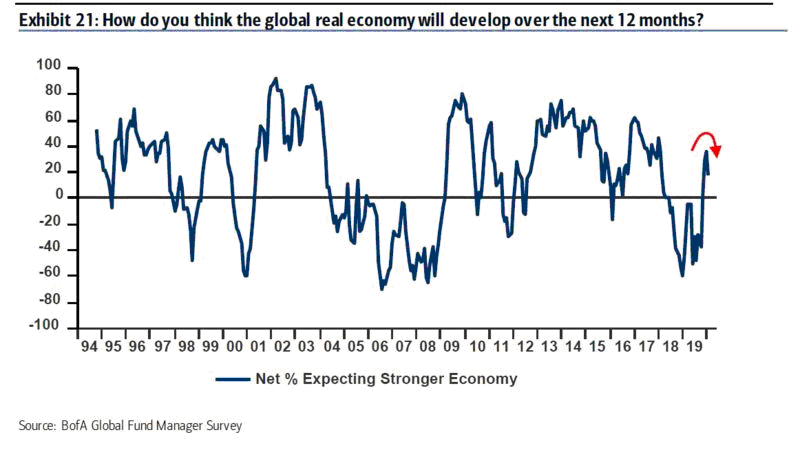

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”