- Coronavirus sparks hectic trading in search of treatment (Financial Times)

- Barron’s Picks And Pans: GM, Kraft Heinz, Tesla, Under Armour And More (Benzinga)

- Elliott Management Raises SoftBank Stake, Pushes For Buybacks, Says Market ‘Undervalues’ Portfolio (Benzinga)

- Some Gas Left in the Tank for the Stock Market Rally? (ZeroHedge)

- Goldman Sachs says impact of coronavirus will be ‘limited,’ and these are the stocks to buy if it’s right (MarketWatch)

- Modi’s India is in a slump, but some stocks are worth buying (Barron’s)

- ‘Swing for the fences’: Warren Buffett’s advice headlines Bill and Melinda Gates Foundation’s 20th annual letter (Business Insider)

- FedEx (FDX) Could Save $300M Per Year by Shifting Traffic Through the Ground Network – Bernstein (StreetInsider)

- Simon Property Group Announces $3.6B Acquisition Of Taubman Group (Benzinga)

- Can Opec stop the slide in the oil price? (Financial Times)

Tag: Warren Buffett

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)

Quote of the Day…

Be in the know. 10 key reads for Saturday…

- 4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s)

- James Bond’s favorite car maker Aston Martin gets rescue investor (New York Post)

- UK formally leaves the European Union and begins Brexit transition period (CNBC)

- What Third Point Is Worried About in 2020 (Institutional Investor)

- S&P 500 wipes out gain for the year on coronavirus fears (Financial Times)

- The Inner Game: Why Trying Too Hard Can Be Counterproductive (Farnam Street)

- How Warren Buffett Made 50% Returns During His Partnership Days | Warren Buffett’s Investment Strategy Explained (Macro-Ops)

- Eight Things I Never Knew About Jack Dorsey (Ramp Capital)

- Ray Dalio Is Still Driving His $160 Billion Hedge-Fund Machine (WSJ)

- Drugmakers Are Racing to Develop a Coronavirus Vaccine (Barron’s)

Be in the know. 6 key reads for Martin Luther King Day…

- ‘Took me right out of my seat’ — Warren Buffett was inspired by a Martin Luther King Jr. speech to push for civil rights (Business Insider)

- Hedge-Fund Titans Hohn, Mandel Lead $178 Billion Year of Profits (Bloomberg)

- Hedge Funds That Bet on Big Trends Are Trying to Bounce Back (Bloomberg)

- OPEC oil production cuts likely to continue for the ‘whole of 2020’: Wood Mackenzie (CNBC)

- Oil climbs above $65 after an escalation in Libya’s civil war forces the shutdown of 2 major oilfields (Business Insider)

- British Pound Shows Signs of Strength Before Brexit (Bloomberg)

Be in the know. 12 key reads for Tuesday…

- Oil Companies Are Finally Pumping Out Cash. That’s Good News for Their Stocks. (Barron’s)

- Buy Occidental Petroleum Stock, Morgan Stanley Says. Its Dividend Is ‘Best-In-Class.’ (Barron’s)

- JPMorgan posts record profit in strong start to US earnings season (Financial Times)

- Citigroup earnings beat expectations on 49% fixed-income trading surge (CNBC)

- For Howard Marks, Investing Is Like a Game (Institutional Investor)

- Hedge fund puts $550m into technology stock option financing (Financial Times)

- EXCLUSIVE: JPMorgan CEO Jamie Dimon praises ‘phase one’ US-China trade deal (Fox Business)

- 2 GM engineers arrested after 100-mph Kentucky joyride in new Corvettes (USA Today)

- Big Commitments for China Energy/Ag Buys in Phase 1 Trade Deal (Reuters)

- Worry over ‘Japanification’ of the economy is overblown (Barron’s)

- Warren Buffett Should Buy FedEx. It’s Cheap and Elephant-Sized. (Barron’s)

- Xi Strikes Optimistic Tone After Riding Out Trade War With Trump (Bloomberg)

Be in the know. 8 key reads for Friday…

- The Stock Market Was Up the First 5 Days of 2020. Here’s What History Says Will Happen Next. (Barron’s)

- After A Sizzling End To 2019, Biotech Stocks Could Soar In 2020 (Investor’s Business Daily)

