appoints new CEO to lead car rental giant (Fox Business)

- Dwayne ‘The Rock’ Johnson ‘very proud’ of his daughter joining WWE New York Post)

- Dan Bilzerian Pushes Party Brand From a Social Distance (Bloomberg)

- Brent at one-month high, U.S. oil tops $31 as restrictions ease (Street Insider)

Be in the know. 25 key reads for Saturday…

- Newly Flush PNC Could Kick Off the Next Round of Bank M&A (Barron’s)

- Oil Market Dazzled With a Swift Delivery of Supply Cuts (Bloomberg)

- Slash tax rate in half for corporations returning to US, White House adviser suggests (New York Post)

- McConnell says next stimulus must have coronavirus liability protections (New York Post)

- Appaloosa buys Twitter, Netflix stakes, exits Caesars, cuts Facebook position (TheFly)

- TSA Preparing to Check Passenger Temperatures at Airports Amid Coronavirus Concerns (Wall Street Journal)

- Wells Fargo Has Lost $220 Billion in Market Value Under Fed Cap (Bloomberg)

- Inside the Science and Companies Racing to Develop a Covid-19 Vaccine (Barron’s)

- John Malone Has a Great Investing Record. Here’s How to Play Along. (Barron’s)

- How Investors Should Evaluate Energy Bonds — And the Funds That Own Them (Barron’s)

- This Economist Sees a ‘Regime Change’ Favoring Stockpickers (Barron’s)

- Assessing the stock market after one of the fastest declines and subsequent comebacks in history (CNBC)

- On Furlough From the Kingdom, Disney Workers Try to Keep the Magic Alive (Wall Street Journal)

- Michael Jordan Didn’t Manage People, He Lit Them on Fire (Wall Street Journal)

- Car Makers See Chinese Market Picking Up (Wall Street Journal)

- Bill Murray drinks, jokes with Guy Fieri on Nacho Showdown: ‘Truth is, he’s a redhead’ (USA Today)

- Google Antitrust Lawsuit Being Drafted by U.S Justice Department (Bloomberg)

- Next coronavirus aid package expected to become reality ‘in June at the earliest,’ as House passes its bill (MarketWatch)

- Is this the pullback you’ve been waiting for? (QuantifiableEdges)

- JPMorgan Bets on a Dash for the Suburbs (Institutional Investor)

- What Happens to Stocks After a Big Up Month? (A Wealth of Common Sense)

- Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years (CNBC)

- Loeb’s Third Point Builds Stake in Disney, Exits Campbell Soup (Bloomberg)

- Saudi wealth fund snaps up $7.7bn of blue-chip stocks (Financial Times)

- How bank hedging jolted investors into talk of negative rates (Financial Times)