- Stocks More Than Doubled Over the Last Decade. Many Investors Missed Out. (Institutional Investor)

- Facebook Says It Won’t Back Down From Allowing Lies in Political Ads (New York Times)

- Warren Buffett calls this ‘indispensable’ life advice: ‘You can always tell someone to go to hell tomorrow’ (CNBC)

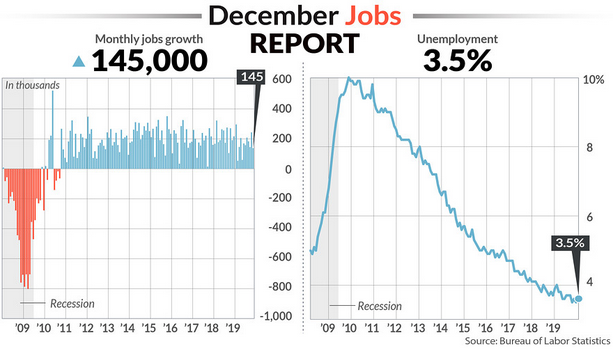

- The U6 unemployment rate fell to 6.7% to mark the lowest level on record (MarketWatch)

- Fed’s Bullard, Kashkari Favor Holding Interest Rates Steady (Wall Street Journal)

- Top 2019 Stock Picker Spotted Under-the-Radar Tech (Bloomberg)

Be in the know. 15 key reads for Thursday…

- China Moves to Steady Its Slowing Economic Growth (New York Times)

- The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results) (ZeroHedge)

- These 6 charts compare the US and China economies (CNBC)

- Irrational exuberance? Why last year’s stellar returns may have been a reversal of ‘excessive pessimism’ (MarketWatch)

- Goldman Sachs Was the Worst Dow Stock of 2018. It Was One of the Best in 2019. (Barron’s)

- FedEx Stock Ended 2019 With a Loss. One Director Bought Up Shares in December. (Barron’s)

- The highest-paid CEOs of 2019 (USA Today)

- The Dollar’s Losses May Just Be Getting Started (Bloomberg)

- Almost Everything Wall Street Expects in 2020 (Bloomberg)

- OPEC Output Falls as Gulf Nations Step Up Delivery of Oil Cuts (Bloomberg)

- This is what the Warren Buffett empire looks like, in one giant chart (MarketWatch)

- Treasury’s Mnuchin to head U.S. delegation to Davos conclave (Reuters)

- 7 Excellent Value Stocks to Buy for 2020 (Yahoo! Finance)

- Twilio CEO Lawson Tinkers Until Solving Customers’ Problems (Investor’s Business Daily)

- MAX Crashes Strengthen Resolve of Boeing to Automate Flight (Wall Street Journal)

Be in the know. 15 key reads for New Year’s Day…

- Three Neglected Parts of the Stock Market That Could Win in 2020 (Barron’s)

- How investors see 2020 shaping up in US financial markets (Financial Times)

- Stock Market Caps Bullish Year With Modest Gains; Which Sectors Will Lead In 2020? (Investor’s Business Daily)

- Steve Cohen one of few bright spots in bad year for hedge funds (New York Post)

- Chill, It Might Not Be That Bad: The Optimist’s Guide to 2020 (Bloomberg)

- India Stocks Rise as Investors Bank on Economic Recovery in 2020 (Bloomberg)

- Oil Caps Strongest Year Since 2016 on OPEC Cuts, Trade Truce (Bloomberg)

- UK is set to exit the EU next month: Here are some important Brexit-related dates of 2020 (CNBC)

- Warren Buffett turned down a chance to buy Tiffany’s (Business Insider)

- 11 Top Merrill Lynch Stock Picks for 2020 (24/7 Wall Street)

- Here are the best and worst Dow and S&P 500 stocks of 2019 (MarketWatch)

- These are the 20 best-performing stocks of the past decade, and some of them will surprise you (MarketWatch)

- These 10 S&P 500 stocks were lousy in 2019, but they could return 40% or more in 2020 (MarketWatch)

- Dow, Exxon Mobil and IBM top the ‘Dogs of the Dow’ list as 2019 ends (MarketWatch)

- Oil analysts bet on modest price gains in 2020 as supply shrinks: Reuters poll (Yahoo! Finance)